- Free Writing Prospectus - Filing under Securities Act Rules 163/433 (FWP)

December 02 2011 - 6:01AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement dated

November 30, 2011 and the Prospectus dated January 4, 2011

Registration No. 333-171526

November 30, 2011

CCO HOLDINGS, LLC

CCO HOLDINGS CAPITAL CORP.

This Supplement is qualified in its entirety by reference to the Preliminary Prospectus Supplement.

The information in this Supplement supplements the Preliminary Prospectus Supplement and

supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with

the information in the Preliminary Prospectus Supplement.

|

|

|

|

|

Aggregate Principal Amount:

|

|

$750,000,000

|

|

|

|

|

|

Title of Securities:

|

|

7.375% Senior Notes due 2020

|

|

|

|

|

|

Final Maturity Date:

|

|

June 1, 2020

|

|

|

|

|

|

Issue Price:

|

|

100.000%, plus accrued interest, if any

|

|

|

|

|

|

Coupon:

|

|

7.375%

|

|

|

|

|

|

Yield to Maturity:

|

|

7.375%

|

|

|

|

|

|

Interest Payment Dates:

|

|

June 1 and December 1

|

|

|

|

|

|

Record Dates:

|

|

May 15 and November 15

|

|

|

|

|

|

First Interest Payment Date:

|

|

June 1, 2012

|

|

|

|

|

|

Gross Proceeds:

|

|

$750,000,000

|

|

|

|

|

|

Underwriting Discount:

|

|

1.30%

|

|

|

|

|

|

Net Proceeds to the Issuers

before Estimated Expenses:

|

|

$740,250,000

|

|

|

|

|

|

Optional Redemption:

|

|

Except as described below, the Notes are not redeemable before December 1,

2015. On or after December 1, 2015, the Issuers may redeem all or a part of

the Notes upon not less than 30 nor more than 60 days notice, at the redemption

prices (expressed as percentages of principal amount of Notes) set forth below

plus accrued and unpaid interest thereon, if any, to the applicable redemption

date, if redeemed during the twelve-month period beginning on December 1 of the

years indicated below:

|

|

|

|

|

|

|

|

Date

|

|

Price

|

|

2015

|

|

|

103.688

|

%

|

|

|

|

|

|

|

|

2016

|

|

|

101.844

|

%

|

|

|

|

|

|

|

|

2017 and thereafter

|

|

|

100.000

|

%

|

|

|

|

|

|

|

|

At any time prior and from time to time prior to December 1, 2015, the Issuers

may also redeem the outstanding Notes, in whole or in part, at a redemption

price equal to 100% of the principal amount thereof plus accrued and unpaid

interest, if any, on such Notes to the redemption date,

plus

the Make-Whole

Premium.

|

|

|

|

|

|

Optional Redemption with Equity Proceeds:

|

|

At any time prior to December 1, 2014, the Issuers may, on any one or more

occasions, redeem up to 35% of the Notes at a redemption price equal to

107.375% of the principal amount thereof, plus accrued and unpaid interest to

the redemption date, with the net cash proceeds of certain equity offerings.

|

|

|

|

|

|

Change of Control:

|

|

101%

|

|

|

|

|

|

Underwriters:

|

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) LLC

Deutsche Bank Securities Inc.

UBS Securities LLC

J.P. Morgan Securities LLC

U.S. Bancorp Investments, Inc.

RBC Capital Markets, LLC

Goldman, Sachs & Co.

Morgan Stanley & Co. LLC

Morgan Joseph TriArtisan LLC

Credit Agricole Securities (USA) Inc.

|

|

|

|

|

|

Use of Proceeds:

|

|

We intend to use the proceeds of this offering (i) to fund the Tender Offer for

the Subject Notes, (ii) to pay fees and expenses related to this offering and

(iii) for general corporate purposes.

|

|

|

|

|

|

Trade Date:

|

|

November 30, 2011

|

|

|

|

|

|

Settlement Date:

|

|

December 14, 2011 (T+10)

|

|

|

|

|

|

Distribution:

|

|

SEC Registered (Registration No. 333-171526)

|

|

|

|

|

|

CUSIP/ISIN Numbers:

|

|

CUSIP: 1248EP AW3

|

|

|

|

ISIN: US1248EPAW31

|

|

|

|

|

|

|

|

|

|

Listing:

|

|

None

|

|

|

|

|

|

Other:

|

|

Certain of the underwriters and their affiliates are acting as arrangers for

the Term Loan A Financing referred to in the Preliminary Prospectus Supplement

under “Prospectus Supplement Summary—Recent Events” and are expected to act as

lenders for a portion of the new Term Loan A Financing.

|

The Issuers and the guarantor have filed a registration statement (including a prospectus) with the

Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents that the Issuers and

the guarantor have filed with the SEC for more complete information about the Issuers, the guarantor and this

offering. You may get these documents for free by visiting the SEC Web site at

www.sec.gov.

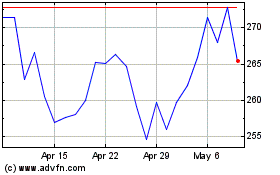

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

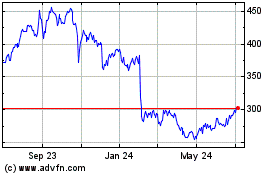

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Nov 2023 to Nov 2024