Shares of Lululemon and Crocs Skyrocket Despite Disappointing Retail Data

February 02 2012 - 8:20AM

Marketwired

Shares of retailers such as have struggled over the last week as US

consumer confidence continues to deteriorate. The New York-based

Conference Board's confidence index decreased to 61.1 from a

revised 64.8 reading the prior month. The Paragon Report examines

investing opportunities in the Retail (Apparel) Sector and provides

investment research on Lululemon Athletica, Inc. (NASDAQ: LULU)

(TSX: LLL) and Crocs, Inc. (NASDAQ: CROX). Access to the full

company reports can be found at:

www.paragonreport.com/LULU

www.paragonreport.com/CROX

Despite the largest increase in personal incomes since March,

December saw no increase in consumer spending, Commerce Department

figures show. US retail sales increased 0.1% in December, falling

short of the 0.3% gain forecast in a Bloomberg survey of

economists. Jobless claims rose 24,000 to 399,000 in the week ended

January 7, compared with a median estimate of 375,000 in a

Bloomberg survey.

Restrained consumer spending last quarter prevented growth from

meeting economists' forecast, Bloomberg reports. The US economy

expanded 2.8 percent in the final three months of 2011, compared

with a 3 percent estimate.

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the Retail industry register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Crocs, Inc. and its subsidiaries engage in the design,

development, manufacture, marketing, and distribution of footwear,

apparel, and accessories for men, women, and children. The company

recently released a press release stating that it expects to

achieve the higher end of its revenue guidance of $200 million to

$205 million for the fourth quarter of 2011, based on the strong

performance of retail business. Shares of Crocs are up an

impressive 36 percent year-to-date.

Lululemon Athletica Inc., together with its subsidiaries engages

in the design, manufacture, and distribution of athletic apparel

and accessories for women, men, and female youth primarily in

Canada, the United States, and Australia. Shares of the company are

up roughly 38 percent this year.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

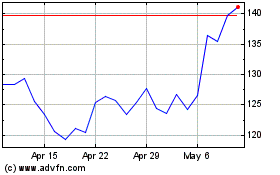

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Apr 2024 to May 2024

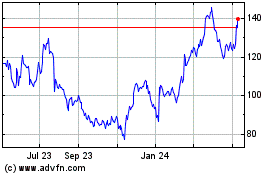

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2023 to May 2024