Chordiant Software Announces Preliminary Financial Results for the Fourth Quarter and Fiscal Year Ended September 30, 2008

October 08 2008 - 4:05PM

Business Wire

Chordiant Software, Inc. (Nasdaq:CHRD), the leading provider of

Customer Experience (Cx�) software and services, today announced

selected preliminary financial results for the fourth quarter and

fiscal year ended September 30, 2008 and provided an overview of

revenue and profitability expectations for fiscal 2009. Q4 and

Fiscal Year 2008 Selected Preliminary Financial Results Based on

currently available information, Chordiant expects to report the

following financial and operating results for the fourth quarter

ended September 30, 2008: Total revenues of between $27.0 million

and $28.0 million. License revenues of approximately $9.0 million.

GAAP net income of between $0.5 million and $1.0 million, or $0.02

and $0.03 per fully diluted share. Non-GAAP net income of between

$1.5 million and $2.0 million, or $0.05 and $0.07 per fully diluted

share. Total bookings of approximately $14.6 million. Ending total

backlog of approximately $71 million as of September 30, 2008.

Cash, cash equivalents and restricted cash of approximately $55

million as of September 30, 2008. For the full fiscal year ended

September 30, 2008, Chordiant expects to report the following

results: Total revenues of between $111.5 million and $112.5

million. License revenues of approximately $34.0 million. GAAP net

income of between $0.5 million and $1.0 million, or $0.02 and $0.03

per fully diluted share. Non-GAAP net income of between $5.7

million and $6.2 million, or $0.18 and $0.19 per fully diluted

share. Total bookings of approximately $111 million. �The fourth

quarter was more challenging than we had originally anticipated,�

stated Steven R. Springsteel, Chairman and Chief Executive Officer.

�The macroeconomic climate, even in the emerging geographies, which

until recently had remained strong, deteriorated significantly

during the last few weeks of the quarter. A number of transactions

that we anticipated closing slipped out of the quarter, which

negatively impacted our results for the quarter. Despite the

shortfall in revenue, bookings and backlog, I�m pleased that we

remained profitable which attests to our strong financial

discipline.� All statements relating to Chordiant�s fourth quarter

and fiscal 2008 financial performance contained in this news

release are preliminary in nature and may change based on the

completion of the quarterly and annual closing and audit procedures

by the Company�s management and Chordiant�s independent registered

public auditing firm. Reduction in Force Chordiant also announced

today an approximate net 13% reduction in force, which impacts

approximately 33 people and is expected to reduce operating costs

by more than $4.8 million annually. Preliminary Guidance and

Outlook for Fiscal Year 2009 Chordiant expects both revenues and

bookings for the full fiscal year ending September 30, 2009 to be

between $100 and $110 million. With the cost reductions resulting

from the reduction in force and additional reductions associated

with third party consultants, the Company expects to remain

profitable on a non-GAAP basis for fiscal 2009. �While the actions

we took today were difficult, we believe they are necessary to

ensure that Chordiant remains a profitable company�, stated Steven

R. Springsteel, Chairman and Chief Executive Officer. �After a

thorough review of our business operations we felt that these

changes were prudent to better align our resources to the current

market conditions.� Conference Call Information Chordiant will host

an investor conference call and webcast today, October 8, 2008 at

2:00 p.m. Pacific Time, 5:00 p.m. Eastern Time to further discuss

the information in this release. Participating in the call and

webcast will be Steven R. Springsteel, Chairman, President and

Chief Executive Officer and Peter Norman, Chief Financial Officer.

To access this call please dial (800) 257-6566 domestically, or

(303) 262-2125 internationally. A telephonic replay will be

available on October 8th, 2008, beginning at approximately 4:00

p.m. Pacific Time, 7:00 p.m. Eastern Time for seven days after the

live call. The replay can be accessed by dialing (800) 405-2236,

access code 11120921#. Webcast Access A live audio webcast will be

available to investors and the public from the following website:

http://www.veracast.com/webcasts/chordiant2/36109178.cfm

Alternatively, you may prefer to access Chordiant�s website at

http://www.chordiant.com, where you will see the event listed on

the homepage. Access is also possible from the Investor Relations

page of Chordiant�s website. The webcast will be archived on the

Chordiant website and will be available for 30 days. Non-GAAP

Financial Measurements This press release and the accompanying

table include non-GAAP financial measures. For a description of

these non-GAAP financial measures, including the reasons management

uses each measure, and reconciliations of these non-GAAP financial

measures to the most directly comparable financial measures

prepared in accordance with GAAP, please see the section below

titled "Non-GAAP Financial Measures" as well as Table A which

follows it. About Chordiant Software, Inc. Chordiant helps leading

global brands with high-volume customer service needs deliver the

best possible customer experience. Unlike traditional business

applications, Chordiant Customer Experience (Cx) front-office

solutions blend multi-channel interaction management with

predictive desktop decisioning, enabling companies to capture and

effectively anticipate and respond to customer behavior in all

channels, in real-time. For global leaders in insurance/healthcare,

telecommunications and financial services, this deeper

understanding cultivates a lasting, one-to-one relationship that

aligns the most appropriate value proposition to each consumer.

With Chordiant Cx solutions, customer loyalty, operational

productivity and profitability reach new levels of return. For more

information, visit Chordiant at www.chordiant.com Safe Harbor

Statement This Press Release includes "forward-looking statements"

within the meaning of Section�27A of the Securities Act of 1933, as

amended, and Section�21E of the Securities Exchange Act of 1934, as

amended, including statements regarding the Company�s expected

financial and operating results for its fourth quarter and fiscal

year ended September 30, 2008 and fiscal year ending September 30,

2009; and its expected reduction in operating costs resulting from

its reduction in force. Forward-looking statements are generally

identified by words such as "believes," �expects," "guidance," and

similar expressions. There are a number of important factors that

could cause the results or outcomes discussed herein to differ

materially from those indicated by these forward-looking

statements. Such risks and uncertainties include, but are not

limited to, whether the Company will be able to close license

transactions, including postponed transactions, with new and

existing customers and achieve its bookings and revenue targets;

whether the reduction in force will achieve the desired results;

fluctuations in customer spending, particularly in the banking and

insurance/healthcare industries, due to consolidation, economic,

geopolitical and other factors; the Company�s dependence on a small

number of customers for a substantial portion of its revenue; and

the success of the Company�s efforts to negotiate severance

arrangements and contract terminations within established

parameters. These and other risks are set forth in the Company�s

Annual Report on Form 10-K for the fiscal year ended September 30,

2007, Quarterly Report on Form 10-Q for the quarter ended June 30,

2008, and subsequent SEC filings. These filings are available on a

website maintained by the Securities and Exchange Commission at

http://www.sec.gov. The forward-looking statements and risks stated

in this report are based on information available to the Company

today. The Company assumes no obligation to update them. Chordiant

and the Chordiant logo are registered trademarks of Chordiant

Software, Inc. The Customer Experience Company and Cx are

trademarks of Chordiant Software, Inc. All other trademarks and

registered trademarks are the properties of their respective

owners. NON-GAAP FINANCIAL MEASURES The accompanying press release

dated October 8, 2008 contains non-GAAP financial measures. Table A

reconciles the non-GAAP financial measures contained in the press

release to the most directly comparable financial measures prepared

in accordance with GAAP. These non-GAAP financial measures include

non-GAAP net income and diluted non-GAAP net income per share.

Chordiant continues to provide all information required in

accordance with GAAP and does not suggest or believe non-GAAP

financial measures should be considered as a substitute for, or

superior to, measures of financial performance prepared in

accordance with GAAP. Chordiant believes that these non-GAAP

financial measures provide meaningful supplemental information

regarding its operating results primarily because they exclude

amounts Chordiant does not consider part of ongoing operating

results when assessing the performance of certain functions,

certain geographies or certain members of senior management. The

operating budgets of functional managers do not include stock-based

compensation expenses, acquisition-related costs, restructuring

costs and certain other excluded items that may impact their

functions� profitability, and accordingly, we exclude these amounts

from our measures of functional performance. We also exclude these

amounts from our internal planning and forecasting process. We

believe that our non-GAAP financial measures also facilitate the

comparison of results for current periods and guidance for future

periods with results for past periods. We exclude the following

items from our non-GAAP financial measures: Stock-based

compensation expense. Our non-GAAP financial measures exclude

stock-based compensation expenses, which consist of expenses for

stock options, restricted stock and restricted stock units.

Additionally, historical comparative periods in certain prior years

also included stock-based compensation for certain stock options

that were subject to variable accounting. Under variable

accounting, movements in the market value of our stock caused

significant unpredictable charges or benefits from period to

period. The operating budgets of functional or geographic managers

do not include stock-based compensation expenses impacting their

function�s income (loss) and, accordingly, we exclude stock-based

compensation expenses from our measures of functional or geographic

performance. While stock-based compensation is a significant

expense affecting our results of operations, management excludes

stock-based compensation from our budget and planning process. We

exclude stock-based compensation expenses from our non-GAAP

financial measures for these reasons and the other reasons stated

above. We compute weighted average dilutive shares using the method

required by Statement of Financial Accounting Standard No. 128 for

both GAAP and non-GAAP diluted net income (loss) per share.

Amortization of purchased intangible assets. In accordance with

GAAP amortization of purchased intangible assets in cost of revenue

includes amortization of software and other technology assets

related to acquisitions and acquisition-related charges and in

operating expenses includes amortization of other purchased

intangible assets such as customer lists and covenants not to

compete. Acquisition activities are managed on a corporate-wide

basis and the operating budgets of functional or geographic

managers do not include acquisition-related costs impacting their

function�s income (loss). We exclude these amounts from our

measures of corporate performance and from our budget and planning

process. We exclude amortization of intangible assets from our

non-GAAP financial measures for these reasons and the other reasons

stated above. Restructuring expense and infrequent charges. Our

non-GAAP financial measures exclude restructuring expense and

infrequent charges. Restructuring expense consists of expenses for

excess facilities, lease and contract termination costs, and

expenses for severance charges related to reductions in our

workforce. Infrequent charges primarily relate to severance expense

associated with executive management. The operating budgets of

functional or geographic managers do not include restructuring

expenses and infrequent charges or the financial impact to their

functions or geographies income (loss). Accordingly, we exclude

restructuring expenses and infrequent charges from measures of

functional or geographic performance. We also exclude these

expenses in non-GAAP financial measures for these reasons and the

other reasons stated. Chordiant refers to these non-GAAP financial

measures in evaluating and measuring the performance of our ongoing

operations and for planning and forecasting in future periods.

These non-GAAP financial measures also facilitate our internal

comparisons to historical operating results. Historically, we have

reported similar non-GAAP financial measures and believe that the

inclusion of comparative numbers provides consistency in our

financial reporting. We compute non-GAAP financial measures using

the same consistent method from quarter-to-quarter and

year-to-year. Chordiant believes that non-GAAP measures have

significant limitations in that they do not reflect all of the

amounts associated with Chordiant's financial results as determined

in accordance with GAAP and that these measures should only be used

to evaluate Chordiant's financial results in conjunction with the

corresponding GAAP measures. Because of these limitations,

Chordiant qualifies the use of non-GAAP financial information in a

statement when non-GAAP information is presented. In addition, the

exclusion of the charges and expenses indicated above from the

non-GAAP financial measures presented does not indicate an

expectation by Chordiant management that similar charges and

expenses will not be incurred in subsequent periods. Table A

Chordiant Software, Inc. Three Months and Fiscal Year Ended

September 30, 2008 Reconciliation of Preliminary Selected Financial

Results for Non-GAAP Financial Measures To Most Directly Comparable

GAAP Financial Measures (in thousands, except for share amounts)

(unaudited) � � � � Preliminary Selected Financial Results Quarter

EndedSeptember 30, 2008GAAPRange of Estimates Adjustments Quarter

EndedSeptember 30, 2008Non-GAAPRange of Estimates From To From To �

Revenue $ 27,000 $ 28,000 $ 27,000 $ 28,000 � Net income 500 1,000

1,000 �[A] 1,500 2,000 � Net income per diluted share $ 0.02 $ 0.03

$ 0.05 $ 0.07 Shares used 30,200 30,200 30,200 30,200 � � [A]

Reflects estimated adjustments for $0.3 million of amortization of

purchased intangible assets and $0.7 million of stock based

compensation. � � Preliminary Selected Financial Results Fiscal

Year EndedSeptember 30, 2008GAAPRange of Estimates Adjustments

Fiscal Year EndedSeptember 30, 2008Non-GAAPRange of Estimates From

To From To � Revenue $ 111,500 $ 112,500 $ 111,500 $ 112,500 � Net

income 500 1,000 5,200 �[A] 5,700 6,200 � Net income per diluted

share $ 0.02 $ 0.03 $ 0.18 $ 0.19 Shares used 31,900 31,900 31,900

31,900 � � [A] Reflects estimated adjustments for $1.2 million of

amortization of purchased intangibles assets and $4.0 million of

stock based compensation.

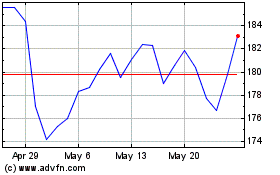

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

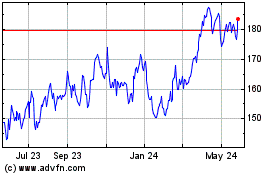

Chord Energy (NASDAQ:CHRD)

Historical Stock Chart

From Nov 2023 to Nov 2024