Earnings Preview: Equinix - Analyst Blog

April 26 2011 - 1:37PM

Zacks

Equinix Inc. (EQIX) is scheduled to announce

its first quarter 2011 results on April 27, 2011, after the market

closes. We see limited revisions in analyst estimates at this

point.

Fourth Quarter Overview

Equinix’ fourth quarter revenue increased 42.0% from the

year-ago period on strong demand across international markets,

interconnection growth, significant pickup in cross-connects,

exchange ports and traffic on switches.

However, net income per share plunged 29.5% year over year to 31

cents. A steep rise in the quarter’s operating expenses due to

higher selling and general expenditures was largely responsible for

the decline.

Equinix delivered an impressive fourth quarter, beating the

Zacks Consensus Estimates both in respect of revenue and earnings

per share. The company is increasing its investments in sales and

capex as it sees solid demand trends across all geographical

regions. We believe that this activity will boost sales in the

upcoming quarters.

First Quarter Outlook

The company expects revenues in the range of $354.0 million to

$356.0 million. Gross margin is expected to be roughly 64%. Cash

selling, general and administrative expenses are projected at $75.0

million. Adjusted EBITDA is expected at between $151.0 million and

$153.0 million.

Total capital expenditure, including approximately $25.0 million

of ongoing capital expenditures and $160.0 million of expansion

capital expenditures, is likely to be approximately $185.0

million.

For full-year 2011, total revenue is expected to be greater than

$1.5 billion. Cash selling, general and administrative expenses are

estimated at approximately $300.0 million. Adjusted EBITDA is

projected to exceed $675.0 million. Capital expenditures for 2011

are expected in the range of $400.0 million to $500.0 million.

Agreement of Analysts

Out of the 22 and 23 analysts providing estimates for the first

quarter and fiscal 2011, respectively, none revised any estimate in

the past 30 days. There were also no estimate revisions for fiscal

2012.

The limited number of changes to estimates point to the fact

that there was no major catalyst during the quarter that could

drive results. Consequently, most of the analysts are sticking to

the estimates they projected post fourth quarter earnings.

Magnitude of Estimate Revisions

There was no change to the Zacks Consensus Estimates for the

first quarter and fiscal 2011 over the past 30 days. However, the

first quarter estimate moved down by six cents in the past ninety

days to 30 cents. The Zacks Consensus Estimate for fiscal 2011

increased 4 cents over the past ninety days to $2.02.

The Zacks Consensus Estimate for fiscal 2012 witnessed a

significant jump of 6 cents to $3.58 since the fourth quarter

results. The reason for the uptick is the growing demand for

Equinix’ security products. The analysts belive that the data

centre space offers a lot of hope based on continued growth of IP

and Internet traffic, which Equinix can capitalise.

Recommendation

Equinix is expanding its current facilities and client-base, and

is also exercising fiscal discipline. The new data centers were

kicked off successfully, especially in Europe, and made a good

contribution to overall 2010 revenue growth. We believe that the

company has a decent line-up of new data centers for 2011. We are

also optimistic on its recurring revenue model and current

expansion plans.

Despite all the positives, we remain a bit apprehensive

regarding stiff competition from networking aces like

AT&T Inc. (T) and Verizon

Inc. (VZ). European exposure is also a cause for concern.

Moreover, capex growth could also impact near-term results.

Currently, Equinix has a Zacks #3 Rank, implying a short-term

Hold recommendation.

EQUINIX INC (EQIX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

Zacks Investment Research

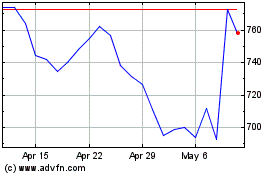

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

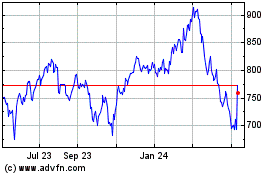

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Sep 2023 to Sep 2024