false

00000

0001796514

00-0000000

0001796514

2024-09-06

2024-09-06

0001796514

BTCT:OrdinarySharesMember

2024-09-06

2024-09-06

0001796514

BTCT:WarrantsMember

2024-09-06

2024-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 11, 2024 (September 6, 2024).

BTC DIGITAL LTD.

(Exact name of Company as specified in its charter)

| Cayman Islands |

|

001-39258 |

|

N/A |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification Number) |

1306, 13th Floor, Xuesong Dasha Building B

No. 52 Tairan 6th Road, Futian District

Shenzhen, Guangdong Province

People’s Republic of China

(Address of principal executive offices)

+86 755-8255-5262

(Registrant’s

telephone number including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary Shares |

|

BTCT |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

BTCTW |

|

The Nasdaq Stock Market LLC |

Item 1.01 Entry into a Material Definitive

Agreement.

As previously disclosed in its current report

on Form 6-K dated December 22, 2021, Meten Holding Group Ltd. (now known as BTC Digital Ltd.) (the “Company”) entered into

a joint venture agreement (the “Joint Venture Agreement”) with four individuals, pursuant to which all parties agreed to form

a joint venture for the purpose of engaging in the business of researching, developing, manufacturing and selling cryptocurrency mining

machines (the “Joint Venture”). The Company, through its wholly owned subsidiary, Met Chain Investment Holding Company Ltd.,

held 24.3% of the equity interests in the Joint Venture.

On September 6, 2024, the Company entered into

an equity transfer agreement with each of the four other equity holders of the Joint Venture. Based on the terms of the equity transfer

agreement, a copy of which is attached hereto as exhibit 10.1, the Company will acquire a total of 5.23% of the equity interests in the

Joint Venture from the four equity holders, through Met Chain Investment Holding Company Ltd., in consideration for such number of ordinary

shares of the Company, par value $0.06 per share (the “ordinary shares”), valued at US$1,050,400 (the “Total Consideration”).

According to the equity transfer agreement, the number of ordinary shares to be issued to the four equity holders shall be equal to the

Total Consideration divided by the average trading price of the ordinary shares 90 trading days prior to the closing date of the transaction

contemplated by the agreement. The full terms and conditions of the transaction are disclosed in Exhibit 10.1 of this report.

Item 9.01 Financial Statement and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

BTC Digital Ltd. |

| |

|

|

| Date: September 11, 2024 |

By: |

/s/ Siguang Peng |

| |

|

Siguang Peng |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

Equity Transfer Agreement

| Party A (Transferee): BTC Digital Ltd. |

| |

| Legal

Representative: Siguang Peng |

| |

| Address: Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman KY101111, Cayman Islands |

| |

|

|

| Party B (Transferor) |

| |

| Party B1: Vermilion Bird Holding Group Limited |

| |

| Legal Representative: Zhijun Liu |

| |

| Address: Room 2303, Building T1, Fangda Cheng, Nanshan District, Shenzhen |

| |

|

|

| Party B 2: ZX Investment Group Limited |

| |

| Legal Representative: Yunning Li |

| |

| Address: Room 2205, Unit 1, Building 1, Zhongtian Weigang, No. 688 Qinglv S. Road, Xiangzhou District, Zhuhai, Guangdong. |

| |

|

|

| Party B 3: Liao Manning |

| |

| Address: Room 2610A, Building 4, Zhuoyue Shiji Zhongxin, Futian District, Shenzhen |

| |

| Party B4: Yun Feng Assets Inc. |

| |

| Legal Representative: Yue Li |

| |

| Address: PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands |

| |

|

|

Met Chain Co., Limited (hereinafter referred

to as the “Company”) was incorporated in the Hong Kong Special Administrative Region on January 18, 2022 as a private company

limited by shares, with the business scope of researching, developing, manufacturing and selling cryptocurrency mining machines and cryptocurrency

industry-related products. Party B holds 75.7% equity of the Company. Party B intends to transfer certain equity of the Company held

by Party B to Party A, and Party A agrees to accept the transfer (the “Transfer”). Therefore, in accordance with relevant

laws and regulations and as approved by Party A’s board of directors, Party A and Party B hereby reach the following Agreement

on the transfer of the Company’s equity:

I. Equity Transfer

1. Party A agrees to accept 5.23% of the Company’s

equity held by Party B by means of directional issuance of shares (NASDAQ: BTCT) (“Shares”), and Party B agrees to transfer

5.23% of the Company’s equity. The transferee designated by Party A is Met Chain Investing Holding Company Ltd., which is Party

A’s wholly owned subsidiary. Among them, Party B1 agrees to transfer 0.84% of the Company’s equity held, Party B2 agrees

to transfer 0.15% of the Company’s equity held, Party B3 agrees to transfer 0.06% of the Company’s equity held, and Party

B4 agrees to transfer 4.18% of the Company’s equity held. All parties have no objection to this arrangement.

2. The consideration paid by Party A is equivalent to US$1,050,400

of Shares.

3. The consideration value is calculated as the average share price

multiplied by the number of shares issued at the closing price 90 trading days prior to the transfer date.

4. Share ownership information of each party before and after the Transfer.

| Name of shareholder | |

Share Ownership before the Transfer | | |

The equity to be transferred

to Party A | | |

Share Ownership after the Transfer | |

| Met Chain Investing Holding Company Ltd. | |

| 24.30 | % | |

| N/A | | |

| 29.53 | % |

| Vermilion Bird Holding Group Limited | |

| 30.96 | % | |

| 0.84 | % | |

| 30.12 | % |

| ZX Investment Group Limited | |

| 5.46 | % | |

| 0.15 | % | |

| 5.31 | % |

| Liao Manning | |

| 2.28 | % | |

| 0.06 | % | |

| 2.22 | % |

| Yun Feng Assets Inc. | |

| 37.00 | % | |

| 4.18 | % | |

| 32.82 | % |

| Total | |

| 100 | % | |

| 5.23 | % | |

| 100 | % |

II. Business Division and Profit and Loss Sharing (including creditor’s

rights and debts) before the Transfer:

1. Before this Agreement becomes effective, the parties shall share

the profits of the Company and the corresponding risks and loss in the proportion of the shares before the Transfer.

2. After this Agreement takes effect, the parties shall share the profits

of the Company and the corresponding risks and losses in proportion to the equity after the Transfer.

3. Party B undertakes to Party A that: the Company does not have any

facts related to the Company’s assets or business that may have a material adverse impact on the Company’s assets or business

that Party B has not disclosed to Party A;

The Company does not provide guarantee for any person, business or

other entity. The Company does not sign any debt paying off agreements or settlement agreements or other arrangements with creditors that

may involve the interests of the Company.

If the Company is liable for compensation, payment of liability or

similar liability to any third party (including but not limited to natural person, enterprise legal person, administrative authority,

etc.) due to any behavior of the Company before the Transfer, such liability shall be fully borne by Party B, and Party A shall be compensated

for the losses arising therefrom.

III. Liability for Breach of this Agreement:

Once this Agreement comes into effect, all parties must perform voluntarily.

Any party who fails to fully perform its obligations as provided in the Agreement shall be liable for liability arising therefrom in accordance

with the law and this Agreement.

If Party B fails to perform the equity transfer obligations or go through

relevant procedures as agreed herein, it shall pay Party A penalty equal to 20% of the total transfer price, and continue to perform this

Agreement.

IV. Modification or Termination of the Agreement:

Party A and Party B may modify or terminate this Agreement upon mutual

agreement through negotiation. If the Agreement is modified or terminated through negotiation, the parties shall sign modification or

termination agreement separately.

V. Related expenses:

The relevant expenses incurred in the process of equity transfer (such

as evaluation or audit, industrial and commercial change registration, etc.) shall be borne by each party by half.

VI. Dispute Resolution Method:

Any dispute arising out of or in connection with this Agreement shall

be settled by both parties through friendly negotiation. If no agreement can be reached through negotiation, both parties agree to submit

the dispute to Hong Kong International Arbitration Center for arbitration, which shall be governed by the laws and regulations of Hong

Kong Special Administrative Region.

VII. Effective conditions:

This Agreement shall come into force upon being signed and approved

by both parties, and both parties agree to go through the equity change procedures within 15 working days.

VIII. This Agreement is made in five copies, with Party A holding

one copy and Party B holding four copies.

[Intentionally Left Blank; Signature Page Follows]

Party A – Stamp

Signature of legal representative (authorized person): /s/Siguang Peng

Party B 1(signature, stamping fingerprint): /s/ Zhijun Liu

Party B 2 (signature, stamping fingerprint): /s/ Yunning Li

Party B 3 (signature, stamping fingerprint): /s/ Manning Liao

Party B 4 (Signature, stamping finger mold): /s/ Yue Li

This Agreement is entered into by and between the parties on September

6, 2024 in Nanshan District, Shenzhen.

3

v3.24.2.u1

Cover

|

Sep. 06, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 06, 2024

|

| Entity File Number |

001-39258

|

| Entity Registrant Name |

BTC DIGITAL LTD.

|

| Entity Central Index Key |

0001796514

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

1306, 13th Floor, Xuesong Dasha Building B

|

| Entity Address, Address Line Two |

No. 52 Tairan 6th Road, Futian District

|

| Entity Address, City or Town |

Shenzhen

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

00000

|

| City Area Code |

+86

|

| Local Phone Number |

755-8255-5262

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Ordinary Shares |

|

| Title of 12(b) Security |

Ordinary Shares

|

| Trading Symbol |

BTCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Title of 12(b) Security |

Warrants

|

| Trading Symbol |

BTCTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BTCT_OrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BTCT_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

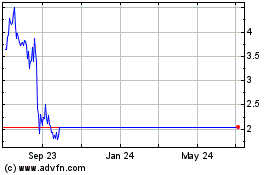

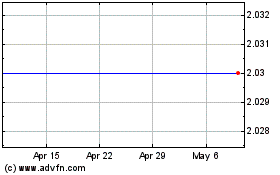

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Sep 2024 to Oct 2024

BTC Digital (NASDAQ:METX)

Historical Stock Chart

From Oct 2023 to Oct 2024