Cintas Corporation (Nasdaq:CTAS) today reported its

results for the first quarter of its fiscal year 2011. Revenue for

the quarter, which ended August 31, 2010, was $924 million,

representing a 3.6% increase compared to last year’s first quarter.

When adjusting for the impact of acquisitions, the organic revenue

growth was 2.8%.

Net income and earnings per diluted share for the quarter were

$61 million and $0.40, respectively. Last year’s net income and

earnings per diluted share were $54 million and $0.35,

respectively. Last year’s first quarter results included a legal

settlement, net of insurance proceeds, which reduced net income and

earnings per diluted share by $12 million and $0.08,

respectively.

First quarter earnings per diluted share were positively

impacted by $0.03 due to the resolution of several tax audits which

we anticipated would be resolved later in the fiscal year. The

resolution of these tax audits during the first quarter resulted in

an effective tax rate of 30.8%. We expect tax rates to be higher in

subsequent quarters resulting in an annual rate of approximately

37.3%.

Scott D. Farmer, Chief Executive Officer, stated, “We continue

to be encouraged by our performance in this period of economic

uncertainty and sluggish private sector job growth. We have been

able to generate revenue growth by focusing our sales force on both

adding new customers and penetrating existing customer accounts

with additional products and services.”

Mr. Farmer also announced, “During our first quarter and into

September, we purchased 7.6 million shares of our common stock at a

cost of approximately $202 million, completing our authorized share

buyback program. The total purchases included acquiring 4.9 million

shares at a cost of approximately $130 million during the latter

part of the first quarter, and the remaining 2.7 million shares

were purchased during September at a cost of approximately $72

million. Our strong cash position enabled us to take advantage of

the opportunity to complete our program without incurring any

additional debt. Going forward, we will continue to use our strong

cash generation to take advantage of opportunities that maximize

the long-term value of Cintas for our shareholders and working

partners.”

The Company’s balance sheet remains very strong. Cash and

marketable securities were $369 million at August 31, 2010. The

current ratio was 3.8 to one and total debt to total capitalization

was 24%.

Mr. Farmer concluded, “Based on our first quarter results, we

reiterate our fiscal 2011 revenue expectations to be in the range

of $3.55 billion to $3.75 billion. Although the purchases under our

share buyback program had no impact on the first quarter results,

they will impact our earnings per diluted share for the remainder

of the fiscal year. As a result, we now expect fiscal 2011 earnings

per diluted share to be in the range of $1.55 to $1.63.”

About Cintas

Headquartered in Cincinnati, Cintas Corporation provides highly

specialized services to businesses of all types primarily

throughout North America. Cintas designs, manufactures and

implements corporate identity uniform programs, and provides

entrance mats, restroom supplies, promotional products, first aid,

safety, fire protection products and services and document

management services for approximately 800,000 businesses. Cintas is

a publicly held company traded over the Nasdaq Global Select Market

under the symbol CTAS, and is a Nasdaq-100 company and component of

the Standard & Poor’s 500 Index.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a

safe harbor from civil litigation for forward-looking statements.

Forward-looking statements may be identified by words such as

“estimates,” “anticipates,” “predicts,” “projects,” “plans,”

“expects,” “intends,” “target,” “forecast,” “believes,” “seeks,”

“could,” “should,” “may” and “will” or the negative versions

thereof and similar words, terms and expressions and by the context

in which they are used. Such statements are based upon current

expectations of Cintas and speak only as of the date made. You

should not place undue reliance on any forward-looking statement.

We cannot guarantee that any forward-looking statement will be

realized. These statements are subject to various risks,

uncertainties, potentially inaccurate assumptions and other factors

that could cause actual results to differ from those set forth in

or implied by this Press Release. Factors that might cause such a

difference include, but are not limited to, the possibility of

greater than anticipated operating costs including energy costs,

lower sales volumes, loss of customers due to outsourcing trends,

the performance and costs of integration of acquisitions,

fluctuations in costs of materials and labor including increased

medical costs, costs and possible effects of union organizing

activities, failure to comply with government regulations

concerning employment discrimination, employee pay and benefits and

employee health and safety, uncertainties regarding any existing or

newly-discovered expenses and liabilities related to environmental

compliance and remediation, the cost, results and ongoing

assessment of internal controls for financial reporting required by

the Sarbanes-Oxley Act of 2002, disruptions caused by the

unavailability of computer systems, the initiation or outcome of

litigation, investigations or other proceedings, higher assumed

sourcing or distribution costs of products, the disruption of

operations from catastrophic or extraordinary events, changes in

federal and state tax and labor laws and the reactions of

competitors in terms of price and service. Cintas undertakes no

obligation to publicly release any revisions to any forward-looking

statements or to otherwise update any forward-looking statements

whether as a result of new information or to reflect events,

circumstances or any other unanticipated developments arising after

the date on which such statements are made. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the year ended May 31, 2010

and in our reports on Forms 10-Q and 8-K. The risks and

uncertainties described herein are not the only ones we may face.

Additional risks and uncertainties presently not known to us or

that we currently believe to be immaterial may also harm our

business.

Cintas Corporation Consolidated Condensed Statements of

Income (Unaudited) (In thousands except per share

data) Three Months Ended

August 31,

2010

August 31,

2009

% Chng. Revenue: Rental uniforms and ancillary

products $ 657,564 $ 655,638 0.3 Other services 266,340

235,931 12.9 Total revenue $ 923,904 $

891,569 3.6 Costs and expenses: Cost of rental uniforms and

ancillary products $ 371,515 $ 362,929 2.4 Cost of other services

158,718 145,845 8.8 Selling and administrative expenses 293,425

264,427 11.0 Legal settlement, net of insurance proceeds -

19,477 N/A Operating income $

100,246 $ 98,891 1.4 Interest income $ (578 ) $ (359 ) 61.0

Interest expense 12,274 12,038

2.0 Income before income taxes $ 88,550 $ 87,212 1.5 Income

taxes 27,273 33,228 -17.9 Net

income $ 61,277 $ 53,984 13.5 Per share

data: Basic earnings per share $ 0.40 $ 0.35

14.3 Diluted earnings per share $ 0.40 $ 0.35

14.3 Weighted average number of shares outstanding 152,164

152,828 Diluted average number of shares outstanding 152,164

152,828

Reconciliation of Non-GAAP Financial Measures and

Regulation G Disclosure The press release contains

non-GAAP financial measures within the meaning of Regulation G

promulgated by the Securities and Exchange Commission. To

supplement its consolidated financial statements presented in

accordance with U.S. generally accepted accounting principles

(GAAP), the Company provides additional measures of operating

results, net earnings and earnings per share adjusted to exclude

certain costs, expenses and gains and losses. The Company believes

that these non-GAAP financial measures are appropriate to enhance

understanding of its past performance as well as prospects for

future performance. A reconciliation of the differences between

these non-GAAP financial measures with the most directly comparable

financial measures calculated in accordance with GAAP is shown

below. Management believes earnings per diluted share

excluding the legal settlement charge, net of insurance proceeds,

provides investors pertinent information given the one-time nature

of this charge.

Three Months Ended August

31,

2010

August 31,

2009

% Chng. Income before income taxes $

88,550 $ 87,212 1.5 Excluding: Legal settlement, net

of insurance proceeds $ - $ 19,477 Income before

income taxes, excluding charge $ 88,550 $ 106,689 -17.0 Income

taxes, excluding charge 27,273 40,649 Net

income, excluding charge $ 61,277 $ 66,040 -7.2 Per

share data: Earnings per diluted share, excluding charge $ 0.40

$ 0.43 -7.0

CINTAS CORPORATION SUPPLEMENTAL

DATA Three Months Ended August 31,

2010

August 31,

2009

Rental uniforms and ancillary products gross margin 43.5%

44.6% Other services gross margin 40.4% 38.2% Total gross margin

42.6% 42.9% Net margin 6.6% 6.1% Net margin, excluding charge 6.6%

7.4% Depreciation and amortization $47,791 $48,905 Capital

expenditures $48,200 $24,819 Debt to total capitalization

24.2% 24.5%

Computation of Free Cash Flow

Three Months Ended August 31,

2010

August 31,

2009

Net cash provided by operations $ 35,298 $ 144,894

Capital expenditures 48,200 24,819 Free

cash flow $ 83,498 $ 169,713

Note:

Management uses free cash flow to

assess the financial performance of the Company. Management

believes that free cash flow is useful to investors because it

relates the operating cash flow of the Company to the capital that

is spent to continue to improve and grow business operations.

SUPPLEMENTAL SEGMENT DATA

RentalUniforms

andAncillaryProducts

Uniform

DirectSales

First Aid,Safety

andFireProtection

DocumentManagement

Corporate Total For the three months

ended August 31, 2010 Revenue $

657,564 $ 98,780 $ 93,534 $ 74,026 $ - $ 923,904 Gross margin $

286,049 $ 29,960 $ 38,253 $ 39,409 $ - $ 393,671 Selling and

administrative expenses $ 207,831 $ 20,113 $ 34,475 $ 31,006 $ - $

293,425 Interest income $ - $ - $ - $ - $ (578 ) $ (578 ) Interest

expense $ - $ - $ - $ - $ 12,274 $ 12,274 Income (loss) before

income taxes $ 78,218 $ 9,847 $ 3,778 $ 8,403 $ (11,696 ) $ 88,550

Assets $ 2,407,268 $ 221,053 $ 347,281 $ 545,853 $ 369,449 $

3,890,904 For the three months ended August 31, 2009 Revenue

$ 655,638 $ 89,301 $ 90,001 $ 56,629 $ - $ 891,569 Gross margin $

292,709 $ 27,245 $ 35,262 $ 27,579 $ - $ 382,795 Selling and

administrative expenses $ 190,256 $ 19,156 $ 29,475 $ 25,540 $ - $

264,427 Legal settlement, net of insurance proceeds $ - $ - $ - $ -

$ 19,477 $ 19,477 Interest income $ - $ - $ - $ - $ (359 ) $ (359 )

Interest expense $ - $ - $ - $ - $ 12,038 $ 12,038 Income (loss)

before income taxes $ 102,453 $ 8,089 $ 5,787 $ 2,039 $ (31,156 ) $

87,212 Assets $ 2,497,775 $ 130,721 $ 320,226 $ 472,469 $ 357,879 $

3,779,070

Cintas Corporation Consolidated Balance

Sheets (In thousands except share data)

ASSETS

Aug 31,

2010

May 31,

2010

Current assets: Cash & cash equivalents $ 290,646 $

411,281 Marketable securities 78,803 154,806 Accounts receivable,

net 383,943 366,301 Inventories, net 184,363 169,484 Uniforms and

other rental items in service 347,588 332,106 Income taxes, current

- 15,691 Deferred tax asset 52,907 52,415 Prepaid expenses and

other 33,903 22,860 Total current

assets 1,372,153 1,524,944 Property and equipment, at cost,

net 915,358 894,522 Goodwill 1,400,797 1,356,925 Service

contracts, net 102,661 103,445 Other assets, net 99,935

89,900 $ 3,890,904 $ 3,969,736

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities: Accounts payable $ 81,307 $ 71,747

Accrued compensation and related liabilities 45,585 66,924 Accrued

liabilities 219,994 244,402 Income taxes, current 10,828 -

Long-term debt due within one year 1,765 609

Total current liabilities 359,479 383,682 Long-term

liabilities: Long-term debt due after one year 785,682 785,444

Deferred income taxes 148,180 150,560 Accrued liabilities

127,585 116,021 Total long-term liabilities

1,061,447 1,052,025 Shareholders' equity: Preferred stock,

no par value: - - 100,000 shares authorized, none outstanding

Common stock, no par value: 135,170 132,058 425,000,000 shares

authorized FY11: 173,338,299 issued and 148,009,335 outstanding

FY10: 173,207,493 issued and 152,869,848 outstanding Paid-in

capital 84,550 84,616 Retained earnings 3,141,356 3,080,079

Treasury stock: (930,193 ) (798,857 ) FY11: 25,328,964 shares FY10:

20,337,645 shares Other accumulated comprehensive income (loss):

Foreign currency translation 46,219 42,870 Unrealized loss on

derivatives (7,411 ) (6,997 ) Other 287 287 Unrealized loss on

available-for-sale securities - (27 ) Total

shareholders' equity 2,469,978 2,534,029 $ 3,890,904

$ 3,969,736

Cintas Corporation

Consolidated Condensed Statements of Cash Flows (In

thousands) Three Months

Ended

Cash flows from operating activities:

Aug 31,

2010

Aug 31,

2009

Net income $ 61,277 $ 53,984

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation 37,362 38,549 Amortization of deferred charges 10,429

10,356 Stock-based compensation 3,046 3,630 Deferred income taxes

(2,538 ) (412 )

Change in current assets and

liabilities, net of acquisitions of businesses:

Accounts receivable, net (13,747 ) (1,425 ) Inventories, net

(14,799 ) 16,976 Uniforms and other rental items in service (15,483

) 5,986 Prepaid expenses and other (10,921 ) (4,890 ) Accounts

payable 8,420 3,481 Accrued compensation and related liabilities

(21,350 ) (7,118 ) Accrued liabilities (32,926 ) (6,433 ) Income

taxes payable 26,528 32,210 Net

cash provided by operating activities 35,298 144,894

Cash flows from investing activities:

Capital expenditures (48,200 ) (24,819 ) Proceeds from

redemption of marketable securities 77,653 - Purchase of marketable

securities and investments (6,416 ) (19,259 ) Acquisitions of

businesses, net of cash acquired (47,824 ) (2,633 ) Other

(2,762 ) (25 ) Net cash used in investing activities

(27,549 ) (46,736 )

Cash flows from financing activities:

Proceeds from issuance of debt 1,542 - Repayment of debt

(148 ) (179 ) Repurchase of common stock (131,336 ) (959 ) Other

2,181 516 Net cash used in

financing activities (127,761 ) (622 ) Effect of exchange

rate changes on cash and cash equivalents (623 ) 30 Net

(decrease) increase in cash and cash equivalents (120,635 ) 97,566

Cash and cash equivalents at beginning of period

411,281 129,745 Cash and cash

equivalents at end of period $ 290,646 $ 227,311

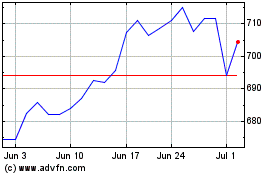

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

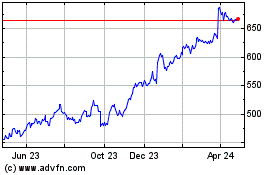

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024