Check Point� Software Technologies Ltd. (NASDAQ:CHKP), the

worldwide leader in securing the Internet, today announced its

financial results for the second quarter ended June 30, 2008.

�Check Point�s success during the quarter is a direct result of

effectively executing our Total Security strategy,� said Gil Shwed,

chairman and chief executive officer at Check Point. �We have

continued to experience strength across our business which is

reflected in the double-digit year over year growth in revenue,

earnings per share and deferred revenue.� Financial Highlights for

the Second Quarter of 2008: Total Revenues: $199.6 million, an

increase of 13 percent, compared to $176.2 million in the second

quarter of 2007. Product and license revenue was $85.0 million, an

increase of 16 percent, compared to $73.3 million in the second

quarter of 2007. Net Income � GAAP: $79.2 million, an increase of

14 percent, compared to $69.5 million in the second quarter of

2007. Net income in the second quarter of 2008 includes

acquisition-related charges of $8.9 million and equity-based

compensation expenses of $8.4 million. Net of taxes, these charges

totaled $13.5 million. Net income in the second quarter of 2007

included acquisition-related charges of $10.3 million and

equity-based compensation expenses of $8.6 million. Net of taxes

these charges totaled $16.2 million. Net Income � Non-GAAP:1 $92.7

million, an increase of 8 percent, compared to $85.7 million in the

second quarter of 2007. Non-GAAP net income excludes equity-based

compensation expenses and acquisition-related charges.2 Earnings

per Diluted Share � GAAP: $0.36, an increase of 18 percent,

compared to $0.31 in the second quarter of 2007. GAAP earnings per

diluted share for the second quarter of 2008 included equity-based

compensation expenses of $0.04 and acquisition-related charges of

$0.05. Net of taxes, these charges totaled $0.07. GAAP earnings per

diluted share for the second quarter of 2007 included

acquisition-related charges of $0.05 and equity-based compensation

expenses of $0.03. Net of taxes these charges totaled $0.07.

Earnings per Diluted Share � Non-GAAP: $0.43, an increase of 12

percent, compared to $0.38 in the second quarter of 2007. Non-GAAP

earnings per diluted share exclude equity-based compensation

expenses and acquisition-related charges. Deferred Revenues: As of

June 30, 2008, we had deferred revenue of $279.2 million, a $43

million or 18% increase compared to deferred revenues as of June

30, 2007. Cash Flow: $82.6 million in cash flow from operations and

we had $1.34 billion in cash and investments as of June 30, 2008.

Share Repurchase Program: During the second quarter of 2008, Check

Point repurchased 2.1 million shares at an approximate cost of

$50.0 million. Business Highlights for the Second Quarter of 2008:

Since April we have expanded and continued to improve the

performance of our unified line of security gateways. We introduced

the Power-1 appliances, a new line of high-performance security

gateways delivering excellent performance of up to 14 Gbps and

record price performance at less than $4 per Mbps. In addition, we

added five new UTM-1 Total Security appliances, expanded the range

of solutions from a sub-five thousand dollar model and up to 4.5

Gbps performance providing our customers with more choices when

selecting network security appliances. The new appliances further

compliment our Open Choice program which allows customers to choose

from a variety of gateway security platforms, including Check Point

Power-1 and UTM-1 branded appliances, software on open servers and

Check Point software integrated on partner appliances. We continued

to address the growing security needs of our customers utilizing

Apple�s Mac OS X and iPhone with the release of Check Point Full

Disk Encryption (FDE) for the Mac and VPN-1 support for the iPhone.

Our FDE for Mac is the only enterprise full-disk encryption

solution with pre-boot authentication available in the market

today. During the second quarter we also received awards from

third-party industry organizations including: �Best Enterprise

Firewall� from SC Magazine for Check Point VPN-1 Power, �Endpoint

Security Product of the Year� from Techworld for Check Point

Endpoint Security, �VB100 Award� from Virus Bulletin for ZoneAlarm

Internet Security and �Ten Best Web Support Sites� for 2008 from

Association of Support Professionals Mr. Shwed concluded, �I am

pleased with our results for the quarter as we have now exceeded

our plans for the sixth quarter in a row. During that time we have

also expanded and executed our strategy of delivering a

comprehensive integrated security solution that includes a unified

line of security gateways, a single-agent for endpoint security and

a single security management console.� Conference Call and Webcast

Information Check Point will host a conference call with the

investment community on July 22, 2008 at 8:30 AM ET/5:30 AM PT. To

listen to the live webcast, please visit Check Point�s website at

http://www.checkpoint.com/ir. A replay of the conference call will

be available through August 5, 2008 at the company's website

http://www.checkpoint.com/ir or by telephone at +1.800.642.1687

passcode # 54900277. 1 See �Use of Non-GAAP Financial Information�

and �Reconciliation of Supplemental Financial Information� below

for more information regarding Check Point�s use of non-GAAP

measures. 2 �Equity-based compensation expenses� refer to the

amortized fair value of all equity based awards granted to

employees. �Acquisition-related charges� refer to the impact of the

amortization of intangibles. About Check Point Software

Technologies Ltd. Check Point Software Technologies Ltd.

(www.checkpoint.com) is the leader in securing the Internet. Check

Point offers total security solutions featuring a unified gateway,

single endpoint agent and single management architecture,

customized to fit customers� dynamic business needs. This

combination is unique and is a result of our leadership and

innovation in the enterprise firewall, personal firewall/endpoint,

data security and VPN markets. Check Point�s award-winning

ZoneAlarm solutions protect millions of consumer PCs from hackers,

spyware and identity theft. Check Point solutions are sold,

integrated and serviced by a network of Check Point partners around

the world and its customers include 100 percent of Fortune 100

companies and tens of thousands of businesses and organizations of

all sizes. �2003�2008 Check Point Software Technologies Ltd. All

rights reserved. Use of Non-GAAP Financial Information In addition

to reporting financial results in accordance with generally

accepted accounting principles, or GAAP, Check Point uses non-GAAP

measures of net income, operating income and earnings per share,

which are adjustments from results based on GAAP to exclude

non-cash equity-based compensation charges in accordance with SFAS

123R, in-process R&D expense and acquisition related charges.

Check Point�s management believes the non-GAAP financial

information provided in this release is useful to investors�

understanding and assessment of Check Point�s ongoing core

operations and prospects for the future. Historically, Check Point

has also publicly presented these supplemental non-GAAP financial

measures in order to assist the investment community to see the

Company �through the eyes of management,� and thereby enhance

understanding of its operating performance. The presentation of

this non-GAAP financial information is not intended to be

considered in isolation or as a substitute for results prepared in

accordance with GAAP. A reconciliation of the non-GAAP financial

measures discussed in this press release to the most directly

comparable GAAP financial measures is included with the financial

statements contained in this press release. Management uses both

GAAP and non-GAAP information in evaluating and operating business

internally and as such has determined that it is important to

provide this information to investors. Safe Harbor Regarding

Forward Looking Statements This press release contains

forward-looking statements within the meaning of Section�27A of the

Securities Act of 1933 and Section�21E of the Securities Exchange

Act of 1934, including, but not limited to, statements related to

Check Point�s expectations that we will continue to build upon the

success of our industry-leading security products by increasing the

breadth of their functionality and providing tighter integration

throughout our comprehensive product line to address the security

needs of our customers worldwide. Because these statements pertain

to future events they are subject to various risks and

uncertainties, actual results could differ materially from Check

Point's current expectations and beliefs. Factors that could cause

or contribute to such differences include, but are not limited to:

general market conditions in the Check Point�s industry; economic

and political uncertainties; the impact of political changes and

weaknesses in various regions of the world, including hostilities

or acts of terrorism�in Israel, where�Check Point�s international

headquarters are based; inclusion of network security functionality

in third-party hardware or system software; any foreseen and

unforeseen developmental or technological difficulties with regard

to Check Point's products; changes in the competitive landscape,

including new competitors or the impact of competitive pricing and

products; rapid technological advances and changes in customer

requirements to which Check Point is unable to respond

expeditiously, if at all; a shift in demand for products such as

Check Point's; factors affecting third parties with which Check

Point has formed business alliances; and the timely availability

and customer acceptance of Check Point's new and existing products.

The forward-looking statements contained in this press release are

subject to other factors and risks, including those discussed in

Check Point's Annual Report on Form 20-F for the year ended

December 31, 2007, which is on file with the Securities and

Exchange Commission. Check Point assumes no obligation to update

information concerning its expectations or beliefs. CHECK POINT

SOFTWARE TECHNOLOGIES LTD. CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS � (In thousands, except per share amounts) � Three

Months Ended � Six Months Ended June 30, June 30, 2008 � 2007 2008

� 2007 (unaudited) (unaudited) (unaudited) (unaudited) Revenues:

Products and licenses $ 84,973 $ 73,318 $ 162,352 $ 139,366

Software updates, maintenance and services � 114,633 � 102,874 �

228,851 � 200,795 Total revenues � 199,606 � 176,192 � 391,203 �

340,161 � Operating expenses: Cost of products and licenses 9,693

6,747 18,686 11,987 Cost of software updates, maintenance and

services 7,101 5,899 13,851 11,357 Amortization of technology �

5,800 � 7,154 � 12,954 � 13,416 Total cost of revenues 22,594

19,800 45,491 36,760 � Research and development 23,824 20,775

46,569 39,643 Selling and marketing 56,588 55,176 110,248 107,338

General and administrative 13,005 11,621 26,571 25,721 Acquired in

process research and development � - � - � - � 17,000 Total

operating expenses � 116,011 � 107,372 � 228,879 � 226,462 �

Operating income 83,595 68,820 162,324 113,699 Financial income,

net � 12,789 � 11,645 � 27,409 � 24,713 Income before income taxes

96,384 80,465 189,733 138,412 Taxes on income � 17,211 � 11,004 �

32,302 � 22,003 Net income $ 79,173 $ 69,461 $ 157,431 $ 116,409

Earnings per share (basic) $ 0.37 $ 0.31 $ 0.72 $ 0.52 Number of

shares used in computing earnings per share (basic) � � 215,030 � �

223,291 � � 217,568 � � 222,989 Earnings per share (diluted) $ 0.36

$ 0.31 $ 0.71 $ 0.52 Number of shares used in computing earnings

per share (diluted) � � 217,951 � � 226,151 � � 220,192 � � 225,806

CHECK POINT SOFTWARE TECHNOLOGIES LTD. RECONCILIATION OF

SUPPLEMENTAL FINANCIAL INFORMATION � � �(In thousands, except per

share amounts) � � Three Months Ended Six Months Ended June 30,

June 30, 2008 � � 2007 � 2008 � � 2007 � (unaudited) (unaudited)

(unaudited) (unaudited) � GAAP operating income $ 83,595 $ 68,820 $

162,324 $ 113,699 Stock-based compensation (1) 8,385 8,588 17,456

16,926 Amortization of intangible assets (2) 8,893 10,338 19,197

19,308 Acquired in process research and development � - � � - � � -

� � 17,000 � Non-GAAP operating income $ 100,873 � $ 87,746 � $

198,977 � $ 166,933 � � GAAP net income $ 79,173 $ 69,461 $ 157,431

$ 116,409 Stock-based compensation (1) 8,385 8,588 17,456 16,926

Amortization of intangible assets (2) 8,893 10,338 19,197 19,308

Acquired in process research and development - - - 17,000 Taxes on

stock-based compensation and amortization of intangible assets (3)

� (3,753 ) � (2,698 ) � (8,017 ) � (5,344 ) Non-GAAP net income $

92,698 � $ 85,689 � $ 186,067 � $ 164,299 � � GAAP Earnings per

share (diluted) $ 0.36 $ 0.31 $ 0.71 $ 0.52 Stock-based

compensation (1) 0.04 0.03 0.08 0.07 Amortization of intangible

assets (2) 0.05 0.05 0.10 0.09 Acquired in process research and

development - - - 0.07 Taxes on stock-based compensation and

amortization of intangible assets (3) � (0.02 ) � (0.01 ) � (0.04 )

� (0.02 ) Non-GAAP Earnings per share (diluted) $ 0.43 � $ 0.38 � $

0.85 � $ 0.73 � � Number of shares used in computing Non-GAAP

earnings per share (diluted) � 217,951 � � 226,151 � � 220,192 � �

225,806 � � (1) Stock-based compensation: Cost of products and

licenses $ 15 $ 13 $ 27 $ 24 Cost of software updates, maintenance

and services 194 193 377 310 Research and development 1,204 1,060

2,301 2,070 Selling and marketing 1,926 2,627 4,166 4,348 General

and administrative � 5,046 � � 4,695 � � 10,585 � � 10,174 � 8,385

8,588 17,456 16,926 � (2) Amortization of intangible assets and

acquisition related expenses: Cost of products and licenses 5,800

7,154 12,954 13,416 Selling and marketing � 3,093 � � 3,184 � �

6,243 � � 5,892 � 8,893 10,338 19,197 19,308 (3) Taxes on

stock-based compensation and amortization of intangible assets �

(3,753 ) � (2,698 ) � (8,017 ) � (5,344 ) Total, net $ 13,525 � $

16,228 � $ 28,636 � $ 30,890 � CHECK POINT SOFTWARE TECHNOLOGIES

LTD. CONDENSED CONSOLIDATED BALANCE SHEET DATA (In thousands)

ASSETS � � � June 30, December 31, 2008 � 2007 � (unaudited)

(unaudited) Current assets: Cash and cash equivalents $ 472,970 $

509,664 Marketable securities 279,557 332,355 Trade receivables,

net 158,129 201,515 Other current assets � 29,899 � � 21,595 �

Total current assets � 940,555 � � 1,065,129 � � Long-term assets:

Marketable securities 590,246 399,490 Property, plant and

equipment, net 57,098 56,947 Severance pay fund 12,115 9,302

Deferred income taxes, net 17,793 14,920 Intangible assets, net

140,937 160,133 Goodwill 664,602 664,910 Other assets � 645 � � 636

� Total long-term assets � 1,483,436 � � 1,306,338 � � Total assets

$ 2,423,991 � $ 2,371,467 � � � LIABILITIES AND SHAREHOLDERS�

EQUITY Current liabilities: Deferred revenues $ 279,188 $ 273,693

Trade payables and other accrued liabilities � 81,404 � � 116,406 �

Total current liabilities � 360,592 � � 390,099 � � Income tax

accrual 91,470 78,545 Deferred tax liability, net 26,845 31,465

Accrued severance pay � 17,585 � � 14,403 � � Total liabilities �

496,492 � � 514,512 � � Shareholders� equity: Share capital 774 774

Additional paid-in capital 489,017 464,330 Treasury shares at cost

(1,011,033 ) (907,022 ) Accumulated other comprehensive income

(loss) (6,330 ) 1,233 Retained earnings � 2,455,071 � � 2,297,640 �

Total shareholders� equity � 1,927,499 � � 1,856,955 � Total

liabilities and shareholders� equity $ 2,423,991 � $ 2,371,467 �

Total cash and cash equivalents and marketable $ 1,342,773 � $

1,241,509 � CHECK POINT SOFTWARE TECHNOLOGIES LTD. SELECTED

CONSOLIDATED CASH FLOW DATA (In thousands) � Three Months Ended Six

Months Ended June 30, June 30, 2008 � � 2007 � 2008 � � 2007 �

(unaudited) (unaudited) (unaudited) (unaudited) Cash flow from

operating activities: Net income $ 79,173 $ 69,461 $ 157,431 $

116,409 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization of property,

plant and equipment 2,186 1,707 4,375 2,944 Decrease (increase) in

trade and other receivables, net (11,342 ) 2,063 36,784 40,624

Increase (decrease) in deferred revenues, trade payables and other

accrued liabilities � 1,213 � (7,557 � ) 4,544 (13,343 )

Acquisition of in process research and development - - - 17,000

Amortization of intangible assets 8,893 10,338 � 19,197 19,308

Stock-based compensation 8,385 8,588 17,456 16,926 Excess tax

benefit from stock-based compensation (2,681 ) - (6,029 ) -

Deferred income taxes, net � (3,268 ) � (3,136 ) � (8,323 ) �

(8,396 ) Net cash provided by operating activities � 82,559 � �

81,464 � � 225,435 � � 191,472 � � Cash flow from investing

activities: Cash paid in conjunction with the acquisition of

Protect Data, net (9,042 ) (260 ) (9,042 ) (594,294 ) Investment in

property, plant and equipment � (2,591 ) � (5,564 ) � (4,526 ) �

(9,986 ) Net cash used in investing activities � (11,633 ) � (5,824

) � (13,568 ) � (604,280 ) � Cash flow from financing activities:

Proceeds from issuance of shares upon exercise of options 9,304

7,418 15,772 14,935 Purchase of treasury shares (50,000 ) (50,000 )

(123,000 ) (105,627 ) Excess tax benefit from stock-based

compensation � 2,681 � � - � � 6,029 � � - � Net cash used in

financing activities � (38,015 ) � (42,582 ) � (101,199 ) � (90,692

) � Unrealized gain (loss) on marketable securities, net � (8,844 )

� (4,388 ) � (9,404 ) � 3,738 � � Increase (decrease) in cash and

cash equivalents, deposits and marketable securities 24,067 28,670

101,264 (499,762 ) � Cash and cash equivalents, deposits and

marketable securities at the beginning of the period � 1,318,706 �

� 1,121,506 � � 1,241,509 � � 1,649,938 � � Cash and cash

equivalents, deposits and marketable securities at the end of the

period $ 1,342,773 � $ 1,150,176 � $ 1,342,773 � � $ 1,150,176 �

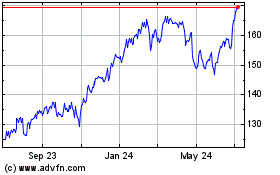

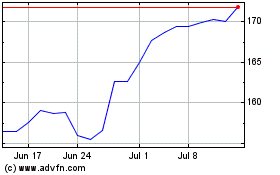

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Apr 2024 to May 2024

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2023 to May 2024