Report of Foreign Issuer (6-k)

August 24 2020 - 2:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2020

Commission File No. 001-38612

ELECTRAMECCANICA

VEHICLES CORP.

(Translation of registrant's name into English)

102 East 1st Avenue

Vancouver, British Columbia, V5T 1A4, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ¨

Amendment to Compensation Arrangement

Effective on August 12, 2020, we entered

into further employment agreement amendment (the “Further Amendment”) to the employment agreement between Michael

Paul Rivera (the “Employee”) and EMV Automotive USA (“EMV Automotive”) a wholly-owned subsidiary

of Electrameccanica Vehicles Corp. (“EMV”, and together with EMV Automotive, the “Company”),

dated as of May 17, 2019, as amended by way of letter agreements on each of July 2, 2019 and February 26, 2020 (collectively, the

“Employment Agreement”). Any capitalized terms used but not otherwise defined herein shall have the meanings

given them in the Employment Agreement. Pursuant to the terms of the Further Amendment, the Employee and the Company agreed as

follows:

|

|

1.

|

Section 4.1 of the Employment Agreement is hereby amended

by substituting the new amount “US370,000” for the old amount “US300,000” which takes effect on July 16,

2020 going forward under the Employment Agreement;

|

|

|

2.

|

Section 4.3 of the Employment Agreement is hereby deleted

in its entirety and replaced with the following:

|

“Equity Awards.

It is hereby acknowledged and agreed

that on June 24, 2019 the Employee was granted by the Company, as was originally contemplated, and in accordance with the terms

of the Company’s then 2015 Stock Option Plan (the “2015 Plan”), an initial incentive stock option (an

“Option”) to purchase up to an aggregate of up to 700,000 common shares of the Company (each, an “Option

Share”), on a fully vested basis, at an exercise price of US$2.62 per Option Share and for an exercise period ending

on June 25, 2022.

It is hereby also acknowledged

and agreed that on December 6, 2019 the Employee was granted by the Company a further Option under its then 2015 Plan (the “Additional

Option”) to purchase an aggregate of up to an additional 2,300,000 Option Shares, at an exercise price of US$1.91 per

Option Share and for an exercise period ending on December 6, 2022; and that it was always intended, and is hereby acknowledged

and agreed, that the Additional Option would vest as to one-third (that being as to 766,666 of the Option Shares) on December 6,

2019 with the balance (that being as to 1,533,334 Option Shares) vesting in equal monthly instalments commencing on the date of

grant and ending on the final date of the current term of the Employment Agreement (the “Vesting Term”; that

being monthly from December 6, 2019 until August 12, 2022 presently).

It is hereby further acknowledged

and agreed that, in accordance with the provisions of the Company’s new 2020 Stock Incentive Plan (the “Stock Incentive

Plan”), dated for reference May 29, 2020, as ratified by the Company’s shareholders on July 9, 2020 and replacing

the 2015 Plan, and in conjunction with the authority granted the Plan Administrator under the Stock Incentive Plan, the prior Restriction

placed on the Additional Option under the Last Amendment to the Employment Agreement is hereby removed; such that the Employee

is no longer restricted as to how many vested Option Shares may be acquired under the Additional Option when exercisable during

or after the Vesting Term.

In

addition, and in furtherance of the form of Option and Additional Option award agreements provided to the Employee under the 2015

Plan and the new Stock Incentive Plan, it is hereby acknowledged and agreed that each of the Option and the Additional Option

may terminate under certain circumstances and in the following manner (and any capitalized terms used but not otherwise defined

herein shall have the meanings given them in the Stock Incentive Plan):

|

|

(a)

|

if the Employee is a director, officer, employee, or

consultant of the Company or a Subsidiary, and ceases to be a director, officer, employee or consultant by reason of termination

or removal by the Company for Cause or by the Employee without Good Reason, the Option and the Additional Option will terminate

on the effective date of the Employee ceasing to be a director, officer, employee, or consultant, as the case may be, for that

reason;

|

|

|

(b)

|

if the Employee is a director, officer, employee, or

consultant of the Company or a Subsidiary, and ceases to be a director, officer, employee or consultant by reason of death or

Disability, then the entire Option and Additional Option shall immediately vest as to any portion of the Option and Additional

Option which has not then yet vested (such that the Vesting Term is then removed) and the Employee’s personal representative

will have the right to exercise any unexercised portion of the then fully vested portion of the Option and the Additional Option,

in whole or in part, at any time until the earlier of (a) the Expiry Date and (b) the date that is two years year after the effective

date of the Employee ceasing to be a director, officer, employee, or consultant by reason of death or Disability; and

|

|

|

(c)

|

if the Employee is a director, officer, employee, or

consultant of the Company or a Subsidiary, and ceases to be a director, officer, employee, or consultant for any reason other

than as set out in subparagraphs (a) or (b) above, then the entire Option and Additional Option shall immediately vest as to any

portion of the Option and Additional Option which has not then yet vested (such that the Vesting Term is then removed) and the

Employee will have the right to exercise any unexercised portion of the then fully vested portion of the Option and the Additional

Option, in whole or in part, any anytime until the earlier of (a) the Expiry Date and (b) the date that is two years after the

effective date of the Employee ceasing to be a director, officer, employee, or consultant for that other reason.”.

|

The foregoing description of the Further

Amendment does not purport to be complete and is qualified in its entirety by the Further Amendment which is filed as Exhibit 99.1

hereto and is incorporated by reference herein.

The information in Item 8.01 of this Report

of Foreign Private Issuer on Form 6-K (and the applicable exhibit) is incorporated by reference into: (i) our registration statement

on Form F-3 (333-227883), originally filed on October 18, 2018, and the prospectus supplement thereto filed on July 14, 2020; and

(ii) our registration statement on Form F-3 (333-229562), originally filed on February 8, 2019, and the prospectus thereto filed

on March 1, 2019.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Date: August 24, 2020.

|

ELECTRAMECCANICA VEHICLES CORP.

|

|

|

|

|

|

By:

|

/s/ Bal Bhullar

|

|

|

|

Name: Bal Bhullar

|

|

|

Title: Chief Financial Officer and Director

|

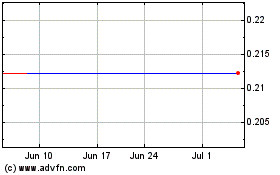

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Nov 2023 to Nov 2024