Career Education Corporation (NASDAQ: CECO) today reported total

revenue of $405.6 million and a net loss of ($0.1) million, or

$0.00 per diluted share, during the third quarter of 2008 compared

to total revenue of $427.2 million and net income of $15.6 million,

or $0.17 per diluted share, during the third quarter of 2007.

Included in the results for the third quarter of 2008 are the

following significant items: $15.7 million pre-tax, or ($0.12) per

share in charges, related to the company�s ongoing effort to

optimize its real estate footprint, representing $10.9 million

pre-tax, or ($0.08) per share of cash lease exit expenses and $4.8

million pretax, or ($0.04) per share in noncash asset impairment

charges, $2.0 million pre-tax, or ($0.01) per share, in trade name

noncash impairment charges related to brand consolidation actions,

and $3.2 million, or $0.04 per share, in tax benefit related to the

sale of a foreign subsidiary. �I am encouraged that despite

external challenges, our financial results remain in line with our

expectations,� said Gary E. McCullough, president and chief

executive officer. �Our Health Education and International segments

maintained their strong performance in the third quarter and

continue to execute well. Additionally, online starts within the

University segment grew over nine percent in the quarter. Through

the first nine months of the year, the Culinary Arts segment has

taken the necessary steps to adjust its operations and student

financing capabilities to the new lending environment. These

actions provide a blueprint for the Art & Design segment as it

seeks to address similar challenges. While we still have work to

do, we continue to make solid progress in positioning the company

for the long-term.� Three Months Ended September 30, 2008 Total

revenue was $405.6 million during the third quarter of 2008, a 5.0

percent decrease from $427.2 million during the third quarter of

2007. Operating loss was ($8.8) million during the third quarter of

2008, a decrease from $18.9 million of operating income during the

third quarter of 2007. Operating margin percentage was (2.2%)

percent during the third quarter of 2008, a 6.6 percentage point

decrease relative to an operating profit margin percentage of 4.4

percent during the third quarter of 2007. Loss from continuing

operations was ($0.0) million, or $0.00 per diluted share, during

the third quarter of 2008, compared to income from continuing

operations of $16.2 million, or $0.18 per diluted share, during the

third quarter of 2007. Nine Months Ended September 30, 2008 Total

revenue was $1.279 billion during the nine months ended September

30, 2008, relative to $1.308 billion during the nine months ended

September 30, 2007. Operating income declined to $28.6 million

during the nine months ended September 30, 2008, from $64.2 million

during the nine months ended September 30, 2007. Operating margin

percentage decreased to 2.2 percent during the nine months ended

September 30, 2008, from 4.9 percent during the nine months ended

September 30, 2007. Included in the results from continuing

operations for the nine months ended September 30, 2008 and for the

nine months ended September 30, 2007 are the following significant

items: � � � Pre-Tax Expense(In Millions) � � Diluted Earnings

perShare Impact Income (Loss) Nine Months Ended September 30, 2008

Lease Exit Charges $10.9 ($0.08 ) Severance/Stay Bonuses $13.3

($0.09 ) Asset Impairment Charges $9.1 ($0.07 ) Tax Benefit - $0.04

� TOTAL $33.3 ($0.20 ) � Nine Months Ended September 30, 2007 Legal

Settlements $13.1 ($0.09 ) Severance $1.7 ($0.01 ) TOTAL $14.8

($0.10 ) Income from continuing operations during the nine months

ended September 30, 2008, was $31.8 million, or $0.35 per diluted

share, relative to $52.4 million, or $0.55 per diluted share,

during the nine months ended September 30, 2007. CONSOLIDATED CASH

FLOWS AND FINANCIAL POSITION Cash Flows Net cash flow provided by

operating activities was $158.9 million during the nine months

ended September 30, 2008, compared to net cash flow provided by

operating activities of $193.2 million during the nine months ended

September 30, 2007. The decrease in operating cash flows in 2008

was due to lower net income as compared to the prior year as well

as payments related to legal matters accrued for in the previous

year. Capital expenditures decreased to $39.9 million during the

nine months ended September 30, 2008, from $44.1 million during the

nine months ended September 30, 2007. Capital expenditures

represented 3.1 percent of total revenue during the nine months

ended September 30, 2008. Financial Position As of September 30,

2008 and December 31, 2007, cash and cash equivalents and

investments totaled $509.0 million and $390.0 million,

respectively. Days sales outstanding (DSO) were 14 days as of

September 30, 2008, consistent with DSO of 14 days as of December

31, 2007. POPULATION AND NEW STUDENT START DATA Student Population

Total student population by reportable segment as of October 31,

2008 and 2007, were as follows: � As of October 31, � % Change 2008

� 2007 2008 vs. 2007 STUDENT POPULATION Art & Design 14,000

14,700 (5 %) Culinary Arts 10,300 12,100 (15 %) Health Education

17,200 14,600 18 % International 9,700 8,600 13 % University 44,800

42,300 6 % Subtotal 96,000 92,300 4 % Transitional Schools 2,700

8,200 (67 %) Total Student Population 98,700 100,500 (2 %) ONLINE

POPULATION Art & Design 800 300 N/M University 34,400 31,900 8

% Total Online Population 35,200 32,200 9 % New Student Starts New

student starts by reportable segment during the third quarter of

2008 and 2007, were as follows: � For the three months

endedSeptember 30, � % Change 2008 � 2007 2008 vs. 2007 NEW STUDENT

STARTS Art & Design 3,080 3,490 (12 %) Culinary Arts (1) 4,710

4,480 5 % Health Education 5,600 4,740 18 % International 4,070

3,380 21 % University 14,130 13,120 8 % Subtotal 31,590 29,210 8 %

Transitional Schools 10 2,000 N/M Total New Student Starts 31,600

31,210 1 % ONLINE STARTS Art & Design 320 190 68 % University

11,480 10,520 9 % Total Online Starts 11,800 10,710 10 % (1)

Culinary Arts new student starts comparability was impacted by an

additional start period in the third quarter of 2008, which

resulted in approximately 1,100 additional student starts in the

quarter as compared to the third quarter 2007. Accordingly, in the

fourth quarter 2008, Culinary will have one less start period than

the fourth quarter of 2007. CONFERENCE CALL INFORMATION Career

Education Corporation will host a conference call on November 6,

2008 at 10:00 AM (Eastern Time). Interested parties can access the

live webcast of the conference call at www.careered.com.

Participants can also listen to the conference call by dialing

866-362-4666 (domestic) or 617-597-5313 (international) and citing

code 65468933. Please log-in or dial-in at least 10 minutes prior

to the start time to ensure a connection. An archived version of

the webcast will be accessible for 90 days at www.careered.com. A

replay of the call will also be available for seven days by calling

888-286-8010 (domestic) or 617-801-6888 (international) and citing

code 45600050. About Career Education Corporation The colleges,

schools, and universities that are part of the Career Education

Corporation (CEC) family offer high quality education to a diverse

population of approximately 90,000 students across the world in a

variety of career-oriented disciplines. The more than 75 campuses

that serve these students are located throughout the U.S. and in

France, Italy, and the United Kingdom, and offer doctoral,

master's, bachelor's, and associate degrees and diploma and

certificate programs. Approximately one-third of its students

attend the web-based virtual campuses of American InterContinental

University Online and Colorado Technical University Online. CEC is

an industry leader whose gold-standard brands are recognized

globally. Those brands include, among others, the Le Cordon Bleu

Schools North America; Harrington College of Design; Brooks

Institute; International Academy of Design & Technology;

American InterContinental University; Colorado Technical University

and Sanford-Brown Institutes and Colleges. Through its schools, CEC

is committed to providing quality education, enabling students to

graduate and pursue rewarding careers. For more information, see

the company�s website at www.careered.com. The company's website

includes a detailed listing of individual campus locations and web

links to its more than 75 colleges, schools, and universities.

Except for the historical and present factual information contained

herein, the matters set forth in this release, including statements

identified by words such as "anticipate," "believe," "plan,"

"expect," "intend," "project," "will," and similar expressions, are

forward-looking statements as defined in Section 21E of the

Securities Exchange Act of 1934, as amended. These statements are

based on information currently available to us and are subject to

various risks, uncertainties and other factors that could cause our

actual growth, results of operations, performance and business

prospects, and opportunities to differ materially from those

expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation

to update such factors or to publicly announce the results of any

of the forward-looking statements contained herein to reflect

future events, developments, or changed circumstances or for any

other reason. These risks and uncertainties, the outcome of which

could materially and adversely affect our financial condition and

operations, include, but are not limited to, the following: the

adverse impact and potential impacts on the availability of Title

IV and private student loans for our students of (1) the

willingness or ability of private lenders to make private student

loans in the current U.S. credit markets, (2) new student lending

related reporting and disclosure obligations on institutions that

participate in Title IV federal student financial aid programs

under The Higher Education Opportunity Act (�HEOA�), signed into

law on August 14, 2008, in the first full reauthorization of the

Higher Education Act of 1965, as amended, and (3) pending

regulations under HEOA and Congress� willingness or ability to

maintain or increase funding for Title IV programs; potential

higher bad debt expense or reduced revenue associated with

requiring students to pay more of their educational expenses while

in school or with directly making student loans to our students;

increased competition; the effectiveness of our regulatory

compliance efforts; impairment of goodwill and other intangible

assets as we continue to redefine the company and manage our brands

and marketing to improve effectiveness and reduce costs; charges

and expenses associated with exiting excess facility space,

centralizing various functional areas, such as human resources and

financial aid, and continuing to align the SBUs and corporate staff

to remove layers, overlaps and redundancies; the impact on our

revenues and profitability of our discontinued operations segment;

our ability to comply with accrediting agency requirements or

obtain accrediting agency approvals; costs and impacts of legal and

administrative proceedings and investigations, governmental

regulations, and class action and other lawsuits; costs and

difficulties related to the integration of acquired businesses; our

ability to manage and continue growth; and other factors discussed

in our Annual Report on Form 10-K for the year ended December 31,

2007, and from time to time in our quarterly and current reports

filed with the Securities and Exchange Commission. CAREER EDUCATION

CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share amounts and percentages)

� � � � � � � For the Three Months EndedSeptember 30, % of % of

2008 Revenue 2007 (1) Revenue � REVENUE: Tuition and registration

fees $ 385,849 95.1 % $ 401,939 94.1 % Other 19,784 � 4.9 % 25,266

� 5.9 % Total revenue 405,633 � 100.0 % 427,205 � 100.0 % �

OPERATING EXPENSES: Educational services and facilities 170,055

41.9 % 162,636 38.1 % General and administrative 218,454 53.9 %

227,186 53.2 % Depreciation and amortization 19,034 4.7 % 18,500

4.3 % Goodwill and asset impairment 6,843 � 1.7 % - � 0.0 % Total

operating expenses 414,386 � 102.2 % 408,322 � 95.6 % Operating

(loss) income (8,753 ) -2.2 % 18,883 � 4.4 % � OTHER INCOME

(EXPENSE): Interest income 2,875 0.7 % 4,152 1.0 % Interest expense

(211 ) -0.1 % (342 ) -0.1 % Share of affiliate earnings - 0.0 % 209

0.0 % Miscellaneous (expense) income (220 ) -0.1 % 65 � 0.0 % Total

other income, net 2,444 � 0.6 % 4,084 � 1.0 % � Pretax (loss)

income from continuing operations (6,309 ) -1.6 % 22,967 5.4 % �

(Benefit) provision for income taxes (6,263 ) -1.5 % 6,755 � 1.6 %

� (Loss) income from continuing operations (46 ) 0.0 % 16,212 3.8 %

� Loss from discontinued operations, net of tax (101 ) $ (651 ) �

NET (LOSS) INCOME $ (147 ) $ 15,561 � � NET (LOSS) INCOME PER SHARE

- DILUTED (Loss) income from continuing operations $ (0.00 ) $ 0.18

Loss from discontinued operations (0.00 ) (0.01 ) Net (loss) income

$ (0.00 ) $ 0.17 � � DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING

89,675 � 93,455 � (1) � Prior period financial results have been

reclassified to account for the teach-out of our schools previously

reported as held for sale, the change in our reportable business

segments during the first quarter of 2008 and to present Brooks

College - Sunnyvale, CA and IADT Toronto as discontinued

operations. For further information regarding our reclassification

of reportable segments, please refer to our Form 8-K filings dated

March 28, 2008 and April 11, 2008. CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED BALANCE SHEETS (In thousands) �

� � � � September 30,2008 December 31,2007 (1) � ASSETS CURRENT

ASSETS: Cash and cash equivalents $ 224,908 $ 223,334 Investments

284,046 � 166,618 � Total cash and cash equivalents and investments

508,954 389,952 Receivables: Students, net of allowance for

doubtful accounts of $35,393 and$35,507 as of September 30, 2008,

and December 31, 2007, respectively 54,981 59,584 Other, net 7,969

9,052 Prepaid expenses 44,691 50,025 Inventories 11,850 15,400

Deferred income tax assets 19,403 19,418 Other current assets

10,120 16,456 Assets of discontinued operations 628 � 23,554 �

Total current assets 658,596 � 583,441 � NON-CURRENT ASSETS:

Property and equipment, net 302,955 337,073 Goodwill 377,288

379,507 Intangible assets, net 40,851 44,395 Other assets, net

20,074 � 22,050 � TOTAL ASSETS $ 1,399,764 � $ 1,366,466 � �

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES: Current

maturities of long-term debt and capital lease obligations $ 9,683

$ 11,843 Accounts payable 39,726 27,826 Accrued expenses: Payroll

and related benefits 56,435 34,305 Income taxes 5,822 19,556 Other

76,784 102,058 Deferred tuition revenue 175,581 159,482 Liabilities

of discontinued operations 2,590 � 8,282 � Total current

liabilities 366,621 � 363,352 � � LONG-TERM LIABILITIES: Long-term

debt and capital lease obligations, net of current maturities 1,984

2,179 Deferred rent obligations 99,051 98,115 Deferred income tax

liabilities 412 624 Other 13,085 � 4,473 � Total long-term

liabilities 114,532 � 105,391 � � SHARE-BASED AWARDS SUBJECT TO

REDEMPTION 6,191 11,615 � STOCKHOLDERS' EQUITY: Preferred stock - -

Common stock 933 930 Additional paid-in capital 220,833 207,294

Accumulated other comprehensive income 8,777 16,304 Retained

earnings 770,955 736,603 Cost of shares in treasury (89,078 )

(75,023 ) Total stockholders' equity 912,420 � 886,108 � TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY $ 1,399,764 � $ 1,366,466 �

(1) � Prior period financial results have been reclassified to

account for the teach-out of our schools previously reported as

held for sale, the change in our reportable business segments

during the first quarter of 2008 and to present Brooks College -

Sunnyvale, CA and IADT Toronto as discontinued operations. For

further information regarding our reclassification of reportable

segments, please refer to our Form 8-K filings dated March 28, 2008

and April 11, 2008. CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands,

except per share amounts and percentages) � � � � � � For the Nine

Months EndedSeptember 30, % of % of 2008 Revenue 2007 (1) Revenue �

REVENUE: Tuition and registration fees $ 1,224,581 95.7 % $

1,245,274 95.2 % Other 54,371 � 4.3 % 62,960 � 4.8 % Total revenue

1,278,952 � 100.0 % 1,308,234 � 100.0 % � OPERATING EXPENSES:

Educational services and facilities 502,617 39.3 % 479,885 36.7 %

General and administrative 680,007 53.2 % 708,147 54.1 %

Depreciation and amortization 58,630 4.6 % 56,043 4.3 % Goodwill

and asset impairment 9,070 � 0.7 % - � 0.0 % Total operating

expenses 1,250,324 � 97.8 % 1,244,075 � 95.1 % Operating income

28,628 � 2.2 % 64,159 � 4.9 % � OTHER INCOME (EXPENSE): Interest

income 9,327 0.7 % 12,787 1.0 % Interest expense (703 ) -0.1 % (877

) -0.1 % Share of affiliate earnings 4,665 0.4 % 2,870 0.2 %

Miscellaneous (expense) income (496 ) 0.0 % 784 � 0.1 % Total other

income, net 12,793 � 1.0 % 15,564 � 1.2 % � Pretax income from

continuing operations 41,421 3.2 % 79,723 6.1 % � Provision for

income taxes 9,655 � 0.8 % 27,329 � 2.1 % � Income from continuing

operations 31,766 2.5 % 52,394 4.0 % � Loss from discontinued

operations, net of tax (2,838 ) (1,670 ) � NET INCOME $ 28,928 � $

50,724 � � NET INCOME PER SHARE - DILUTED Income from continuing

operations $ 0.35 $ 0.55 Loss from discontinued operations (0.03 )

(0.02 ) Net income $ 0.32 � $ 0.53 � � DILUTED WEIGHTED AVERAGE

SHARES OUTSTANDING 90,144 � 95,055 � (1) � Prior period financial

results have been reclassified to account for the teach-out of our

schools previously reported as held for sale, the change in our

reportable business segments during the first quarter of 2008 and

to present Brooks College - Sunnyvale, CA and IADT Toronto as

discontinued operations. For further information regarding our

reclassification of reportable segments, please refer to our Form

8-K filings dated March 28, 2008 and April 11, 2008. CAREER

EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands) � � � � For the Nine Months

Ended September 30, 2008 2007 � CASH FLOWS FROM OPERATING

ACTIVITIES OF CONTINUING OPERATIONS: Net income $ 28,928 $ 50,724

Adjustments to reconcile net income to net cash provided by

operating activities: Goodwill and asset impairment 13,600 -

Depreciation and amortization expense 60,070 57,744 Bad debt

expense 33,350 32,055 Compensation expense related to share-based

awards 10,017 11,700 Gain on sale of business (1,555 ) - Loss

(gain) on disposition of property and equipment 573 (220 ) Share of

affiliate earnings, net of cash received 939 (927 ) Changes in

operating assets and liabilities 13,022 � 42,164 � Net cash

provided by operating activities 158,944 � 193,240 � � CASH FLOWS

FROM INVESTING ACTIVITIES: Business acquisitions, net of acquired

cash - (30,324 ) Acquisition transaction costs - (1,553 ) Purchases

of property and equipment (39,874 ) (44,085 ) Purchases of

available-for-sale investments (470,324 ) (504,180 ) Sales of

available-for-sale investments 352,896 522,789 Other 944 � (196 )

Net cash used in investing activities (156,358 ) (57,549 ) � CASH

FLOWS FROM FINANCING ACTIVITIES: Purchase of treasury stock (14,055

) (149,241 ) Issuance of common stock 3,089 14,730 Tax benefit

associated with stock option exercises 433 2,868 Payments on

revolving loans (1,492 ) - Payments of capital lease obligations

and other long-term debt (479 ) (1,385 ) Net cash used in financing

activities (12,504 ) (133,028 ) � � EFFECT OF FOREIGN CURRENCY

EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS: (2,815 ) 7,993

� � NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (12,733 )

10,656 Add: Cash balance of discontinued operations at beginning of

the period 14,371 8,530 Less: Cash balance of discontinued

operations at end of the period 64 13,059 CASH AND CASH

EQUIVALENTS, beginning of the period 223,334 � 181,286 � CASH AND

CASH EQUIVALENTS, end of the period $ 224,908 � $ 187,413 � CAREER

EDUCATION CORPORATION SELECTED SEGMENT INFORMATION (In thousands) �

� � For the Three Months EndedSeptember 30, 2008 2007 (1) �

REVENUE: University $ 172,856 $ 166,322 Culinary Arts 85,961 98,472

Health Education 58,071 51,916 Arts & Design 61,766 68,450

International 12,595 10,891 Transitional Schools 14,385 31,151

Corporate and other (1 ) 3 � $ 405,633 � $ 427,205 � � SEGMENT

OPERATING (LOSS) INCOME: University $ 27,341 $ 16,899 Culinary Arts

(2) (10,423 ) 15,566 Health Education 3,289 2,578 Arts & Design

3,832 8,281 International (5,240 ) (3,054 ) Transitional Schools

(3) (10,646 ) (8,879 ) Corporate and other (16,906 ) (12,508 ) $

(8,753 ) $ 18,883 � � SEGMENT OPERATING (LOSS) INCOME PERCENTAGE:

University 15.8 % 10.2 % Culinary Arts -12.1 % 15.8 % Health

Education 5.7 % 5.0 % Arts & Design 6.2 % 12.1 % International

-41.6 % -28.0 % Transitional Schools -74.0 % -28.5 % (1) � Prior

period financial results have been reclassified to account for the

teach-out of our schools previously reported as held for sale, the

change in our reportable business segments during the first quarter

of 2008 and to present Brooks - Sunnyvale, CA and IADT Toronto as

discontinued operations. For further information regarding our

reclassification of reportable segments, please refer to our Form

8-K filings dated March 28, 2008 and April 11, 2008. � (2) Culinary

Arts 2008 operating loss includes pretax charges in the quarter of

$18.5 million. Pretax charges related to the following: $9.7

million in lease exit charges related to two facilities, $4.8

million asset impairment due to the exit of a facility, and $4.0

million expense associated with an increase in legal reserves. �

(3) Transitional Schools 2008 operating loss includes charges in

the quarter of $1.1 million for unused space. CAREER EDUCATION

CORPORATION SELECTED SEGMENT INFORMATION (In thousands) � � � For

the Nine Months EndedSeptember 30, 2008 2007 (1) � REVENUE:

University $ 525,365 $ 530,746 Culinary Arts 251,026 271,743 Health

Education 171,120 152,369 Arts & Design 196,214 202,328

International 71,872 49,322 Transitional Schools 63,347 101,587

Corporate and other 8 � 139 � $ 1,278,952 � $ 1,308,234 � � SEGMENT

OPERATING (LOSS) INCOME: University $ 79,806 $ 75,903 Culinary Arts

(2) (5,317 ) 34,121 Health Education 12,191 9,062 Arts & Design

19,002 18,557 International 10,754 3,577 Transitional Schools (3)

(36,926 ) (37,619 ) Corporate and other (50,882 ) (39,442 ) $

28,628 � $ 64,159 � � SEGMENT OPERATING (LOSS) INCOME PERCENTAGE:

University 15.2 % 14.3 % Culinary Arts -2.1 % 12.6 % Health

Education 7.1 % 5.9 % Arts & Design 9.7 % 9.2 % International

15.0 % 7.3 % Transitional Schools -58.3 % -37.0 % (1) � Prior

period financial results have been reclassified to account for the

teach-out of our schools previously reported as held for sale, the

change in our reportable business segments during the first quarter

of 2008 and to present Brooks - Sunnyvale, CA and IADT Toronto as

discontinued operations. For further information regarding our

reclassification of reportable segments, please refer to our Form

8-K filings dated March 28, 2008 and April 11, 2008. � (2) Culinary

Arts 2008 operating loss includes pretax charges of $18.5 million.

Pretax charges related to the following: $9.7 million in lease exit

charges related to two facilities, $4.8 million asset impairment

due to the exit of a facility, and $4.0 million expense associated

with an increase in legal reserves. � (3) Transitional Schools 2008

operating loss includes charges totaling $12.7 million. Charges of

$9.5 million in severance and stay bonuses, asset impairment of

$2.1 million related to a school being taught out, and charges of

$1.1 million for unused space. CAREER EDUCATION CORPORATION

SELECTED SEGMENT START-UP INFORMATION (In thousands) � � � � � For

the Three Months EndedSeptember 30, For the Nine Months

EndedSeptember 30, 2008 2007 (1) 2008 2007 (1) � REVENUE: Culinary

Arts (2) $ 4,694 $ 391 $ 10,400 $ 391 Health Education (3) - � - �

- � - � $ 4,694 � $ 391 � $ 10,400 � $ 391 � � SEGMENT OPERATING

(LOSS) INCOME: Culinary Arts (2) $ (2,408 ) $ (2,025 ) $ (7,353 ) $

(4,531 ) Health Education (3) (229 ) - � (596 ) - � $ (2,637 ) $

(2,025 ) $ (7,949 ) $ (4,531 ) (1) � Prior period financial results

have been reclassified to account for the teach-out of our schools

previously reported as held for sale and the change in our

reportable business segments during the first quarter of 2008. For

further information regarding our reclassification of reportable

segments, please refer to our Form 8-K filings dated March 28, 2008

and April 11, 2008. � (2) For the three and nine months ended

September 30, 2008 and 2007, Culinary Arts start-up campuses

include LCB, Boston, MA, Dallas, TX and St. Louis, MO and Kitchen

Academy Seattle, WA. � (3) For the three and nine months ended

September 30, 2008, Health Education start-up campuses include SBI

San Antonio, TX. CAREER EDUCATION CORPORATION SELECTED UNIVERSITY

SEGMENT INFORMATION (In thousands) � � � � � For the Three Months

EndedSeptember 30, For the Nine Months EndedSeptember 30, 2008 2007

(1) 2008 2007 (1) � UNIVERSITY REVENUE: AIU Online $ 77,767 $

73,122 $ 229,343 $ 245,606 Onground 16,787 18,880 57,918 66,467 CTU

Online 58,925 55,701 175,584 156,861 Onground 12,543 11,700 39,249

37,085 Briarcliffe 6,834 � 6,919 � 23,271 � 24,727 � University $

172,856 � $ 166,322 � $ 525,365 � $ 530,746 � � UNIVERSITY SEGMENT

OPERATING INCOME (LOSS): AIU Online $ 21,545 $ 14,716 $ 52,042 $

64,609 Onground (5,374 ) (7,508 ) (11,654 ) (13,129 ) CTU Online

12,659 11,298 41,041 26,738 Onground (1,025 ) (632 ) (959 ) (927 )

Briarcliffe (464 ) (975 ) (664 ) (1,388 ) University $ 27,341 � $

16,899 � $ 79,806 � $ 75,903 � � UNIVERSITY SEGMENT OPERATING

INCOME (LOSS) PERCENTAGE: AIU Online 27.7 % 20.1 % 22.7 % 26.3 %

Onground -32.0 % -39.8 % -20.1 % -19.8 % CTU Online 21.5 % 20.3 %

23.4 % 17.0 % Onground -8.2 % -5.4 % -2.4 % -2.5 % Briarcliffe -6.8

% -14.1 % -2.9 % -5.6 % University 15.8 % 10.2 % 15.2 % 14.3 % � �

Student Population as of October 31, 2008 2007 AIU Online 16,100

15,600 Onground 3,800 4,100 CTU Online 18,300 16,300 Onground 4,800

4,300 Briarcliffe 1,800 � 2,000 � University 44,800 � 42,300 � � �

Student Starts for thethree months endedSeptember 30, 2008 2007 AIU

Online 5,200 4,830 Onground 930 880 CTU Online 6,280 5,690 Onground

1,020 900 Briarcliffe 700 � 820 � University 14,130 � 13,120 � (1)

� Prior period financial results have been reclassified to account

for the teach-out of our schools previously reported as held for

sale and the change in our reportable business segments during the

first quarter of 2008. For further information regarding our

reclassification of reportable segments, please refer to our Form

8-K filings dated March 28, 2008 and April 11, 2008.

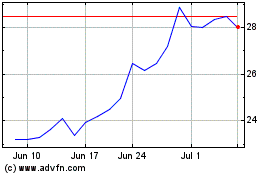

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Sep 2024 to Oct 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Oct 2023 to Oct 2024