Brightcove Inc. (Nasdaq: BCOV), the global leader in video for

business, today announced financial results for the third quarter

ended September 30, 2021.

“Brightcove made progress across a number of our strategic

priorities during the third quarter, in particular on product

innovation and retention,” said Jeff Ray, Brightcove’s Chief

Executive Officer. “We continue to enhance the value proposition of

the Brightcove platform and enable our customers to improve their

business performance with video every day.”

“While our revenue and profitability performance in the quarter

were ahead of expectations, we did experience sales challenges in

certain regions," Ray continued, "We have seen success with our

go-to-market strategy in North America and have an aggressive plan

to leverage these strategies across all of our go-to-market teams.

We remain confident in Brightcove’s long-term ability to deliver

significantly faster revenue growth and higher levels of

profitability.”

Update on Executive Leadership:

Jeff Ray, Brightcove’s Chief Executive Officer, has informed the

Company’s Board of Directors that he intends to retire from

Brightcove at the end of 2022 and will step down as CEO and Board

Director when his successor is hired. Mr. Ray will continue to lead

Brightcove until that time, with a focus on executing on the

Company’s growth plans and ensuring a smooth and orderly transition

to the next CEO.

Mr. Ray commented, “I am incredibly proud of what we have

accomplished in my time at Brightcove, in particular the

significant acceleration in our product innovation and our

relentless focus on customer success. I strongly believe in the

transformational power of video and Brightcove’s unique ability to

help customers be successful with their video strategies. I am

confident we have laid the foundation for Brightcove to deliver

greater value for our customers and achieve the company’s long-term

financial targets.”

Deb Besemer, Chairperson of the Board of Brightcove, said,

“Under Jeff’s leadership, Brightcove has made significant progress

on our strategic priorities that build upon the company’s rich

history as the world’s leading online video platform. On behalf of

the Brightcove Board of Directors and all of our employees, I want

to thank Jeff for his exceptional contributions to the company. The

timing of Jeff’s retirement provides the company the time to find

the right successor and ensure a smooth and effective transition to

the next CEO.”

Third Quarter 2021 Financial Highlights:

- Revenue for the third quarter of 2021 was $52.2 million,

an increase of 6% compared to $49.1 million for the third quarter

of 2020. Subscription and support revenue was $49.2 million, an

increase of 6% compared to $46.3 million for the third quarter of

2020.

- Gross profit for the third quarter of 2021 was $33.5

million, representing a gross margin of 64% compared to a gross

profit of $31.0 million and 63% for the third quarter of 2020.

Non-GAAP gross profit for the third quarter of 2021 was $34.1

million, representing a non-GAAP gross margin of 65%, compared to a

non-GAAP gross profit of $31.5 million and 64% for the third

quarter of 2020. Non-GAAP gross profit and non-GAAP gross margin

exclude stock-based compensation expense and the amortization of

acquired intangible assets.

- Loss from operations was $233 thousand for the third

quarter of 2021, compared to an income of $1.3 million for the

third quarter of 2020. Non-GAAP operating income, which excludes

stock-based compensation expense, restructuring, the amortization

of acquired intangible assets, merger-related expense and other

(benefit) expense, was $2.9 million for the third quarter of 2021,

compared to non-GAAP operating income of $4.5 million during the

third quarter of 2020.

- Net loss was $1.0 million, or a loss of $0.02 per

diluted share, for the third quarter of 2021. This compares to a

net income of $1.3 million, or $0.03 per diluted share, for the

third quarter of 2020. Non-GAAP net income, which excludes

stock-based compensation expense, restructuring, the amortization

of acquired intangible assets, merger-related expense and other

(benefit) expense, was $2.1 million for the third quarter of 2021,

or $0.05 per diluted share, compared to non-GAAP net income of $4.6

million for the third quarter of 2020, or $0.11 per diluted

share.

- Adjusted EBITDA was $4.2 million for the third quarter

of 2021, compared to adjusted EBITDA of $5.9 million for the third

quarter of 2020. Adjusted EBITDA excludes stock-based compensation

expense, merger-related expense, other (benefit) expense,

restructuring, the amortization of acquired intangible assets,

depreciation expense, other income/expense and the provision for

income taxes.

- Cash flow provided by operations was $7.4 million for

the third quarter for 2021, compared to cash flow provided by

operations of $3.6 million for the third quarter of 2020.

- Free cash flow was $4.9 million after the company

invested $2.5 million in capital expenditures and capitalization of

internal-use software during the third quarter of 2021. Free cash

flow was $1.4 million for the third quarter of 2020.

- Cash and cash equivalents were $45.3 million as of

September 30, 2021 compared to $37.5 million on December 31,

2020.

A Reconciliation of GAAP to Non-GAAP results has been provided

in the financial statement tables included at the end of this press

release. An explanation of these measures is also included below

under the heading “Non-GAAP Financial Measures.”

Other Third Quarter and Recent Highlights:

- Average annual subscription revenue per premium customer was

$93,400 in the third quarter of 2021, excluding starter customers

who had average annualized revenue of $4,400 per customer. This

compares to $89,000 in the comparable period in 2020.

- Recurring dollar retention rate was 93% in the third quarter of

2021, within our historical target of the low to mid-90 percent

range.

- Net revenue retention rate was 95% in the third quarter of

2021.

- Ended the quarter with 3,205 customers, of which 2,265 were

premium.

- New customers and customers who expanded their relationship

during the third quarter include: Football Co, Mars Information

Services, ITV, GameStop, Funny or Die, and Nikkei Visual

Images.

- Announced the acquisition of HapYak technology from Newsela, a

leading K-12 instructional content platform, to help advance video

interactivity. With the integration of the HapYak technology,

Brightcove users can quickly and easily incorporate interactivity

into virtually any video, including clickable hotspots, quizzes,

shopping cart purchases, personalization, choose-your-own adventure

paths, and a variety of calls to action. The technology will also

enable marketers, HR, corporate training departments, and sales

teams to track viewer actions and sentiment and to personalize

customer journeys in entirely new ways.

- Announced Brightcove Marketing Studio, a new solution that

gives marketers access to easily find, use, and repurpose video

assets, which are costly to create and underutilized across

marketing teams. Brightcove Marketing Studio provides role-based

access to video assets through a team's preferred social platforms,

marketing automation, digital asset management, and content

management tools.

- Announced Brightcove CorpTV, a solution designed for companies

to think and act like media brands. Brightcove CorpTV enables

organizations to create channels similar to Netflix or Hulu that

stream content to customers and employees and other target

audiences, each with their own, audience-specific, content.

Business Outlook

Based on information as of today, October 27, 2021, the Company

is issuing the following financial guidance.

Fourth Quarter 2021:

- Revenue is expected to be in the range of $51.0 million

to $52.0 million, including approximately $2.2 million of

professional services revenue.

- Non-GAAP income from operations is expected to be in the

range of $1.0 million to $2.0 million, which excludes stock-based

compensation of approximately $2.6 million and the amortization of

acquired intangible assets of approximately $0.7 million.

- Adjusted EBITDA is expected to be in the range of $2.2

million to $3.2 million, which excludes stock-based compensation of

approximately $2.6 million, the amortization of acquired intangible

assets of approximately $0.7 million, depreciation expense of

approximately $1.2 million, and other income/expense and the

provision for income taxes of approximately $0.3 million.

- Non-GAAP net income per diluted share is expected to be

$0.02 to $0.04, which excludes stock-based compensation of

approximately $2.6 million, the amortization of acquired intangible

assets of approximately $0.7 million, and assumes approximately

41.9 million weighted-average shares outstanding.

Full Year 2021:

- Revenue is expected to be in the range of $209.5 million

to $210.5 million, including approximately $12.0 million of

professional services revenue.

- Non-GAAP income from operations is expected to be in the

range of $15.3 million to $16.3 million, which excludes stock-based

compensation of approximately $9.9 million, the amortization of

acquired intangible assets of approximately $3.0 million,

merger-related expenses of $0.3 and other (benefit) expense of

($2.0) million.

- Adjusted EBITDA is expected to be in the range of $20.5

million to $21.5 million, which excludes stock-based compensation

of approximately $9.9 million, the amortization of acquired

intangible assets of approximately $3.0 million, merger-related

expenses of $0.3, depreciation expense of approximately $5.3

million, other (benefit) expense of approximately ($2.0) million,

and other income/expense and the provision for income taxes of

approximately $1.8 million.

- Non-GAAP earnings per diluted share is expected to be

$0.32 to $0.35, which excludes stock-based compensation of

approximately $9.9 million, the amortization of acquired intangible

assets of approximately $3.0 million, merger-related expenses of

$0.3, other (benefit) expense of ($2.0) million and assumes

approximately 42.0 million weighted-average shares

outstanding.

Conference Call Information

Brightcove will host a conference call today, October 27, 2021,

at 5:00 p.m. (Eastern Time) to discuss the Company's financial

results and current business outlook. A live webcast of the call

will be available at the “Investors” page of the Company’s website,

http://investor.brightcove.com. To access the call, dial

877-407-3982 (domestic) or 201-493-6780 (international). A replay

of this conference call will be available for a limited time at

844-512-2921 (domestic) or 412-317-6671 (international). The replay

conference ID is 13723548. A replay of the webcast will also be

available for a limited time at http://investor.brightcove.com.

About Brightcove Inc. (NASDAQ: BCOV)

Brightcove creates the world’s most reliable, scalable, and

secure video technology solutions to build a greater connection

between companies and their audiences, no matter where they are or

on which devices they consume content. In more than 70 countries,

Brightcove’s intelligent video platform enables businesses to sell

to customers more effectively, media leaders to stream and monetize

content more reliably, and every organization to communicate with

team members more powerfully. With two Technology and Engineering

Emmy® Awards for innovation, uptime that consistently leads the

industry, and unmatched scalability, we continuously push the

boundaries of what video can do.

Visit www.brightcove.com. Brightcove. Video that means

business™

Forward-Looking Statements

This press release includes certain “forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements concerning our financial guidance for

the fourth fiscal quarter and full year 2021, our position to

execute on our growth strategy, and our ability to expand our

leadership position and market opportunity. These forward-looking

statements include, but are not limited to, plans, objectives,

expectations and intentions and other statements contained in this

press release that are not historical facts and statements

identified by words such as "expects," "anticipates," "intends,"

"plans," "believes," "seeks," "estimates" or words of similar

meaning. These forward-looking statements reflect our current views

about our plans, intentions, expectations, strategies and

prospects, which are based on the information currently available

to us and on assumptions we have made. Although we believe that our

plans, intentions, expectations, strategies and prospects as

reflected in or suggested by those forward-looking statements are

reasonable, we can give no assurance that the plans, intentions,

expectations or strategies will be attained or achieved.

Furthermore, actual results may differ materially from those

described in the forward-looking statements and will be affected by

a variety of risks and factors that are beyond our control

including, without limitation: the effect of the COVID-19 pandemic,

including our business operations, as well as its impact on the

general economic and financial market conditions; our ability to

retain existing customers and acquire new ones; our history of

losses; the timing and successful integration of the Ooyala

acquisition; expectations regarding the widespread adoption of

customer demand for our products; the effects of increased

competition and commoditization of services we offer, including

data delivery and storage; keeping up with the rapid technological

change required to remain competitive in our industry; our ability

to manage our growth effectively and successfully recruit

additional highly-qualified personnel; the price volatility of our

common stock; and other risks set forth under the caption "Risk

Factors" in our most recently filed Annual Report on Form 10-K. We

assume no obligation to update any forward-looking statements

contained in this document as a result of new information, future

events or otherwise.

Non-GAAP Financial Measures

Brightcove has provided in this release the non-GAAP financial

measures of non-GAAP gross profit, non-GAAP gross margin, non-GAAP

income (loss) from operations, non-GAAP net income (loss), adjusted

EBITDA and non-GAAP diluted net income (loss) per share. Brightcove

uses these non-GAAP financial measures internally in analyzing its

financial results and believes they are useful to investors, as a

supplement to GAAP measures, in evaluating Brightcove's ongoing

operational performance. Brightcove believes that the use of these

non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and trends

and in comparing its financial results with other companies in

Brightcove’s industry, many of which present similar non-GAAP

financial measures to investors. As noted, the non-GAAP financial

results discussed above of non-GAAP gross profit, non-GAAP gross

margin, non-GAAP income (loss) from operations, non-GAAP net income

(loss) and non-GAAP diluted net income (loss) per share exclude

stock-based compensation expense, amortization of acquired

intangible assets, merger-related expenses, restructuring and other

(benefit) expense. The non-GAAP financial results discussed above

of adjusted EBITDA is defined as consolidated net income (loss),

plus other income/expense, including interest expense and interest

income, the provision for income taxes, depreciation expense, the

amortization of acquired intangible assets, stock-based

compensation expense, merger-related expenses, restructuring and

other (benefit) expense. Merger-related expenses include fees

incurred in connection with an acquisition. Non-GAAP financial

measures have limitations as an analytical tool and should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. Investors are

encouraged to review the reconciliation of these non-GAAP measures

to their most directly comparable GAAP financial measures. As

previously mentioned, a reconciliation of our non-GAAP financial

measures to their most directly comparable GAAP measures has been

provided in the financial statement tables included below in this

press release. The Company’s earnings press releases containing

such non-GAAP reconciliations can be found on the Investors section

of the Company’s web site at http://www.brightcove.com.

Brightcove Inc. Condensed Consolidated Balance Sheets

(in thousands)

September 30, 2021

December 31, 2020

Assets Current assets: Cash and cash equivalents

$ 45,285

$ 37,472

Accounts receivable, net of allowance

28,138

29,305

Prepaid expenses and other current assets

20,376

18,738

Total current assets

93,799

85,515

Property and equipment, net

18,777

15,968

Operating lease right-of-use asset

5,668

8,699

Intangible assets, net

8,213

10,465

Goodwill

60,902

60,902

Other assets

6,491

5,254

Total assets

$ 193,850

$ 186,803

Liabilities and stockholders' equity Current liabilities:

Accounts payable

$ 11,007

$ 10,456

Accrued expenses

21,082

25,397

Operating lease liability

2,176

4,346

Deferred revenue

61,739

58,741

Total current liabilities

96,004

98,940

Operating lease liability, net of current portion

3,734

5,498

Other liabilities

1,536

2,763

Total liabilities

101,274

107,201

Stockholders' equity: Common stock

41

40

Additional paid-in capital

295,464

287,059

Treasury stock, at cost

(871)

(871)

Accumulated other comprehensive loss

(600)

(188)

Accumulated deficit

(201,458)

(206,438)

Total stockholders’ equity

92,576

79,602

Total liabilities and stockholders' equity

$ 193,850

$ 186,803

Brightcove Inc. Condensed Consolidated Statements of

Operations (in thousands, except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2021

2020

2021

2020

Revenue: Subscription and support revenue

$ 49,226

$ 46,338

$ 148,667

$ 136,613

Professional services and other revenue

2,937

2,746

9,785

7,050

Total revenue

52,163

49,084

158,452

143,663

Cost of revenue: (1) (2) Cost of subscription and support revenue

16,406

15,735

46,840

50,290

Cost of professional services and other revenue

2,247

2,363

8,205

6,349

Total cost of revenue

18,653

18,098

55,045

56,639

Gross profit

33,510

30,986

103,407

87,024

Operating expenses: (1) (2) Research and development

7,902

8,215

24,041

26,199

Sales and marketing

18,451

14,813

52,730

42,370

General and administrative

7,345

6,694

21,822

19,633

Merger-related

45

-

300

5,768

Other (benefit) expense

-

-

(1,965)

-

Total operating expenses

33,743

29,722

96,928

93,970

Income (loss) from operations

(233)

1,264

6,479

(6,946)

Other (expense) income, net

(319)

204

(937)

(291)

Income (loss) before income taxes

(552)

1,468

5,542

(7,237)

Provision for income taxes

468

154

562

597

Net income (loss) before income taxes

$ (1,020)

$ 1,314

$ 4,980

$ (7,834)

Net income (loss) per share—basic and diluted Basic

$ (0.02)

$ 0.03

$ 0.12

$ (0.20)

Diluted

(0.02)

0.03

0.12

(0.20)

Weighted-average shares—basic and diluted Basic

40,935

39,682

40,571

39,320

Diluted

40,935

40,646

42,238

39,320

(1) Stock-based compensation included in above line items:

Cost of subscription and support revenue

$ 157

$ 139

$ 501

$ 452

Cost of professional services and other revenue

113

63

299

233

Research and development

408

142

1,261

839

Sales and marketing

583

768

2,082

2,440

General and administrative

1,072

896

3,091

2,760

(2) Amortization of acquired intangible assets

included in the above line items: Cost of subscription and support

revenue

$ 335

$ 336

$ 1,006

$ 1,166

Sales and marketing

407

477

1,245

1,432

Brightcove Inc. Condensed Consolidated Statements of Cash

Flows (in thousands)

Nine Months Ended September

30,

Operating activities

2021

2020

Net income (loss)

$ 4,980

$ (7,834)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

6,284

6,497

Stock-based compensation

7,234

6,724

Provision for reserves on accounts receivable

246

461

Changes in assets and liabilities: Accounts receivable

710

(1,433)

Prepaid expenses and other current assets

(914)

(6,414)

Other assets

(1,273)

(1,247)

Accounts payable

79

104

Accrued expenses

(4,402)

3,410

Operating leases

(903)

(13)

Deferred revenue

2,707

8,667

Net cash provided by operating activities

14,748

8,922

Investing activities Purchases of property and

equipment, net of returns

(1,625)

(2,163)

Capitalization of internal-use software costs

(4,657)

(5,108)

Net cash used in investing activities

(6,282)

(7,271)

Financing activities Proceeds from exercise of stock

options

2,200

1,207

Deferred acquisition payments

(475)

-

Proceeds from debt

-

10,000

Debt paydown

-

(5,000)

Other financing activities

(1,375)

(448)

Net cash provided by financing activities

350

5,759

Effect of exchange rate changes on cash and cash equivalents

(1,003)

163

Net increase in cash and cash equivalents

7,813

7,573

Cash and cash equivalents at beginning of period

37,472

22,759

Cash and cash equivalents at end of period

$ 45,285

$ 30,332

Brightcove Inc. Reconciliation of GAAP Gross Profit, GAAP

Loss From Operations, GAAP Net Loss and GAAP Net Loss Per Share

to Non-GAAP Gross Profit, Non-GAAP Income From Operations,

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) Per

Share (in thousands, except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2021

2020

2021

2020

GROSS PROFIT: GAAP gross profit

$ 33,510

$ 30,986

$ 103,407

$ 87,024

Stock-based compensation expense

270

202

800

685

Amortization of acquired intangible assets

335

336

1,006

1,166

Restructuring

-

-

-

51

Non-GAAP gross profit

$ 34,115

$ 31,524

$ 105,213

$ 88,926

INCOME (LOSS) FROM OPERATIONS: GAAP income (loss) from operations

$ (233)

$ 1,264

$ 6,479

$ (6,946)

Stock-based compensation expense

2,333

2,008

7,234

6,724

Amortization of acquired intangible assets

742

813

2,251

2,598

Merger-related

45

-

300

5,768

Restructuring

-

443

-

1,711

Other (benefit) expense

-

-

(1,965)

-

Non-GAAP income from operations

$ 2,887

$ 4,528

$ 14,299

$ 9,855

NET INCOME (LOSS): GAAP net income (loss)

$ (1,020)

$ 1,314

$ 4,980

$ (7,834)

Stock-based compensation expense

2,333

2,008

7,234

6,724

Amortization of acquired intangible assets

742

813

2,251

2,598

Merger-related

45

-

300

5,768

Restructuring

-

443

-

1,711

Other (benefit) expense

-

-

(1,965)

-

Non-GAAP net income

$ 2,100

$ 4,578

$ 12,800

$ 8,967

GAAP diluted net income (loss) per share

$ (0.02)

$ 0.03

$ 0.12

$ (0.20)

Non-GAAP diluted net income per share

$ 0.05

$ 0.11

$ 0.30

$ 0.22

Shares used in computing GAAP diluted net income (loss) per

share

40,935

39,682

40,571

39,320

Shares used in computing Non-GAAP diluted net income (loss) per

share

41,736

40,646

42,238

39,971

Brightcove Inc. Calculation of Adjusted EBITDA (in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2021

2020

2021

2020

Net income (loss)

$ (1,020)

$ 1,314

$ 4,980

$ (7,834)

Other expense, net

319

(204)

937

291

Provision for income taxes

468

154

562

597

Depreciation and amortization

2,006

2,140

6,284

6,497

Stock-based compensation expense

2,333

2,008

7,234

6,724

Merger-related

45

-

300

5,768

Restructuring

-

443

-

1,711

Other (benefit) expense

-

-

(1,965)

-

Adjusted EBITDA

$ 4,151

$ 5,855

$ 18,332

$ 13,754

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211027005973/en/

Investors: ICR for Brightcove Brian Denyeau, 646-277-1251

brian.denyeau@icrinc.com

Media: Brightcove Meredith Duhaime

mduhaime@brightcove.com

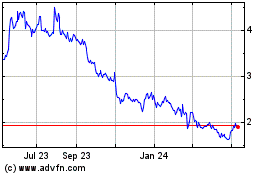

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Oct 2024 to Nov 2024

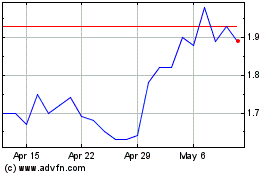

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Nov 2023 to Nov 2024