3rd UPDATE: Electronic Oil Market Trades Resumed After Halt

February 13 2012 - 5:29PM

Dow Jones News

A technical glitch shut down CME Group Inc.'s (CME) electronic

oil-trading platform for more than a hour Monday, throwing

end-of-day trading into disarray and sending traders scrambling to

place trades on the New York Mercantile Exchange floor.

The shutdown shortly after 2 p.m. EST halted electronic trading

of the world's biggest benchmark oil contract and roiled what had

been a relatively a quiet, low-volume session. Prices rose 50 cents

a barrel from levels earlier.

The shutdown was caused by "technical issues," according to CME.

The Globex trading platform resumed at 3:15 p.m. EST.

"The issue has been fixed and the market is back up and

running," a CME spokesman said.

In a notice on the CME Group's website, the firm, which owns the

Nymex, said it would cancel outstanding orders placed Monday on the

electronic trading platform, but not completed trades.

The shutdown, which coincided with the end of the trading

session, led to confusion over the final day's price of oil, called

the settlement price. Front-month March crude ultimately settled up

$2.24, or 2.3%, at $100.91 a barrel.

Such technical glitches are relatively uncommon for CME compared

with U.S. stock exchanges, where billions of shares change hands

per day--far more than the average 11.6 million contracts bought

and sold on CME's markets last month.

But when hiccups strike futures trading the impact is more

severe, since there are only two major venues--CME and rival

IntercontinentalExchange Inc. (ICE)--for trading crude oil

contracts.

Even though electronic trading ground to a halt, open outcry

trading remained open. Traders on the floor of the Nymex rushed

into the normally sleepy oil-futures pits, looking to place trades

and take advantage of any price dislocations due to the failure of

Globex, traders said.

"A bunch of options guys ran over there, nat gas brokers are

there; everybody is trying to take advantage of the wide quotes and

stuff," said Fred Rigolini, vice president of Paramount Options, a

brokerage on the Nymex floor.

"There's a little yelling and screaming in the crude ring right

now," said Jeffrey Grossman, president of BRG Brokerage on the

Nymex floor, shortly after the Globex halt.

CME did not offer additional details as to the cause of the

shutdown. However, an analysis of the trading halt by Nanex, a

market data service, found that shortly after 2 p.m., a series of

800 to 1,000 price quotes in Nymex crude-oil futures repeated in a

loop a dozen times over about four minutes. Globex shut down

shortly after.

"The same block of quotes just kept getting transferred by the

system," said Eric Hunsader, CEO of Nanex. "Then I think someone

pulled the plug."

John Woods, a Nymex floor trader and head of JJ Woods

Associates, said telephone calls from customers were twice as high

as during a normal trading session, and he headed to the crude-oil

pit.

In recent years, the majority of oil-futures volume has flooded

to the electronic market, leaving trading thin on the Nymex floor

in downtown New York. When the exchange announced the day's

settlement would be computed from the floor, Woods said there were

cheers and laughter.

"It was a throwback to the old days, I guess this just shows we

aren't done yet," he said.

-By Jerry A. DiColo and Dan Strumpf, Dow Jones Newswires;

212-416-2155; jerry.dicolo@dowjones.com

--Jacob Bunge contributed to this article

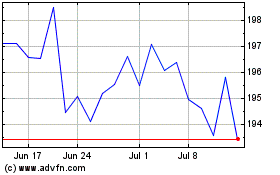

CME (NASDAQ:CME)

Historical Stock Chart

From May 2024 to Jun 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2023 to Jun 2024