Charter Communications Prices Senior Notes Offering; Deal Increased to $450 Million Senior Notes Due 2010

January 26 2006 - 7:09PM

Business Wire

Charter Communications, Inc. (Nasdaq: CHTR - the "Company")

announced today that its subsidiary, CCH II, LLC, agreed to issue

$450 million principal amount of 10.250% Senior Notes due 2010 (the

"Notes") in a private transaction. The issue price of the Notes

will be approximately 97.75% of the principal amount and have terms

substantially identical to the terms of the issuer's existing $1.6

billion 10.250% Senior Notes due 2010. The Notes will not be

registered under the Securities Act of 1933, as amended (the

"Securities Act"), and, unless so registered, may not be offered or

sold in the United States except pursuant to an exemption from the

registration requirements of the Securities Act and applicable

state securities laws. The Company said that, subject to market

conditions, it anticipated that the sale would be completed within

the next week. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy, nor shall there be any

sale of the Notes in any state in which such offer, solicitation or

sale would be unlawful. About Charter Communications Charter

Communications, Inc., a broadband communications company, provides

a full range of advanced broadband services to the home, including

cable television on an advanced digital video programming platform

via Charter Digital(TM), Charter High-Speed(TM) Internet service

and Charter Telephone(TM). Charter Business(TM) provides scalable,

tailored and cost-effective broadband communications solutions to

organizations of all sizes through business-to-business Internet,

data networking, video and music services. Advertising sales and

production services are sold under the Charter Media(R) brand. More

information about Charter can be found at www.charter.com.

Cautionary Statement Regarding Forward-Looking Statements: This

release includes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended (the

"Securities Act"), and Section 21E of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"), regarding, among other

things, our plans, strategies and prospects, both business and

financial. Although we believe that our plans, intentions and

expectations reflected in or suggested by these forward-looking

statements are reasonable, we cannot assure you that we will

achieve or realize these plans, intentions or expectations.

Forward-looking statements are inherently subject to risks,

uncertainties and assumptions. Many of the forward-looking

statements contained in this release may be identified by the use

of forward-looking words such as "believe," "expect," "anticipate,"

"should," "planned," "will," "may," "intend," "estimated" and

"potential," among others. Important factors that could cause

actual results to differ materially from the forward-looking

statements we make in this release are set forth in reports or

documents that we file from time to time with the SEC. All

forward-looking statements attributable to us or any person acting

on our behalf are expressly qualified in their entirety by this

cautionary statement. We are under no duty or obligation to update

any of the forward-looking statements after the date of this

release.

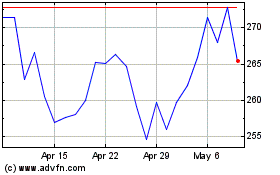

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Oct 2024 to Nov 2024

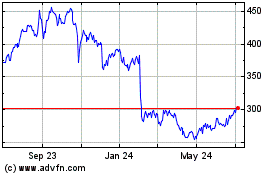

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Nov 2023 to Nov 2024