East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, one of the nation’s premier regional banks, today

reported financial results for the second quarter of 2010. For the

second quarter of 2010, net income was $36.3 million or $0.21 per

diluted share.

“For the second quarter, East West increased net income 46% from

$24.9 million in the previous quarter to $36.3 million. This

continued profitability was driven by our improving asset quality,

our ability to integrate the United Commercial Bank acquisition

quickly and efficiently and the strong performance of our

franchise,” stated Dominic Ng, Chairman and Chief Executive Officer

of East West. “I am pleased to report that our credit indicators

continue to trend in a positive direction. Quarter over quarter,

our provision for loan losses decreased by $21.2 million or 28% and

net charge-offs decreased $8.7 million or 14%. Further, our

nonperforming assets to total assets ratio has remained below 1%

for three consecutive quarters.”

Ng stated, “During the quarter, we acquired Washington First

International Bank through an FDIC-assisted transaction and

strengthened our operations in the greater Seattle area. This

strategically attractive acquisition increased our market share in

the Seattle region in a cost-effective, immediately accretive

way.”

“For the remainder of 2010, East West will focus on growing our

revenue and profitability and reinvesting in our business while

remaining disciplined on expenses. For the past three consecutive

quarters we have increased our profitability and expect to continue

to do so for the remainder of 2010,” concluded Ng.

Second Quarter 2010 Highlights

- Second Quarter Earnings

– For the second quarter 2010, net income was $36.3 million,

an increase of $11.4 million over net income of $24.9 million

reported in the first quarter of 2010 and an increase of $128.4

million over a net loss of $92.1 million reported in the second

quarter of 2009.

- Acquisition of Washington

First International Bank – East West acquired the banking

operations of Seattle-based Washington First International Bank

(WFIB) in a purchase and assumption agreement with the Federal

Deposit Insurance Corporation (FDIC) on June 11, 2010. East West

acquired total assets of $492.6 million, including $313.9 million

of loans (net of purchase accounting adjustments) and assumed

$395.9 million in deposits.

- Net Charge-offs Down 14% from

Q1 2010, Down 59% from Q2 2009 – Net charge-offs declined to

$55.2 million, a decrease of $8.7 million or 14% from the prior

quarter and a decrease of $78.7 million or 59% from the second

quarter of 2009.

- Nonperforming Assets to Total

Assets Below 1% – Nonperforming assets remain low at

$195.6 million, or 0.98% of total assets, a decline of 51 basis

points from June 30, 2009.

- Strong Core Deposit Growth

– Core deposits grew to a record $8.2 billion as of June 30,

2010, an increase of $444.1 million or 6% from March 31, 2010. At

June 30, 2010 core deposits from WFIB totaled $84.2 million.

Excluding the impact of the WFIB acquisition, East West grew core

deposits by $359.9 million or 5% from March 31, 2010.

- Strong Net Interest

Margin – The net interest margin for the quarter totaled 4.66%.

Excluding discount accretion on covered loan dispositions and

recoveries, the net interest margin totaled 3.98% for the quarter,

compared to 2.98% in the second quarter of 2009. (See

reconciliation of the GAAP financial measure to this non-GAAP

financial measure in the tables attached.)

- Strong Capital Levels –

As of June 30, 2010, East West’s Tier 1 risk-based capital and

total risk-based capital ratios were 18.9% and 20.8%, respectively,

significantly higher than the well capitalized requirements of 6%

and 10%, respectively.

Management Guidance

The Company is providing guidance for the third quarter of 2010.

Management currently estimates that fully diluted earnings per

share for the third quarter of 2010 will range from $0.19 to $0.22

per diluted share. This EPS guidance is based on the following

assumptions:

- Flat balance sheet growth

- A stable interest rate

environment and a net interest margin between 3.98% and 4.02%,

excluding the impact of discount accretion on covered loan

dispositions and recoveries

- Provision for loan losses of

approximately $35 million to $40 million for the quarter

- Noninterest expense of

approximately $105 million, net of FDIC reimbursable items

- Effective tax rate of

approximately 37%

FDIC-Assisted Acquisition of Washington First International

Bank

On June 11, 2010, East West acquired the banking operations of

Seattle-based WFIB in a purchase and assumption agreement with the

FDIC. East West acquired total assets of $492.6 million and assumed

$395.9 million in deposits, net of purchase accounting adjustments.

This strategically attractive transaction expands East West’s

footprint in the greater Seattle area, enhancing our ability to

increase operating efficiencies and grow our customer base in this

region.

In connection with the acquisition, East West entered into a

loss-sharing agreement with the FDIC that covers approximately

$420.0 million in loans and real estate owned. Pursuant to the

terms of the loss-sharing arrangement, the FDIC is obligated to

reimburse the Bank for 80% of all eligible losses on covered

assets. As a result of this transaction, East West recorded a

pre-tax gain of $19.5 million.

The integration of WFIB is progressing smoothly and we are on

target for full integration of all systems by the end of October

2010.

All WFIB legacy loans were accounted for at fair value at the

date of acquisition and recorded at a discount to book value. As

such, losses that East West expects to incur have already been

written off and considered in the fair value of loans acquired as

of June 11, 2010.

A summary of the net assets received from the FDIC is as

follows:

June 11, 2010

(in thousands) Assets Cash and cash equivalents 67,186

Investment securities 37,532 Core deposit intangible 3,065 Loans

covered by FDIC loss sharing (gross balance $395,156 and shown net

of discount of $84,174) 310,982 Loans not covered by FDIC loss

sharing 2,869 FDIC indemnification asset 41,131 Other real estate

owned covered, net 23,443

Other assets

6,380

Total assets acquired

492,588 Liabilities Deposits 395,910 FHLB Advances 65,348

Securities sold under repurchase agreements 1,937

Other liabilities

9,917

Total liabilities assumed

473,112 Net assets acquired 19,476

Balance Sheet Summary

At June 30, 2010 total assets were $20.0 billion compared to

$20.3 billion at March 31, 2010, and $12.7 billion at June 30,

2009. The decrease in total assets quarter over quarter was driven

by prepayments on FHLB advances of $740.0 million, sales of

consumer student loans of $227.3 million and sales of fixed rate

investment securities of $208.7 million.

Gross loans at June 30, 2010 totaled $13.7 billion, compared to

$13.8 billion at March 31, 2010. Noncovered loan balances decreased

$82.7 million during the quarter to $8.5 billion as of June 30,

2010. During the quarter, growth in commercial loans of $84.1

million and single family loans of $71.7 million was offset by

decreases in consumer loans resulting from the sale of student

loans and paydowns on commercial real estate, construction and land

loans.

Covered loans totaled $5.3 billion at June 30, 2010, as compared

to $5.2 billion at March 31, 2010. The increase in covered loans

was a result of the addition of $311.0 million in loans from the

acquisition of WFIB, partially offset by a reduction in loan

balances from United Commercial Bank.

Deposit balances totaled $14.9 billion at June 30, 2010,

compared to $14.6 billion at March 31, 2010. During the quarter

East West assumed $395.9 million in deposits from the acquisition

of WFIB, reduced brokered deposits by $174.5 million and increased

deposits organically by $90.6 million. Total core deposits

increased to a record $8.2 billion as of June 30, 2010, or an

increase of $444.1 million or 6% from March 31, 2010. The average

cost of deposits decreased to 0.80% for the second quarter, an

improvement of 13 basis points from the first quarter of 2010 and

an improvement of 67 basis points from the second quarter of

2009.

During the second quarter of 2010, East West continued to

execute on its strategy to lower borrowing costs, prepaying $740.0

million in FHLB advances with an average cost of 1.72% during the

quarter. As of June 30, 2010, FHLB advances totaled $1.0 billion, a

decline of $747.4 million or 42% from March 31, 2010. As a result

of the prepayments, East West incurred a prepayment penalty of $3.9

million, net of purchase accounting adjustments recorded, which is

included in noninterest expense. The average cost of funds

decreased to 1.17% for the second quarter of 2010, down 11 basis

points from the first quarter of 2010 and down 95 basis points from

the second quarter of 2009.

Second Quarter 2010 Operating Results

Net Interest Income

Despite a prolonged and challenging low interest rate

environment, net interest income has remained stable. As previously

discussed, East West has grown low-cost core deposits, reducing the

cost of deposits to 0.80% for the second quarter of 2010, down from

0.93% in the first quarter of 2010. Further, East West prepaid

higher-cost FHLB advances, improving the cost of funds.

Included in net interest income is discount accretion on early

payoffs and recoveries on covered loans of $29.8 million in the

second quarter of 2010, compared to $81.3 million in the first

quarter of 2010. Excluding the impact of discount accretion, the

net interest margin was 3.98% for the second quarter of 2010,

compared to 4.02% in the prior quarter and an increase from 2.98%

in the second quarter of 2009.

The adjustments to net interest income are summarized in the

table below:

Reconciliation of Net Interest Income to Adjusted Net

Interest Income

Quarter

Ended

June 30, 2010

March 31, 2010 Interest

Yield Interest Yield Net

interest income and net interest margin $ 203,623 4.66 % $ 261,724

5.92 % Less yield adjustment related to:

Covered loan disposition and recoveries 29,755 81,343 Repurchase

agreement termination gain - 2,536 Total yield

adjustment 29,755 $ 83,879

Net interest income and net

interest margin, excluding yield adjustment

$ 173,868 3.98 % $ 177,845 4.02 %

Noninterest Income

Noninterest income for the second quarter totaled $35.7 million,

compared to a loss of $8.5 million in the first quarter of 2010 and

a loss of $26.2 million in the second quarter of 2009. The loss in

the first quarter of 2010 was primarily due to a $43.6 million

decrease in the FDIC indemnification asset and receivable compared

to a $9.4 million decrease in the second quarter of 2010. The

decreases in the FDIC indemnification asset and receivable in both

the first and second quarters are primarily due to early payoffs on

covered loans, resulting in a net reduction in the FDIC

indemnification asset and receivable. The loss in the second

quarter of 2009 was primarily due to impairment losses on

investment securities of $37.4 million compared to $4.6 million of

impairment losses in the second quarter of 2010.

As previously mentioned, during the second quarter we sold

$227.3 million in student loans and $208.7 million in fixed rate

investment securities at gains of $8.1 million and $5.8 million,

respectively. Noninterest income for the second quarter also

included a gain of $19.5 million as a result of the acquisition of

WFIB.

During the second quarter we recorded impairment losses on

investment securities totaling $4.6 million, of which $2.4 million

was recorded on pooled trust preferred securities and $2.2 million

was recorded on agency preferred stock. As of June 30, 2010, the

agency preferred stock was written down to zero.

As compared to the second quarter of 2009, branch fees increased

by $3.2 million or 65%, letters of credit fees and commissions

increased $935 thousand or 48%, and ancillary loan fees increased

$1.0 million or 75%, primarily due to the acquisition of UCB.

Excluding the impact of the decrease in the FDIC indemnification

asset and receivable, gains on sales of investment securities and

loans, gain on acquisition, and impairment charges on investment

securities, noninterest income for the second quarter totaled $16.4

million, a $6.8 million or a 71% increase as compared to the second

quarter of 2009. See reconciliation of the GAAP financial measure

to this non-GAAP financial measure in the tables attached. A

summary of these second quarter 2010 noninterest income items is

detailed below:

Quarter Ended June 30,

2010 Noninterest income $ 35,685 Add: Impairment loss on

investment securities 4,642 Net gain on sale of investment

securities (5,847 ) Net gain on sale of loans (8,073 ) Gain on

acquisition (19,476 )

Decrease in FDIC indemnification

asset and FDIC Receivable

9,424 Operating noninterest income $ 16,355

Noninterest Expense

Noninterest expense totaled $125.3 million for the second

quarter of 2010 compared to $138.9 million for the first quarter of

2010. Second quarter noninterest expense includes $28.7 million of

expenses that are either not expected to be ongoing expenses in

future quarters or are reimbursable from the FDIC, as detailed in

the table below:

Quarter Ended (In

thousands)

June 30, 2010 Noninterest Expense: $ 125,318

Prepayment penalty for FHLB advances 3,900 Expenses related to the

integration of UCB 3,602 Expenses for UCB covered assets,

reimbursable from the FDIC: OREO expenses 15,258 Loan related

expenses 4,062 Legal expenses 1,877 Total reimbursable

expenses on covered assets 21,197

Noninterest expense excluding

prepayment penalty on FHLB advances, integration costs related to

the acquisition of UCB, and reimbursable expenses

$ 96,619

Included in noninterest expense are integration expenses of $3.6

million, of which $1.5 million is related to severance costs. In

addition, under the loss share agreement with the FDIC, 80% of

eligible expenses on covered assets are reimbursable from the FDIC.

In the second quarter, we incurred $26.5 million in expenses on

covered loans and REO assets, 80%, or $21.2 million of which we

expect to be reimbursed by the FDIC. As discussed above, East West

also prepaid $740.0 million in FHLB advances and paid a prepayment

penalty of $3.9 million. Management anticipates that in the third

quarter of 2010, noninterest expense will total approximately $105

million, net of FDIC reimbursable items.

The effective tax rate for the second quarter was 38.1% compared

to 41.1% in the prior year period. The effective tax rate is

reduced from the statutory tax rate primarily due to the

utilization of tax credits related to affordable housing

investments.

Credit Management

Credit indicators have continued to be strong. Nonperforming

assets have remained low at $195.6 million as of June 30, 2010.

Nonperforming assets, excluding covered assets, to total assets was

0.98% at June 30, 2010, compared to 1.49% of total assets at June

30, 2009. Nonperforming assets, excluding covered assets, as of

June 30, 2010 included nonaccrual loans totaling $179.1 million and

REO assets totaling $16.6 million.

The provision for loan losses was $55.3 million for the second

quarter of 2010, a decrease of $21.2 million or 28% compared to the

previous quarter and a decrease of $96.2 million or 64% from the

second quarter of 2009. Total net charge-offs fell to $55.2 million

for the second quarter, a decrease of $8.7 million or 14% from the

previous quarter and a decrease of $78.7 million or 59% from the

second quarter of 2009. Management expects that the provision for

loan losses and net charge-offs will continue to decrease for the

second half of 2010 and range from $35 million to $40 million for

the third quarter of 2010.

Credit metrics on our seasoned commercial real estate portfolio

have remained strong. Nonperforming commercial real estate loans

were 0.52% of total commercial real estate loans as of June 30,

2010 and net charge-offs on commercial real estate loans were 1.34%

of total average commercial real estate loans (annualized) for the

second quarter. Further, land and construction loan balances are

down to only 5% of total gross loans receivable.

Notwithstanding the improvements noted above, we have maintained

a strong allowance for loan losses at $249.5 million or 2.94% of

non-covered loans receivable at June 30, 2010, to cover inherent

losses in the portfolio, as compared to allowance for loan losses

of $250.5 million or 2.93% at March 31, 2010 and $223.7 million or

2.62% of outstanding loans at June 30, 2009.

All loans acquired from UCB and WFIB were recorded at estimated

fair value as of the acquisition dates. East West entered into loss

sharing agreements with the FDIC that covers future losses incurred

on nearly all the UCB and WFIB legacy loans. As of June 30, 2010,

we believe no allowance is required for these covered loans.

Capital Strength

Capital

Strength (Dollars in millions)

June 30, 2010

Well

CapitalizedRegulatoryRequirement

Total Excess AboveWell

CapitalizedRequirement

Tier 1 leverage capital ratio 10.5 % 5.00 % $ 1,077 Tier 1

risk-based capital ratio 18.9 % 6.00 % 1,397 Total risk-based

capital ratio 20.8 % 10.00 % 1,175 Tangible common equity to

tangible asset 7.90 % N/A N/A Tangible common equity to risk

weighted assets ratio 14.2 % 4.00 % * 1,110 As there is no

stated regulatory guideline for this ratio, the SCAP guideline of

4.00% tangible common equity has been used.

East West remains committed to maintaining strong capital levels

that exceed regulatory requirements. As of the end of the second

quarter of 2010, our Tier 1 leverage capital ratio increased to

10.5%, Tier 1 risk-based capital ratio totaled 18.9% and the total

risk-based capital ratio totaled 20.8%. East West exceeds well

capitalized requirements for all regulatory guidelines by over $1.0

billion.

Dividend Payout

East West’s Board of Directors has declared third quarter

dividends on the common stock and Series A Preferred Stock. The

common stock cash dividend of $0.01 is payable on or about August

24, 2010 to shareholders of record on August 10, 2010. The dividend

on the Series A Preferred Stock of $20.00 per share is payable on

August 1, 2010 to shareholders of record on July 15, 2010.

About East West

East West Bancorp is a publicly owned company with $20.0 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol “EWBC”. The Company’s wholly owned subsidiary, East West

Bank, is one of the largest independent commercial banks

headquartered in California with over 130 locations worldwide,

including the U.S. markets of California, New York, Georgia,

Massachusetts, Texas and Washington. In Greater China, East West’s

presence includes a full service branch in Hong Kong and

representative offices in Beijing, Shanghai, Shenzhen and Taipei.

Through a wholly-owned subsidiary bank, East West’s presence in

Greater China also includes full service branches in Shanghai and

Shantou and representative offices in Beijing and Guangzhou. For

more information on East West Bancorp, visit the Company's website

at www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2009 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank’s expectations of results or any change in event.

EAST WEST BANCORP, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands, except per share amounts)

(unaudited) June 30, 2010 December 31,

2009 Assets Cash and cash equivalents $ 1,185,944 $ 835,141

Short-term investments 447,168 510,788 Securities purchased under

resale agreements 230,000 227,444 Investment securities 2,077,011

2,564,081

Loans receivable, excluding

covered loans (net of allowance for loan losses of $249,462 and

$238,833)

8,177,966 8,246,685 Covered loans 5,275,492

5,598,155 Total loans receivable, net 13,453,458 13,844,840

Federal Home Loan Bank and Federal Reserve stock 223,395 217,002

FDIC indemnification asset 947,011 1,091,814 Other real estate

owned, net 16,562 13,832 Other real estate owned covered, net

113,999 44,273 Premiums on deposits acquired, net 86,106 89,735

Goodwill 337,438 337,438 Other assets 849,229

782,824 Total assets $ 19,967,321 $ 20,559,212

Liabilities and Stockholders' Equity Deposits $ 14,918,694 $

14,987,613 Federal Home Loan Bank advances 1,022,011 1,805,387

Securities sold under repurchase agreements 1,051,192 1,026,870

Subordinated debt and trust preferred securities 235,570 235,570

Other borrowings 35,504 67,040 Accrued expenses and other

liabilities 365,386 152,073 Total

liabilities 17,628,357 18,274,553 Stockholders' equity

2,338,964 2,284,659 Total liabilities and

stockholders' equity $ 19,967,321 $ 20,559,212 Book

value per common share $ 13.31 $ 14.47 Number of common shares at

period end 147,939 109,963

Ending Balances June

30, 2010 December 31, 2009 Loans receivable Real estate

- single family $ 1,033,155 $ 930,840 Real estate - multifamily

985,194 1,025,849 Real estate - commercial 3,500,273 3,606,179 Real

estate - land 297,364 370,394 Real estate - construction 354,547

458,292 Commercial 1,528,863 1,512,709 Consumer 774,746

624,784 Total loans receivable, excluding

covered loans 8,474,142 8,529,047 Covered loans 5,275,492

5,598,155 Total loans receivable 13,749,634

14,127,202 Unearned fees, premiums and discounts (46,714 ) (43,529

) Allowance for loan losses (249,462 ) (238,833 ) Net

loans receivable $ 13,453,458 $ 13,844,840 Deposits

Noninterest-bearing demand $ 2,396,087 $ 2,291,259 Interest-bearing

checking 685,572 667,177 Money market 4,162,128 3,138,866 Savings

946,043 991,520 Total core deposits

8,189,830 7,088,822 Time deposits 6,728,864

7,898,791 Total deposits $ 14,918,694 $ 14,987,613

EAST WEST BANCORP, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share

amounts) (unaudited) Quarter Ended

June 30, 2010 March 31, 2010 June 30, 2009

Interest and dividend income $ 253,533 $ 318,703 $ 146,333

Interest expense (49,910 ) (56,979 ) (58,073 )

Net interest income before provision for loan losses 203,623

261,724 88,260 Provision for loan losses (55,256 )

(76,421 ) (151,422 ) Net interest income after provision for

loan losses 148,367 185,303 (63,162 ) Noninterest income (loss)

35,685 (8,451 ) (26,199 ) Noninterest expense (125,318 )

(138,910 ) (57,912 ) Income (loss) before benefit for

income taxes 58,734 37,942 (147,273 ) Provision (benefit) for

income taxes 22,386 13,026

(60,548 ) Net income (loss) before extraordinary item 36,348 24,916

(86,725 ) Extraordinary item, net of tax - -

(5,366 ) Net income (loss) after extraordinary item $

36,348 $ 24,916 $ (92,091 ) Preferred stock dividend, inducement,

and amortization of preferred stock discount (6,147 )

(6,138 ) (23,623 ) Net income (loss) available to common

stockholders $ 30,201 $ 18,778 $ (115,714 ) Net income (loss) per

share, basic $ 0.21 $ 0.17 $ (1.83 ) Net income (loss) per share,

diluted $ 0.21 $ 0.13 $ (1.83 ) Shares used to compute per share

net loss: - Basic 146,372 109,961 63,105 - Diluted 147,131 146,865

63,105

Quarter Ended June 30, 2010

March 31, 2010 June 30, 2009 Noninterest income

(loss): Decrease in FDIC indemnification asset and FDIC receivable

$ (9,424 ) $ (43,572 ) $ - Impairment loss on investment securities

(4,642 ) (4,799 ) (37,447 ) Net gain on sale of investment

securities 5,847 16,111 1,680 Gain on acquisition 19,476 8,095 -

Branch fees 8,219 8,758 4,991 Net gain on sale of loans 8,073 3

Letters of credit fees and commissions 2,865 2,740 1,930 Ancillary

loan fees 2,369 1,689 1,356 Other operating income 2,902

2,527 1,288 Total noninterest

income (loss) $ 35,685 $ (8,451 ) $ (26,199 ) Noninterest

expense: Compensation and employee benefits $ 41,579 $ 50,779 $

16,509 Other real estate owned expense 20,983 18,012 8,682

Occupancy and equipment expense 13,115 11,944 6,297 Legal expense

6,183 2,907 1,755 Prepayment penalty for FHLB advances 3,900 9,932

- Deposit insurance premiums and regulatory assessments 4,528

11,581 9,568 Amortization of premiums on deposits acquired 3,310

3,384 1,092 Data processing 3,046 2,482 1,141 Amortization of

investments in affordable housing partnerships 2,638 3,037 1,652

Consulting expense 1,919 2,141 672 Loan related expenses 5,254

2,997 1,642 Other operating expense 18,863

19,714 8,902 Total noninterest expense $

125,318 $ 138,910 $ 57,912

EAST WEST

BANCORP, INC. CONDENSED CONSOLIDATED STATEMENTS OF

INCOME (In thousands, except per share amounts)

(unaudited) Year To Date June 30, 2010

June 30, 2009 Interest and dividend income $ 572,236

$ 291,256 Interest expense (106,889 ) (123,315 ) Net

interest income before provision for loan losses 465,347 167,941

Provision for loan losses (131,677 ) (229,422 ) Net

interest income after provision for loan losses 333,670 (61,481 )

Noninterest income (loss) 27,234 (12,405 ) Noninterest expense

(264,228 ) (109,318 ) Income (loss) before benefit

for income taxes 96,676 (183,204 ) Provision (benefit) for income

taxes 35,412 (74,013 ) Net loss before

extraordinary item 61,264 (109,191 ) Extraordinary item, net of tax

- (5,366 ) Net income (loss) after

extraordinary item $ 61,264 $ (114,557 ) Preferred stock dividend,

inducement, and amortization of preferred stock discount

(12,285 ) (32,366 ) Net income (loss) available to common

stockholders $ 48,979 $ (146,923 ) Net income (loss) per share,

basic $ 0.40 $ (2.33 ) Net income (loss) per share, diluted $ 0.34

$ (2.33 ) Shares used to compute per share net loss: - Basic

123,445 63,052 - Diluted 142,143 63,052

Year To

Date June 30, 2010 June 30, 2009 Noninterest

income (loss): Decrease in FDIC indemnification asset and FDIC

receivable $ (52,996 ) $ - Impairment loss on investment securities

(9,441 ) (37,647 ) Net gain on sale of investment securities 21,958

5,201 Gain on acquisition 27,571 - Branch fees 16,977 9,784 Net

gain on sale of loans 8,073 11 Letters of credit fees and

commissions 5,605 3,784 Ancillary loan fees 4,058 3,585 Other

operating income 5,429 2,877 Total

noninterest income (loss) $ 27,234 $ (12,405 ) Noninterest

expense: Compensation and employee benefits $ 92,358 $ 33,617 Other

real estate owned expense 38,995 15,713 Occupancy and equipment

expense 25,059 13,688 Deposit insurance premiums and regulatory

assessments 16,109 12,893 Prepayment penalty for FHLB advances

13,832 - Legal expense 9,090 3,533 Amortization of premiums on

deposits acquired 6,694 2,217 Amortization of investments in

affordable housing partnerships 5,675 3,412 Data processing 5,528

2,283 Consulting expense 4,060 1,120 Loan related expenses 8,251

3,077 Other operating expense 38,577 17,765

Total noninterest expense $ 264,228 $ 109,318

EAST WEST BANCORP, INC. QUARTERLY ALLOWANCE FOR

LOAN LOSSES RECAP (In thousands) (unaudited)

Quarter Ended 6/30/2010

3/31/2010 12/31/2009

9/30/2009 6/30/2009 LOANS

Allowance balance, beginning of period $ 250,517 $ 238,833 $

230,650 $ 223,700 $ 195,450 Allowance for unfunded loan commitments

and letters of credit (1,115 ) (808 ) (1,161 ) (1,051 ) 1,442

Provision for loan losses 55,256 76,421 140,000 159,244 151,422

Impact of desecuritization - - - - 9,262 Net Charge-offs:

Real estate - single family 3,257 3,426 7,083 8,034 14,058 Real

estate - multifamily 7,552 4,860 8,425 7,231 2,256 Real estate -

commercial 11,836 8,201 13,305 23,105 12,472 Real estate - land

9,765 26,828 20,390 39,988 33,183 Real estate - residential

construction 3,086 11,642 48,919 32,535 30,634 Real estate -

commercial construction 8,548 2,029 21,355 23,051 28,602 Commercial

10,563 6,422 5,789 14,956 11,577 Trade finance (88 ) (54 ) 2,569

2,256 774 Consumer 677 575

2,821 87

320 Total net charge-offs

(recovery) 55,196 63,929

130,656 151,243

133,876 Allowance balance, end

of period $ 249,462 $ 250,517

$ 238,833 $ 230,650

$ 223,700

UNFUNDED LOAN COMMITMENTS AND

LETTERS OF CREDIT: Allowance balance, beginning of period $

8,927 $ 8,119 $ 6,958 $ 5,907 $ 7,349 Provision for unfunded loan

commitments and letters of credit 1,115

808 1,161

1,051 (1,442 ) Allowance

balance, end of period $ 10,042 $ 8,927

$ 8,119 $ 6,958

$ 5,907 GRAND TOTAL, END OF PERIOD $ 259,504

$ 259,444 $ 246,952

$ 237,608 $ 229,607

Nonperforming assets to total assets (1) 0.98 % 0.89 % 0.91

% 1.84 % 1.49 % Allowance for loan losses to total gross

non-covered loans at end of period 2.94 % 2.93 % 2.80 % 2.74 % 2.62

% Allowance for loan losses and unfunded loan commitments to total

gross non-covered loans at end of period 3.06 % 3.03 % 2.90 % 2.82

% 2.69 % Allowance to non-covered nonaccrual loans at end of period

139.31 % 143.62 % 137.91 % 112.82 % 137.94 % Nonaccrual loans to

total loans (2) 1.30 % 1.27 % 1.23 % 2.43 % 1.90 % (1)

Nonperforming assets excludes covered loans and REOs. Total assets

includes covered assets. (2) Nonaccrual loans excludes covered

loans. Total loans includes covered loans.

EAST WEST BANCORP, INC TOTAL NON-PERFORMING ASSETS,

EXCLUDING COVERED ASSETS (in thousands)

(unaudited) AS OF JUNE 30, 2010 Total

Nonaccrual Loans

90+

DaysDelinquent

Under 90+

DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 14,835 $ - $ 14,835

$ 395 $ 15,230 Real estate - multifamily 13,180 5,521 18,701 3,131

21,832 Real estate - commercial 15,778 2,569 18,347 7,047 25,394

Real estate - land 43,775 5,292 49,067 2,541 51,608 Real estate -

residential construction 1,454 23,370 24,824 2,272 27,096 Real

estate - commercial construction 22,997 449 23,446 830 24,276

Commercial 19,310 8,994 28,304 - 28,304 Trade Finance - - - - -

Consumer 1,436 104 1,540 346

1,886

Total $ 132,765 $ 46,299

$ 179,064 $ 16,562 $

195,626 AS OF MARCH 31, 2010 Total

Nonaccrual Loans

90+

DaysDelinquent

Under 90+

DaysDelinquent

TotalNonaccrualLoans

REO Assets

Total

Non-PerformingAssets

Loan Type Real estate - single family $ 13,673 $ - $ 13,673

$ - $ 13,673 Real estate - multifamily 12,444 4,780 17,224 712

17,936 Real estate - commercial 28,484 4,127 32,611 2,979 35,590

Real estate - land 27,077 32,266 59,343 2,007 61,350 Real estate -

residential construction 3,188 782 3,970 379 4,349 Real estate -

commercial construction 15,066 9,652 24,718 830 25,548 Commercial

7,209 13,722 20,931 - 20,931 Trade Finance - 505 505 - 505 Consumer

1,218 234 1,452 - 1,452

Total $ 108,359 $ 66,068

$ 174,427 $ 6,907 $

181,334 AS OF DECEMBER 31, 2009 Total

Nonaccrual Loans

90+

DaysDelinquent

Under 90+

DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 3,262 $ - $ 3,262 $

264 $ 3,526 Real estate - multifamily 10,631 - 10,631 2,118 12,749

Real estate - commercial 11,654 18,450 30,104 5,687 35,791 Real

estate - land 27,179 42,666 69,845 4,393 74,238 Real estate -

residential construction 17,179 - 17,179 540 17,719 Real estate -

commercial construction - 17,132 17,132 830 17,962 Commercial 8,002

16,765 24,767 - 24,767 Trade Finance - - - - - Consumer 114

146 260 - 260

Total $

78,021 $ 95,159 $ 173,180

$ 13,832 $ 187,012 AS OF JUNE

30, 2009 Total Nonaccrual Loans

90+

DaysDelinquent

Under 90+

DaysDelinquent

TotalNonaccrualLoans

REO Assets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 5,181 $ - $ 5,181 $

4,921 $ 10,102 Real estate - multifamily 7,938 - 7,938 281 8,219

Real estate - commercial 19,786 4,590 24,376 2,887 27,263 Real

estate - land 35,660 1,656 37,316 13,307 50,623 Real estate -

residential construction 46,176 - 46,176 4,154 50,330 Real estate -

commercial construction 20,629 - 20,629 - 20,629 Commercial 8,034

8,067 16,101 626 16,727 Trade Finance 3,706 - 3,706 211 3,917

Consumer 339 412 751 801 1,552

Total $ 147,449 $ 14,725

$ 162,174 $ 27,188 $

189,362

EAST WEST

BANCORP, INC. QUARTER TO DATE AVERAGE BALANCES, YIELDS AND

RATES PAID (In thousands) (unaudited)

Quarter

Ended June 30, 2010 June 30, 2009

Average Average Volume

Interest Yield (1)

Volume Interest Yield

(1)

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 948,361 $ 1,502 0.64 % $ 876,386

$ 2,509 1.15 % Securities purchased under resale agreements 455,743

2,630 2.28 % 51,374 1,292 9.95 % Investment securities (2)

2,202,676 14,741 2.68 % 2,612,998 30,440 4.67 % Loans receivable

8,556,680 116,916 5.48 % 8,244,850 111,669 5.43 % Loans receivable

- covered 5,137,863 116,867 9.12 % - - - Federal Home Loan Bank and

Federal Reserve Bank stocks 224,473

877 1.56 % 123,514

545 1.76 % Total

interest-earning assets 17,525,796

253,533 5.80 % 11,909,122

146,455 4.93 %

Noninterest-earning assets: Cash and due from banks 603,907

113,853 Allowance for loan losses (255,904 ) (198,802 ) Other

assets 2,012,470 794,849 Total assets $

19,886,269 $ 12,619,022

LIABILITIES AND STOCKHOLDERS'

EQUITY

Interest-bearing liabilities: Checking accounts 663,936 527

0.32 % 356,756 324 0.36 % Money market accounts 3,968,293 8,336

0.84 % 1,822,470 6,140 1.35 % Savings deposits 961,374 1,274 0.53 %

415,828 659 0.64 % Time deposits 6,714,972 18,995 1.13 % 4,548,935

23,767 2.10 % Federal Home Loan Bank advances 1,238,400 6,175 2.00

% 1,273,640 13,142 4.14 % Securities sold under repurchase

agreements 1,042,305 12,045 4.57 % 1,006,614 12,004 4.72 %

Subordinated debt and trust preferred securities 235,570 1,591 2.67

% 235,570 2,034 3.42 % Other borrowings 49,785

967 7.68 % 4,849

3 0.24 % Total

interest-bearing liabilities 14,874,635

49,910 1.35 % 9,664,662

58,073 2.41 %

Noninterest-bearing liabilities: Demand deposits 2,300,228

1,300,676 Other liabilities 400,783 123,431 Stockholders' equity

2,310,623 1,530,253

Total liabilities and

stockholders' equity

$ 19,886,269 $ 12,619,022 Interest rate spread

4.45 % 2.52 % Net interest income and net interest margin $

203,623 4.66 % $ 88,382 2.98 % Net interest income and net

interest margin adjusted (3) $ 173,868 3.98 % (1) Annualized

(2) Amounts calculated on a fully taxable equivalent basis using

the current statutory federal tax rate. (3) Amounts exclude yield

adjustment related to covered loan disposition and recoveries of

$29,755 for the three months ended June 30, 2010.

EAST WEST BANCORP, INC. YEAR TO DATE

AVERAGE BALANCES, YIELDS AND RATES PAID (In thousands)

(unaudited)

Year To Date June 30, 2010

June 30, 2009 Average Average

Volume Interest Yield

(1) Volume Interest

Yield (1)

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 1,119,912 $ 5,043 0.91 % $

804,379 $ 5,485 1.38 % Securities purchased under resale agreements

358,074 8,893 4.94 % 50,691 2,542 9.97 % Investment securities (2)

2,194,322 34,931 3.21 % 2,658,478 59,905 4.54 % Loans receivable

8,582,214 238,944 5.61 % 8,221,143 222,485 5.46 % Loans receivable

- covered 5,256,293 282,783 10.85 % - - - Federal Home Loan Bank

and Federal Reserve Bank stocks 223,097

1,656 1.48 % 121,786

1,051 1.73 % Total

interest-earning assets 17,733,912

572,250 6.51 % 11,856,477

291,468 4.96 %

Noninterest-earning assets: Cash and due from banks 485,965

118,351 Allowance for loan losses (254,700 ) (192,465 ) Other

assets 2,195,865 775,633

Total assets

$ 20,161,042 $ 12,557,996

LIABILITIES AND STOCKHOLDERS'

EQUITY

Interest-bearing liabilities: Checking accounts 651,655

1,141 0.35 % 358,492 717 0.40 % Money market accounts 3,716,606

16,302 0.88 % 1,655,476 11,834 1.44 % Savings deposits 976,695

2,416 0.50 % 413,046 1,361 0.66 % Time deposits 7,013,720 42,721

1.23 % 4,681,241 54,051 2.33 % Federal Home Loan Bank advances

1,634,910 15,180 1.87 % 1,279,323 27,019 4.26 % Securities sold

under repurchase agreements 1,035,539 24,586 4.72 % 1,002,621

23,876 4.74 % Subordinated debt and trust preferred securities

235,570 3,138 2.65 % 235,570 4,451 3.76 % Other borrowings

74,893 1,405 3.73 %

3,653 6

0.33 % Total interest-bearing liabilities 15,339,588

106,889 1.41 %

9,629,422 123,315

2.58 %

Noninterest-bearing liabilities: Demand

deposits 2,260,847 1,270,716 Other liabilities 258,399 122,326

Stockholders' equity 2,302,208 1,535,532

Total liabilities and stockholders' equity $ 20,161,042

$ 12,557,996 Interest rate spread 5.10 % 2.38

% Net interest income and net interest margin $ 465,361 5.29

% $ 168,153 2.86 % Net interest income and net interest

margin adjusted (3) $ 351,728 4.00 % (1) Annualized (2)

Amounts calculated on a fully taxable equivalent basis using the

current statutory federal tax rate. (3) Amounts exclude yield

adjustment related to covered loan disposition and recoveries of

$111,097 and repurchase agreement termination gain of $2,536 for

the six months ended June 30, 2010.

EAST WEST BANCORP, INC.

SELECTED FINANCIAL INFORMATION (In thousands)

(unaudited) Average Balances Quarter

Ended June 30, 2010 March 31, 2010 June 30,

2009 Loans receivable Real estate - single family $ 989,744 $

931,318 $ 686,073 Real estate - multifamily 998,090 1,071,910

823,890 Real estate - commercial 3,530,045 3,601,112 3,516,257 Real

estate - land 317,291 356,908 523,799 Real estate - construction

383,846 449,272 1,072,319 Commercial 1,492,560 1,472,451 1,387,257

Consumer 845,104 731,771 235,255

Total loans receivable, excluding covered loans 8,556,680

8,614,742 8,244,850 Covered loans 5,137,863

5,369,328 - Total loans receivable 13,694,543

13,984,070 8,244,850 Investment securities 2,202,676 2,185,875

2,612,998 Earning assets 17,525,796 17,940,933 11,909,122 Total

assets 19,886,269 20,398,717 12,619,022 Deposits

Noninterest-bearing demand $ 2,300,228 $ 2,222,104 $ 1,300,676

Interest-bearing checking 663,936 636,039 356,756 Money market

3,968,293 3,464,234 1,822,470 Savings 961,374

992,186 415,828 Total core deposits 7,893,831

7,314,563 3,895,730 Time deposits 6,714,972

7,315,789 4,548,935 Total deposits 14,608,803

14,630,352 8,444,665 Interest-bearing liabilities 14,874,635

15,763,168 9,664,662 Stockholders' equity 2,310,623 2,293,712

1,530,253

Selected Ratios Quarter Ended

June 30, 2010 March 31, 2010 June 30, 2009 For

The Period Return on average assets 0.73 % 0.49 % -2.92 % Return on

average common equity 6.26 % 4.71 % -43.81 % Interest rate spread

(2) 4.45 % 5.73 % 2.52 % Net interest margin (2) 4.66 % 5.92 % 2.98

% Net interest margin adjusted (4) 3.98 % 4.02 % 2.98 % Yield on

earning assets (2) 5.80 % 7.20 % 4.93 % Cost of deposits 0.80 %

0.93 % 1.47 % Cost of funds 1.17 % 1.28 % 2.12 % Noninterest

expense/average assets (1) 2.32 % 2.40 % 1.75 % Efficiency ratio

(3) 56.56 % 58.45 % 55.12 % (1) Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, amortization of investments in affordable

housing partnerships and prepayment penalty for FHLB advances. (2)

Yields on certain securities have been adjusted upward to a "fully

taxable equivalent" basis in order to reflect the effect of income

which is exempt from federal income taxation at the current

statutory tax rate. (3) Represents noninterest expense, excluding

the amortization of intangibles, amortization and impairment loss

of premiums on deposits acquired, investments in affordable housing

partnerships and prepayment penalty for FHLB advances, divided by

the aggregate of net interest income before provision for loan

losses, excluding nonrecurring adjustments and noninterest income,

excluding impairment loss on investment securities and gain on

acquisition and the decrease in FDIC indemnification asset and FDIC

receivable.

(4) Amounts exclude yield

adjustment related to covered loan disposition and recoveries of

$29,755 for the quarter ended June 30, 2010. and yield adjustment

related to covered loan disposition of $74,439 for the quarter

ended December 31, 2009.

EAST WEST BANCORP, INC. SELECTED

FINANCIAL INFORMATION (In thousands) (unaudited)

Average Balances Year To Date June 30,

2010 June 30, 2009 Loans receivable Real estate - single

family $ 961,800 $ 596,913 Real estate - multifamily 1,034,830

758,744 Real estate - commercial 3,563,975 3,491,166 Real estate -

land 336,990 552,917 Real estate - construction 416,378 1,151,836

Commercial 1,479,533 1,437,732 Consumer 788,708

231,835 Total loans receivable, excluding covered

loans 8,582,214 8,221,143 Covered loans 5,256,293

- Total loans receivable 13,838,507 8,221,143

Investment securities 2,194,322 2,658,478 Earning assets 17,733,912

11,856,477 Total assets 20,161,042 12,557,996 Deposits

Noninterest-bearing demand $ 2,260,847 $ 1,270,716 Interest-bearing

checking 651,655 358,492 Money market 3,716,606 1,655,476 Savings

976,695 413,046 Total core deposits

7,605,803 3,697,730 Time deposits 7,013,720

4,681,241 Total deposits 14,619,523 8,378,971

Interest-bearing liabilities 15,339,588 9,629,422 Stockholders'

equity 2,302,208 1,535,532

Selected Ratios

Year To Date June 30, 2010 June 30, 2009 For

The Period Return on average assets 0.61 % -1.82 % Return on

average common equity 5.55 % -27.66 % Interest rate spread (2) 5.10

% 2.38 % Net interest margin (2) 5.29 % 2.86 % Net interest margin

adjusted (4) 4.00 % 2.86 % Yield on earning assets (2) 6.51 % 4.96

% Cost of deposits 0.86 % 1.64 % Cost of funds 1.22 % 2.28 %

Noninterest expense/average assets (1) 2.36 % 1.65 % Efficiency

ratio (3) 57.52 % 53.51 % (1) Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, amortization of investments in affordable

housing partnerships and prepayment penalty for FHLB advances. (2)

Yields on certain securities have been adjusted upward to a "fully

taxable equivalent" basis in order to reflect the effect of income

which is exempt from federal income taxation at the current

statutory tax rate. (3) Represents noninterest expense, excluding

the amortization of intangibles, amortization and impairment loss

of premiums on deposits acquired, investments in affordable housing

partnerships and prepayment penalty for FHLB advances, divided by

the aggregate of net interest income before provision for loan

losses, excluding nonrecurring adjustments and noninterest income,

excluding impairment loss on investment securities and gain on

acquisition and the decrease in FDIC indemnification asset and FDIC

receivable. (4) Amounts exclude yield adjustment related to covered

loan disposition and recoveries of $111,097 and repurchase

agreement termination gain of $2,536 for the six months ended June

30, 2010.

EAST

WEST BANCORP, INC. GAAP TO NON-GAAP RECONCILIATION

(In thousands) (Unaudited) The tangible common

equity to risk weighted asset and tangible common equity to

tangible asset ratios is a non-GAAP disclosure. The Company uses

certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. As the use of tangible common equity to

tangible asset is more prevalent in the banking industry and with

banking regulators and analysts, we have included the tangible

common equity to risk-weighted assets and tangible common equity to

tangible asset ratios.

As of June 30, 2010

Stockholders' Equity $ 2,338,964 Less: Preferred Equity (369,695 )

Goodwill and other intangible assets (424,746 ) Tangible

common equity $ 1,544,523 Risk-weighted assets

10,863,240 Tangible Common Equity to risk-weighted

assets 14.2 %

As of June 30, 2010 Total

assets $ 19,967,321 Less: Goodwill and other intangible assets

(424,746 ) Tangible assets $ 19,542,575

Tangible common equity to tangible asset ratio 7.90 %

Operating noninterest income is a non-GAAP disclosure. The Company

uses certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. There are noninterest income line items that

are non-core in nature. Operating noninterest income excludes such

non-core noninterest income line items. The Company believes that

presenting the operating noninterest income provides more clarity

to the users of financial statements regarding the core noninterest

income amounts.

Quarter Ended

June 30, 2010 Noninterest income $ 35,685 Add: Impairment

loss on investment securities 4,642 Net gain on sale of investment

securities (5,847 ) Net gain on sale of loans (8,073 ) Gain on

acquisition (19,476 )

Decrease in FDIC indemnification

asset and FDIC receivable

9,424 Operating noninterest income (non-GAAP) $

16,355

Quarter Ended

June 30, 2009 Noninterest income $ (26,199 ) Add: Impairment

loss on investment securities 37,447 Net gain on sale of investment

securities (1,680 ) Net gain on sale of loans (3 ) Gain on

acquisition -

Decrease in FDIC indemnification

asset and FDIC receivable

- Operating noninterest income (non-GAAP) $ 9,565

EAST

WEST BANCORP, INC. GAAP TO NON-GAAP RECONCILIATION

(In thousands) (Unaudited)

Operating noninterest expense is a

non-GAAP disclosure. The Company uses certain non-GAAP financial

measures to provide supplemental information regarding the

Company's performance to provide additional disclosure. There are

noninterest expense line items that are non-core in nature.

Operating noninterest expense excludes such non-core noninterest

expense line items. The Company believes that presenting the

operating noninterest expense provides more clarity to the users of

financial statements regarding the core noninterest expense

amounts.

Quarter Ended June 30, 2010 Noninterest

Expense: $ 125,318 Prepayment penalty for FHLB advances 3,900

Expenses related to the integration of UCB 3,602 Expenses

for UCB covered assets, reimbursable from the FDIC: OREO Expenses

15,258 Loan related expenses 4,062 Legal expenses 1,877

Total reimbursable expenses on covered assets 21,197

Noninterest expense excluding

prepayment penalty on FHLB advances, integration costs related to

the acquisition of UCB, and reimbursable expenses

$ 96,619

Quarter Ended March 31, 2010

Noninterest Expense: $ 138,910 Prepayment penalty for FHLB advances

9,932 Expenses related to the integration of UCB Compensation and

employee benefits 6,240 Other integration expenses

3,664

Total integration costs related to

the acquisition of UCB

9,904 REO expense for UCB covered assets, reimbursable from the

FDIC 11,092

Noninterest expense excluding

prepayment penalty on FHLB advances, integration costs related to

the acquisition of UCB, and reimbursable REO expenses

$ 107,982

EAST WEST BANCORP, INC.

GAAP TO NON-GAAP RECONCILIATION (In thousands)

(Unaudited)

The Company uses certain non-GAAP

financial measures to provide supplemental information regarding

the Company's performance to provide additional disclosure. For the

second quarter of 2010, the quarter to date net interest income and

net interest margin includes a yield adjustment of $29,755 related

to covered loan disposition, the year to date net interest income

and net interest margin includes a yield adjustment of $111,097

related to covered loan disposition and recoveries and repurchase

agreement termination gain of $2,536. For the first quarter of 2010

net interest income and net interest margin includes a yield

adjustment of $81,343 related to covered loan disposition and

recoveries and repurchase agreement termination gain of $2,536.

These amounts are nonrecurring in nature. As such, the Company

believes that presenting the net interest income and net interest

margin excluding these nonrecurring items provides additional

clarity to the users of financial statements regarding the core net

interest income and net interest margin.

Quarter Ended June 30, 2010 Average Volume Interest

Yield Total interest-earning assets $ 17,525,796 $ 253,533 5.80 %

Net interest income and net interest margin $ 203,623 4.66 % Less

yield adjustment related to: Covered loan disposition and

recoveries 29,755

Net interest income and net

interest margin, excluding yield adjustment

$ 173,868 3.98 %

Quarter Ended March 31, 2010 Average

Volume Interest Yield Total interest-earning assets $ 17,940,933 $

318,717 7.20 % Net interest income and net interest margin $

261,724 5.92 % Less yield adjustment related to: Covered loan

disposition and recoveries 81,343 Repurchase agreement termination

gain 2,536 Total yield adjustment $ 83,879

Net interest income and net

interest margin, excluding yield adjustment

$ 177,845 4.02 %

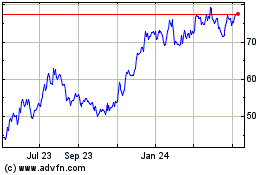

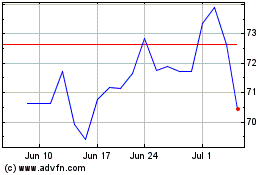

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Apr 2024 to May 2024

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2023 to May 2024