Cintas Partners With ScanMD - Analyst Blog

February 22 2012 - 6:30AM

Zacks

In order to convert medical charts to electronic formats

Cintas Corporation (CTAS) has entered into a

partnership with ScanMD recently. Cintas will now be able to switch

to electronic medical records (EMR) instead of maintaining

elaborate paper charts and files.

The coalition will guarantee Cintas the security of medical

records by converting the paper charts into electronic formats,

backed-up on secure servers. The searchable data fields will

make the task of searching the patient’s records easier. The PDF

files will simplify the navigation process, thus saving time.

Alongside, the solution will also save the cost and space required

for maintaining the paper charts and files.

The alliance with ScanMD has helped Cintas in curtailing the

cost and labor of transforming the healthcare information and

records to EMR program. Moreover, Cintas is also able to stay ahead

of the future legislative regulations of utilizing EMR

programs.

ScanMD specializes in converting paper medical charts to

electronic formats. It integrates paper charts to EMR and

safeguards them, fulfilling the norms of Health Insurance

Portability and Accountability Act (HIPAA). The system also

diminishes the risk of HIPAA issues by reducing the number of lost

or inaccessible files.

In the recently reported quarterly results, Cintas’ earnings

increased 50% to 57 cents per share from 38 cents in the

year-ago-quarter. Total revenue increased 9% year over year to

$1.02 billion. The Zacks Consensus Estimate for the third quarter

of the year 2012 is 52 cents.

Cintas continues to deliver margin expansion through better

sales productivity and cost efficiencies, offsetting the rising

headwinds from higher energy and other input costs. During the

second quarter of fiscal 2012, gross margin increased 50 basis

points to 42.2% and in operating margin there was an impressive 200

basis point expansion to 13%; this happens to be the fourth

consecutive quarter of strong operating margin expansion after

several years of decline.

This performance was commendable considering the ongoing

headwinds from higher energy and garment material prices. There is

scope for further gross margin expansion as the company has

unutilized capacity in facilities that it can leverage.

Furthermore, due to a weak labor outlook, much of the growth over

the last few quarters has been driven by new business sales rather

than existing customers adding more employees, which is more

profitable. Any increase in hiring at existing customers will boost

margin expansion.

Currently, the shares of Cintas maintain a Zacks #2 (short-term

“Buy” recommendation) Rank. It competes with the likes of

G&K Services Inc. (GKSR) and privately held

Alsco Inc. and ARAMARK

Corporation.

Based in Cincinnati, Ohio, Cintas Corporation (CTAS) provides

specialized services to businesses of all types throughout North

America. The company designs, manufactures, implements corporate

identity uniform programs, and provides entrance mats, restroom

supplies, promotional products and first aid and safety products

for approximately 800,000 businesses. Cintas operates under two

operating segments, Rental Uniforms and Ancillary Products and

Other Services.

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

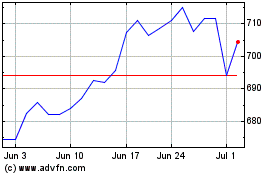

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Apr 2024 to May 2024

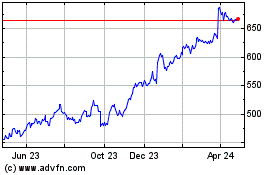

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2023 to May 2024