Equinix Tops on Higher Revenues - Analyst Blog

April 28 2011 - 12:26PM

Zacks

Equinix Inc. (EQIX) reported

first-quarter 2011 earnings per share of 55 cents, comprehensively

beating the Zacks Consensus Estimate of 30 cents.

Revenues

Revenues in the first quarter were $363.0 million, up 46.0% from

the comparable period last year and 5.0% from the previous quarter.

Reported revenues exceeded the Zacks Consensus Estimate of $355.0

million as well as the company’s guidance.

The quarterly revenue of the company includes non-recurring

benefits of about $4.0 million. The company faced volatility in

foreign currency rates in the reported quarter, which led to

positive revenue benefits of roughly $1.5 million versus the

average rates witnessed during the fourth quarter and a benefit of

$1.2 million compared to the guidance rates used.

On a regional basis, all the operating units of the company

performed better-than- expected, especially America. Moreover, the

company is also witnessing a favorable pricing environment across

all of its markets.

In first quarter 2011, contractual bookings (excluding billings)

witnessed significant upside compared with the prior-quarter

level.

Recurring revenues in the quarter, arising from collocation,

interconnection and managed services, were $343.9 million (94.7% of

the total revenue), up 44.9% from the year-ago quarter and 5.4%

from the previous quarter. However, non-recurring revenues were

$19.1 million (5.3% of the total revenue), which shot up 67.6% from

the comparable quarter last year and 1.13% sequentially.

Operating Results

Cash gross margin (excluding depreciation, amortization, but

including stock-based compensation) in the quarter was 66.0%, was

flat on a year-over-year basis and up from 64.0% in the

sequentially preceding quarter. Total operating expenses surged

43.7% from the year-ago quarter, but dipped 0.06% from the previous

quarter.

The year-over-year increase in operating expenses was primarily

attributed to higher selling and marketing expenses (up 72.8%) and

general and administrative expenses (up 45%). Adjusted EBITDA

margin in the quarter was 46.0% compared with 47.0% in the

comparable quarter last year and 43.0% in the previous quarter.

Reported net loss in the quarter came in at $25.1 million or 53

cents per diluted share, versus net income of $14.2 million or 35

cents in the year-ago quarter. However, excluding restructuring

charges and acquisition costs but including stock-based

compensation, adjusted net income came in at $26.1 million or 55

cents (pls ckh point 8 for calculation in the press release).

The company generated cash from operating activities of $115.2

million for the first quarter compared with $122.9 million in the

previous quarter and $99.8 million in the year-ago quarter.

Capital expenditures in the first quarter were $172.5 million,

of which $139.8 million was attributed to future expansion

strategies and the remaining $32.7 million was attributed to the

ongoing capital expenditures. Equinix exited the quarter with cash,

cash equivalents and investments of $456.7 million compared with

$592.8 million as of December 31, 2010.

Guidance

For the second quarter of 2011, the company expects revenues in

the range of $376.0 to $378.0 million. Cash gross margins are

expected to be approximately 65.0%. Cash selling, general and

administrative expenses are projected to be roughly $76.0

million.

Adjusted EBITDA is expected to be in $166.0 and $170.0 million

range. Capital expenditures are expected to be in the range of

$220.0 and $240.0 million, comprising approximately $40.0 million

of ongoing capital expenditures and between $180.0 and $200.0

million for expansion strategies.

For fiscal 2011, total revenues are expected to be more than

$1,525.0 million. Cash gross margin is expected to range between

65.0% and 66.0%. Cash selling, general and administrative expenses

are expected to approximate $315.0 million.Adjusted EBITDA for the

full-year is expected to be greater than $685.0 million. Capital

expenditures for 2011 are expected to be in the range of $615.0 to

$665.0 million, comprising approximately $115.0 million of ongoing

capital expenditures and $500.0 to $550.0 million for expansion

strategies.

Conclusion

We are encouraged by Equinix’ effort to expand the current

facilities and also maintaining its fiscal discipline

simultaneously. We are positive about its recurring revenue model.

However, increased competition, European exposure, industry

consolidation and a long sales cycle are causes for concern.

The company currently has a Zacks #3 Rank, implying a short-term

Hold rating.

EQUINIX INC (EQIX): Free Stock Analysis Report

Zacks Investment Research

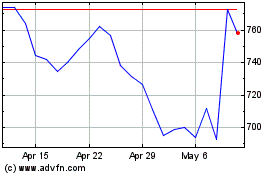

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2024 to Jun 2024

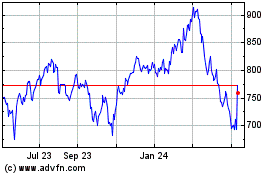

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Jun 2023 to Jun 2024