Cintas and Accounting Firm Brixey & Meyer Issue Tax Day Tips to Protect Personal Information

April 18 2011 - 8:00AM

Business Wire

In conjunction with Tax Day on Monday, April 18, Cintas, a

leader in secure document management, and Brixey & Meyer, a

full-service accounting and business advisory firm, issued tax tips

to help consumers protect their confidential information and remain

compliant with the Internal Revenue Service (IRS).

“In 2009, revenue department officials identified more than

29,000 tax-related stolen identity cases,” said Douglas Meyer, a

certified public accountant (CPA) for Brixey & Meyer. “Tax

returns contain an abundance of personal information including your

name, address and social security number. It’s important to take

precaution to keep your sensitive information out of the hands of

identity thieves.”

Meyer, a co-founder and a tax consulting partner for Brixey

& Meyer, provided the below tips for preparing and disposing

tax documents safely. Please consult your legal advisor for

specific retention schedules appropriate for your personal

records.

1. Create a retention policy. Keep all tax returns for at

least three years. In addition to returns, keep supporting

documents such as receipts, mileage logs, invoices, bank statements

and cancelled checks to support your return in case the IRS

conducts an audit. Items to keep for more than three years, as they

could affect future tax returns, include documentation of major

assets such as homes, vehicles, substantial gifts and stock

purchases.

2. Use a qualified tax preparer. If filing with a

professional, ensure they are a certified public accountant. The

IRS is becoming much more stringent regarding who is eligible to

sign tax returns so it’s critical to ensure your preparer is

qualified. Also, inquire about the company’s security policy to

ensure your confidential information will remain safe and

secure.

3. Keep proof of filing. Whether physically mailing your

tax returns or filing electronically, keep proof of delivery

forever. The IRS has no statute of limitations on returns not

filed, so a receipt will serve as proof. If mailing your returns,

send all items via certified mail. This provides confirmation of

mailing and delivery and helps keep your identity safe. When filing

electronically, print out the confirmation that your return was

accepted.

4. Securely shred documents no longer needed. After three

years, securely shred old tax returns and supporting documents.

Home shredders do not sufficiently protect individuals from

identity theft. Identity thieves can reconstruct your documents

using software. Instead, have your documents destroyed by a

professional organization that offers secure shredding services.

Select a provider that is AAA-NAID certified, which ensures the

company complies with the most stringent operational security

procedures in the industry.

5. File returns electronically if possible. By filing

electronically, you eliminate the risk of your return getting lost

in the mail and ending up in the wrong hands. Filing electronically

provides an extra level of security and also enables you to receive

your refund faster if eligible.

6. Store documents in a secure place. Keep records in a

safe, secure place. Ideally, store documents in a fire-proof,

locked safe to protect your documents from catastrophic events and

burglars.

“As consumers, we all must properly manage our tax documents to

remain compliant with the IRS and protect ourselves from identity

theft,” said Chad Schiesler, Controller, Cintas. “By following

these simple tips and being informed of the risks associated with

improper document management, consumers can help keep their

information safe and secure.”

Cintas offers customized document management consultations, as

well as secure document shredding, storage and imaging programs.

Its services are designed to provide businesses with data privacy

and security, compliance with regulatory requirements and more

efficient control and access to information. Cintas is the first

North American AAA NAID-certified and PCI-DSS compliant document

management provider.

For more information on Cintas’ document management programs,

please visit www.cintas.com/documentmanagement.

About Cintas Corporation:

Headquartered in Cincinnati, Ohio, Cintas Corporation provides

highly specialized services to businesses of all types. Cintas

designs, manufactures and implements corporate identity uniform

programs, and provides entrance mats, restroom supplies,

promotional products, first aid and safety products, fire

protection services and document management services to

approximately 800,000 businesses. Cintas is a publicly held company

traded over the Nasdaq National Market under the symbol CTAS, and

is a component of the Standard & Poor's 500 Index.

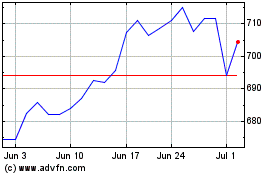

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

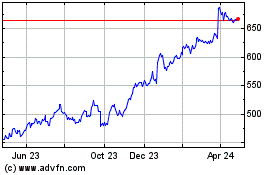

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024