Cintas Sells Notes in 2 Tranches - Analyst Blog

May 19 2011 - 10:43AM

Zacks

Cintas Corporation (CTAS) recently sold $500

million of senior notes in two equal tranches and appointed

KeyCorp (KEY) and JPMorgan Chase &

Co. (JPM) as the joint book running managers for the

sale.

In the first tranche, the company sold $250 million non-callable

senior notes, having a coupon rate of 2.85% and a yield of 2.851%,

maturing on June 1, 2016. The notes are issued at a price of

$99.995 and the first pay out will commence on December 1, 2011,

which will be semi-annual. The issue has Moody’s A2 rating while

S&P has rendered BBB+. The spread is 100 basis points more than

government notes.

In the second tranche, the company sold $250 million

non-callable senior notes, having a coupon rate of 4.30% and a

yield of 4.326%, maturing on June 1, 2021. The notes are issued at

a price of $99.789 and the first pay out will commence from

December 1, 2011, which will be semi-annual.

The issue has Moody’s A2 rating while S&P has rendered BBB+.

The spread is 115 basis points more than government notes. The date

of settlement for both the tranches is May 23, 2011.

The company recently announced fiscal third quarter results

delivering an EPS of 41 cents surpassing the Zacks Consensus

Estimate of 36 cents and 32 cents reported during the prior-year

quarter. Total revenue also increased 8.8% y/y to $937.8 million in

the reported quarter, outperforming the Zacks Consensus Estimate of

$909 million.

Cintas’ reported cash and marketable securities were $216.7

million as of February 28, 2011 compared with $566.1 million as of

May 31, 2011. Current ratio of the company was 3.4:1.

Debt-to-capitalization ratio was 24.6% as of February 28, 2011,

24.7% as of November and 24.2% as of August 31, 2011.

Cincinnati, Ohio-based Cintas Corporation designs, manufactures

and implements corporate identity uniform programs, and provides

entrance mats, restroom supplies, promotional products, and first

aid and safety products for approximately 800,000 businesses.

Cintas competes with G&K Services Inc.

(GKSR) and privately held Alsco Inc. and ARAMARK Corporation.

Cintas currently retains a Zacks #3 Rank (short-term Hold

rating).

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

KEYCORP NEW (KEY): Free Stock Analysis Report

Zacks Investment Research

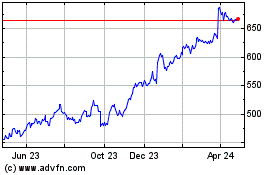

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

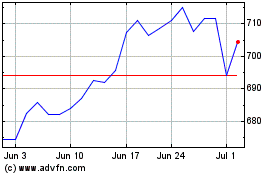

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024