- Current report filing (8-K)

March 18 2009 - 5:17PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 12, 2009

Charter Communications,

Inc.

(Exact name of registrant as

specified in its charter)

Delaware

(State or Other Jurisdiction of

Incorporation or Organization)

|

000-27927

|

|

43-1857213

|

|

(Commission File

Number)

|

|

(I.R.S.

Employer Identification

Number)

|

12405

Powerscourt Drive

St. Louis

,

Missouri

63131

(Address of principal executive

offices including zip code)

(314)

965-0555

(Registrant's telephone number,

including area code)

Not

Applicable

(Former name or former address, if

changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

ITEM

5.02 DEPARTURE OF DIRECTORS; CERTAIN OFFICERS; ELECTION OF DIRECTORS;

APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN

OFFICERS.

On

March 12, 2009, Charter Communications, Inc. (the "Company") adopted the Charter

Communications, Inc. Value Creation Plan (the "Plan”), which replaces the

Restructuring Value Plan previously adopted by the Company. The Plan

is comprised of two components, the Restructuring Value Program (the “RVP”), and

the Cash Incentive Program (the “CIP”).

The

RVP provides incentives to encourage and reward participants for a successful

restructuring of the Company. Participants who continue to be

employed by the Company or its subsidiaries until payment of RVP awards earn

payments under the RVP upon either (i) the Company’s emergence from its Chapter

11 restructuring proceeding (the “Proceeding”) or (ii), if the Company’s

restructuring plan is the Joint Plan (as defined in the Plan), when the

Commitment Fees under the Joint Plan are first payable. Participants

also earn their RVP payments upon an earlier of (i) their termination of

employment due to death or disability, or their termination on or after the

Company’s emergence from the Proceeding by the Company for a reason other than

“cause,” or voluntarily due to a “good reason” (as each such term is defined in

the Plan) or (ii) a “change in control” of the Company if they are then employed

by the Company or its subsidiaries. The target RVP awards for the Company’s

named executive officers as of the date hereof (which are subject to change in

accordance with the terms of the Plan) are: N. Smit - $6 million; M. Lovett -

$2.38 million; E. Schmitz - $765,000; and G. Raclin -

$765,000.

The

CIP provides annual incentives for participants to achieve specified individual

performance goals during each of the three years following the Company’s

emergence from the Proceeding. Performance goals will be established

for each of the first three years following the Company’s emergence from the

Proceeding. Participants will earn all or a portion of their target

bonus based on the degree to which these goals are achieved in a particular

year. Amounts that are not earned in a particular year may be earned

in a subsequent year if the performance goals applicable to that subsequent year

are achieved. Participants also earn the CIP payments upon an earlier

of, or due to (i) a termination of their employment on or after the Company’s

emergence from the Proceeding due to death, disability, by the Company for a

reason other than “cause,” or voluntarily due to a “good reason” (as each such

term is defined in the Plan) and (ii) a “change in control” of the Company if

they are then employed by the Company. The annual target awards for

the Company’s named executive officers as of the date hereof (which are subject

to change in accordance with the terms of the Plan) are: N. Smit - $2.5 million;

M. Lovett - $910,000; E. Schmitz - $664,000; and G. Raclin -

$597,000.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this Current Report to be signed on its behalf by the undersigned

hereunto duly authorized.

CHARTER

COMMUNICATIONS, INC.

By:

/s/ Kevin D.

Howard

Date:

March 18,

2009

Name: Kevin D. Howard

Title: Vice President, Controller and Chief Accounting

Officer

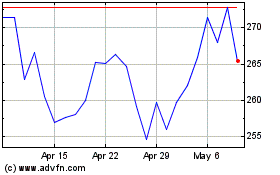

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From May 2024 to Jun 2024

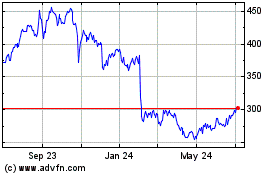

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2023 to Jun 2024