AUSTIN, Texas, Nov. 9 /PRNewswire-FirstCall/ -- EZCORP, Inc.

(NASDAQ:EZPW) announced today results for its fiscal fourth quarter

and 2006 fiscal year, which ended September 30, 2006. For the

quarter ended September, net income increased to $9,168,000 ($0.64

per share) from $3,705,000 ($0.27 per share) for the 2005 fiscal

fourth quarter. Total revenues for the quarter increased 19% to

$87,355,000 compared to $73,183,000 for the prior year period. For

the twelve month period ended September, net income increased 98%

to $29,259,000 ($2.08 per share) from $14,752,000 ($1.09 per share)

for fiscal 2005. Total revenues for the fiscal year increased 24%

to $315,852,000 from $254,159,000 for fiscal 2005. The results for

the current period include a net benefit of approximately $0.04 per

share from three non-recurring items. The prior year results

include an unfavorable impact of approximately $0.04 per share due

to losses associated with hurricanes Katrina and Rita and expenses

directly related to the Company's conversion of 181 Texas EZMONEY

locations to a credit services organization. Commenting on these

results, President and Chief Executive Officer, Joe Rotunda,

stated, "We are pleased and excited with the strong results we have

delivered for the quarter and year. The fourth quarter was our

seventeenth consecutive quarter of year-over-year earnings growth.

Increases in our signature loan contribution, or signature loan

fees less bad debt and direct transaction expense, led the

improvement with growth of 95% or $7.7 million. Our pawn operation

also made a significant contribution with pawn net revenues up $5.4

million or 17%." Rotunda continued, "I am pleased to announce that

we opened forty-six EZMONEY locations during the fourth quarter,

making this fiscal year the third consecutive year of opening more

than 100 stores. In addition, we just opened our first pawn store

in Mexico and plan to have two more open before the end of

January." Rotunda concluded, "Looking forward to fiscal 2007, we

expect to generate earnings per share in the range of $2.40 to

$2.45. For our first fiscal 2007 quarter, we expect to generate

earnings per share of $0.58 to $0.60. In fiscal 2007, we plan to

continue expansion of our store base by opening approximately 100

new EZMONEY stores and several additional Mexico locations." On

November 3, 2006, the Company's Board of Directors declared a

three- for-one stock split of its two classes of common stock to

shareholders of record as of the close of business on November 27,

2006. Shares resulting from the stock split are expected to be

distributed on or about December 11, 2006. All share and per share

figures disclosed in this announcement are presented before the

stock split. EZCORP is primarily a lender or provider of credit

services to individuals who do not have cash resources or access to

credit to meet their short-term cash needs. In 280 EZPAWN locations

open on September 30, 2006, the Company offers non-recourse loans

collateralized by tangible personal property, commonly known as

pawn loans. At these locations, the Company also sells merchandise,

primarily collateral forfeited from its pawn lending operations, to

consumers looking for good value. In 334 EZMONEY locations open on

September 30, 2006 and 82 EZPAWN locations, the Company offers

short-term non- collateralized loans, often referred to as payday

loans, or fee based credit services to customers seeking loans.

This announcement contains certain forward-looking statements

regarding the Company's expected performance for future periods

including, but not limited to, new unit growth and expected future

earnings. Actual results for these periods may materially differ

from these statements. Such forward- looking statements involve

risks and uncertainties such as changing market conditions in the

overall economy and the industry, consumer demand for the Company's

services and merchandise, changes in regulatory environment, and

other factors periodically discussed in the Company's annual,

quarterly and other reports filed with the Securities and Exchange

Commission. You are invited to listen to a conference call

discussing these results on November 9, 2006 at 3:30pm Central

Time. The conference call can be accessed over the Internet (or

replayed at your convenience) at the following address.

http://www.videonewswire.com/event.asp?id=36178 For additional

information, contact Dan Tonissen at (512) 314-2289. EZCORP, Inc.

Highlights of Consolidated Statements of Operations (Unaudited) (in

thousands, except per share data) Three Months Ended September 30,

2006 2005 1 Revenues: 2 Merchandise sales $30,022 $27,538 3 Jewelry

scrapping sales 16,804 13,295 4 Pawn service charges 18,337 16,201

5 Payday loan service charges 1,787 2,605 6 Credit service fees

20,104 13,246 7 Other 301 298 8 Total revenues 87,355 73,183 9 Cost

of goods sold: 10 Cost of merchandise sales 18,044 16,162 11 Cost

of jewelry scrapping sales 11,133 10,281 12 Total cost of goods

sold 29,177 26,443 13 Net revenues 58,178 46,740 14 15 Operations

expense 29,487 25,492 16 Payday loan bad debt and direct

transaction expenses 768 1,291 17 Credit service bad debt and

direct transaction expenses 5,223 6,395 18 Administrative expense

7,402 5,898 19 Depreciation and amortization 2,208 2,088 20

Operating income 13,090 5,576 21 22 Interest expense (income), net

(192) 359 23 Equity in net income of unconsolidated affiliate (688)

(572) 24 Loss on sale/disposal of assets 55 --- 25 Income before

income taxes 13,915 5,789 26 Income tax expense 4,747 2,084 27 Net

income $9,168 $3,705 28 29 Net income per share, diluted $0.64

$0.27 30 31 Weighted average shares, diluted 14,303 13,740 EZCORP,

Inc. Highlights of Consolidated Statements of Operations

(Unaudited) (in thousands, except per share data) Year Ended

September 30, 2006 2005 1 Revenues: 2 Merchandise sales $134,326

$118,951 3 Jewelry scrapping sales 43,098 29,459 4 Pawn service

charges 65,325 62,274 5 Payday loan service charges 5,389 28,954 6

Credit service fees 66,451 13,246 7 Other 1,263 1,275 8 Total

revenues 315,852 254,159 9 Cost of goods sold: 10 Cost of

merchandise sales 78,459 68,680 11 Cost of jewelry scrapping sales

28,414 21,998 12 Total cost of goods sold 106,873 90,678 13 Net

revenues 208,979 163,481 14 15 Operations expense 111,110 95,876 16

Payday loan bad debt and direct transaction expenses 2,525 7,808 17

Credit service bad debt and direct transaction expenses 16,000

6,395 18 Administrative expense 27,749 23,067 19 Depreciation and

amortization 8,610 8,104 20 Operating income 42,985 22,231 21 22

Interest expense (income), net (79) 1,275 23 Equity in net income

of unconsolidated affiliate (2,433) (2,173) 24 (Gain) loss on

sale/disposal of assets (7) 79 25 Income before income taxes 45,504

23,050 26 Income tax expense 16,245 8,298 27 Net income $29,259

$14,752 28 29 Net income per share, diluted $2.08 $1.09 30 31

Weighted average shares, diluted 14,088 13,574 EZCORP, Inc.

Highlights of Consolidated Balance Sheets (Unaudited) (in

thousands, except per share data and store counts) As of September

30, 2006 2005 1 Assets: 2 Current assets: 3 Cash and cash

equivalents $29,939 $4,168 4 Pawn loans 50,304 52,864 5 Payday

loans, net 2,443 1,634 6 Pawn service charges receivable, net 8,234

9,492 7 Payday loan service charges receivable, net 426 272 8

Credit service fees receivable, net 3,954 3,007 9 Inventory, net

35,616 30,293 10 Deferred tax asset 7,150 10,534 11 Federal income

taxes receivable 35 --- 12 Prepaid expenses and other assets 3,907

1,998 13 Total current assets 142,008 114,262 14 Investment in

unconsolidated affiliate 18,920 17,348 15 Property and equipment,

net 29,447 26,964 16 Deferred tax asset, non-current 3,749 4,012 17

Other assets, net 3,379 2,862 18 Total assets $197,503 $165,448 19

Liabilities and stockholders' equity: 20 Current liabilities: 21

Accounts payable and other accrued expenses $22,579 $18,988 22

Customer layaway deposits 1,890 1,672 23 Federal income taxes

payable --- 648 24 Total current liabilities 24,469 21,308 25 26

Long-term debt --- 7,000 27 Deferred gains and other long- term

liabilities 3,249 3,597 28 Total long-term liabilities 3,249 10,597

29 Total stockholders' equity 169,785 133,543 30 Total liabilities

and stockholders' equity $197,503 $165,448 31 32 Pawn loan balance

per ending pawn store $180 $189 33 Inventory per ending pawn store

$127 $108 34 Book value per share $12.58 $10.39 35 Tangible book

value per share $12.37 $10.21 36 Pawn store count - end of period

280 280 37 Mono-line payday loan store count - end of period 334

234 38 Shares outstanding - end of period 13,495 12,859

http://www.videonewswire.com/event.asp?id=36178DATASOURCE: EZCORP,

Inc. CONTACT: Dan Tonissen of EZCORP, Inc., +1-512-314-2289 Web

site: http://www.ezcorp.com/

Copyright

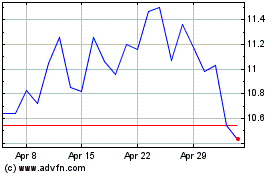

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Sep 2024 to Oct 2024

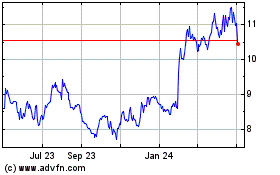

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Oct 2023 to Oct 2024