Cintas Corporation - Growth & Income

December 22 2011 - 7:00PM

Zacks

Cintas Corporation (CTAS) carried its momentum into the

second quarter of its fiscal 2012 and delivered an outstanding 19%

EPS beat on solid organic revenue growth.

Management also raised its 2012 guidance, prompting

analysts to revise their estimates higher for both this year and

next. It is a Zacks #2 Rank (Buy).

On top of strong earnings growth potential, the

company also pays a dividend that yields a solid 1.5%.

Company Description

Cintas Corporation provides uniforms, restroom

supplies, first aid, safety and fire protection, and other

ancillary products to approximately 900,000 businesses. The company

should benefit from an improving labor market in the United States,

as more workers means more uniforms.

Cintas was founded in 1968 and has a market cap of

$4.5 billion.

Huge Second Quarter

Cintas delivered excellent second quarter 2012

results on December 20. Earnings per share came in at 57 cents,

crushing the Zacks Consensus Estimate by 9 cents. It was a whopping

50% increase over the same quarter in 2011.

Revenue rose 9% to a record $1.019 billion, ahead

of the Zacks Consensus Estimate of $1.003 billion. Organic revenue

increased a solid 7% as the company maintained its momentum in its

Rental Uniforms & Ancillary Products segment, as well as in it

First Aid, Safety & Fire Protection Services segment.

Operating income improved 30% year-over-year as the

company leveraged its selling and administrative expenses. The

operating margin improved from 10.9% to 13.0%.

Outlook

Management raised its guidance for the remainder of

its fiscal 2012 following strong Q2 earnings. The company now

expects EPS in the range of $2.16-$2.20, with revenue between

$4.075 billion and $4.125 billion. This is up from previous EPS

guidance of $1.97-$2.05 on revenue of $4.000-$4.100 billion.

The company stated that "while we remain cautious

about the U.S. economic picture, we have more confidence about our

ability to execute in this less than robust environment."

These factors caused analysts to raise their

estimates significantly for both 2012 and 2013, sending the stock

to a Zacks #2 Rank (Buy). The Zacks Consensus Estimate for 2012 is

now $2.19, within guidance, and representing 29% growth over 2011

EPS. The 2013 consensus estimate is currently 8% higher at

$2.35.

Dividend

Cintas has a history of rewarding its shareholders

and has raised its dividend every year since it began paying one in

1991. It currently yields a solid 1.5%.

It would be safe to bet that the company will

continue raising its dividend in the near future. Its payout ratio

is still relatively low at 27%, and earnings are projected to grow

at a healthy clip over the next couple of years.

Valuation

Shares of CTAS are up more than 20% since I wrote

about it on September 29. But valuation still looks very

reasonable. Shares trade at just 15.8x 12-month forward earnings, a

discount to its 10-year median of 17.8x.

The Bottom Line

With strong earnings momentum, solid growth

prospects, a rising dividend and reasonable valuation, Cintas still

offers plenty of upside potential.

This Week's Growth & Income Zacks Rank Buy

Stocks:

Kennametal Inc. (KMT) recently delivered its

10th consecutive positive earnings surprise on record EPS for the

first quarter. Management raised its EPS guidance for 2012,

prompting analysts to revise their estimates higher. It is a Zacks

#2 Rank (Buy) stock. Kennametal also recently raised its quarterly

payout by 17%, marking the first dividend increase in 4 years. It

yields a solid 1.6%. Read the full article.

The Kroger Co. (KR) recently delivered

excellent results for the third quarter of 2011, driven by a

stellar 5.0% increase in same-store sales. Management raised its

guidance for the remainder of the year off the strong quarter,

prompting analysts to revise their estimates higher, and sending

the stock to a Zacks #2 Rank (Buy). It also pays a dividend that

yields 1.9%. Read the full article.

Union Pacific Corporation (UNP) recently

posted record financial results for the third quarter of 2011,

beating the Zacks Consensus Estimates on both the top and bottom

lines. Analysts revised their 2011 and 2012 estimates higher off

the strong quarter, sending the stock to a Zacks #2 Rank (Buy). The

company is also shareholder-friendly as it buys back stock and

boosts its dividend. It currently yields a solid 2.4%. Read the

full article.

Total System Services, Inc. (TSS) delivered

the coveted triple play for the third quarter of 2011: a positive

revenue beat, positive earnings beat, and increased guidance from

management. This caused analysts to revise their estimates higher

for both 2011 and 2012, sending the stock to a Zacks #2 Rank (Buy).

The company also increased its quarterly dividend for the first

time in over 5 years. It now yields a solid 2.1%. Read the full

article.

Todd Bunton is the Growth & Income Stock

Strategist for Zacks Investment Research and Co-Editor of the

Reitmeister Value Investor.

CINTAS CORP (CTAS): Free Stock Analysis Report

To read this article on Zacks.com click here.

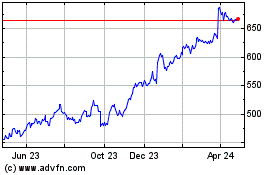

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

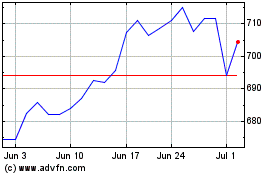

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024