UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission File Number: 000-32743

ZHONE TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

22-3509099

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

7195 Oakport Street

Oakland, California 94621

(Address of principal executive office)

Registrant’s telephone number, including area code: (510) 777-7000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Common Stock, $0.001 Par Value

|

|

The Nasdaq Stock Market LLC

|

|

(Title of class)

|

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes

¨

No

x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d)

of the Exchange Act. Yes

¨

No

x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be filed to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

x

No

¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting company. See definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

¨

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

x

|

|

|

|

|

|

(Do not check if a smaller reporting

company)

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2

of the Exchange Act). Yes

¨

No

x

As of March 1, 2012, there were 30,852,201 shares outstanding of the registrant’s common stock, $0.001 par

value. As of June 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of common stock held by non-affiliates of the registrant was approximately $58,343,693.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2012 Annual Meeting of Stockholders are incorporated

by reference into Part III of this Form 10-K where indicated.

TABLE OF CONTENTS

Forward-looking Statements

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 and the Securities Exchange Act of 1934. These statements

are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. We use words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,”

“will,” “would,” variations of such words, and similar expressions to identify forward-looking statements. In addition, statements that refer to projections of earnings, revenue, costs or other financial items; anticipated growth

and trends in our business or key markets; future growth and revenues from our Single Line Multi-Service, or SLMS, products; our ability to refinance or repay our existing indebtedness prior to the applicable maturity date; future economic

conditions and performance; anticipated performance of products or services; plans, objectives and strategies for future operations; and other characterizations of future events or circumstances, are forward-looking statements. Readers are cautioned

that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict, including those identified under the heading “Risk Factors” in Item 1A, elsewhere in

this report and our other filings with the Securities and Exchange Commission (the SEC). Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Factors that might cause such a difference

include, but are not limited to, the ability to generate sufficient revenue to achieve or sustain profitability, the ability to raise additional capital to fund existing and future operations or to refinance or repay our existing indebtedness,

defects or other performance problems in our products, the economic slowdown in the telecommunications industry that has restricted the ability of our customers to purchase our products, commercial acceptance of our SLMS products, intense

competition in the communications equipment market from large equipment companies as well as private companies with products that address the same networks needs as our products, higher than anticipated expenses that we may incur, and other factors

identified elsewhere in this report. We undertake no obligation to revise or update any forward-looking statements for any reason.

PART I

Company

Overview

We design, develop and manufacture communications network equipment for telecommunications,

wireless and cable operators worldwide. We believe that these network service providers can increase their revenues and lower their operating costs by using our products to deliver high quality video and interactive entertainment and Internet

Protocol (IP) enabled next generation voice services in addition to their existing voice and data service offerings, all on a platform that permits a seamless migration from legacy technologies to a converged packet-based architecture. Our mature

SLMS architecture provides cost-efficiency and feature flexibility with support for voice over internet protocol (VoIP) and IP entertainment (IPTV). Within this versatile SLMS architecture, our products allow service providers to deliver all of

these and other next generation converged packet services over their existing copper lines while providing support for fiber or Fiber to the home or business (FTTx) build-out. With our products and solutions, network service providers can seamlessly

migrate from traditional circuit-based networks to packet-based networks and from copper-based access lines to fiber-based access lines without abandoning the investments they have made in their existing infrastructures.

In addition to our established product offerings, Zhone launched our flagship MXK IP Multi-service Terabit Access

Concentrator (MXK) and multiple new Optical Line Terminal (OLT) and outdoor units in late 2009. Our MXK product is a converged multi-services access platform that can be configured as a Gigabit Passive Optical Network (GPON) or Active Ethernet OLT.

The MXK GPON line module is ITU-T G.984 compliant, delivering

1

data throughputs of up to 2.5 Gbps downstream and 1.25 Gbps upstream. Each line card is designed for up to 64 passive splits per fiber. Active Ethernet delivers up to 100 Mbps point-to-point from

a 20-port card. In 2011, we sold over 2,200 MXK systems to new and existing customers globally.

Zhone’s

MXK product supports the next generation of high-performance business and residential FTTx services. Unlike most competing products, MXK has the ability to support both Passive Optical Network (PON) and Active Ethernet fiber technologies to the

node, curb or premises. With our MXK product, service providers can offer digital or Ratio Frequency (RF) video, high-bandwidth Internet access, VoIP and cell relay services from a single OLT over IP. Additionally, our MXK product provides Zhone

with industry leading density featuring an 8 port GPON Module enabling support for up to 9,216 GPON subscribers in a single MXK chassis.

The flexibility of our MXK product enables service providers to choose the best technology for both services and network architecture. Active Ethernet provides dedicated high symmetric bandwidth to the

end customers and makes it an excellent technology for deployment of business services. GPON provides a cost-effective way to deliver high bandwidth to the residence for a robust triple play offering while enabling a host of high speed data and

video options for the businesses. In addition to Active Ethernet and dense GPON support, the MXK provides a wide array of multi-service functionality supporting well defined access standards enabling the convergence of voice, data and entertainment

over any access medium delivering high-performance all IP solutions designed for today’s traffic mix.

Corporate

Information

We were incorporated in Delaware under the name Zhone Technologies, Inc. in June 1999, and

in November 2003, we consummated our merger with Tellium, Inc. (Tellium). Although Tellium acted as the legal acquirer, due to various factors, including the relative voting rights, board control and senior management composition of the combined

company, Zhone was treated as the “acquirer” for accounting purposes. Following the merger, the combined company was renamed Zhone Technologies, Inc. and retained substantially all of Zhone’s previous management and operating

structure. The mailing address of our worldwide headquarters is 7195 Oakport Street, Oakland, California 94621, and our telephone number at that location is (510) 777-7000. Our website address is

www.zhone.com

. The information on our

website does not constitute part of this report. Through a link on the Investor Relations section of our website

,

we make available the following filings as soon as reasonably practicable after they are electronically filed with or furnished

to the SEC: our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. All such

filings are available free of charge.

Industry Background

Over the past decade, the communications network industry has experienced rapid expansion as the internet and the

proliferation of bandwidth intensive applications and services have led to an increased demand for high bandwidth communications networks. The broad adoption of new technologies such as smartphones, MP3 players, digital cameras and high definition

televisions allow music, pictures, user-generated content (as found on the many video-sharing sites) and high definition video to be a growing part of consumers’ regular exchange of information. In recent years, the growth of social

communications and social networking has continued to place demands on existing copper based access infrastructure and new consumer demands are challenging even the newest and most advanced infrastructures. All of these new technologies share a

common dependency on high bandwidth communication networks and sophisticated traffic management tools. However, network service providers have struggled to meet the increased demand for high speed broadband access due to the constraints of the

existing communications network infrastructure. This infrastructure consists of two interconnected networks:

|

|

•

|

|

the “core” network, which interconnects service providers with each other; and

|

|

|

•

|

|

the “access” network, which connects end-users to a service provider’s closest facility.

|

2

To address the increased demand for higher transmission speeds via greater

bandwidth, service providers have expended significant capital over the past decade to upgrade the core network by replacing much of their copper infrastructure with high-speed optical infrastructure. While the use of fiber optic equipment in the

core network has relieved the bandwidth capacity constraints in the core network between service providers, the access network continues to be a “bottleneck” that severely limits the transmission speed between service providers and

end-users. As a result, communications in the core network can travel at up to 10 gigabits per second, while in stark contrast, many communications over the access network throughout the world still occur at a mere 56 kilobits per second, a speed

that is 175,000 times slower. At 56 kilobits per second, it may take several minutes to access even a modestly media laden website and several hours to download large files. Fiber access lines have the potential to remedy this disparity,

but re-wiring every home or business with fiber optic cable is both cost prohibitive and extremely time consuming. Consequently, solving the access network bottleneck has typically required more efficient use of the existing copper wire

infrastructure and support for the gradual migration from copper to fiber.

In an attempt to deliver high

bandwidth services over existing copper wire in the access network, service providers began deploying digital subscriber line (DSL) technology over a decade ago. However, this early DSL technology has practical limitations. Copper is a distance

sensitive medium in that the amount of bandwidth available over a copper wire is inversely proportional to the length of the copper wire. In other words, the greater the distance between the service provider’s equipment and the customer’s

premises, the lower the bandwidth. Unfortunately, most DSL services available today are provided by first generation DSL access multiplexer (DSLAM) equipment. These large unwieldy devices require conditioned power and a climate controlled

environment typically found only in a telephone company’s central office, which is often at great distance from the customer. While adequate for basic data services, these first generation DSLAMs were not designed to meet the needs of

today’s high bandwidth applications. The modest bandwidth provided by existing DSLAM equipment is often incapable of delivering even a single channel of standard definition video, much less multiple channels of standard definition video or high

definition video.

Over the past decade, regulatory changes have introduced new competitors in the

telecommunication services industry. Cable operators, with extensive networks designed originally to provide only video programming, have collaborated to adopt new packet technologies that leverage their hybrid fiber/coaxial cable infrastructure.

Using more recent technologies, cable operators have begun to cost-effectively deliver new service bundles. The new service offerings provide not only enhanced features and capabilities, but also allow the cable operators to deliver these services

over a common network. The resulting cost-efficiencies realized by cable operators are difficult for incumbent telephone companies to match. Even with the telephone companies’ legacy voice switches fully paid for, maintaining separate networks

for their circuit-based voice and packet-based video and data networks is operationally non-competitive. Perhaps even more important than economic efficiencies, by integrating these services over a common packet infrastructure, cable operators will

realize levels of integration between applications and new features that will be difficult to achieve from a multi-platform solution. Despite these benefits, coaxial cable has its own share of limitations. Unlike DSL, coaxial cable shares its

bandwidth among all customers connected to it. Consequently, as new customers are added to coaxial cable networks, performance decreases. As a shared medium, large numbers of subscribers who simultaneously access the same segment of the coaxial

cable network can potentially compromise performance and security. This represents a source of strategic advantage for telecom operators who employ technology designed to maximize their service capabilities on the point-to-point (i.e. not shared)

architecture of their copper infrastructure. In addition, the introduction of 3G and 4G wireless technologies and improved satellite technologies have enabled wireless and satellite service providers to provide competitive broadband offerings as

alternatives to traditional landline access. This increased competition has placed significant pressure on all network service providers. With significant service revenues at risk, these service providers have sought to upgrade and modernize their

networks and broaden their service offerings to enable delivery of additional high bandwidth, high margin services, and to lower the cost of delivering these services.

3

The Zhone Solution

We believe that we are the first company dedicated solely to developing the full spectrum of next-generation access

network solutions to cost-effectively deliver high bandwidth services while simultaneously preserving the investment in legacy networks. Our next-generation solutions are based upon our SLMS architecture. From its inception, this SLMS architecture

was specifically designed for the delivery of multiple classes of subscriber services (such as voice, data and video distribution), rather than being based on a particular protocol or media. In other words, our SLMS products are built to support the

migration from legacy circuit to packet technologies and from copper to fiber technologies. This flexibility and versatility allows our products to adapt to future technologies while allowing service providers to focus on the delivery of additional

high bandwidth services. Because this SLMS architecture is designed to interoperate with existing legacy equipment, service providers can leverage their existing networks to deliver a combination of voice, data and video services today, while they

migrate, either simultaneously or at a future date, from legacy equipment to next-generation equipment with minimal interruption. We believe that our SLMS solution provides an evolutionary path for service providers using their existing

infrastructures, as well as giving newer service providers the capability to deploy cost-effective, multi-service networks that can support voice, data and video.

Triple Play Services with Converged Voice, Data and Video –

SLMS simplifies the access network by

consolidating new and existing services onto a single line. This convergence of services and networks simplifies provisioning and operations, ensures quality of service and reliability, and reduces the time required to provide services. SLMS

integrates access, transport, customer premises equipment, and management functions in a standards-based system that provides scalability, interoperability and functionality for voice, data and video services.

Packet Migration –

SLMS is a flexible multi-service architecture that provides current services while

simultaneously supporting migration to a pure packet network. This flexibility allows service providers to cost-effectively provide carrier class performance, and functionality for current and future services without interrupting existing services

or abandoning existing subscribers. SLMS also protects the value of the investments made by residential and commercial subscribers in equipment, inside wiring and applications, thereby minimizing transition impact and subscriber attrition.

Fiber to the Home, Premise, Node, or Curb (FTTx)

– We provide support for the full range of

fiber-based access network architectures that are seeing increased use by carriers. In many markets worldwide, both business and residential demand for bandwidth is growing to the point where the deployment of fiber in the access network is

increasingly desirable. Where copper loops are plentiful and where civil restrictions make fiber deployment all the way to the customer premises prohibitively expensive, if not impossible, many operators are choosing to deploy fiber from central

offices to neighborhoods and then using VDSL2 over copper to deliver broadband connectivity over the last hundred meters or so. In other circumstances operators choose to deploy passive optical networks (PON) all the way to the customer premises,

where a single fiber’s bandwidth is shared through splitters with up to 64 subscribers. Some circumstances demand so-called “home run” fiber networks (with dedicated fiber resources linking every customer directly to the central

office) to maximize bandwidth or service segmentation. By supporting all these architectures within a common SLMS-based platform, we provide carriers maximum flexibility to build the network that best suits their needs.

Ethernet Service Delivery –

We offer a complete array of equipment that allows carriers to deliver ethernet

services over copper or fiber. For business subscribers, our ethernet over copper product family allows carriers to quickly deliver ethernet services over existing copper SHDSL or T1/E1 circuits. Multiple circuits can be bonded to provide over 70

Megabits per second, enough to deliver ample ethernet bandwidth to satisfy business subscribers’ growing service requirements. This copper-based solution provides a compelling alternative to burying fiber and dedicating valuable fiber strands

to long-haul ethernet services to small and medium enterprises.

4

The Zhone Strategy

Our strategy has been to combine internal development with acquisitions of established access equipment vendors to achieve

the critical mass required of telecommunications equipment providers. We expect that our future growth will focus primarily on organic growth in emerging technology markets. Going forward, the key elements of our strategy include:

|

|

•

|

|

Expand Our Infrastructure to Meet Service Provider Needs

. Network service providers require extensive support and integration with

manufacturers to deliver reliable, innovative and cost-effective services. By combining advanced, computer-aided design, test and manufacturing systems with experienced, customer-focused management and technical staff, we believe that we have

established the critical mass required to fully support global service provider requirements. We continue to expand our infrastructure through ongoing development and strategic relationships, continuously improving quality, reducing costs and

accelerating delivery of advanced solutions.

|

|

|

•

|

|

Continue the Development and Enhancement of Our SLMS Products

. Our SLMS architecture is the cornerstone of our product development strategy.

The design criteria for SLMS products include carrier-class reliability, multi-protocol and multi-service support, and ease of provisioning. We intend to continue to introduce SLMS products that offer the configurations and feature sets that our

customers require. In addition, we have introduced products that adhere to the standards, protocols and interfaces dictated by international standards bodies and service providers. In 2009, we introduced our MXK product, a new flagship SLMS product

that provides a converged multi-services access platform. To facilitate the rapid development of our existing and new SLMS architecture and products, we have established engineering teams responsible for each critical aspect of the architecture and

products. We intend to continue to leverage our expertise in voice, data and video technologies to enhance our SLMS architecture, supporting new services, protocols and technologies as they emerge. To further this objective, we intend to continue

investing in research and development efforts to extend the SLMS architecture and introduce new SLMS products.

|

|

|

•

|

|

Deliver Full Customer Solutions

. In addition to delivering hardware and software product solutions, we provide customers with pre-sales and

post-sales support, education and professional services to enable our customers to more efficiently deploy and manage their networks. We provide customers with application notes, business planning information, web-based and phone-based

troubleshooting assistance and installation guides. Our support programs provide a comprehensive portfolio of support tools and resources that enable our customers to effectively sell to, support and expand their subscriber base using our products

and solutions.

|

Product Portfolio

Our products provide the framework around which we are designing and developing high speed communications software and

equipment for the access network. All of the products listed below are currently available and being shipped to customers. Our products span two distinct categories:

SLMS Products

Our SLMS products address three areas

of customer requirements. Our Broadband Aggregation and Service products aggregate, concentrate and optimize communications traffic from copper and fiber networks. These products are deployed in central offices, remote offices, points of presence,

curbsides, data and co-location centers, and large enterprises. Our Customer Premise Equipment, or CPE, products offer a cost-effective solution for combining analog voice and data services to the subscriber’s premises over a single platform.

The Zhone Management System, or ZMS, product provides optional software tools to help manage aggregation and customer premises network hardware. These products deliver voice, data and video interface connectivity for broadcast and subscription

television, internet routers and traditional telephony equipment.

5

Our SLMS products include:

|

|

|

|

|

|

|

Category

|

|

Product

|

|

Function

|

|

Broadband Aggregation and Service

|

|

MXK

|

|

Multi-Service Terabit Access Concentrator

|

|

|

|

MALC

|

|

Multi-Access Line Concentrator

|

|

|

|

MXP/MX

|

|

Scalable 1U SLMS VDSL2/Active Ethernet

|

|

|

|

MALC-OLT

|

|

FTTx Optical Line Terminal

|

|

|

|

4000 /8000 /12000

|

|

DSLAMs

|

|

Customer Premise Equipment (CPE)

|

|

EtherXtend

|

|

Ethernet Over Copper

|

|

|

|

16xx, 17xx, 6xxx

zNID

|

|

Wireline/Wireless DSL Modems

Optical Network Terminals

|

|

Network and Subscriber Management

|

|

ZMS

|

|

Zhone Management System

|

Legacy, Service and Other Products

Our legacy products support a variety of voice and data services, and are broadly deployed by service providers worldwide.

Our main legacy product during 2011 and 2010 was our IMACS product which functions as a multi-access multiplexer.

Global Service & Support

In addition to our product offerings, we provide a broad range of service offerings through our Global Service & Support organization. We supplement our standard and extended product warranties

with programs that offer technical support, product repair, education services and enhanced support services. These services enable our customers to protect their network investments, manage their networks more efficiently and minimize downtime for

mission-critical systems. Technical support services are designed to help ensure that our products operate efficiently, remain highly available, and benefit from recent software releases. Through our education services program, we offer in-depth

training courses covering network design, installation, configuration, operation, trouble-shooting and maintenance. Our enhanced services offering is a comprehensive program that provides network engineering, configuration, integration, project

management and other consultative support to maximize the results of our customers during the design, deployment and operational phases. As part of our commitment to ensure around-the-clock support, we maintain a technical assistance center and a

staff of qualified network support engineers to provide customers with 24-hour service, seven days a week.

Technology

We believe that our future success is built upon our investment in the development of advanced technologies. SLMS is based

on a number of technologies that provide sustainable advantages, including the following:

|

|

•

|

|

Services-Centric Architecture.

SLMS has been designed from inception for the delivery of multiple classes of subscriber services (such as

voice, data or video distribution), rather than being based on a particular protocol or media. Our SLMS products are built to interoperate in networks supporting packet, cell and circuit technologies. This independence between services and the

underlying transportation is designed to position our products to be able to adapt to future transportation technologies within established architectures and to allow our customers to focus on service delivery.

|

|

|

•

|

|

Common Code Base.

Our SLMS products share a common base of software code, which is designed to accelerate development, improve software

quality, enable rapid deployment, and minimize training and operations costs, in conjunction with network management software.

|

|

|

•

|

|

Network Management and Operations.

Our ZMS product provides management capabilities that enable rapid, cost-effective, and secure control of

the network; standards-based interfaces for seamless

|

6

|

|

integration with supporting systems; hierarchical service and subscriber profiles to allow rapid service definition and provisioning, and to enable wholesaling of services; automated and

intelligent CPE provisioning to provide the best end-user experience and accelerate service turn-up; load-balancing for scalability; and full security features to ensure reliability and controlled access to systems and data.

|

|

|

•

|

|

Test Methodologies.

Our SLMS architecture provides for interoperability with a variety of products that reside in networks in which we will

deploy our products. To ensure interoperability, we have built a testing facility to conduct extensive multi-vendor trials and to ensure full performance under valid network conditions. Testing has included participation with partners’

certification and accreditation programs for a wide range of interoperable products, including soft switches, SAN equipment and management software. The successful completion of these processes is required by our largest customers to ensure

interoperability with their existing software and systems.

|

|

|

•

|

|

Acquired Technologies.

Since our inception, we have completed twelve acquisitions pursuant to which we acquired products, technology and

additional technical expertise.

|

Customers

We sell our products and services to network service providers that offer voice, data and video services to businesses,

governments, utilities and residential consumers. Our global customer base includes regional, national and international telecommunications carriers. To date, our products are deployed by over 750 network service providers on six continents

worldwide. Emirates Telecommunications Corporation (Etisalat) accounted for 15% of net revenue in 2011 and 24% of net revenue in 2010. No other customer accounted for 10% or more of net revenue during either period.

Research and Development

The industry in which we compete is subject to rapid technological developments, evolving industry standards, changes in customer requirements, and continuing developments in communications service

offerings. Our continuing ability to adapt to these changes, and to develop new and enhanced products, is a significant factor in maintaining or improving our competitive position and our prospects for growth. Therefore, we continue to make

significant investments in product development.

We conduct the majority of our research and product

development activities at our headquarters in Oakland, California. In Oakland, we have built an extensive communications laboratory with hundreds of access infrastructure products from multiple vendors that serve as an interoperability and test

facility. This facility allows us to emulate a communications network with serving capacity equivalent to that supporting a city of 350,000 residents. We also have focused engineering staff and activities at additional development centers located in

Alpharetta, Georgia; Largo, Florida; Westlake Village, California; and Portsmouth, New Hampshire.

Our product

development activities focus on products to support both existing and emerging technologies in the segments of the communications industry that we consider viable revenue opportunities. We are actively engaged in continuing to refine our SLMS

architecture, introducing new products under our SLMS architecture, and creating additional interfaces and protocols for both domestic and international markets.

We continue our commitment to invest in leading edge technology research and development. Our research and product

development expenditures were $21.4 million, $21.2 million, and $22.1 million, in 2011, 2010 and 2009, respectively. All of our expenditures for research and product development costs, as well as stock-based compensation expense relating to research

and product development, have been expensed as incurred. These amounts include stock-based compensation of $0.2 million, $0.4 million, and $0.4 million for 2011, 2010, and 2009, respectively. We plan to continue to support the development of new

products and features, while seeking to carefully manage associated costs through expense controls.

7

Intellectual Property

We seek to establish and maintain our proprietary rights in our technology and products through the use of patents,

copyrights, trademarks and trade secret laws. We also seek to maintain our trade secrets and confidential information by nondisclosure policies and through the use of appropriate confidentiality agreements. We have obtained a number of patents and

trademarks in the United States and in other countries. There can be no assurance, however, that these rights can be successfully enforced against competitive products in every jurisdiction. Although we believe the protection afforded by our

patents, copyrights, trademarks and trade secrets has value, the rapidly changing technology in the networking industry and uncertainties in the legal process make our future success dependent primarily on the innovative skills, technological

expertise, and management abilities of our employees rather than on the protection afforded by patent, copyright, trademark, and trade secret laws.

Many of our products are designed to include software or other intellectual property licensed from third parties. While it may be necessary in the future to seek or renew licenses relating to various

aspects of our products, we believe, based upon past experience and standard industry practice, that such licenses generally could be obtained on commercially reasonable terms. Nonetheless, there can be no assurance that the necessary licenses would

be available on acceptable terms, if at all. Our inability to obtain certain licenses or other rights or to obtain such licenses or rights on favorable terms, or the need to engage in litigation regarding these matters, could have a material adverse

effect on our business, operating results and financial condition.

The communications industry is

characterized by rapidly changing technology, a large number of patents, and frequent claims and related litigation regarding patent and other intellectual property rights. We cannot assure you that our patents and other proprietary rights will not

be challenged, invalidated or circumvented, that others will not assert intellectual property rights to technologies that are relevant to us, or that our rights will give us a competitive advantage. In addition, the laws of some foreign countries

may not protect our proprietary rights to the same extent as the laws of the United States.

Sales and Marketing

We have a sales presence in various domestic and foreign locations, and we sell our products and services both directly

and indirectly through channel partners with support from our sales force. Channel partners include distributors, resellers, system integrators and service providers. These partners sell directly to end customers and often provide system

installation, technical support, professional services and support services in addition to the network equipment sale. Our sales efforts are generally organized according to geographical regions:

|

|

•

|

|

U.S. Sales.

Our U.S. Sales organization establishes and maintains direct relationships with domestic customers, which include communication

service providers, cable operators, independent operating companies, or IOCs, as well as competitive carriers, developers and utilities. In addition, this organization is responsible for managing our distribution and original equipment manufacturer,

or OEM, partnerships.

|

|

|

•

|

|

International Sales.

Our International Sales organization targets foreign based service providers and is staffed with individuals with

specific experience dealing with service providers in their designated international territories.

|

Our marketing team works closely with our sales, research and product development organizations, and our customers by providing communications that keep the market current on our products and features.

Marketing also identifies and sizes new target markets for our products, creates awareness of our company and products, generates contacts and leads within these targeted markets and performs outbound education and public relations.

8

Backlog

Our backlog consists of purchase orders for products and services that we expect to ship or perform within the next year. At December 31, 2011, our backlog was $7.3 million, as compared to $4.4

million at December 31, 2010. We consider backlog to be an indicator, but not the sole predictor, of future sales because our customers may cancel or defer orders without penalty.

Competition

We compete in the communications equipment

market, providing products and services for the delivery of voice, data and video services. This market is characterized by rapid change, converging technologies and a migration to solutions that offer superior advantages. These market factors

represent both an opportunity and a competitive threat to us. We compete with numerous vendors, including Alcatel-Lucent, Calix, Huawei, and ZTE, among others. In addition, a number of companies have introduced products that address the same network

needs that our products address, both domestically and abroad. The overall number of our competitors may increase, and the identity and composition of competitors may change. As we continue to expand our sales globally, we may see new competition in

different geographic regions. Barriers to entry are relatively low, and new ventures to create products that do or could compete with our products are regularly formed. Many of our competitors have greater financial, technical, sales and marketing

resources than we do.

The principal competitive factors in the markets in which we presently compete and may

compete in the future include:

|

|

•

|

|

interoperability with existing products;

|

|

|

•

|

|

scalability and upgradeability;

|

|

|

•

|

|

conformance to standards;

|

|

|

•

|

|

ease of installation and use;

|

|

|

•

|

|

geographic footprints for products;

|

|

|

•

|

|

ability to provide customer financing;

|

|

|

•

|

|

technical support and customer service; and

|

While we believe that we compete successfully with respect to each of these factors, we expect to face intense competition in our market. In addition, the inherent nature of communications networking

requires interoperability. As such, we must cooperate and at the same time compete with many companies.

Manufacturing

We manufacture our products using a strategic combination of procurement from qualified suppliers, in-house manufacturing

at our facility in Florida, and the use of original design manufacturers (ODM) located in the Far East. Since our acquisition of Paradyne Networks, Inc., or Paradyne, in September 2005, we have been manufacturing a significant majority of our more

complex products at our manufacturing facility in Florida.

9

Our parts and components are procured from a variety of qualified suppliers

in the U.S., Far East, Mexico, and other countries around the world per our Approved Supplier List and detailed engineering specifications. Some completed products are procured to our specifications and shipped directly to our customers. We also

acquire completed products from certain suppliers and configure and ship from our facility. Some of these purchases are significant. We purchase both standard off-the-shelf parts and components, which are generally available from more than one

supplier, and single-source parts and components. We have generally been able to obtain adequate supplies to meet customer demand in a timely manner from our current vendors, or, when necessary, from alternate vendors. We believe that alternate

vendors can be identified if current vendors are unable to fulfill our needs, or design changes can be made to employ alternate parts.

We design, specify, and monitor all of the tests that are required to meet our quality standards. Our manufacturing and test engineers work closely with our design engineers to ensure manufacturability

and testability of our products, and to ensure that manufacturing and testing processes evolve as our technologies evolve. Our manufacturing engineers specify, build, or procure our test stations, establish quality standards and protocols, and

develop comprehensive test procedures and processes to assure the reliability and quality of our products. These processes and tests are reviewed by our design engineers to ensure they meet the intent of the design. Products that are procured

complete or partially complete are inspected, tested, and audited for quality control.

Our manufacturing

quality system is ISO-9001 and is certified to ISO-9001 by our external registrar. ISO-9001 ensures our processes are documented, followed, and continuously improved. Internal audits are conducted on a regular schedule by our quality assurance

personnel, and external audits are conducted by our external registrar every six months. Our quality system is based upon our model for quality assurance in design, development, production, installation, and service to ensure our products meet

rigorous quality standards.

We believe that we have sufficient production capacity to meet current and future

demand for our product offerings through a combination of existing and added capacity, additional employees, or the outsourcing of products or components.

Compliance with Regulatory and Industry Standards

Our

products must comply with a significant number of voice and data regulations and standards which vary between the U.S. and international markets, and which vary between specific international markets. Standards for new services continue to evolve,

and we may need to modify our products or develop new versions to meet these standards. Standards setting and compliance verification in the U.S. are determined by the Federal Communications Commission, or FCC, Underwriters Laboratories, Quality

Management Institute, Telcordia Technologies, Inc., and other communications companies. In international markets, our products must comply with standards issued by the European Telecommunications Standards Institute, or ETSI, and implemented and

enforced by the telecommunications regulatory authorities of each nation.

Environmental Matters

Our operations and manufacturing processes are subject to federal, state, local and foreign environmental protection laws

and regulations. These laws and regulations relate to the use, handling, storage, discharge and disposal of certain hazardous materials and wastes, the pre-treatment and discharge of process waste waters and the control of process air pollutants.

We believe that our operations and manufacturing processes currently comply in all material respects

with applicable environmental protection laws and regulations. If we fail to comply with any present and future regulations, we could be subject to future liabilities, the suspension of production or a prohibition on the sale of our products. In

addition, such regulations could require us to incur other significant expenses to comply with environmental regulations, including expenses associated with the redesign of any non-compliant product. From time to time new regulations are enacted,

and it is difficult to anticipate how such regulations will be

10

implemented and enforced. For example, in 2003 the European Union enacted the Restriction on the Use of Certain Hazardous Substances in Electrical and Electronic Equipment Directive (RoHS) and

the Waste Electrical and Electronic Equipment Directive (WEEE), for implementation in European Union member states. We are aware of similar legislation that is currently in force or is being considered in the United States, as well as other

countries. Our failure to comply with any of such regulatory requirements or contractual obligations could result in our being liable for costs, fines, penalties and third-party claims, and could jeopardize our ability to conduct business in

countries in the jurisdictions where these regulations apply.

Employees

As of December 31, 2011, we employed 339 individuals worldwide. We consider the relationships with our employees to

be positive. Competition for technical personnel in our industry is intense. We believe that our future success depends in part on our continued ability to hire, assimilate and retain qualified personnel. To date, we believe that we have been

successful in recruiting qualified employees, but there is no assurance that we will continue to be successful in the future.

Executive

Officers

Set forth below is information concerning our executive officers and their ages as of

December 31, 2011.

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

|

Position

|

|

Morteza Ejabat

|

|

|

61

|

|

|

Chief Executive Officer, President and

Chairman of the Board of Directors

|

|

Kirk Misaka

|

|

|

53

|

|

|

Chief Financial Officer, Corporate Treasurer and

Secretary

|

Morteza Ejabat

is a co-founder of Zhone and has served as Chairman of the Board of

Directors, President and Chief Executive Officer since June 1999. Prior to co-founding Zhone, from June 1995 to June 1999, Mr. Ejabat was President and Chief Executive Officer of Ascend Communications, Inc., a provider of telecommunications

equipment which was acquired by Lucent Technologies, Inc. in June 1999. Previously, Mr. Ejabat held various senior management positions with Ascend from September 1990 to June 1995, most recently as Executive Vice President and Vice President,

Operations. Mr. Ejabat holds a B.S. in Industrial Engineering and an M.S. in Systems Engineering from California State University at Northridge and an M.B.A. from Pepperdine University.

Kirk Misaka

has served as Zhone’s Corporate Treasurer since November 2000 and as Chief Financial Officer and

Secretary since July 2003. Prior to joining Zhone, Mr. Misaka was a Certified Public Accountant with KPMG LLP from 1980 to 2000, becoming a partner in 1989. Mr. Misaka earned a B.S. and an M.S. in Accounting from the University of Utah,

and an M.S. in Tax from Golden Gate University.

Set forth below and elsewhere in this report and in other documents we file with the SEC are risks and uncertainties that could cause actual results to differ materially from the results contemplated by

the forward-looking statements contained in this report.

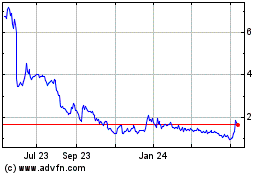

Our future operating results are difficult to predict and our stock price may

continue to be volatile.

As a result of a variety of factors discussed in this report, our revenues for a

particular quarter are difficult to predict. Our revenue and operating results may vary significantly from quarter to quarter due to a number of factors, many of which are outside of our control. The primary factors that may affect our results of

operations include the following:

|

|

•

|

|

commercial acceptance of our SLMS products;

|

11

|

|

•

|

|

fluctuations in demand for network access products;

|

|

|

•

|

|

the timing and size of orders from customers;

|

|

|

•

|

|

the ability of our customers to finance their purchase of our products as well as their own operations;

|

|

|

•

|

|

new product introductions, enhancements or announcements by our competitors;

|

|

|

•

|

|

our ability to develop, introduce and ship new products and product enhancements that meet customer requirements in a timely manner;

|

|

|

•

|

|

changes in our pricing policies or the pricing policies of our competitors;

|

|

|

•

|

|

the ability of our company and our contract manufacturers to attain and maintain production volumes and quality levels for our products;

|

|

|

•

|

|

our ability to obtain sufficient supplies of sole or limited source components;

|

|

|

•

|

|

increases in the prices of the components we purchase, or quality problems associated with these components;

|

|

|

•

|

|

unanticipated changes in regulatory requirements which may require us to redesign portions of our products;

|

|

|

•

|

|

changes in accounting rules, such as recording expenses for employee stock option grants;

|

|

|

•

|

|

integrating and operating any acquired businesses;

|

|

|

•

|

|

our ability to achieve targeted cost reductions;

|

|

|

•

|

|

how well we execute on our strategy and operating plans; and

|

|

|

•

|

|

general economic conditions as well as those specific to the communications, internet and related industries.

|

Any of the foregoing factors, or any other factors discussed elsewhere herein, could have a material adverse effect on

our business, results of operations, and financial condition that could adversely affect our stock price. In addition, public stock markets have experienced, and may in the future experience, extreme price and trading volume volatility, particularly

in the technology sectors of the market. This volatility has significantly affected the market prices of securities of many technology companies for reasons frequently unrelated to or disproportionately impacted by the operating performance of these

companies. These broad market fluctuations may adversely affect the market price of our common stock. In addition, if our average market capitalization falls below the carrying value of our assets for an extended period of time as it did in 2011,

this may indicate that the fair value of our net assets is below their carrying value, and may result in recording impairment charges.

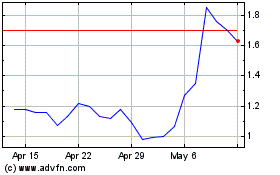

During 2008-2009 and the fourth quarter of 2011, declines in our stock price caused the bid price for our common stock to fall below the $1.00 minimum per share bid price required for continued inclusion

on The Nasdaq Capital Market under Marketplace Rule 5550(a)(2), and we received letters from The Nasdaq Stock Market, or Nasdaq, requiring us to regain compliance within a specified period. A failure to regain compliance could result in our stock

being delisted, subject to a right of appeal. In March 2010, we regained compliance with the minimum bid price rule by effecting a reverse stock split at an exchange ratio of one-for-five. In February 2012, we received a letter from Nasdaq advising

us that we had regained compliance with the minimum bid price rule as the closing bid price of our common stock had been $1.00 per share or greater for ten consecutive business days. Our stock price continues to be volatile, and there can be no

assurance that our stock price will remain above the minimum bid price or that we will be able to regain compliance if our stock price falls below the minimum bid price again in the future.

12

We have incurred significant losses to date and expect that we may continue to incur

losses in the foreseeable future. If we fail to generate sufficient revenue to achieve or sustain profitability, our stock price could decline.

We have incurred significant losses to date and expect that we may continue to incur losses in the foreseeable future. Our net losses for 2011 and 2010 were $11.7 million and $4.8 million, respectively,

and we had an accumulated deficit of $1,032.1 million at December 31, 2011. We have significant fixed expenses and expect that we will continue to incur substantial manufacturing, research and product development, sales and marketing, customer

support, administrative and other expenses in connection with the ongoing development of our business. In addition, we may be required to spend more on research and product development than originally budgeted to respond to industry trends. We may

also incur significant new costs related to acquisitions and the integration of new technologies and other acquisitions that may occur in the future. We may not be able to adequately control costs and expenses or achieve or maintain adequate

operating margins. As a result, our ability to achieve and sustain profitability will depend on our ability to generate and sustain substantially higher revenue while maintaining reasonable cost and expense levels. If we fail to generate sufficient

revenue to achieve or sustain profitability, we will continue to incur substantial operating losses and our stock price could decline.

We have significant debt obligations, which could adversely affect our business, operating results and financial condition.

As of December 31, 2011, we had approximately $15.0 million of total debt outstanding under our $25.0 million

revolving line of credit and letter of credit facility with Silicon Valley Bank, or SVB (the SVB Facility), of which all was current. In addition, as of December 31, 2011, $7.9 million was committed as security for various letters of credit

under the SVB Facility. In January 2012, we repaid all amounts owing under the SVB Facility, and the SVB Facility expired on March 13, 2012. On March 13, 2012, we entered into a new credit agreement with Wells Fargo Bank, or WFB, for a

$25.0 million revolving line of credit and letter of credit facility, or the WFB Facility, to provide us with liquidity and working capital through March 12, 2014. We expect to make borrowings from time to time under the WFB Facility. The WFB

Facility includes covenants, restrictions and financial ratios that may restrict our ability to operate our business. Our debt obligations could materially and adversely affect us in a number of ways, including:

|

|

•

|

|

limiting our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or general corporate

purposes;

|

|

|

•

|

|

limiting our flexibility to plan for, or react to, changes in our business or market conditions;

|

|

|

•

|

|

requiring us to use a significant portion of any future cash flow from operations to repay or service the debt, thereby reducing the amount of cash

available for other purposes;

|

|

|

•

|

|

making us more highly leveraged than some of our competitors, which may place us at a competitive disadvantage; and

|

|

|

•

|

|

making us more vulnerable to the impact of adverse economic and industry conditions and increases in interest rates.

|

We cannot assure you that we will be able to generate sufficient cash flow in amounts sufficient to enable us to service

our debt or to meet our working capital and capital expenditure requirements. If we are unable to generate sufficient cash flow from operations or to borrow sufficient funds to service our debt, due to borrowing base restrictions or otherwise, we

may be required to sell assets, reduce capital expenditures or obtain additional financing. We cannot assure you that we will be able to engage in any of these actions on reasonable terms, if at all.

If we default under our WFB Facility because of a covenant breach or otherwise, all outstanding amounts thereunder could

become immediately due and payable. We were in compliance with our covenants under our former SVB Facility as of December 31, 2011; however, our failure to satisfy the financial covenant thereunder

13

regarding minimum EBITDA for the compliance period ended December 31, 2010 constituted a default under the SVB Facility. Although we were able to obtain a waiver under the SVB Facility with

respect to this default, we cannot give assurances that we will be able to obtain a waiver should a default under our new WFB Facility occur in the future. Any acceleration of amounts due could have a material adverse effect on our liquidity and

financial condition.

If we are unable to obtain additional capital to fund our existing and future operations, we may be

required to reduce the scope of our planned product development, and marketing and sales efforts, which would harm our business, financial condition and results of operations.

The development and marketing of new products, and the expansion of our direct sales operations and associated support

personnel requires a significant commitment of resources. We may continue to incur significant operating losses or expend significant amounts of capital if:

|

|

•

|

|

the market for our products develops more slowly than anticipated;

|

|

|

•

|

|

we fail to establish market share or generate revenue at anticipated levels;

|

|

|

•

|

|

our capital expenditure forecasts change or prove inaccurate; or

|

|

|

•

|

|

we fail to respond to unforeseen challenges or take advantage of unanticipated opportunities.

|

As a result, we may need to raise substantial additional capital. Additional capital, if required, may not be available

on acceptable terms, or at all. For example, U.S. credit markets have in recent years experienced significant dislocations and liquidity disruptions which caused the spreads on prospective debt financings to widen considerably. These circumstances

materially impacted liquidity in debt markets, making financing terms for borrowers less attractive and resulting in the general unavailability of some forms of debt financing. Uncertainty in credit or capital markets could negatively impact our

ability to access debt financing or to refinance existing indebtedness in the future on favorable terms, or at all. If additional capital is raised through the issuance of debt securities or other debt financing, the terms of such debt may include

covenants, restrictions and financial ratios that may restrict our ability to operate our business. Weak and recessionary economic conditions in recent years have also adversely affected the trading prices of equity securities of many U.S.

companies, including Zhone, which may make it more difficult or costly for us to raise capital through the issuance of common stock, preferred stock or other equity securities. If we elect to raise equity capital, this may be dilutive to existing

stockholders and could reduce the trading price of our common stock. If we are unable to obtain additional capital or are required to obtain additional capital on terms that are not favorable to us, we may be required to reduce the scope of our

planned product development and sales and marketing efforts beyond the reductions that we have previously taken, which could have a material adverse effect on our business, financial condition and results of operations.

Our lack of liquid funds and other sources of financing may limit our ability to maintain our existing operations, grow our business

and compete effectively.

Our continued losses reduced our cash, cash equivalents and short-term

investments in 2010 and 2011. As of December 31, 2011, we had approximately $18.2 million in cash, cash equivalents and short-term investments and $15.0 million outstanding under our bank lending facility. In order to meet our liquidity needs

and finance our capital expenditures and working capital needs for our business, we may be required to sell assets, or to borrow on potentially unfavorable terms. We may be unable to sell assets, or access additional indebtedness to meet these

needs. As a result, we may become unable to pay our ordinary expenses, including our debt service, on a timely basis. Our current lack of liquidity could harm us by:

|

|

•

|

|

increasing our vulnerability to adverse economic conditions in our industry or the economy in general;

|

|

|

•

|

|

requiring substantial amounts of cash to be used for debt servicing, rather than other purposes, including operations;

|

14

|

|

•

|

|

limiting our ability to plan for, or react to, changes in our business and industry; and

|

|

|

•

|

|

influencing investor and customer perceptions about our financial stability and limiting our ability to obtain financing or acquire customers.

|

We cannot be certain that additional financing, if needed, will be available on acceptable

terms or at all. If we cannot raise any necessary additional financing on acceptable terms, we may not be able to fund our business expansion, take advantage of future opportunities, meet our existing debt obligations or respond to competitive

pressures or unanticipated capital requirements, any of which could have a material adverse effect on our business, financial condition and results of operations. Further, if we issue additional equity or debt securities, stockholders may experience

additional dilution or the new equity securities may have rights, preference or privileges senior to those of existing holders of our common stock.

We face a number of risks related to continued weak economic and market conditions.

Global market and economic conditions in recent years have been unprecedented and challenging, with most major economies experiencing tighter credit conditions and an economic recession. Continued market

turbulence and weak economic conditions, as well as concerns about energy costs, geopolitical issues, the availability and cost of credit, and the global housing and mortgage markets have contributed to continued market volatility and weak economic

growth in most major economies. These conditions, combined with volatile oil prices, low business and consumer confidence and continued significant unemployment, have contributed to volatility of unprecedented levels. Continued weak economic and

market conditions globally could impact our business in a number of ways, including:

Potential deferment of purchases and

orders by customers

: Uncertainty about current and future global economic conditions may cause consumers, businesses and governments to defer purchases in response to continued flat revenue budgets, tighter credit, decreased cash availability

and weak consumer confidence. Accordingly, future demand for our products could differ materially from our current expectations.

Customers’ inability to obtain financing to make purchases from Zhone and/or maintain their business:

Some of our customers require substantial financing in order to finance their business

operations, including capital expenditures on new equipment and equipment upgrades, and make purchases from Zhone. The potential inability of these customers to access the capital needed to finance purchases of our products and meet their payment

obligations to us could adversely impact our financial condition and results of operations. If our customers become insolvent due to market and economic conditions or otherwise, it could have a material adverse impact on our business, financial

condition and results of operations.

Negative impact from increased financial pressures on third-party dealers,

distributors and retailers

: We make sales in certain regions through third-party dealers, distributors and retailers. These third parties may be impacted, among other things, by the significant decrease in available credit in recent years. If

credit pressures or other financial difficulties result in insolvency for these third parties and we are unable to successfully transition end customers to purchase our products from other third parties, or from us directly, it could adversely

impact our financial condition and results of operations.

Negative impact from increased financial pressures on key

suppliers:

Our ability to meet customers’ demands depends, in part, on our ability to obtain timely and adequate delivery of quality materials, parts and components from our suppliers. Certain of our components are available only from a

single source or limited sources. If certain key suppliers were to become capacity constrained or insolvent, it could result in a reduction or interruption in supplies or a significant increase in the price of supplies and adversely impact our

financial condition and results of operations. In addition, credit constraints of key suppliers could result in accelerated payment of accounts payable by Zhone, impacting our cash flow.

15

If weak economic, market and geopolitical conditions in the United States

and the rest of the world continue or worsen, we may experience material adverse impacts on our business, operating results and financial condition.

If demand for our SLMS products does not develop, then our results of operations and financial condition will be adversely affected.

Our future revenue depends significantly on our ability to successfully develop, enhance and market our SLMS products to

the network service provider market. Most network service providers have made substantial investments in their current infrastructure, and they may elect to remain with their current architectures or to adopt new architectures, such as SLMS, in

limited stages or over extended periods of time. A decision by a customer to purchase our SLMS products will involve a significant capital investment. We must convince our service provider customers that they will achieve substantial benefits by

deploying our products for future upgrades or expansions. We do not know whether a viable market for our SLMS products will develop or be sustainable. If this market does not develop or develops more slowly than we expect, our business, financial

condition and results of operations will be seriously harmed.

We depend upon the development of new products and

enhancements to existing products, and if we fail to predict and respond to emerging technological trends and customers’ changing needs, our operating results and market share may suffer.

The markets for our products are characterized by rapidly changing technology, evolving industry standards, changes in

end-user requirements, frequent new product introductions and changes in communications offerings from network service provider customers. Our future success depends on our ability to anticipate or adapt to such changes and to offer, on a timely and

cost-effective basis, products that meet changing customer demands and industry standards. We may not have sufficient resources to successfully and accurately anticipate customers’ changing needs and technological trends, manage long

development cycles or develop, introduce and market new products and enhancements. The process of developing new technology is complex and uncertain, and if we fail to develop new products or enhancements to existing products on a timely and

cost-effective basis, or if our new products or enhancements fail to achieve market acceptance, our business, financial condition and results of operations would be materially adversely affected.

Because our products are complex and are deployed in complex environments, our products may have defects that we discover only after

full deployment by our customers, which could seriously harm our business.

We produce highly complex

products that incorporate leading-edge technology, including both hardware and software. Software typically contains defects or programming flaws that can unexpectedly interfere with expected operations. In addition, our products are complex and are

designed to be deployed in large quantities across complex networks. Because of the nature of these products, they can only be fully tested when completely deployed in large networks with high amounts of traffic, and there is no assurance that our

pre-shipment testing programs will be adequate to detect all defects. As a result, our customers may discover errors or defects in our hardware or software, or our products may not operate as expected, after they have been fully deployed by our

customers. If we are unable to cure a product defect, we could experience damage to our reputation, reduced customer satisfaction, loss of existing customers and failure to attract new customers, failure to achieve market acceptance, reduced sales

opportunities, loss of revenue and market share, increased service and warranty costs, diversion of development resources, legal actions by our customers, and increased insurance costs. Defects, integration issues or other performance problems in

our products could also result in financial or other damages to our customers. Our customers could seek damages for related losses from us, which could seriously harm our business, financial condition and results of operations. A product liability

claim brought against us, even if unsuccessful, would likely be time consuming and costly. The occurrence of any of these problems would seriously harm our business, financial condition and results of operations.

16

A shortage of adequate component supply or manufacturing capacity could increase our

costs or cause a delay in our ability to fulfill orders, and our failure to estimate customer demand properly may result in excess or obsolete component inventories that could adversely affect our gross margins.

Occasionally, we may experience a supply shortage, or a delay in receiving, certain component parts as a result of strong

demand for the component parts and/or capacity constraints or other problems experienced by suppliers. If shortages or delays persist, the price of these components may increase, or the components may not be available at all, and we may also

encounter shortages if we do not accurately anticipate our needs. Conversely, we may not be able to secure enough components at reasonable prices or of acceptable quality to build new products in a timely manner in the quantities or configurations

needed. Accordingly, our revenue and gross margins could suffer until other sources can be developed. Our operating results would also be adversely affected if, anticipating greater demand than actually develops, we commit to the purchase of more

components than we need. Furthermore, as a result of binding price or purchase commitments with suppliers, we may be obligated to purchase components at prices that are higher than those available in the current market. In the event that we become

committed to purchase components at prices in excess of the current market price when the components are actually used, our gross margins could decrease. In the past we experienced component shortages that adversely affected our financial results

and in the future may continue to experience component shortages.

We rely on contract manufacturers for a portion of our

manufacturing requirements.

We rely on contract manufacturers to perform a portion of the manufacturing

operations for our products. These contract manufacturers build product for other companies, including our competitors. In addition, we do not have contracts in place with some of these providers and may not be able to effectively manage those

relationships. We cannot be certain that our contract manufacturers will be able to fill our orders in a timely manner. We face a number of risks associated with this dependence on contract manufacturers including reduced control over delivery

schedules, the potential lack of adequate capacity during periods of excess demand, poor manufacturing yields and high costs, quality assurance, increases in prices, and the potential misappropriation of our intellectual property. We have

experienced in the past, and may experience in the future, problems with our contract manufacturers, such as inferior quality, insufficient quantities and late delivery of products.

We depend on a limited source of suppliers for several key components. If we are unable to obtain these components on a timely basis,

we will be unable to meet our customers’ product delivery requirements, which would harm our business.

We currently purchase several key components from a limited number of suppliers. If any of our limited source of suppliers

become insolvent, cease business or experience capacity constraints, work stoppages or any other reduction or disruption in output, they may be unable to meet our delivery schedules. Our suppliers may enter into exclusive arrangements with our

competitors, be acquired by our competitors, stop selling their products or components to us at commercially reasonable prices, refuse to sell their products or components to us at any price or be unable to obtain or have difficulty obtaining

components for their products from their suppliers. If we do not receive critical components from our limited source of suppliers in a timely manner, we will be unable to meet our customers’ product delivery requirements. Any failure to meet a

customer’s delivery requirements could materially adversely affect our business, operating results and financial condition and could materially damage customer relationships.

Our target customer base is concentrated, and the loss of one or more of our customers could harm our business.