Enanta Pharmaceuticals, Inc., (NASDAQ:ENTA), a research and

development-focused biotechnology company dedicated to creating

small molecule drugs in the infectious disease field, today

reported financial results for its fiscal fourth quarter and year

ended September 30, 2013.

Fiscal Fourth Quarter and Year Ended September 30, 2013

Financial Results

Revenue for the three months ended September 30, 2013 was $1.3

million compared to $1.9 million for the three months ended

September 30, 2012. For the year ended September 30, 2013 revenue

was $32.1 million compared to $41.7 million for the year ended

September 30, 2012. The changes in revenue for the three and

twelve-month periods are primarily related to the timing and amount

of milestone and other payments from collaborations, which have

varied significantly from period to period and are expected to

continue to do so.

Research and development expenses totaled $4.3 million for both

the three months ended September 30, 2013 and for the three months

ended September 30, 2012. For the year ended September 30, 2013,

research and development expenses were $16.8 million compared to

$15.1 million for the year ended September 30, 2012. The increase

in research and development expenses is primarily due to increases

in preclinical expenses for our early stage drug discovery

programs.

General and administrative expenses totaled $1.7 million for

both the three months ended September 30, 2013 and the three months

ended September 30, 2012. For the year ended September 30, 2013,

general and administrative expenses were $6.2 million compared to

$5.3 million for the year ended September 30, 2012. The increase is

primarily due to higher stock-based compensation expense related to

grants of additional employee stock options, as well as additional

expenses incurred as a result of operating as a public company.

Net loss for the three months ended September 30, 2013 was $4.4

million compared to a net loss of $4.1 million for the same period

in 2012. Net income for the year ended September 30, 2013 was $9.6

million compared to net income of $21.4 million for the same period

in 2012.

Cash, cash equivalents and marketable securities totaled $112.2

million at September 30, 2013. This compares to $45.4 million at

September 30, 2012. The increase in cash, cash equivalents and

marketable securities is primarily due to our March 2013 initial

public offering that resulted in $59.9 million in net proceeds to

the company. Enanta expects that its current cash, cash equivalents

and marketable securities will be sufficient to meet its

anticipated cash requirements for at least the next 24 months.

“2013 was a transformational year for Enanta,” stated Jay R.

Luly, Ph.D., President and Chief Executive Officer. “Our initial

public offering in March further strengthened our cash position,

and we ended the year with three HCV compounds in the clinic and we

have progressed our internal programs and pipeline candidates.”

Pipeline and Business Review

- Enanta recently announced results from

the SAPPHIRE-I study, one of six phase 3 registrational studies

being conducted by AbbVie for the treatment of hepatitis C virus

(HCV) genotype 1 (GT1) infection, using a regimen containing

Enanta’s lead protease inhibitor ABT-450. Results demonstrated a

sustained virologic response at 12 weeks post-treatment (SVR12) of

96 percent in treatment-naive adult patients chronically infected

with GT1 HCV. Results from the remaining five ABT-450 containing

studies will be available in the coming months, supporting

regulatory submissions starting in the second quarter of 2014.

- Data from AbbVie’s PEARL-1 study was

presented at the AASLD meeting on November 3, 2013. In an

intent-to-treat analysis, a two-direct acting antiviral HCV regimen

which included ABT-450, produced SVR12 results of 95% in GT 1b,

treatment-naïve HCV patients and SVR12 results of 90% in prior null

responders, without the use of interferon or ribavirin

- The National Institute of Allergy and

Infectious Diseases (NIAID) awarded Enanta an additional $9.2

million to further fund development of Enanta’s new class of

bridged bicyclic antibiotics known as Bicyclolides.

- Bicyclolide EDP-788 is targeted to

begin phase 1 clinical studies in the first half of calendar

2014.

Upcoming Events and Presentations

Enanta management will participate at the Deutsche Bank BioFest

investor conference in Boston, MA on December 3, 2013.

Conference Call and Webcast Information

Enanta will host a conference call and webcast today at 8:30

a.m. Eastern time. To participate in the live conference call,

please dial (855) 840-0595 in the U.S. or (518) 444-4814 for

international callers. A replay of the conference call will be

available starting at approximately 11:30 a.m. Eastern time on

November 25, 2013, through 11:59 p.m. Eastern time on November 29,

2013 by dialing (855) 859-2056 from the U.S. or (404) 537-3406 for

international callers. The passcode for both the live call and the

replay is 10354107. A live audio webcast of the call will be

accessible at www.enanta.com. Please visit the Investor home page

of our website and search for calendar of events. A replay of the

webcast will be available on www.enanta.com approximately two hours

following the live webcast.

About Enanta

Enanta Pharmaceuticals is a research and development-focused

biotechnology company that uses its robust chemistry-driven

approach and drug discovery capabilities to create small molecule

drugs in the infectious disease field. Enanta is discovering, and

in some cases, developing novel inhibitors designed for use against

the hepatitis C virus (HCV). These inhibitors include members of

three direct acting antiviral (DAA) inhibitor classes – protease

(partnered with AbbVie), NS5A (partnered with Novartis) and

nucleotide polymerase – as well as a host-targeted antiviral (HTA)

inhibitor class targeted against cyclophilin. Additionally, Enanta

has created a new class of antibiotics, called Bicyclolides, for

the treatment of multi-drug resistant bacteria, with a focus on

developing an intravenous and oral treatment for hospital and

community MRSA (methicillin-resistant Staphylococcus aureus)

infections.

Forward Looking Statements Disclaimer

This press release contains forward-looking statements,

including statements with respect to the prospects for further

clinical development of ABT-450 and EDP-788, the expected timeline

for announcement of results of Phase III studies of regimens that

include ABT-450, and the projected sufficiency of Enanta’s cash

equivalent resources. Statements that are not historical facts are

based on management’s current expectations, estimates, forecasts

and projections about Enanta’s business and the industry in which

it operates and management’s beliefs and assumptions. The

statements contained in this release are not guarantees of future

performance and involve certain risks, uncertainties and

assumptions, which are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

in such forward-looking statements. Important factors and risks

that may affect actual results include: Enanta’s reliance on the

development and commercialization efforts of AbbVie for treatment

regimens containing ABT-450 or any additional collaboration

protease inhibitor and on the efforts of NIAID for the early

clinical development of EDP-788; regulatory actions affecting

clinical development or treatment regimens containing ABT-450 or

any additional protease inhibitors; clinical development of

competitive product candidates of others for HCV and other viruses

or for MRSA and other bacteria; Enanta’s lack of clinical

development experience; Enanta’s need to attract and retain senior

management and key scientific personnel; Enanta’s lack of resources

and experience commercializing drugs, including any future

proprietary drug candidates it may develop; Enanta’s need to obtain

and maintain patent protection for its product candidates and avoid

potential infringement of the intellectual property rights of

others; and other risk factors described or referred to in “Risk

Factors” in Enanta’s most recent Form 10-Q and other periodic

reports filed with the Securities and Exchange Commission. Enanta

cautions investors not to place undue reliance on the

forward-looking statements contained in this release. These

statements speak only as of the date of this release, and Enanta

undertakes no obligation to update or revise these statements,

except as may be required by law.

ENANTA

PHARMACEUTICALS, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share amounts)

Three Months Ended Year Ended

September 30, September 30, 2013 2012

2013 2012 Revenue $ 1,349 $ 1,858 $ 32,053 $

41,706 Operating expenses Research and development 4,300 4,255

16,841 15,115 General and administrative 1,750

1,699 6,183 5,302 Total

operating expenses 6,050 5,954

23,024 20,417 Income (loss) from operations

(4,701 ) (4,096 ) 9,029 21,289 Other income, net 258

44 598 110 Net income

(loss) (4,443 ) (4,052 ) 9,627 21,399 Liabilities, Preferred

Stock and Stockholders' Equity (Deficit) to redemption value -

(1,332 ) (2,526 ) (5,367 ) Net income attributable to participating

securities - - (13,670 )

(14,663 ) Net income (loss) attributable to common stockholders $

(4,443 ) $ (5,384 ) $ (6,569 ) $ 1,369 Net

income (loss) per share attributable to common stockholders Basic $

(0.25 ) $ (4.78 ) $ (0.67 ) $ 1.26 Diluted $ (0.25 ) $ (4.78 ) $

(0.67 ) $ 1.13 Weighted average common shares outstanding Basic

17,904 1,127 9,788 1,089 Diluted 17,904 1,127 9,788 2,475

ENANTA PHARMACEUTICALS, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands)

September 30, September 30, 2013 2012

Assets Current assets Cash and cash equivalents $ 8,859 $

10,511 Short-term marketable securities 92,621 33,251 Accounts

receivable 808 1,049 Unbilled receivables 784 1,893 Prepaid

expenses and other current assets 1,641 604

Total current assets 104,713 47,308 Property and equipment, net

1,121 611 Long-term marketable securities 10,703 1,656 Restricted

cash 436 436 Other assets - 2,151 Total assets

$ 116,973 $ 52,162

Liabilities, Preferred Stock and

Stockholders' Equity (Deficit) Current liabilities Accounts

payable $ 1,481 $ 1,851 Accrued expenses 3,035 3,866 Deferred

revenue 10 17 Total current liabilities 4,526

5,734 Warrant liability 1,620 2,001 Other long-term liabilities

359 498 Total liabilities 6,505

8,233 Redeemable convertible preferred stock - 158,955

Convertible preferred stock - 327 Total stockholders' equity

(deficit) 110,468 (115,353 ) Total liabilities,

preferred stock and stockholders' equity (deficit) $ 116,973 $

52,162

InvestorEnanta Pharmaceuticals, Inc.Carol Miceli,

617-607-0710cmiceli@enanta.comorMediaMacDougall Biomedical

CommunicationsKari Watson, 781-235-3060kwatson@macbiocom.com

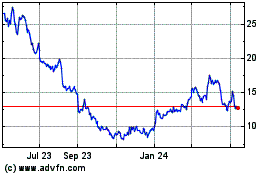

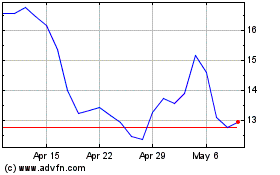

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Jul 2023 to Jul 2024