Chordiant Software, Inc. (Nasdaq:CHRD), the leading provider of

Customer Experience (Cx�) software and services, today announced

its financial results for the fourth quarter and fiscal year 2008

ended September 30, 2008, and filed its Annual Report on Form 10-K

with the Securities and Exchange Commission. Fourth Quarter Fiscal

Year 2008 Financial Highlights Total revenues of $28.4 million;

License revenues of $9.5 million; GAAP (Generally Accepted

Accounting Principles) net income of $1.3 million, or $0.04 per

fully diluted share; Non-GAAP net income of $1.7 million, or $0.05

per fully diluted share; Bookings of $14.4 million; Ending backlog

of $70.1 million; and Ending cash, cash equivalents and restricted

cash of $55.6 million. Fiscal Year 2008 Financial Highlights Total

revenues of $113.0 million; License revenues of $34.1 million; GAAP

net income of $1.1 million, or $0.03 per fully diluted share;

Non-GAAP net income of $5.9 million, or $0.18 per fully diluted

share; and Bookings of $111.0 million. Fiscal Year 2008 Business

Highlights Signed seven new transactions greater than $1 million;

Signed $26.1 million transaction with Vodafone, the largest in the

Company�s history; Reported non-GAAP profits in each quarter,

bringing its total to seven consecutive quarters of non-GAAP

profitability; Ended the year with over 1,300 Chordiant experienced

partner resources through its �Partner Enablement� model; Continued

technical leadership through new product releases of Collections

Manager, Decisioning, Enterprise Case Management, Marketing

Director, Recommendation Advisor, and Teller; Received industry

honors including: Intelligent Enterprise�s �2008 Editor�s Choice

Award;� IBM�s �2008 IMPACT Business Process Management Award;� �Fin

Tech 100;� Software Magazine�s �Software 500;� and O2�s �Vision

Award.� �Although our fourth quarter results fell short of our

original expectations, I am pleased that Chordiant was able to post

its seventh consecutive quarter of non-GAAP profitability,� said

Steve Springsteel, President and Chief Executive Officer. �While

overall market conditions remain challenging, what is paramount in

times like these is our customers� focus on reducing their customer

churn and in leveraging their customer base. This demand plays to

the strength of our broad suite of products.� Fourth Quarter Fiscal

Year 2008 Financial Results Total revenues for the fourth quarter

of fiscal year 2008 were $28.4 million, down 7.5% from the prior

quarter and down 11.5% from the $32.1 million for the fourth

quarter of fiscal year 2007. License revenues for the fourth

quarter of fiscal year 2008 were $9.5 million, down from the $11.0

million reported in the prior quarter and $13.9 million in the

fourth quarter of fiscal year 2007. Service revenues for the fourth

quarter of fiscal year 2008 were $18.9 million, compared to $19.8

million in the prior quarter and $18.2 million reported for the

same period of fiscal year 2007. Chordiant reported GAAP net income

of $1.3 million, or fully diluted GAAP earnings per share of $0.04,

for the fourth quarter of fiscal year 2008 compared to $5.3 million

and $0.16, respectively, for the same period of fiscal year 2007.

Chordiant reported fourth quarter fiscal year 2008 non-GAAP net

income of $1.7 million, or fully diluted non-GAAP earnings per

share of $0.05, compared to non-GAAP net income of $6.3 million, or

fully-diluted non-GAAP earnings per share of $0.18, for the fourth

quarter of fiscal year 2007. Non-GAAP net income excludes

stock-based compensation expense, the amortization of purchased

intangible assets and the non-cash tax benefit relating to net

operating loss carryforwards. Deferred Revenue Deferred revenue at

the end of the fourth quarter and fiscal year 2008 was $46.3

million, a decrease of $21.7 million as compared to the ending

balance of $68.0 million at September 30, 2007. Deferred revenue

does not include future amounts due under the Vodafone transaction

that was closed in the first quarter of fiscal year 2008. Bookings

Bookings were $14.4 million for the fourth quarter, compared to

$26.4 million in the prior quarter and $20.0 million in the same

period last year. Bookings for fiscal year 2008 totaled $111.0

million, compared to $163.8 million in the prior year. Backlog of

Business At September 30, 2008, Chordiant's backlog, which includes

deferred revenue, decreased to $70.1 million from $89.6 million at

the end of the prior quarter. The primary reasons for the decrease

during the period were 1) the adverse impact of foreign exchange

rates on our non-US dollar denominated backlog; 2) the recognition

of license revenues associated with Vodafone and through progress

on several percentage-of-completion transactions; 3) the

recognition of service revenue for hourly work completed; and 4)

support revenue that was recognized on pre-paid multi-year

agreements. Backlog includes $12.6 million of remaining commitments

related to the Vodafone transaction that was closed in the first

quarter of fiscal year 2008. Cash Position Chordiant�s cash, cash

equivalents, restricted cash and marketable securities position

decreased by approximately $34.9 million during the fiscal year to

$55.6 million at September 30, 2008, as compared to $90.5 million

at September 30, 2007. The decrease in the cash balance includes

the $18.6 million used in the second and third quarters of fiscal

year 2008 for the share repurchase program which concluded on April

30, 2008. Fiscal Year 2008 Financial Results Total revenues for

fiscal year 2008 were $113.0 million, compared to a record $124.5

million for fiscal year 2007. License revenues for fiscal year 2008

were $34.1 million, down from $54.1 million reported in the prior

year. Service revenues for fiscal year 2008 were $78.9 million

compared to $70.5 million for the prior year. Chordiant reported

GAAP net income of $1.1 million, or fully diluted GAAP earnings per

share of $0.03, for fiscal year 2008, compared to $6.0 million and

$0.18, respectively, for the same period of fiscal year 2007.

Chordiant reported fiscal year 2008 non-GAAP net income of $5.9

million, or fully diluted non-GAAP earnings per share of $0.18,

compared to non-GAAP net income of $17.1 million, or fully diluted

non-GAAP earnings per share of $0.51, for fiscal year 2007.

Non-GAAP net income excludes stock-based compensation expense, the

amortization of purchased intangible assets and the non-cash tax

benefit relating to net operating loss carryforwards. Q1 Fiscal

Year 2009 Restructuring As previously announced, on October 8, 2008

in its first quarter of fiscal year 2009, Chordiant initiated a

restructuring plan intended to align its resources and cost

structure with expected future revenues. The plan included a

reduction of approximately 13% of its permanent workforce, as well

as a reduction in third party consultants. Savings from the October

restructuring is expected to result in annual operating cost

savings of between $5 and $6 million as compared to fiscal year

2008. Non-GAAP Financial Measurements This press release and the

accompanying tables include non-GAAP financial measures. For a

description of these non-GAAP financial measures, including the

reasons management uses each measure, and reconciliations of these

non-GAAP financial measures to the most directly comparable

financial measures prepared in accordance with GAAP, please see the

section of the accompanying tables titled "Non-GAAP Financial

Measures" as well as the related Table C which follows it. Fiscal

Year 2009 Financial Guidance �Current market conditions make it

very challenging to forecast new bookings,� stated Mr. Springsteel.

�Therefore, today we will only be providing revenue guidance for

fiscal year 2009, since our current backlog and strong maintenance

renewal rates provide us solid visibility into these targets.�

Management currently expects the following revenue and earnings

performance in fiscal year 2009: Total revenues for fiscal year

2009 are expected to range from $95 million to $105 million;

Although the Company is not providing specific earnings targets, it

does expect to be profitable on a non-GAAP basis for fiscal year

2009. Conference Call and Webcast Information Chordiant will host a

conference call and webcast to discuss its financial results for

the fourth quarter and fiscal year 2008 ended September 30, 2008

today, Thursday, November 20, 2008 at 2:00 p.m. (PT), 5:00 p.m.

(ET) and 10:00 pm (GMT). A live audio webcast will be available to

investors and the public from the following website:

http://www.veracast.com/webcasts/chordiant2/78120198.cfm

Alternatively, you may prefer to access Chordiant�s website at

http://www.chordiant.com, where you will see the event listed on

the homepage. Access is also possible from Chordiant�s Investor

Relations website. The webcast will be archived on the Chordiant

website. In addition, a telephone replay will be available on

Thursday, November 20, 2008, beginning at approximately 4:00 p.m.

Pacific Time, 7:00 p.m., Eastern Time, for seven days after the

live call. The replay can be accessed by dialing (800) 405-2236,

access code 11122384#. About Chordiant Software, Inc. Chordiant

helps leading global brands with high-volume customer service needs

deliver the best possible customer experience. Unlike traditional

business applications, Chordiant Customer Experience (Cx)

front-office solutions blend multi-channel interaction management

with predictive desktop decisioning, enabling companies to capture

and effectively anticipate and respond to customer behavior in all

channels, in real-time. For global leaders in insurance/healthcare,

telecommunications and financial services, this deeper

understanding cultivates a lasting, one-to-one relationship that

aligns the most appropriate value proposition to each consumer.

With Chordiant Cx solutions, customer loyalty, operational

productivity and profitability reach new levels of return. For more

information, visit Chordiant at www.chordiant.com. Cautionary Note

Regarding Forward Looking Statements This Press Release includes

"forward-looking statements" within the meaning of Section�27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including statements

regarding the Company�s expected cost savings as a result of its

recent restructuring; and the Company�s expected revenue and

non-GAAP profitability in fiscal year 2009. Forward-looking

statements are generally identified by words such as "believes,"

�expects," "guidance," and similar expressions. There are a number

of important factors that could cause the results or outcomes

discussed herein to differ materially from those indicated by these

forward-looking statements. Such risks and uncertainties include,

but are not limited to, whether the Company is able to close

license and services transactions with new and existing customers

and achieve its revenue targets; fluctuations in customer spending,

particularly in the banking and insurance industries, due to

consolidation, economic, geopolitical and other factors; and the

Company�s dependence on a small number of customers for a

substantial portion of its revenue. These and other risks are set

forth in the Company�s Annual Report on Form 10-K for the fiscal

year ended September 30, 2008. These filings are available on a

website maintained by the Securities and Exchange Commission at

http://www.sec.gov. The forward-looking statements and risks stated

in this Press Release are based on information available to the

Company today. The Company assumes no obligation to update them.

Chordiant and the Chordiant logo are registered trademarks of

Chordiant Software, Inc. The Customer Experience Company and Cx are

trademarks of Chordiant Software, Inc. All other trademarks and

registered trademarks are the properties of their respective

owners. NON-GAAP FINANCIAL MEASURES The accompanying press release

dated November 20, 2008 contains non-GAAP financial measures. Table

C reconciles the non-GAAP financial measures contained in the press

release to the most directly comparable financial measures prepared

in accordance with GAAP. These non-GAAP financial measures include

non-GAAP total cost of revenue, non-GAAP gross profit, non-GAAP

income from operations, non-GAAP net income and basic and diluted

non-GAAP net income per share. Chordiant continues to provide all

information required in accordance with GAAP and does not suggest

or believe non-GAAP financial measures should be considered as a

substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. Chordiant believes that these

non-GAAP financial measures provide meaningful supplemental

information regarding its operating results primarily because they

exclude amounts Chordiant does not consider part of ongoing

operating results when assessing the performance of certain

functions, certain geographies or certain members of senior

management. The operating budgets of functional managers do not

include stock-based compensation expenses, acquisition-related

costs, restructuring costs, non-cash tax expense or benefit and

certain other excluded items that may impact their functions�

profitability, and accordingly, we exclude these amounts from our

measures of functional performance. We also exclude these amounts

from our internal planning and forecasting process. We believe that

our non-GAAP financial measures also facilitate the comparison of

results for current periods and guidance for future periods with

results for past periods. We exclude the following items from our

non-GAAP financial measures: Stock-based compensation expense. Our

non-GAAP financial measures exclude stock-based compensation

expenses, which consist of expenses for stock options, restricted

stock and restricted stock units. Additionally, recent comparative

periods in certain prior years also included stock-based

compensation for certain stock options that were subject to

variable accounting. Under variable accounting, movements in the

market value of our stock caused significant unpredictable charges

or benefits from period to period. The operating budgets of

functional or geographic managers do not include stock-based

compensation expenses impacting their function�s income (loss) and,

accordingly, we exclude stock-based compensation expenses from our

measures of functional or geographic performance. While stock-based

compensation is a significant expense affecting our results of

operations, management excludes stock-based compensation from our

budget and planning process. We exclude stock-based compensation

expenses from our non-GAAP financial measures for these reasons and

the other reasons stated above. We compute weighted average

dilutive shares using the method required by Statement of Financial

Accounting Standard No. 128 for both GAAP and non-GAAP diluted net

income (loss) per share. Amortization of purchased intangible

assets. In accordance with GAAP, amortization of purchased

intangible assets in cost of revenue includes amortization of

software and other technology assets related to acquisitions and

acquisition-related charges, and in operating expenses includes

amortization of other purchased intangible assets such as customer

lists and covenants not to compete. Acquisition activities are

managed on a corporate-wide basis and the operating budgets of

functional or geographic managers do not include

acquisition-related costs impacting their function�s income (loss).

We exclude these amounts from our budget and planning process. We

exclude amortization of intangible assets from our non-GAAP

financial measures for these reasons and the other reasons stated

above. Restructuring expense and infrequent charges. Restructuring

expense consists of expenses for excess facilities, lease

termination costs, and expenses for severance charges related to

reductions in our workforce. Infrequent charges primarily relate to

severance expense associated with senior executive management. The

operating budgets of functional or geographic managers do not

include restructuring expenses and infrequent charges or the

financial impact to their functions or geographies income (loss).

Accordingly, we exclude restructuring expenses and infrequent

charges from measures of functional or geographic performance. We

also exclude these expenses in non-GAAP financial measures for

these reasons and the other reasons stated. Non-cash tax expense or

benefit relating to Net Operating Loss carryforwards. Our non-GAAP

financial measures exclude non-cash tax expenses or benefits. These

amounts include (i) the income tax benefit in fiscal 2008

attributable to the release of the valuation allowance on certain

post-acquisition net operating losses and (ii) the impact of the

utilization of pre- and post-acquisition net operating losses to

offset certain income tax expenses expected to arise in future

periods directly as a result of the release of the valuation

allowance. We exclude these expenses or benefits because they are

non-cash expenses or benefits that we believe are not reflective of

how we view our operating performance. Chordiant refers to these

non-GAAP financial measures in evaluating and measuring the

performance of our ongoing operations and for planning and

forecasting in future periods. These non-GAAP financial measures

also facilitate our internal comparisons to historical operating

results. Historically, we have reported similar non-GAAP financial

measures and believe that the inclusion of comparative numbers

provides consistency in our financial reporting. We compute

non-GAAP financial measures using the same consistent method from

quarter-to-quarter and year-to-year. Chordiant believes that

non-GAAP measures have significant limitations in that they do not

reflect all of the amounts associated with Chordiant's financial

results as determined in accordance with GAAP and that these

measures should only be used to evaluate Chordiant's financial

results in conjunction with the corresponding GAAP measures.

Because of these limitations, Chordiant qualifies the use of

non-GAAP financial information in a statement when non-GAAP

information is presented. In addition, the exclusion of the charges

and expenses indicated above from the non-GAAP financial measures

presented does not indicate an expectation by Chordiant management

that similar charges and expenses will not be incurred in

subsequent periods. Table A CHORDIANT SOFTWARE, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share data) � �

� � (Unaudited) (Audited) Three Months Ended September 30, Years

Ended September 30, � 2008 � � 2007 � � 2008 � � 2007 � Revenues:

License $ 9,537 $ 13,915 $ 34,111 $ 54,052 Service � 18,861 � �

18,167 � � 78,853 � � 70,495 Total revenues 28,398 32,082 112,964

124,547 Cost of revenues: License 138 357 1,059 1,813 Service 8,290

7,976 34,012 30,329 Amortization of intangible assets � 303 � � 303

� � 1,211 � � 1,211 Total cost of revenues � 8,731 � � 8,636 � �

36,282 � � 33,353 Gross profit � 19,667 � � 23,446 � � 76,682 � �

91,194 Operating expenses: Sales and marketing 8,823 7,954 34,722

32,597 Research and development 5,787 6,627 25,598 27,546 General

and administrative 4,308 4,408 17,995 19,898 Restructuring expense

� - � � (185 ) � - � � 6,543 Total operating expenses � 18,918 � �

18,804 � � 78,315 � � 86,584 Income (loss) from operations 749

4,642 (1,633 ) 4,610 Interest income, net 549 719 2,383 2,198 Other

income (expense), net � (154 ) � 444 � � 417 � � 822 Income before

income taxes 1,144 5,805 1,167 7,630 Provision for (benefit from)

income taxes � (116 ) � 456 � � 102 � � 1,602 Net income $ 1,260 �

$ 5,349 � $ 1,065 � $ 6,028 � � Net income per share: Basic $ 0.04

� $ 0.16 � $ 0.03 � $ 0.19 Diluted $ 0.04 � $ 0.16 � $ 0.03 � $

0.18 � � Weighted average shares used in computing net income per

share: Basic � 29,995 � � 33,066 � � 31,658 � � 32,425 Diluted �

30,208 � � 34,217 � � 31,957 � � 33,261 Table B CHORDIANT SOFTWARE,

INC. CONSOLIDATED BALANCE SHEETS (in thousands) (Audited) � �

September 30, September 30, � 2008 � � 2007 � ASSETS Current

assets: Cash and cash equivalents $ 55,516 $ 77,987 Marketable

securities - 12,159 Accounts receivable, net 24,873 27,381 Prepaid

expenses and other current assets � 8,168 � � 5,352 � Total current

assets 88,557 122,879 Property and equipment, net 3,165 3,638

Goodwill 22,608 32,044 Intangible assets, net 1,514 2,725 Deferred

tax assets - non-current 6,849 - Other assets � 2,007 � � 3,529 �

Total assets $ 124,700 � $ 164,815 � � LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $ 7,711

$ 8,080 Accrued expenses 9,456 13,804 Deferred revenue � 33,503 � �

44,548 � Total current liabilities 50,670 66,432 Deferred revenue -

long-term 12,831 23,434 Other liabilities - non-current 818 646

Restructuring costs, net of current portion � 529 � � 942 � Total

liabilities � 64,848 � � 91,454 � � Stockholders' equity: Common

stock 30 33 Additional paid-in capital 281,910 295,650 Accumulated

deficit (225,850 ) (226,915 ) Accumulated other comprehensive

income � 3,762 � � 4,593 � Total stockholders' equity � 59,852 � �

73,361 � Total liabilities and stockholders' equity $ 124,700 � $

164,815 � Table C CHORDIANT SOFTWARE, INC. RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES TO MOST DIRECTLY COMPARABLE GAAP

FINANCIAL MEASURES (in thousands, except per share data)

(Unaudited) � � � � � Three Months Ended Years Ended � Sept. 30,

Sept. 30, Sept. 30, Sept. 30, � 2008 � � 2007 � � 2008 � � 2007 � �

GAAP total cost of revenue $ 8,731 $ 8,636 $ 36,282 $ 33,353

Amortization of purchased intangible assets (303 ) (303 ) (1,211 )

(1,211 ) Stock-based compensation expense � (79 ) � (89 ) � (490 )

� (313 ) Non-GAAP total cost of revenue $ 8,349 � $ 8,244 � $

34,581 � $ 31,829 � � � GAAP gross profit $ 19,667 $ 23,446 $

76,682 $ 91,194 Amortization of purchased intangible assets 303 303

1,211 1,211 Stock-based compensation expense � 79 � � 89 � � 490 �

� 313 � Non-GAAP gross profit $ 20,049 � $ 23,838 � $ 78,383 � $

92,718 � � � GAAP income (loss) from operations $ 749 4,642 $

(1,633 ) $ 4,610 Amortization of purchased intangible assets 303

303 1,211 1,211 Restructuring expenses and infrequent charges -

(185 ) - 6,791 Stock-based compensation expense � 609 � � 786 � �

4,125 � � 3,020 � Non-GAAP income from operations $ 1,661 � $ 5,546

� $ 3,703 � $ 15,632 � � � GAAP net income $ 1,260 $ 5,349 $ 1,065

$ 6,028 Amortization of purchased intangible assets 303 303 1,211

1,211 Restructuring expenses and infrequent charges - (185 ) -

6,791 Stock-based compensation expense 609 786 4,125 3,020 Deferred

tax benefit � (511 ) � - � � (511 ) � - � Non-GAAP net income $

1,661 � $ 6,253 � $ 5,890 � $ 17,050 � � � GAAP net income per

basic share $ 0.04 $ 0.16 $ 0.03 $ 0.19 Amortization of purchased

intangible assets 0.01 0.01 0.04 0.04 Restructuring expenses and

infrequent charges - (0.01 ) - 0.21 Stock-based compensation

expense 0.02 0.03 0.13 0.09 Deferred tax benefit � (0.01 ) � - � �

(0.01 ) � - � Non-GAAP net income per basic share $ 0.06 � $ 0.19 �

$ 0.19 � $ 0.53 � � Shares used in basic per share amounts � 29,995

� � 33,066 � � 31,658 � � 32,425 � � GAAP net income per fully

diluted share $ 0.04 $ 0.16 $ 0.03 $ 0.18 Amortization of purchased

intangible assets 0.01 0.01 0.04 0.04 Restructuring expenses and

infrequent charges - (0.01 ) - 0.20 Stock-based compensation

expense 0.02 0.02 0.13 0.09 Deferred tax benefit � (0.02 ) � - � �

(0.02 ) � - � Non-GAAP net income per fully diluted share $ 0.05 �

$ 0.18 � $ 0.18 � $ 0.51 � � Shares used in fully diluted per share

amounts � 30,208 � � 34,217 � � 31,957 � � 33,261 � Table C

(Continued) CHORDIANT SOFTWARE, INC. RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL

MEASURES (in thousands, except per share data) (Unaudited) � � � �

� � Three Months Ended September 30, 2008 Total Operating Expenses

Research Sales General Total and and and Restructuring Operating

Development Marketing Administrative Expense Expenses � GAAP

operating expenses $ 5,787 $ 8,823 $ 4,308 $ - $ 18,918 Stock-based

compensation expense (59 ) (211 ) (260 ) - (530 ) Restructuring

expenses and infrequent charges � - � � - � � - � � - � � - �

Non-GAAP operating expenses $ 5,728 � $ 8,612 � $ 4,048 � $ - � $

18,388 � � � Three Months Ended September 30, 2007 Total Operating

Expenses Research Sales General Total and and and Restructuring

Operating Development Marketing Administrative Expense Expenses �

GAAP operating expenses $ 6,627 $ 7,954 $ 4,408 $ (185 ) $ 18,804

Stock-based compensation expense (150 ) (179 ) (369 ) - (698 )

Restructuring expenses and infrequent charges � - � � - � � - � �

185 � � 185 � Non-GAAP operating expenses $ 6,477 � $ 7,775 � $

4,039 � $ - � $ 18,291 � � � � � � � � � � � � � � Year Ended

September 30, 2008 Total Operating Expenses Research Sales General

Total and and and Restructuring Operating Development Marketing

Administrative Expense Expenses � GAAP operating expenses $ 25,598

$ 34,722 $ 17,995 $ - $ 78,315 Stock-based compensation expense

(586 ) (922 ) (2,127 ) - (3,635 ) Restructuring expenses and

infrequent charges � - � � - � � - � � - � � - � Non-GAAP operating

expenses $ 25,012 � $ 33,800 � $ 15,868 � $ - � $ 74,680 � � � Year

Ended September 30, 2007 Total Operating Expenses Research Sales

General Total and and and Restructuring Operating Development

Marketing Administrative Expense Expenses � GAAP operating expenses

$ 27,546 $ 32,597 $ 19,898 $ 6,543 $ 86,584 Stock-based

compensation expense (546 ) (744 ) (1,417 ) - (2,707 )

Restructuring expenses and infrequent charges � - � � - � � (248 )

� (6,543 ) � (6,791 ) Non-GAAP operating expenses $ 27,000 � $

31,853 � $ 18,233 � $ - � $ 77,086 �

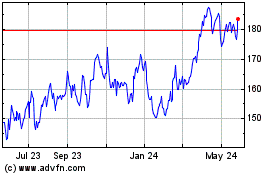

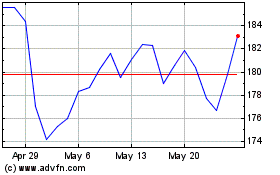

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Sep 2024 to Oct 2024

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Oct 2023 to Oct 2024