CORRECT: CME Launches NDF Clearing Services For Dollar Vs Chilean Peso

May 16 2011 - 5:25PM

Dow Jones News

CME Group Inc. (CME) launched a postexecution clearing service

for nondeliverable forwards on the U.S. dollar versus the Chilean

peso, marking the first step in its plan to offer clearing services

for over-the-counter foreign-exchange transactions.

The move reflects growing demand for clearing services among

local Chilean market participants, said the company's FX products

director, Craig LeVeille.

"There is demand locally for a product like this; it will

facilitate business being done between Chilean counterparties and

international liquidity providers," he added.

CME and other exchanges have been expanding efforts to handle

more of a $4 trillion-a-day foreign exchange trading business

dominated by over-the-counter products. Hedge funds and other

proprietary traders have become more active in the forex market,

increasing the appeal of centralized clearing services provided by

the exchanges.

The new offering is "the first step in our broader initiative to

provide clearing services for a wide range of FX products later

this year," LeVeille said.

CME already offers foreign-exchange futures contracts for more

than 50 currency pairs, said CME Group spokesman Michael Shore.

The company said Monday its offering will mitigate counterparty

risk, expand liquidity and improve operational efficiency for

trades of the nondeliverable forwards.

The Chilean peso was chosen as the service's first currency

offering in this initiative largely in response to client demand,

Shore said.

"There's a lot of liquidity in the Chilean peso, and there was a

market need to clear this style of transaction," he added.

Estimates for average daily volume for the Chilean peso NDF

over-the-counter market range from $5 billion to $10 billion, FX

products director LeVeille said.

"Chile has a strong economy generating large investment

exposures to foreign assets," he added. "Local institutions can use

our clearing service to mitigate the growing credit constraints

they face when hedging currency risks, and this should lead to a

boost in liquidity and an expansion in cross-border activity."

Local Chilean banks and large, fast-growing pension funds could

especially benefit from the service, he said.

Operationally, it was also an easier currency to kick off the

service, he added.

"The Chilean peso seemed like a perfect step forward for us

because it is a smaller currency, so the requirements to get

started are not potentially as demanding as other currencies,"

LeVeille said.

The newly launched service also arrives in step with expected

regulatory changes in the U.S., which will likely mandate NDF

contracts to go through a clearing process, LeVeille said.

Still, "it's not about the mandate ... it's really about solving

an issue for market participants, and to boot, it helps because it

looks like there's going to be a mandate on it anyway," LeVeille

said.

The move also reflects growing investor interest in Latin

American and other emerging-market currencies, analysts said.

"There's just more and more trading popping up in emerging

markets," said Win Thin, global head of emerging-market strategy at

Brown Brothers Harriman.

The growth of local Chilean markets, along with the country's

"fairly clean" monetary and fiscal policies have helped increase

market demand for the Chilean peso, said Benito Berber,

foreign-exchange strategist at Nomura Securities.

"It's very interesting that CME is expanding to these markets,

and this highlights the interest or the demand that we also see

here from macro hedge funds in terms of play in Chile," he

added.

-By Erin McCarthy, Dow Jones Newswires; 212-416-2712;

erin.mccarthy@dowjones.com

--Matt Jarzemsky contributed to this article.

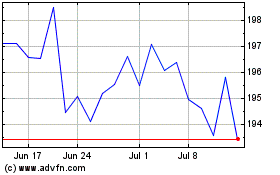

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024