Cintas Hikes Dividend - Analyst Blog

October 19 2011 - 9:53AM

Zacks

Cintas Corporation (CTAS) upped its quarterly

dividend by 5 cents to 54 cents. This marks the 29th consecutive

year of the company’s dividend hike and translates into a 10.2%

increase from the prior dividend of 49 cents. The increased

dividend will be paid on December 14, 2010, to stockholders of

record as on November 11, 2010.

The dividend hike comes almost after a year. On October 26,

2010, Cintas had upped its dividend by 2% to 49 cents per share.

The company has religiously hiked its dividend each year starting

from 1983, the year it went public.

Cintas’ Board of Directors also approved a new share repurchase

program under which the company may repurchase up to $500 million of

Cintas common stock at market prices. The number of shares to be

repurchased and the timing will be determined by the

Board.

Cintas has completed its previously authorized share buyback

program in July 2011. Since the beginning of fiscal 2011, the

company has purchased 23.4 million shares under its share buyback

programs at a total cost of $702 million.

Cintas continues to focus on strengthening its balance sheet and

improving cash flow. The company’s debt-to-capital ratio was a

manageable 37.8% as of August 31, 2011, compared with 24.2% as of

August 31, 2010.

As of August 31, 2010, Cintas had $150.3 million of cash and

cash equivalents on its balance sheet. Cash flow from operations

was $56.6 million in the fiscal first quarter 2012, up sharply 60%

year over year.

The company’s performance in the fiscal first quarter 2012 was

impressive. Cintas’ earnings per share were 52 cents compared with

40 cents in the year-earlier period, outperforming the Zacks

Consensus Estimate of 47 cents.

Cintas recorded revenues of $1.02 billion in the quarter beating

the Zacks Consensus Estimate of $0.998 billion. Revenues improved

10.1% year over year. The quarter marked the second straight period

of double-digit revenue growth.

Cintas, in fiscal 2012, expects to generate revenue in the band

of $4.0 billion to $4.1 billion and guides earnings in a range of

$1.97 to $2.05 per share. The Zacks Consensus Estimate is pegged at

$2.04 per share, nearer the high end of the guidance.

We retain our Outperform rating on Cintas Corporation. The

quantitative Zacks #2 Rank (short-term Buy rating) for the company

indicates upward pressure on the stock over the near term.

Cincinnati, Ohio-based Cintas Corporation designs, manufactures

and implements corporate identity uniform programs, and provides

entrance mats, restroom supplies, promotional products, and first

aid and safety products for approximately 900,000 businesses.

Cintas competes with G&K Services Inc. (GKSR)

and privately held Alsco Inc. and ARAMARK Corporation.

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

Zacks Investment Research

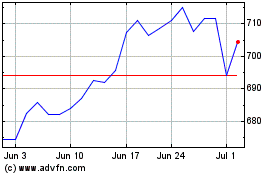

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

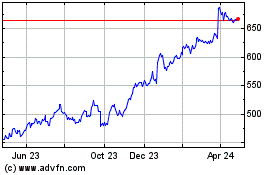

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024