CME Sees $100 Million From Rapid Trading Services By 2016

March 09 2011 - 12:34PM

Dow Jones News

CME Group Inc. (CME) anticipates the business of providing fast

connections to computer-powered traders could bring in $100 million

in revenue within four to five years, a senior executive said

Wednesday.

The world's biggest futures-exchange operator plans to introduce

co-location services for electronic traders in early 2012, and more

than 100 customers have made early commitments to the program,

according to CME Chief Financial Officer Jamie Parisi.

CME, which has built a specialized data center to house its

electronic trading systems in the suburbs of Chicago, has estimated

that the new business could generate $30 million to $40 million in

revenue next year.

Such co-location services involve connecting electronic trading

firms' servers directly to an exchange's trade-matching engines,

with the systems operating within close proximity to cut down on

the time required to transmit orders across physical distances.

Offering a uniform service to all CME customers will ensure a

level playing field among high-speed traders, Parisi said Wednesday

at an event hosted by Citi Investment Research.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com.

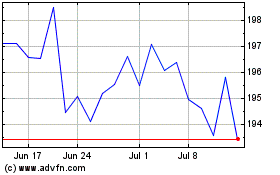

CME (NASDAQ:CME)

Historical Stock Chart

From May 2024 to Jun 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2023 to Jun 2024