NYSE Euronext Plans Global Network Of Trading Hubs

November 23 2010 - 4:55PM

Dow Jones News

NYSE Euronext (NYX) plans to replicate two major data center

units in the U.S. and the U.K. with as many as 40 smaller

facilities in financial centers including Frankfurt, Tokyo and Sao

Paulo, according to senior executives.

The "liquidity hubs" will offer market connections and

technology services to local banks and trading firms, building upon

the two proprietary facilities the Big Board parent launched to

house its own trading systems.

"This is a springboard from the two data centers that we own to

create other points of presence at destinations of importance

around the world," said Stanley Young, chief executive of NYSE

Technologies, in an interview.

The expansion is already under way and 14 European locations are

seen coming online in the first quarter of 2011.

The move represents the next phase in the transatlantic exchange

operator's plan to diversify from trading and listings into

higher-margin hardware and system maintenance business providing

high-speed access to platforms across the globe.

NYSE Euronext CEO Duncan Niederauer this year set a $1 billion

annual revenue target for the technology arm to reach within five

years. About $500 million was allotted to construct the new data

centers in Mahwah, N.J., and Basildon, east of London. They house

the company's own trade-matching engines as well as customer

systems.

NYSE Euronext also is exporting its exchange systems to smaller

markets around the world, like the Philippine Stock Exchange, while

weighing additional acquisitions such as last year's $144 million

deal for trading technology developer Nyfix Inc.

With the proprietary data centers now functional and NYSE

Euronext shifting its exchanges to the new facilities, Young said

the next step is to expand in other, existing data centers in key

financial centers.

The plan is to add space in units run by companies such as

Equinix Inc. (EQIX), Savvis Inc. (SVVS) and Telx Group, he said,

rather than building any more proprietary facilities.

Young said NYSE Euronext could eventually have between 25 and 40

liquidity hubs of varying size around the globe. Some will

initially focus just on collecting market pricing data, while

others will function as miniature versions of the Manwah and

Basildon facilities.

In locales like such as Chicago, Frankfurt, Singapore and

Brazil, where NYSE Euronext already has some market infrastructure,

the company aims to add more services. It also plans to move into

new markets like Hong Kong and Tokyo.

"The whole notion is to provide services to our clients in

places besides where we have our own markets," said Bob Moitoso,

senior vice president at NYSE Technologies.

The span of each facility's offering will depend upon local

customers' needs and region-specific rules. For instance, some

jurisdictions may restrict the offering of co-location services, in

which firms situate their servers within the same physical building

as an exchange's matching engines to maximize the speed of

trading.

Young said NYSE Technologies hopes to offer in many places a

"wholly hosted" trading service, managing traders' hardware,

exchange connections, price data and risk controls as a single

package.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

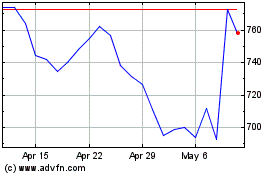

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2024 to Jun 2024

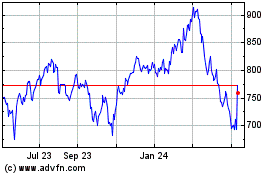

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Jun 2023 to Jun 2024