ElectraMeccanica Reports First Quarter 2021 Financial Results

May 13 2021 - 4:15PM

ElectraMeccanica Vehicles Corp. (NASDAQ:

SOLO) ("ElectraMeccanica" or the "Company"), a designer

and manufacturer of electric vehicles, reported financial results

for the first quarter ended March 31, 2021 in conjunction with the

filing of its Quarterly Report on Form 6-K earlier today.

Recent Company Highlights

- Broke ground on

the Company’s previously announced U.S. assembly facility and

engineering technical center in Mesa, AZ. When fully constructed

and operational, the facility is expected to create up to 500 new

jobs and will be capable of producing up to 20,000

SOLOs per year.

- Appointed EV

industry trailblazer Kevin Pavlov as Chief Operating Officer where

he will be responsible for overseeing operational growth as

ElectraMeccanica ramps up commercial production with a focus on

enhancing profitability and efficiency.

- Expanded the

SOLO retail footprint into ten (10) additional

high-end shopping centers and related areas as well as two (2) new

states. With these additions, ElectraMeccanica now operates a total

of twenty (20) retail locations throughout ten (10) metropolitan

areas in five (5) western states.

Management Commentary

“In the first quarter of 2021 we continued

making progress on several major initiatives, including finalizing

customer-ready designs, increasing production throughput,

optimizing logistics and supply chain management and taking

additional steps towards realizing our U.S. assembly facility and

engineering technical center,” said Company CEO Paul Rivera. “With

the addition of our new COO Kevin Pavlov, we have begun to lay the

groundwork for scaled operations for the coming years with a

continued focus on enhancing profitability and efficiency. Looking

ahead, our company is in its strongest-ever financial position,

which will allow us to invest confidently for our long-term growth

plans.”

First Quarter 2021 Financial

Summary (All amounts reported in USD)

- Cash and cash

equivalents and short-term deposits were $260.4 million as of March

31, 2021, compared with $129.5 million as of December 31, 2020.

During the quarter, the Company’s net cash increased by $130.9

million, which was driven by net cash provided by financing

activities of $147.6 million, offset by cash used in operating

activities of $14.9 million and net cash used in investing

activities of $1.7 million.

- General and

administrative expenses in the first quarter of 2021 were $2.8

million, compared to $1.6 million in the same year-ago quarter. The

increase in G&A expenses was primarily due to increased rent,

office, legal and professional, consulting, and salary

expenses.

- Research and

development expenses in the first quarter of 2021 were $2.0

million, compared to $1.1 million in the same year-ago quarter. The

increase in R&D expenses was primarily due to expenses for the

Company’s pre-production vehicles, the SOLO and eRoadster, whose

costs are attributed to research and development.

- Operating loss

in the first quarter of 2021 was $8.9 million, compared to an

operating loss of $5.1 million in the same year-ago quarter. The

increase in operating loss was primarily due to increases in

G&A, R&D and sales and marketing expenses.

Company CFO Bal Bhullar added: “The focus of

this quarter was on preparing ElectraMeccanica for what’s coming

next. Ending the quarter with more than $260 million in cash

provides us with the capital to not only execute on nearer-term

initiatives like expanded production and our U.S. based assembly

facility and engineering technical center but also to invest

judiciously into R&D for the road ahead. To date, our asset

light approach has allowed us to maintain a relatively low risk

profile. In the coming quarters, we will be putting our new capital

to use while maintaining that same conservative capital allocation

model in the process.”

Subsequent Events

In connection with the appointment of Kevin

Pavlov to the Chief Operating Officer role, on April 13, 2021, the

Company announced that Co-Founder and former COO Henry Reisner

would take the title of Executive Vice President of

ElectraMeccanica and President of its wholly-owned subsidiary,

InterMeccanica. Reisner will be working alongside Pavlov to assist

with this transition as he takes a more active role working on the

e-Roadster model. Reisner (the “Executive”), who has been with the

Company since its inception, recently established an Automatic

Securities Disposition Plan (the “ASDP”) in accordance with

applicable United States and Canadian securities legislation,

including the recommended practices set forth in the recently

issued Canadian Securities Administrators’ Staff Notice 55-317

(“Staff Notice 55-317”) and the Company’s internal securities

trading and insider policies. While ElectraMeccanica is listed on

the Nasdaq Capital Market, it is also a reporting issuer under the

Securities Act (British Columbia) and is, therefore, announcing the

establishment of the ASDP in furtherance of the recently published

guidance provided in Staff Notice 55-317. Under U.S. and Canadian

securities laws and the Company’s trading policies, insiders of the

Company are subject to certain limitations on their ability to sell

shares in the Company. The ASDP addresses this issue by permitting

trades to be made in accordance with pre-arranged instructions

given when the Executive is not in possession of any material

undisclosed information about the Company.

The ASDP is designed to allow for an orderly

disposition of the Executive’s common shares in the Company at

prevailing market prices over the course of 12 months that the ASDP

is expected to be in place. In accordance with the ASDP, the

Executive may sell up to 250,000 Company common shares per quarter

and up to 1,000,000 annually. The Executive has provided clear

trading parameters and other instruments in writing to the

independent dealer administrating the ASDP, specifying the number

of common shares to be sold and setting out minimum trade prices

and maximum volumes based on the current trading price of the

Company’s common shares and the dates or frequency of sales. The

ASDP prohibits the dealer administrating the ASDP from consulting

with the Executive regarding any sales under the ASDP and prohibits

the Executive from disclosing to the dealer any information

concerning the Company that might influence the execution of the

ASDP. The ASDP contains meaningful restrictions on the ability of

the Executive to amend, suspend or terminate the ASDP.

About ElectraMeccanica Vehicles

Corp.

ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO)

is a Canadian designer and manufacturer of environmentally

efficient electric vehicles (EVs). The company’s flagship vehicle

is the innovative, purpose-built, single-seat EV called the

SOLO. This three-wheeled vehicle will

revolutionize the urban driving experience, including commuting,

delivery and shared mobility. The SOLO provides a

driving experience that is unique, trendy, fun, affordable and

environmentally friendly. InterMeccanica, a subsidiary of

ElectraMeccanica, has successfully been building high-end specialty

cars for 61 years. For more information, please visit

www.electrameccanica.com.

Safe Harbor Statement

Except for the statements of historical fact

contained herein, the information presented in this news release

and oral statements made from time to time by representatives of

the Company are or may constitute “forward-looking statements” as

such term is used in applicable United States and Canadian laws and

including, without limitation, within the meaning of the Private

Securities Litigation Reform Act of 1995, for which the Company

claims the protection of the safe harbor for forward-looking

statements. These statements relate to analyses and other

information that are based on forecasts of future results,

estimates of amounts not yet determinable and assumptions of

management. Any other statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or

performance (often, but not always, using words or phrases such as

“expects” or “does not expect”, “is expected”, “anticipates” or

“does not anticipate”, “plans, “estimates” or “intends”, or stating

that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

forward-looking statements. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such risks and other factors include,

among others, the availability of capital to fund programs and the

resulting dilution caused by the raising of capital through the

sale of shares, accidents, labor disputes and other risks of the

automotive industry including, without limitation, those associated

with the environment, delays in obtaining governmental approvals,

permits or financing or in the completion of development or

construction activities or claims limitations on insurance

coverage. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that such statements will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements. Although the Company believes

that the expectations reflected in such forward-looking statements

are based upon reasonable assumptions, it can give no assurance

that its expectations will be achieved. Forward-looking information

is subject to certain risks, trends and uncertainties that could

cause actual results to differ materially from those projected.

Many of these factors are beyond the Company’s ability to control

or predict. Important factors that may cause actual results to

differ materially and that could impact the Company and the

statements contained in this news release can be found in the

Company’s filings with the Securities and Exchange Commission. The

Company assumes no obligation to update or supplement any

forward-looking statements whether as a result of new information,

future events or otherwise. Accordingly, readers should not place

undue reliance on forward-looking statements contained in this news

release and in any document referred to in this news release. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy securities.

Investor Relations ContactGateway Investor

RelationsMatt Glover and Tom Colton(949)

574-3860SOLO@gatewayir.com

Public Relations ContactMichelle

RaveloR&CPMK for ElectraMeccanica(714)

403-9534michelle.ravelo@rogersandcowanpmk.com

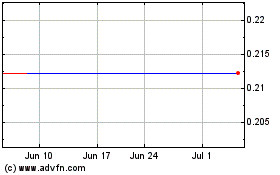

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Nov 2023 to Nov 2024