Cintas' EPS Beats, Raises Outlook - Analyst Blog

July 20 2011 - 7:15AM

Zacks

Cintas Corporation

(CTAS) recently reported its fiscal 2011 earnings results,

delivering an EPS of 49 cents versus 36 cents during the

year-earlier quarter, representing a substantial increase of 36.0%

and outshining the Zacks Consensus Estimates of 44 cents.

For fiscal year the company

reported an EPS of $1.68 versus $1.40 during the prior-year,

representing an increase of 20.0%.

Total revenue in the quarter

increased 11.3% to $1,012.2 billion from $909.4 million in the

year-ago quarter, striding ahead of the Zacks Consensus Estimate of

$988.0 million. For fiscal 2011, the company reported total revenue

of $3.81 billion versus $3.55 billion in the prior-year. The

improvement in the revenue is mainly attributable to the increase

in volumes and continued momentum in all the company’s

segments.

Costs and

Margins

Cintas reported cost of sales of

$579.0 million during the quarter versus $523.9 million in the

year-ago quarter. Gross margin during the quarter increased 40

basis points year over year to 42.8%. Selling general and

administrative expenses increased 6.0% on a year-over-year basis to

$304.2 million.

Operating income during the quarter

increased $26.9% substantially to $128.9 million. Net income of the

company increased 27.6% on a year-over-year basis to $70.8 million

in the quarter. Consequently, net margins also increased 90 basis

points year over year to 7.0%.

Cintas reported cost of sales of

$2.20 billion during the fiscal 2011 versus $2.05 billion in the

prior-year. However, gross margin remained flat at 42.2% from the

prior-year levels. Selling, general and administrative

expenses increased 7.6% on a year-over-year basis to $1.17

billion.

Operating income during the fiscal

2011 increased 12.7% substantially to $440.3 million. Net income of

the company increased 14.5% on a year-over-year basis to $247.0

million in the quarter. Consequently, net margins also increased 40

basis points year over year to 6.5%.

Segmental

Analysis

Rental uniform and ancillary

products: The segment reported revenue of $711.9 million in the

quarter compared with $647.7 million in the year-ago quarter.

For full year the segment reported

total revenue of $2.69 billion versus $2.57 billion during the

prior-year.

Uniform Direct Sales: Total revenue

during the quarter amounted to $109.0 million versus $103.2 million

in the year-ago quarter.

For fiscal 2011, the segment earned

total revenue of $419.2 million compared with $386.4 million during

fiscal 2010.

First Aid, Safety and Fire

Protection: Total revenue in the quarter amounted to $99.6 million

versus $87.9 million during the year-earlier quarter.

For the full year, the segment

reported total revenue of $377.7 million versus $21.5 million in

the fiscal 2010.

Document Management: The segment

reported total revenue of $91.5 million versus $70.7 million in the

year-earlier quarter.

For the full year the segment

earned total revenue of $321.2 million versus $253.0 million in the

prior-year.

Financial

Position

As of May 31, 2011 cash and cash

equivalent amounted to $438.1 million versus $411.3 million as of

May 31, 2010.

Cash flow at the end of fiscal 2011

was $340.9 million versus $565.6 million at the end of fiscal 2010.

Capital expenditure increased to $182.6 million at the end of

fiscal 2011 from $111.1 million at the end of fiscal 2010. Free

cash flow during the same period was $158.3 million compared with

$454.6 million during the prior-year same period.

As of May 31, 2011, the

debt-to-capitalization ratio declined to 35.8% from 23.7% as of May

31, 2010.

During the fourth quarter, the

company purchased 15.8 million shares of its common stock for $500

million, at an average price of $31.65 per share. However, during

the fiscal 2011, the company purchased a total of 23.4 million

shares for $702.0 million at an average price of $30.00 per

share.

Outlook

Share repurchase along with easy

debt financing is likely to create future opportunities and enhance

the company’s value in the long term. The company now guides higher

revenue for fiscal 2012 in the range of $4.0 billion to $4.1

billion; while the full year earnings are projected in the range of

$1.97-$2.05 per share. The guidance is based on the assumption

of an improving economy and employment levels in the coming

year.

Cincinnati, Ohio-based Cintas

Corporation designs, manufactures and implements corporate identity

uniform programs, and provides entrance mats, restroom supplies,

promotional products, and first aid and safety products for

approximately 800,000 businesses. Cintas competes with

G&K Services Inc. (GKSR) and privately-held

Alsco Inc. and ARAMARK Corporation. Cintas currently retains a

Zacks #4 Rank (short-term Sell rating).

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

Zacks Investment Research

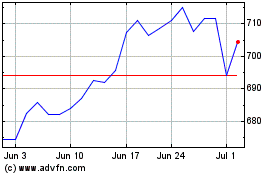

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

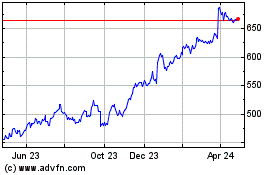

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024