UPDATE: ICE Launches New Brent Contract To Lackluster Response

December 05 2011 - 12:26PM

Dow Jones News

The planned launch of IntercontinentalExchange Inc.'s (ICE) new

Brent futures and options contracts Monday caused little stir in

the oil market as investors remained more focused on immediate

price fluctuations, traders and analysts said.

"We added Brent NX to our system this morning, but it hasn't

traded any volume to speak of," said one broker, while a trader on

the futures market added: "I must admit, I'm surprised how little

chatter I've heard on the issue."

ICE was not immediately available to comment.

Brent is a closely watched global benchmark for oil prices, but

over the years declining production volumes in the North Sea oil

fields where it is found have caused concerns over price

fluctuations.

Now Platts, the McGraw Hill Co. (MHP)-owned company that

calculates the price of Brent on the physical market, intends to

extend the period over which it assesses the oil price to 16 days

from the current 12 to increase liquidity in the benchmark.

ICE's new contracts, known as Brent NX, have different expiry

dates from the current Brent futures contracts and are intended to

better align the futures and physical markets ahead of the January

changes to the pricing system on the physical market.

Market participants said that uptake of ICE's new contract was

likely to be slow, particularly as the first month available to

trade is December 2012.

"Usually the liquidity is more in the front than the back so

it's not going to create a lot of liquidity immediately," said

Olivier Jakob, managing director of Swiss consultancy

Petromatrix.

Next week, rival exchange, CME Group Inc. (CME), will launch its

own version of the Brent NX contract in a bid to make inroads into

the Brent market, which has traditionally been dominated by

ICE.

-By Sarah Kent, Dow Jones Newswires;4420-7842-9376;

sarah.kent@dowjones.com

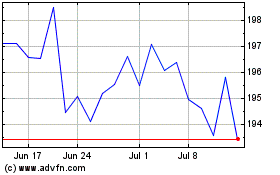

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024