Cintas Corporation (Nasdaq:CTAS) today reported results

for the third quarter of its fiscal year 2010, which ended on

February 28, 2010. Revenues for the third quarter were $861.8

million and earnings per share were $0.32. Both third quarter

revenues and earnings per share slightly exceeded the top end of

the Company’s previously released guidance issued on February 16,

2010. The third quarter of fiscal year 2010 had one fewer workday

than both last year’s fiscal third quarter and the second quarter

of this fiscal year. When adjusting for the one fewer workday in

this year’s third quarter, revenues were 3.7% less than last year’s

third quarter, an improvement from the 10.2% decline experienced in

our second quarter ending November 30, 2009, versus the prior

year’s second quarter. Revenues were comparable to the first two

quarters of this fiscal year when adjusting for workday

differences.

Scott D. Farmer, Chief Executive Officer, stated, “We are

encouraged that job losses appear to be moderating from what we saw

in calendar year 2009. However, we believe job recovery will

continue to be sluggish and thus our revenues will be slow to

return to prior levels. Despite the weather difficulties and

holiday shut downs during our third quarter, our revenues and

margins met our internal plan.”

Mr. Farmer continued, “Our expectations for our fourth quarter

remain unchanged from our previously released guidance. We expect

revenues to be between $870 and $890 million and earnings per share

to be between $0.30 and $0.34. Our businesses continue to be

profitable, generating positive cash flow. During the third

quarter, we increased cash and marketable securities by over $70

million. With total cash and marketable securities of over $550

million at February 28, 2010, our balance sheet is very strong.

Last week, we paid our annual dividend to our shareholders

amounting to $0.48 per share, an increase from $0.47 paid last

year. We have increased our dividend every year since going public

in 1983.”

Scott Farmer concluded, “We remain confident about the future

because of our strong market share position and balance sheet, and

most importantly, due to the quality and ability of our

employee-partners who have continued their commitment to taking

care of our customers and focusing on managing costs.”

About Cintas

Headquartered in Cincinnati, Cintas Corporation provides highly

specialized services to businesses of all types primarily

throughout North America. Cintas designs, manufactures and

implements corporate identity uniform programs, and provides

entrance mats, restroom supplies, promotional products, first aid,

safety, fire protection products and services and document

management services for approximately 800,000 businesses. Cintas is

a publicly held company traded over the Nasdaq Global Select Market

under the symbol CTAS, and is a Nasdaq-100 company and component of

the Standard & Poor’s 500 Index.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a

safe harbor from civil litigation for forward-looking statements.

Forward-looking statements may be identified by words such as

“estimates,” “anticipates,” “predicts,” “projects,” “plans,”

“expects,” “intends,” “target,” “forecast,” “believes,” “seeks,”

“could,” “should,” “may” and “will” or the negative versions

thereof and similar words, terms and expressions and by the context

in which they are used. Such statements are based upon current

expectations of Cintas and speak only as of the date made. You

should not place undue reliance on any forward-looking statement.

We cannot guarantee that any forward-looking statement will be

realized. These statements are subject to various risks,

uncertainties, potentially inaccurate assumptions and other factors

that could cause actual results to differ from those set forth in

or implied by this Press Release. Factors that might cause such a

difference include, but are not limited to, the possibility of

greater than anticipated operating costs including energy costs,

lower sales volumes, loss of customers due to outsourcing trends,

the performance and costs of integration of acquisitions,

fluctuations in costs of materials and labor including increased

medical costs, costs and possible effects of union organizing

activities, failure to comply with government regulations

concerning employment discrimination, employee pay and benefits and

employee health and safety, uncertainties regarding any existing or

newly-discovered expenses and liabilities related to environmental

compliance and remediation, the cost, results and ongoing

assessment of internal controls for financial reporting required by

the Sarbanes-Oxley Act of 2002, the initiation or outcome of

litigation, investigations or other proceedings, higher assumed

sourcing or distribution costs of products, the disruption of

operations from catastrophic or extraordinary events, changes in

federal and state tax and labor laws and the reactions of

competitors in terms of price and service. Cintas undertakes no

obligation to publicly release any revisions to any forward-looking

statements or to otherwise update any forward-looking statements

whether as a result of new information or to reflect events,

circumstances or any other unanticipated developments arising after

the date on which such statements are made. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the year ended May 31, 2009

and in our reports on Forms 10-Q and 8-K. The risks and

uncertainties described herein are not the only ones we may face.

Additional risks and uncertainties presently not known to us or

that we currently believe to be immaterial may also harm our

business.

Cintas Corporation Consolidated Condensed

Statements of Income (Unaudited) (In thousands except

per share data)

Three Months Ended Three Months Ended

February 28,2010

November 30,2009

% Chng.

February 28,2009

% Chng. Revenue: Rental uniforms and ancillary

products $ 622,458 $ 643,597 -3.3 $ 674,701 -7.7 Other services

239,354 240,912 -0.6

233,938 2.3 Total revenue $ 861,812 $ 884,509 -2.6 $ 908,639

-5.2 Costs and expenses: Cost of rental uniforms and

ancillary products $ 356,750 $ 363,728 -1.9 $ 379,466 -6.0 Cost of

other services 145,455 150,934 -3.6 152,736 -4.8 Selling and

administrative expenses 275,596 259,406 6.2 257,129 7.2 Legal

settlements, net of insurance proceeds -

4,052 N/A - N/A Operating income

$ 84,011 $ 106,389 -21.0 $ 119,308 -29.6 Interest income

(422 ) (314 ) 34.4 (540 ) -21.9 Interest expense 11,575

12,579 -8.0 12,407 -6.7

Income before income taxes $ 72,858 $ 94,124 -22.6 $ 107,441

-32.2 Income taxes 23,876 36,948

-35.4 35,630 -33.0 Net income $ 48,982

$ 57,176 -14.3 $ 71,811 -31.8 Per share data:

Basic earnings per share $ 0.32 $ 0.37 -13.5 $

0.47 -31.9 Diluted earnings per share $ 0.32 $

0.37 -13.5 $ 0.47 -31.9 Weighted average

number of shares outstanding 152,869 152,866 152,993 Diluted

average number of shares outstanding 152,869 152,866 152,933

Nine Months Ended

February 28,2010

February 28,2009

% Chng. Revenue: Rental uniforms and ancillary

products $ 1,921,693 $ 2,107,528 -8.8 Other services 716,197

788,474 -9.2 Total revenue $ 2,637,890

$ 2,896,002 -8.9 Costs and expenses: Cost of rental uniforms

and ancillary products $ 1,083,407 $ 1,188,370 -8.8 Cost of other

services 442,234 491,112 -10.0 Selling and administrative expenses

799,429 829,032 -3.6 Legal settlements, net of insurance proceeds

23,529 - N/A Operating

income $ 289,291 $ 387,488 -25.3 Interest income (1,095 )

(2,435 ) -55.0 Interest expense 36,192

38,206 -5.3 Income before income taxes $ 254,194 $

351,717 -27.7 Income taxes 94,052

129,432 -27.3 Net income $ 160,142 $ 222,285

-28.0 Per share data: Basic earnings per share $ 1.04

$ 1.45 -28.3 Diluted earnings per share $ 1.04

$ 1.45 -28.3 Weighted average number of

shares outstanding 152,854 152,790 Diluted average number of shares

outstanding 152,854 152,790

CINTAS CORPORATION

SUPPLEMENTAL DATA Three Months

Ended Three Months Ended

February 28,2010

November 30,2009

February 28,2009

Rental uniforms and ancillary products gross margin 42.7 % 43.5 %

43.8 % Other services gross margin 39.2 % 37.3 % 34.7 % Total gross

margin 41.7 % 41.8 % 41.4 % Net margin 5.7 % 6.5 % 7.9 % Net

margin, excluding charges 5.7 % 6.7 % 7.9 % Depreciation and

amortization $ 47,973 $ 47,562 $ 50,248 Capital expenditures $

30,836 $ 23,273 $ 36,826 Debt to total capitalization 24.1 %

24.0 % 25.3 %

Nine Months Ended

February 28,2010

February 28,2009

Rental uniforms and ancillary products gross margin 43.6 % 43.6 %

Other services gross margin 38.3 % 37.7 % Total gross margin 42.2 %

42.0 % Net margin 6.1 % 7.7 % Net margin, excluding charges 6.6 %

7.7 % Depreciation and amortization $ 144,440 $ 150,142

Capital expenditures $ 78,928 $ 132,783 Debt to total

capitalization 24.1 % 25.3 %

Reconciliation of Non-GAAP Financial Measures and Regulation

G Disclosure

The press release contains non-GAAP financial measures within

the meaning of Regulation G promulgated by the Securities and

Exchange Commission. To supplement its consolidated financial

statements presented in accordance with U.S. generally accepted

accounting principles (GAAP), the Company provides additional

measures of operating results, net earnings and earnings per share

adjusted to exclude certain costs, expenses and gains and losses.

The Company believes that these non-GAAP financial measures are

appropriate to enhance understanding of its past performance as

well as prospects for future performance. A reconciliation of the

differences between these non-GAAP financial measures with the most

directly comparable financial measures calculated in accordance

with GAAP is shown below.

Management believes earnings per diluted share excluding the

legal settlement charge provides investors pertinent information

given the one-time nature of these charges.

Three Months Ended Three Months Ended

February 28,2010

November 30,2009

% Chng.

February 28,2009

% Chng. Income before income taxes $ 72,858 $

94,124 -22.6 $ 107,441 -32.2 Excluding: Legal settlements,

net of insurance proceeds - 4,052 -

Total charges $ - $ 4,052 $ - Income before income

taxes, excluding charges $ 72,858 $ 98,176 -25.8 $ 107,441 -32.2

Income taxes, excluding charges 23,876 38,517

35,630 Net income, excluding charges $ 48,982 $

59,659 -17.9 $ 71,811 -31.8 Per share data: Earnings per

diluted share, excluding charges $ 0.32 $ 0.39 -17.9 $ 0.47

-31.9

Nine Months Ended

February 28,2010

February 28,2009

% Chng. Income before income taxes $ 254,194 $

351,717 -27.7 Excluding: Legal settlements, net of insurance

proceeds 23,529 - Total charges $

23,529 $ - Income before income taxes, excluding charges $

277,723 $ 351,717 -21.0 Income taxes, excluding charges

102,758 129,432 Net income, excluding charges $

174,965 $ 222,285 -21.3 Per share data: Earnings per

diluted share, excluding charges $ 1.14 $ 1.45 -21.4

Computation of Free Cash Flow Nine

Months Ended February 28, 2010 2009 Net Cash Provided

by Operations $ 429,189 $ 339,719 Capital Expenditures $

(78,928 ) $ (132,783 ) Free Cash Flow $ 350,261 $

206,936

Note:

Management uses free cash flow to

assess the financial performance of the Company. Management

believes that free cash flow is useful to investors because it

relates the operating cash flow of the Company to the capital that

is spent to continue, improve and grow business operations.

SUPPLEMENTAL SEGMENT DATA

RentalUniforms

andAncillaryProducts

Uniform

DirectSales

First Aid,Safety

andFireProtection

DocumentManagement

Corporate Total For the three months

ended February 28, 2010 Revenue

$ 622,458 $ 94,428 $ 79,210 $ 65,716 $ - $ 861,812 Gross margin $

265,708 $ 27,915 $ 31,322 $ 34,662 $ - $ 359,607 Selling and

administrative expenses $ 201,389 $ 19,707 $ 29,260 $ 25,240 $ - $

275,596 Interest income $ - $ - $ - $ - $ (422 ) $ (422 ) Interest

expense $ - $ - $ - $ - $ 11,575 $ 11,575 Income (loss) before

income taxes $ 64,319 $ 8,208 $ 2,062 $ 9,422 $ (11,153 ) $ 72,858

For the three months ended November 30, 2009 Revenue $

643,597 $ 99,434 $ 81,557 $ 59,921 $ - $ 884,509 Gross margin $

279,869 $ 29,182 $ 30,560 $ 30,236 $ - $ 369,847 Selling and

administrative expenses $ 187,988 $ 18,707 $ 27,542 $ 25,169 $ - $

259,406 Legal settlements, net of insurance proceeds $ - $ - $ - $

- $ 4,052 $ 4,052 Interest income $ - $ - $ - $ - $ (314 ) $ (314 )

Interest expense $ - $ - $ - $ - $ 12,579 $ 12,579 Income (loss)

before income taxes $ 91,881 $ 10,475 $ 3,018 $ 5,067 $ (16,317 ) $

94,124 For the three months ended February 28, 2009 Revenue

$ 674,701 $ 97,010 $ 86,037 $ 50,891 $ - $ 908,639 Gross margin $

295,235 $ 23,905 $ 33,109 $ 24,188 $ - $ 376,437 Selling and

administrative expenses $ 184,788 $ 23,102 $ 28,968 $ 20,271 $ - $

257,129 Interest income $ - $ - $ - $ - $ (540 ) $ (540 ) Interest

expense $ - $ - $ - $ - $ 12,407 $ 12,407 Income (loss) before

income taxes $ 110,447 $ 803 $ 4,141 $ 3,917 $ (11,867 ) $ 107,441

For the nine months ended February 28, 2010 Revenue $

1,921,693 $ 283,163 $ 250,768 $ 182,266 $ - $ 2,637,890 Gross

margin $ 838,286 $ 84,342 $ 97,144 $ 92,477 $ - $ 1,112,249 Selling

and administrative expenses $ 579,633 $ 57,570 $ 86,277 $ 75,949 $

- $ 799,429 Legal settlements, net of insurance proceeds $ - $ - $

- $ - $ 23,529 $ 23,529 Interest income $ - $ - $ - $ - $ (1,095 )

$ (1,095 ) Interest expense $ - $ - $ - $ - $ 36,192 $ 36,192

Income (loss) before income taxes $ 258,653 $ 26,772 $ 10,867 $

16,528 $ (58,626 ) $ 254,194 Assets $ 2,427,309 $ 158,229 $ 326,496

$ 495,779 $ 552,096 $ 3,959,909 For the nine months ended

February 28, 2009 Revenue $ 2,107,528 $ 334,528 $ 295,059 $ 158,887

$ - $ 2,896,002 Gross margin $ 919,158 $ 98,133 $ 117,675 $ 81,554

$ - $ 1,216,520 Selling and administrative expenses $ 593,282 $

76,090 $ 94,516 $ 65,144 $ - $ 829,032 Interest income $ - $ - $ -

$ - $ (2,435 ) $ (2,435 ) Interest expense $ - $ - $ - $ - $ 38,206

$ 38,206 Income (loss) before income taxes $ 325,876 $ 22,043 $

23,159 $ 16,410 $ (35,771 ) $ 351,717 Assets $ 2,595,144 $ 165,976

$ 338,509 $ 467,911 $ 151,904 $ 3,719,444

Cintas

Corporation Consolidated Balance Sheets (In thousands

except share data)

ASSETS

February 28,2010

May 31,2009

(Unaudited) Current assets: Cash & cash equivalents $

406,503 $ 129,745 Marketable securities 145,593 120,393 Accounts

receivable, net 356,453 357,678 Inventories, net 167,814 202,351

Uniforms and other rental items in service 321,964 335,447 Income

taxes, current 16,088 25,512 Deferred tax asset 68,165 66,368

Prepaid expenses 17,421 17,035 Assets held for sale 15,744

15,744 Total current assets 1,515,745

1,270,273 Property and equipment, at cost, net 894,578

914,627 Goodwill 1,352,096 1,331,388 Service contracts, net

109,402 124,330 Other assets, net 88,088

80,333 $ 3,959,909 $ 3,720,951

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities: Accounts payable $ 80,406 $ 69,965

Accrued compensation and related liabilities 55,702 48,414 Accrued

liabilities 302,543 198,488 Long-term debt due within one year

598 598 Total current liabilities

439,249 317,465 Long-term liabilities: Long-term debt due

after one year 785,595 786,058 Deferred income taxes 162,989

149,032 Accrued liabilities 96,888 100,987

Total long-term liabilities 1,045,472 1,036,077

Shareholders' equity: Preferred stock, no par value: - - 100,000

shares authorized, none outstanding Common stock, no par value:

132,058 129,215 425,000,000 shares authorized FY10: 173,207,493

issued and 152,869,848 outstanding FY09: 173,085,926 issued and

152,790,170 outstanding Paid-in capital 80,978 72,364 Retained

earnings 3,024,601 2,938,419 Treasury stock: (798,848 ) (797,888 )

FY10: 20,337,645 shares FY09: 20,295,756 shares Other accumulated

comprehensive income (loss): Foreign currency translation 43,937

33,505 Unrealized loss on derivatives (7,568 ) (8,207 ) Unrealized

gain on available-for-sale securities 30 1

Total shareholders' equity 2,475,188 2,367,409 $

3,959,909 $ 3,720,951

Cintas

Corporation Consolidated Condensed Statement of Cash

Flows (Unaudited) (In thousands)

Nine Months Ended

Cash flows from operating activities:

February 28,2010

February 28,2009

Net income $ 160,142 $ 222,285

Adjustments to reconcile net

income to net cash provided by operating activities:

Depreciation 113,834 118,119 Amortization of deferred charges

30,606 32,023 Stock-based compensation 11,323 8,904 Deferred income

taxes 11,945 9,052

Change in current assets and

liabilities, net of acquisitions of businesses:

Accounts receivable, net 10,785 42,118 Inventories, net 31,900

(16,427 ) Uniforms and other rental items in service 14,223 12,998

Prepaid expenses (240 ) (5,802 ) Accounts payable 15,167 (22,247 )

Accrued compensation and related liabilities 8,414 (3,250 ) Accrued

liabilities and other 11,507 (45,734 ) Income taxes payable

9,583 (12,320 ) Net cash provided by operating

activities 429,189 339,719

Cash flows from investing activities:

Capital expenditures (78,928 ) (132,783 ) Proceeds from sale

or redemption of marketable securities 34,011 92,061 Purchase of

marketable securities and investments (69,819 ) (94,985 )

Acquisitions of businesses, net of cash acquired (41,375 ) (29,381

) Other 3,804 (428 ) Net cash used in

investing activities (152,307 ) (165,516 )

Cash flows from financing activities:

Proceeds from issuance of debt - 7,500 Repayment of debt

(464 ) (164,510 ) Exercise of stock-based compensation awards 2,843

- Repurchase of common stock (960 ) (25,847 ) Other (3,237 )

736 Net cash used in financing activities

(1,818 ) (182,121 ) Effect of exchange rate changes on cash

and cash equivalents 1,694 (4,055 ) Net increase (decrease)

in cash and cash equivalents 276,758 (11,973 ) Cash and cash

equivalents at beginning of period 129,745

66,224 Cash and cash equivalents at end of period $

406,503 $ 54,251

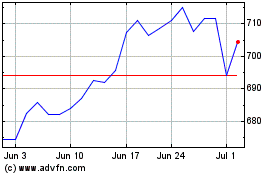

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

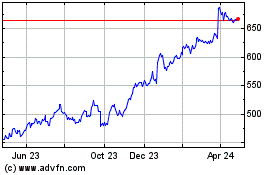

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024