Earnings Preview: Equinix Inc. - Analyst Blog

October 25 2011 - 10:00AM

Zacks

Equinix Inc.

(EQIX) is scheduled to announce its third quarter 2011 results on

October 26, 2011, after the market closes. We see a few upward

revisions in analyst estimates at this point.

Second Quarter

Overview

Equinix delivered an impressive

second quarter, strongly beating the Zacks Consensus Estimate by

36.2% with respect to earnings per share. The quarter’s results saw

an improvement from loss per share of 5 cents in the year-ago

quarter. The improvement could be credited to solid revenue

growth.

Equinix’ second quarter revenue

increased 33.0% from the year-ago period on strong demand across

international markets, interconnection growth, significant pickup

in cross-connects, exchange ports and traffic on switches, as well

as strong contribution from the newly acquired ALOG data

centers.

Solid market fundamentals such as

the growth of IP, mobile, video, cloud and electronic trading

combined with the company’s global leadership position will likely

drive profitability over the long term.

Third Quarter

Outlook

The company expects revenues in the

range of $412.0 to $417.0 million. Cash gross margin is expected to

be approximately 65.0%. Cash selling, general and administrative

expenses are projected at approximately $86.0 million. Adjusted

EBITDA is expected to be between $180.0 million and $185.0 million.

Capital expenditures are estimated at between $160.0 million and

$180.0 million, comprising approximately $30.0 million in ongoing

capital expenditures and $130.0 million to $150.0 million in

expansion capital expenditures.

Agreement of

Analysts

Out of the 17 and 18 analysts

providing estimates for the third quarter and fiscal 2011, 1 and 2

analysts have raised estimates, respectively, in the past 30 days.

Moreover, two analysts raised their estimates for fiscal 2012.

The analysts have high hopes for

strong contribution from ALOG data centers yet again. They are also

positive about Equinix’ impressive data center footprint and robust

network density, which have attracted customers for a long time.

However, in the absence of specific catalysts that could drive

further upside, most analysts have left their estimates

unchanged.

Magnitude of Estimate

Revisions

We noticed that the Zacks Consensus

Estimate for the third quarter has gone down a penny and 6 cents to

44 cents in the past 30 and 90 days, respectively. On the other

hand, the Zacks Consensus Estimate for fiscal 2011 has improved by

7 cents and 10 cents to $2.18 in the same time period,

respectively. The Zacks Consensus Estimate for fiscal 2012 dropped

26 cents over the past ninety days to $2.89.

The reason for the decrease could

be lower expected EBITDA margin due to higher operating expenses

and lower churns.

Recommendation

Equinix is expanding its current

facilities and client-base, and is also exercising fiscal

discipline. The new data centers were kicked off successfully,

especially in Europe, and made a hefty contribution to overall 2010

revenue growth. We believe that the company has a decent line-up of

new data centers for 2011. We are also optimistic about its

recurring revenue model and current expansion plans.

Though stiff competition from

networking aces like AT&T Inc. (T) and

Verizon Inc. (VZ) and the company’s European

exposure are concerns, we believe that the increasing demand trend

and new product launch (Marketplace, which is a new service for the

benefit of data center users) will boost revenue growth.

Currently, Equinix has a Zacks #1

Rank, implying a short-term Strong Buy recommendation.

EQUINIX INC (EQIX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

Zacks Investment Research

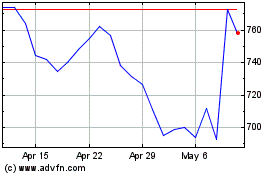

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2024 to May 2024

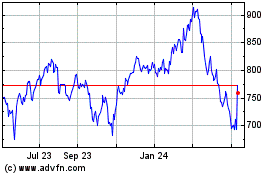

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2023 to May 2024