– Second Quarter 2022 Total Revenue of $32.5

Million; QINLOCK® Net Product Revenue Increases 43% to $31.5

Million Compared to Second Quarter 2021 –

– Phase 1 Single Agent Dose Escalation Data for

DCC-3116 Selected for Oral Presentation as a Proffered Paper at the

ESMO Congress 2022 in September –

– Updated Phase 1/2 Results for Study of

Vimseltinib in TGCT Patients Selected for Poster Presentation at

the ESMO Congress 2022; Continued Patient Enrollment in the Pivotal

Phase 3 MOTION Study –

– Nomination of New Development Candidate from

Pan-RAF Research Program Expected by Fourth Quarter 2022 –

Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH), a

biopharmaceutical company focused on discovering, developing, and

commercializing important new medicines to improve the lives of

people with cancer, today announced financial results for the

second quarter ended June 30, 2022, and provided a corporate

update.

“We delivered strong commercial performance in the second

quarter with QINLOCK®, and we advanced our portfolio of product

candidates with best-in-class potential,” said Steve Hoerter,

President and Chief Executive Officer of Deciphera Pharmaceuticals.

“Germany recently awarded a ‘major additional benefit’ rating for

QINLOCK in its indication in advanced GIST, which is the first time

an orphan oncology treatment has received this rating for its lead

indication since the introduction of the German benefit assessment

of medicinal products over 10 years ago. This, along with a strong

commercial launch in Germany and a successful post-approval paid

access program in France, demonstrate the potential for QINLOCK to

transform how GIST is treated around the world.”

Mr. Hoerter continued, “We are also excited that the initial

data from the Phase 1 study of DCC-3116, our potential

first-in-class autophagy inhibitor, has been selected for an oral

presentation at ESMO next month. Additionally, enrollment in the

pivotal Phase 3 MOTION study of vimseltinib for the treatment of

TGCT is on track and updated results from the Phase 1/2 study will

be presented at ESMO next month, and finally, we expect to nominate

the development candidate from our pan-RAF research program by the

fourth quarter.”

Second Quarter 2022 Highlights and Upcoming

Milestones

QINLOCK (ripretinib)

- Recorded $31.5 million in QINLOCK net product revenue in the

second quarter of 2022, including $23.7 million in U.S. net product

revenue and $7.8 million in international net product revenue, an

increase of 43% from net product revenue of $22.0 million in the

second quarter of 2021.

- Received a “major additional benefit” rating from Germany’s

Federal Joint Committee (G-BA). QINLOCK is the first orphan

oncology treatment in Germany to receive this rating for its lead

indication and the only GIST treatment awarded with this

recognition.

Vimseltinib

- Continued patient enrollment in the pivotal Phase 3 MOTION

study of vimseltinib for the treatment of TGCT. MOTION is a

two-part, randomized, double-blind, placebo-controlled study of

vimseltinib to assess the efficacy and safety in patients with TGCT

who are not amenable to surgery. The primary endpoint of the study

is objective response rate at week 25 as measured by RECIST v1.1 by

blinded independent radiologic review.

- Expects to present updated results from the ongoing Phase 1/2

study in TGCT patients in a poster presentation at the ESMO

Congress 2022 in September.

DCC-3116

- Expects to present data in an oral presentation as a Proffered

Paper at the ESMO Congress 2022 from the single agent dose

escalation portion of the Phase 1 study of DCC-3116 in patients

with advanced or metastatic tumors with a mutant RAS or RAF

gene.

- Expects to initiate three Phase 1b study combination dose

escalation cohorts in the second half of 2022:

- In combination with trametinib, a Food and Drug Administration

(FDA)-approved MEK inhibitor, in patients with advanced or

metastatic solid tumors with RAS, NF1, or RAF mutations.

- In combination with binimetinib, an FDA-approved MEK inhibitor,

in patients with advanced or metastatic solid tumors with RAS, NF1,

or RAF mutations.

- In combination with sotorasib, an FDA- approved KRASG12C

inhibitor, in patients with advanced or metastatic solid tumors

with KRASG12C mutations.

Proprietary Drug Discovery Platform

- Expects to nominate a development candidate by the fourth

quarter of 2022 from the pan-RAF research program discovered using

the Company’s novel switch-control kinase inhibitor platform.

Corporate Updates

- Appointed Kelley Dealhoy as Senior Vice President and Chief

Business Officer to develop and lead the Company’s business

development efforts and corporate strategy initiatives. Ms. Dealhoy

brings 20 years of life science leadership experience to the role

and joined Deciphera from Novartis, where she most recently served

as Vice President of Business Development for the Oncology

Division.

- Published the 2021 Environmental, Social, and Governance (ESG)

Report, highlighting our current practices and initiatives in

several important ESG-related areas as of the 2021 fiscal

year.

Second Quarter 2022 Financial Results

- Revenue: Total revenue for the second quarter of 2022

was $32.5 million, which includes $31.5 million of net product

revenue of QINLOCK and $1.0 million of collaboration revenue

compared to $23.6 million of total revenue, including $22.0 million

of net product revenue of QINLOCK and $1.5 million of collaboration

revenue, for the same period in 2021.

- Cost of Sales: Cost of sales were $1.8 million in the

second quarter of 2022 compared to $1.3 million in the same period

in 2021. Cost of sales for newly launched products will not include

the full cost of manufacturing until the initial pre-launch

inventory is depleted, and additional inventory is manufactured and

sold. The Company expects to continue to sell zero cost inventories

of QINLOCK in the U.S. through 2022.

- R&D Expenses: Research and development expenses for

the second quarter of 2022 were $44.9 million, compared to $60.0

million for the same period in 2021. The decrease was primarily due

to lower clinical trial costs related to QINLOCK, including

INTRIGUE, our Phase 3 study for the treatment of second-line GIST

for which top-line results were announced in November 2021, and the

discontinuation of our rebastinib program following the corporate

restructuring implemented in the fourth quarter of 2021, partially

offset by an increase in clinical trial costs related to our Phase

1 study of DCC-3116 and preclinical costs. Non-cash, stock-based

compensation was $5.4 million and $5.6 million for the second

quarters of 2022 and 2021, respectively.

- SG&A Expenses: Selling, general, and administrative

expenses for the first quarter of 2022 were $29.6 million, compared

to $32.8 million for the same period in 2021. The decrease was

primarily due to a decrease in professional and consultant fees.

Non-cash, stock-based compensation was $7.6 million and $6.8

million for the second quarters of 2022 and 2021,

respectively.

- Net Loss: For the second quarter of 2022, Deciphera

reported a net loss of $43.1 million, or $0.60 per share, compared

with a net loss of $70.4 million, or $1.21 per share, for the same

period in 2021.

- Cash Position: As of June 30, 2022, cash, cash

equivalents, and marketable securities were $393.1 million,

compared to $275.4 million as of March 31, 2022. In April 2022, the

Company completed an underwritten public offering that resulted in

aggregate net proceeds of $163.4 million. Based on its current

operating plans, Deciphera expects its current cash, cash

equivalents, and marketable securities together with anticipated

product, royalty, and supply revenues, but excluding any potential

future milestone payments under its collaboration or license

agreements, will enable the Company to fund its operating and

capital expenditures into 2025.

Conference Call and Webcast

Deciphera will host a conference call and webcast to discuss

this announcement today, August 4, 2022, at 8:00 AM ET. The

conference call may be accessed via this link:

https://register.vevent.com/register/BI14cfe386c5004efcba5c94f8783e2435.

A live webcast of the conference call will be available in the

“Events and Presentations” page in the “Investors” section of the

Company’s website at

https://investors.deciphera.com/events-presentations. A replay will

be available on the Company’s website approximately two hours after

the conference call and will be available for 30 days following the

call.

About Deciphera Pharmaceuticals

Deciphera is a biopharmaceutical company focused on discovering,

developing, and commercializing important new medicines to improve

the lives of people with cancer. We are leveraging our proprietary

switch-control kinase inhibitor platform and deep expertise in

kinase biology to develop a broad portfolio of innovative

medicines. In addition to advancing multiple product candidates

from our platform in clinical studies, QINLOCK® is Deciphera’s

switch control inhibitor for the treatment of fourth-line GIST.

QINLOCK is approved in Australia, Canada, China, the European

Union, Hong Kong, Switzerland, Taiwan, the United Kingdom, and the

United States. For more information, visit www.deciphera.com and

follow us on LinkedIn and Twitter (@Deciphera).

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, including, without limitation, our expectations

and timing regarding the potential of QINLOCK to transform how GIST

is treated around the world, enrollment in the pivotal Phase 3

MOTION study of vimseltinib in TGCT patients, the potential for our

pre-clinical and/or clinical stage pipeline assets to be

first-in-class and/or best-in-class treatments, presenting updated

vimseltinib data from our Phase 1/2 study in TGCT patients at ESMO

2022, presenting initial data from the single agent dose escalation

phase of the Phase 1 study of DCC-3116 at ESMO 2022, initiation of

three combination dose escalation cohorts in the Phase 1 study of

DCC-3116, nominating a development candidate for our pan-RAF

research program, and cash guidance. The words “may,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “seek,” “target” and similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on

management’s current expectations and beliefs and are subject to a

number of risks, uncertainties and important factors that may cause

actual events or results to differ materially from those expressed

or implied by any forward-looking statements contained in this

press release, including, without limitation, risks and

uncertainties related to the severity and duration of the impact of

COVID-19 on our business and operations, our ability to

successfully demonstrate the efficacy and safety of our drug or

drug candidates, the preclinical or clinical results for our

product candidates, which may not support further development of

such product candidates, comments, feedback and actions of

regulatory agencies, our ability to commercialize QINLOCK and

execute on our marketing plans for any drugs or indications that

may be approved in the future, the inherent uncertainty in

estimates of patient populations, competition from other products,

our ability to obtain and maintain reimbursement for any approved

product and the extent to which patient assistance programs are

utilized and other risks identified in our Securities and Exchange

Commission (SEC) filings, including our Quarterly Report on Form

10-Q for the quarter ended June 30, 2022 , and subsequent filings

with the SEC. We caution you not to place undue reliance on any

forward-looking statements, which speak only as of the date they

are made. We disclaim any obligation to publicly update or revise

any such statements to reflect any change in expectations or in

events, conditions or circumstances on which any such statements

may be based, or that may affect the likelihood that actual results

will differ from those set forth in the forward-looking

statements.

Deciphera, the Deciphera logo, QINLOCK, and the QINLOCK logo are

registered trademarks of Deciphera Pharmaceuticals, LLC.

Deciphera Pharmaceuticals,

Inc.

Consolidated Balance

Sheets

(Unaudited, in thousands,

except share and per share amounts)

June 30, 2022

December 31, 2021

Assets

Current assets:

Cash and cash equivalents

$

109,698

$

87,063

Short-term marketable securities

274,149

198,571

Accounts receivable, net

25,851

20,595

Inventory

20,889

14,125

Prepaid expenses and other current

assets

17,944

18,660

Total current assets

448,531

339,014

Long-term marketable securities

9,208

41,950

Long-term investments—restricted and other

long-term assets

3,269

3,110

Property and equipment, net

7,353

8,610

Operating lease assets

38,676

36,800

Total assets

$

507,037

$

429,484

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

16,229

$

13,130

Accrued expenses and other current

liabilities

55,214

80,773

Operating lease liabilities

3,102

2,870

Total current liabilities

74,545

96,773

Operating lease liabilities, net of

current portion

27,481

27,991

Total liabilities

102,026

124,764

Commitments and contingencies

Stockholders' equity:

Preferred stock, $0.01 par value per

share; 5,000,000 shares authorized; no shares issued or

outstanding

—

—

Common stock, $0.01 par value per share;

125,000,000 shares authorized; 66,815,511 shares and 58,549,644

shares issued and outstanding as of June 30, 2022 and December 31,

2021, respectively

668

585

Additional paid-in capital

1,549,996

1,358,516

Accumulated other comprehensive income

(loss)

(1,268

)

51

Accumulated deficit

(1,144,385

)

(1,054,432

)

Total stockholders' equity

405,011

304,720

Total liabilities and stockholders'

equity

$

507,037

$

429,484

Deciphera Pharmaceuticals,

Inc.

Consolidated Statements of

Operations

(Unaudited, in thousands,

except share and per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2022

2021

2022

2021

Revenues:

Product revenues, net

$

31,497

$

22,048

$

60,306

$

42,010

Collaboration revenues

997

1,525

1,411

6,719

Total revenues

32,494

23,573

61,717

48,729

Cost and operating expenses:

Cost of sales

1,799

1,275

2,181

1,497

Research and development

44,858

59,984

92,270

115,665

Selling, general, and administrative

29,625

32,828

57,946

63,575

Total cost and operating expenses

76,282

94,087

152,397

180,737

Loss from operations

(43,788

)

(70,514

)

(90,680

)

(132,008

)

Other income (expense):

Interest and other income, net

727

81

727

277

Total other income (expense), net

727

81

727

277

Net loss

$

(43,061

)

$

(70,433

)

$

(89,953

)

$

(131,731

)

Net loss per share—basic and diluted

$

(0.60

)

$

(1.21

)

$

(1.31

)

$

(2.28

)

Weighted average common shares

outstanding—basic and diluted

72,133,428

57,987,095

68,441,998

57,867,795

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005299/en/

Investor Relations: Maghan Meyers Argot Partners

Deciphera@argotpartners.com 212-600-1902

Media: David Rosen Argot Partners

david.rosen@argotpartners.com 212-600-1902

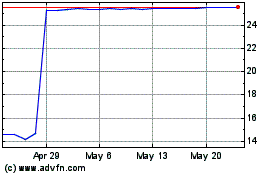

Deciphera Pharmaceuticals (NASDAQ:DCPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

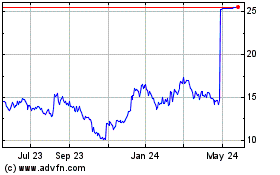

Deciphera Pharmaceuticals (NASDAQ:DCPH)

Historical Stock Chart

From Nov 2023 to Nov 2024