Cintas Corporation Provides Second Half Guidance

February 16 2010 - 8:00AM

Business Wire

Cintas Corporation (Nasdaq: CTAS) today announced its estimate

of revenues and earnings for its third and fourth quarters of

fiscal 2010.

Scott D. Farmer, Chief Executive Officer, commented, “We stated

on December 22, 2009, that we had seen some stabilization in our

business this fiscal year, and that we continued to expect a very

slow recovery in the job market. Additionally, we indicated our

third quarter is traditionally our most challenging due to a

reduced number of workdays and extended customer holiday closures.

As a result, we stated at that time the current analyst

expectations for Cintas revenue and earnings were too optimistic.

We did not provide specific guidance due to continued uncertainties

regarding job recovery and the approaching holiday period. However,

we now believe we can provide revenue and earnings estimates due to

continued stability in our business and increased revenue

clarity.”

The Company expects third quarter revenues to be between $850

and $860 million and earnings per diluted share to be between $0.29

and $0.31. While the recent adverse weather conditions in the

northeast, particularly in the large markets of Baltimore,

Washington and Philadelphia, may affect our third quarter results,

we cannot yet quantify the significance of its impact.

Mr. Farmer further stated, “Growth in our businesses is greatly

influenced by job recovery which tends to lag the general economic

recovery. As we look to the fourth quarter of our fiscal year, we

continue to expect a very slow improvement in the job market. As a

result, we estimate that revenue levels will be between $870 and

$890 million, which is comparable to the third quarter estimate

adjusted for the additional two work days in the fourth quarter

compared to the third quarter. Absent any significant increases in

costs, we expect earnings per diluted share for the fourth quarter

to be between $0.30 and $0.34."

Mr. Farmer continued, “Despite the current pressure, we remain

enthusiastic about our future opportunities. We have a great team

of employee partners. Cintas is a market leader in each of our

businesses, and we believe we have the most modern facilities and

infrastructure. Our balance sheet remains strong and our excellent

cash flow allowed us to recently announce an increase in our annual

dividend, continuing our history of raising our dividend each year

since we went public in 1983.”

About Cintas

Headquartered in Cincinnati, Cintas Corporation provides highly

specialized services to businesses of all types throughout North

America. Cintas designs, manufactures and implements corporate

identity uniform programs, and provides entrance mats, restroom

supplies, promotional products, first aid, safety, fire protection

products and services and document management services for

approximately 800,000 businesses. Cintas is a publicly held company

traded over the Nasdaq Global Select Market under the symbol CTAS,

and is a Nasdaq-100 company and component of the Standard &

Poor’s 500 Index.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a

safe harbor from civil litigation for forward-looking statements.

Forward-looking statements may be identified by words such as

“estimates,” “anticipates,” “predicts,” “projects,” “plans,”

“expects,” “intends,” “target,” “forecast,” “believes,” “seeks,”

“could,” “should,” “may” and “will” or the negative versions

thereof and similar words, terms and expressions and by the context

in which they are used. Such statements are based upon current

expectations of Cintas and speak only as of the date made. You

should not place undue reliance on any forward-looking statement.

We cannot guarantee that any forward-looking statement will be

realized. These statements are subject to various risks,

uncertainties, potentially inaccurate assumptions and other factors

that could cause actual results to differ from those set forth in

or implied by this Press Release. Factors that might cause such a

difference include, but are not limited to, the possibility of

greater than anticipated operating costs including energy costs,

lower sales volumes, loss of customers due to outsourcing trends,

the performance and costs of integration of acquisitions,

fluctuations in costs of materials and labor including increased

medical costs, costs and possible effects of union organizing

activities, failure to comply with government regulations

concerning employment discrimination, employee pay and benefits and

employee health and safety, uncertainties regarding any existing or

newly-discovered expenses and liabilities related to environmental

compliance and remediation, the cost, results and ongoing

assessment of internal controls for financial reporting required by

the Sarbanes-Oxley Act of 2002, the initiation or outcome of

litigation, investigations or other proceedings, higher assumed

sourcing or distribution costs of products, the disruption of

operations from catastrophic or extraordinary events, changes in

federal and state tax and labor laws and the reactions of

competitors in terms of price and service. Cintas undertakes no

obligation to publicly release any revisions to any forward-looking

statements or to otherwise update any forward-looking statements

whether as a result of new information or to reflect events,

circumstances or any other unanticipated developments arising after

the date on which such statements are made. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the year ended May 31, 2009

and in our reports on Forms 10-Q and 8-K. The risks and

uncertainties described herein are not the only ones we may face.

Additional risks and uncertainties presently not known to us or

that we currently believe to be immaterial may also harm our

business.

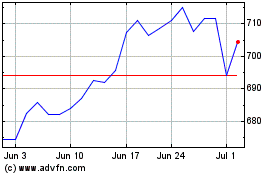

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

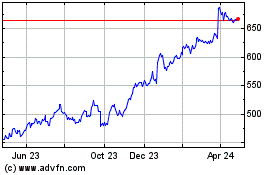

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024