Iris S. Chan and Paul H. Irving Appointed to Board of Directors of East West Bancorp and East West Bank

April 22 2010 - 2:30PM

Business Wire

East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, one of the nation's premier regional banks, appointed

Iris S. Chan and Paul H. Irving to its Board of Directors. Ms.

Chan and Mr. Irving were also appointed to the Board of

Directors of East West Bank.

"We are pleased that Ms. Chan and Mr. Irving have accepted this

opportunity to join the East West family," said Dominic Ng,

Chairman and Chief Executive Officer of East West. "Iris and Paul

each bring to our Board a deep and diverse understanding of the

financial services industry. We look forward to their guidance and

influence as we expand our commercial banking platform to serve new

markets domestically and abroad," continued Ng.

Ms. Chan spent over 20 years with Wells Fargo Bank in San

Francisco and recently retired as the Head of the National

Commercial Banking Group which serves middle market businesses

across the United States. As group head, she oversaw more than 90

commercial banking and loan production offices throughout the

country and was in charge of industry specialty groups including

government, education, non-profit, healthcare, technology, and

waste and environmental management. Additionally, Ms. Chan oversaw

the National Correspondent Banking Group and Treasury Sales. She

served on the Board of Directors of Wells Fargo HSBC Trade Bank

from 2003 to 2009 and was the national spokesperson for the Wells

Fargo Asian Business Service Program for more than a decade. Ms.

Chan currently serves on the Board of Directors of the Asia Society

and was twice named one of the "25 Most Powerful Women in Banking"

by U.S. Banker Magazine.

Mr. Irving is an Advanced Leadership Fellow at Harvard

University. He previously served as Co-Chairman, Chief Executive

and Managing Partner of Manatt, Phelps & Phillips, LLP and

remains a Senior Advisor to the firm. In his 25 years with the

firm, Mr. Irving represented financial services, manufacturing,

media and entertainment and professional services clients in

mergers and acquisitions, capital markets activities, and

governance and regulatory matters. He also served on the firm's

Board of Directors and as Chairman of the financial services group,

compensation committee and recruiting committee. Mr. Irving

previously served as an Adjunct Professor at Loyola Law School, Los

Angeles, was recognized by The Best Lawyers in America for more

than ten years and was named a California Super Lawyer by Los

Angeles Magazine.

About East West

East West Bancorp is a publicly owned company with $20.6 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol "EWBC". The Company's wholly owned subsidiary, East West

Bank, is one of the largest independent commercial banks

headquartered in California with more than 130 locations worldwide,

including the U.S. markets of California, New York, Georgia,

Massachusetts, Texas and Washington. In Greater China, East West's

presence includes a full service branch in Hong Kong and

representative offices in Beijing, Shanghai, Shenzhen and Taipei.

Through a wholly-owned subsidiary bank, East West's presence in

Greater China also includes full service branches in Shanghai and

Shantou and representative offices in Beijing and Guangzhou. For

more information on East West Bancorp, visit the Company's website

at www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp's Annual

Report on Form 10-K for the year ended Dec. 31, 2009 (See Item I --

Business, and Item 7 -- Management's Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC's ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state's Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank's expectations of results or any change in event.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=6261218&lang=en

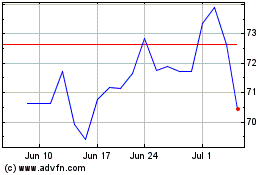

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Apr 2024 to May 2024

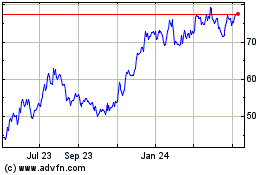

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2023 to May 2024