Iron Mountain Reports Mixed 4Q - Analyst Blog

February 23 2012 - 8:30AM

Zacks

Iron Mountain Inc.’s (IRM) fourth quarter

adjusted earnings per share of 33 cents surpassed the Zacks

Consensus Estimate of 30 cents. However, reported earnings remained

flat on a year-over-year basis.

Revenues

Revenues increased 1.8% year over year to $741.8 million, but

fell shy of the Zacks Consensus Estimates of $744.0 million.

Revenues were positively impacted by internal growth (1.0%) and

favorable foreign exchange rates and acquisitions (1.0%).

Segment wise, Storage revenue (56.7% of revenues) climbed 3.8%

year over year to $420.8 million. Storage revenue’s internal growth

was 3% in the quarter, driven by continued strong performance in

the International business segment and persistent growth in the

North America business. Global records management net volumes crept

up 2% year over year.

Service revenue (43.3% of revenues) dipped 0.8% year over year

to $321.0 million. Core service revenue’s internal growth was

negative 1.0% as strong hybrid service revenue growth and increased

fuel surcharges were more than offset by the softness in North

American core service activity levels.

Operating Performance

Gross profit (excluding depreciation and amortization) fell 2.0%

year over year to $427.0 million in the reported quarter. Gross

margin for the quarter stood at 57.5% versus 59.4% in the year-ago

quarter, due to higher incentive compensation expense and mix shift

toward hybrid service.

Adjusted operating income before depreciation and amortization

(OIBDA) for the quarter upped 2.0% year over year to $237.0

million. Adjusted OBIDA margin for the quarter remained flat on a

year-over-year basis at 32.0%.

Selling, general and administrative (SG&A) expenses were

down 5.2% from the prior-year period to $189.4 million,

attributable to stringent overhead cost controls.

Operating income in the quarter increased 2.0% year over year to

$149.0 million. Operating margin was 20.1%, relatively flat on

year-over-year basis.

Balance Sheet

Iron Mountain exited the quarter with cash and cash equivalents

of $179.8 million compared with $480.9 million at the end of the

previous quarter. Long-term debt (including the current portion)

was $3.35 billion versus $3.32 billion in the prior quarter.

During the fourth quarter of 2011, the company repurchased 14.7

million shares for a total aggregate purchase price of $440.0

million under its existing share repurchase program. On January 13,

2012, the company paid a quarterly dividend of 25 cents per

share.

Guidance

For fiscal 2012, Iron Mountain expects revenues in the range of

$2.97 billion to $3.05 billion. The Zacks Consensus revenue

estimate for the fiscal 2012 is pegged at $3.07 billion.

The company forecasts adjusted OIBDA between $890.0 million and

$930.0 million. Iron Mountain expects earnings per share in the

range of $1.20 to $1.36. The Zacks Consensus Estimate projects

earnings of $1.33 per share for fiscal 2012.

The company expects to spend approximately $215.0 million on

capital assets. Free cash flow is expected in the range of

$320.0 million to $360.0 million for fiscal 2012.

Moreover, management expects a 32.0% year-over-year decline in

paper prices to affect the total revenue by $45 million.

Additionally, North American core service activities will likely

experience continued pressure while the decline in paper prices is

expected to be a headwind going forward.

Recommendation

Iron Mountain has more or less outperformed the Zacks Consensus

Estimates by a positive 2.86% over the last four quarters and the

phenomenon was repeated in the quarter when reported earnings beat

the Zacks Consensus by 10.0%.

We maintain our Neutral recommendation on a long-term basis

(6-12 months) due to weak internal growth coupled with volatile

foreign exchange rates and a decline in paper price that is set to

partially negate the company’s promising product portfolio, strong

market share and a promising International business segment.

Iron Mountain faces stiff competition from Anacomp Inc.,

Cintas Corporation (CTAS) and privately held

SOURCECORP, Inc.

Iron Mountain has a Zacks #3 Rank, which implies a short-term

'Hold' rating (for the next 1-3 months).

CINTAS CORP (CTAS): Free Stock Analysis Report

IRON MOUNTAIN (IRM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

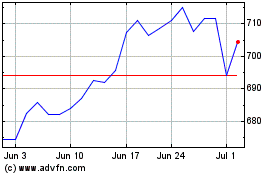

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Apr 2024 to May 2024

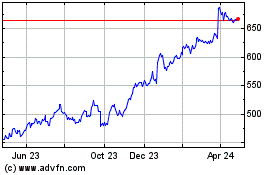

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2023 to May 2024