Cintas to Outperform - Analyst Blog

January 16 2012 - 10:00AM

Zacks

We have recently upgraded

Cintas Corporation (CTAS) from Neutral to

Outperform encouraged by solid organic growth and margin expansion

despite cost headwinds. Furthermore, we believe Cintas’ balance

sheet and cash flow characteristics support a renewed repurchase

authorization and a dividend hike.

Cintas reported earnings of 57

cents per share for fiscal second quarter 2012, comfortably

surpassing the Zacks Consensus Estimate of 48 cents and 50% higher

than the 38 cents earned in the year-ago quarter. Total revenue

increased 9% to a record $1.02 billion, striding ahead of the Zacks

Consensus Estimate of $1 billion.

Cintas was directly affected by a

huge number of job losses and facility closures during the

recession. However, during those times, Cintas enhanced its

operations by evaluating sales force productivity, optimizing

routes and streamlining labor overhead. This helped the company

return to year-over-year organic revenue growth in the fourth

quarter of fiscal 2010 after a stretch of negative performance for

six quarters. Since then, organic growth has only accelerated.

In the reported quarter, the

company posted solid organic growth of 7%, close to the 8% in the

fourth quarter of 2011 – an all time high in the past five years

and a massive improvement over the 4.2% growth reported in the

year-ago quarter. Even as the macro environment remains uncertain,

we believe Cintas will continue to drive growth by adding

salespeople and increasing sales productivity.

Cintas also continues to deliver

margin expansion through better sales productivity and cost

efficiencies, offsetting the rising headwinds from higher energy

and garment material prices. There is scope for further gross

margin expansion as the company has unutilized capacity in

facilities that it can leverage.

Cintas recently raised its

quarterly dividend by 5 cents to 54 cents, the 29th consecutive

year of the company’s dividend hike. The company has religiously

hiked its dividend each year starting from 1983, the year it went

public. In addition, Cintas’ board of directors also approved a new

share repurchase program under which the company may

repurchase up to $500 million of Cintas common stock at market

prices. Since the beginning of fiscal 2011, the company has

purchased 23.4 million shares under its share buyback programs at a

total cost of $702 million. We believe Cintas’ solid balance sheet

and cash flow support a renewed repurchase authorization and a

dividend hike and could create further upside for shareholders.

On the flipside, Cintas continues

to be plagued with rising costs of cotton used in uniforms and

diesel fuel for trucks. Energy and cotton prices remain headwinds

for 2012, particularly in the Rental segment.

Furthermore, its Document

Management segment was affected by a material decline in recycled

paper prices. After experiencing a fairly long stretch of prices in

excess of $200 per ton, the prices dropped to $150 per ton during

the quarter, 16% below the first-quarter average. In the next few

quarters, recycled paper prices will remain sluggish at $150 per

ton. The segment was also affected by the difficult economic

environment in Europe. Although the company has taken steps to

right-size the business, incurring costs this quarter, we await the

segment to deliver a turnaround.

All said, we upgrade our

recommendation from Neutral to Outperform on Cintas Corporation.

The quantitative Zacks #1 Rank (short term Strong Buy rating) for

the company indicates upward pressure on the stock over the

near term.

Cincinnati, Ohio-based Cintas

Corporation designs, manufactures and implements corporate identity

uniform programs, and provides entrance mats, restroom supplies,

promotional products, and first aid and safety products for

approximately 900,000 businesses. Cintas competes with

G&K Services Inc. (GKSR) and privately held

Alsco Inc. and ARAMARK Corporation.

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

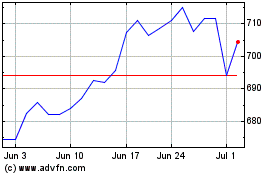

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2024 to Jul 2024

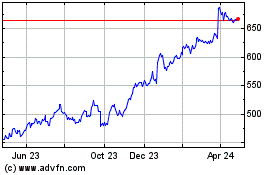

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jul 2023 to Jul 2024