California Pizza Kitchen

Inc (CPKI), a leading casual dining restaurant chain,

reported first quarter 2011 results on May 5, 2011. Earnings per

share (EPS) in the reported quarter surpassed the Zacks Consensus

Estimate.

The recent earnings announcement,

subsequent analyst estimate revisions and the Zacks ratings for

both the short-term and the long-term are covered in depth

below.

Earnings

Review

California Pizza Kitchen posted

first quarter 2011 earnings of 9 cents per share, which were above

the Zacks Consensus Estimate of 6 cents and the company’s guided

range of 3 cents to 5 cents per share. However, reported earnings

missed the prior-year quarter earnings by a penny.

The better-than-expected results

were driven by the menu optimization program, which focuses on

higher margin menu items and cost control.

The pizza restaurant chain reported

that total revenue for the quarter plunged 0.5% year over year to

$156.0 million and was also below the Zacks Consensus Estimate of

$158.0 million.

Comparable store sales fell 2.1% in

the reported quarter, as inclement weather conditions adversely

impacted same-restaurant sales growth and restaurant operating

margin contracted 80 basis points (bps) to 16.1% due to input cost

pressure.

Read our full coverage on this

earnings report: CALIFORNIA PIZZA BEATS ESTIMATES

Earnings Estimate

Revisions: Overview

Following the first quarter

earnings release, the Zacks Consensus Estimate for the company has

been on the rise, with most of the analysts remaining bullish on

the stock. The upside in first quarter results and expectation of

better traffic trends and improvement in restaurant margin have

bolstered their confidence. The earnings estimate details are

discussed below.

Agreement of

Analysts

Analysts mostly remain optimistic

on California Pizza Kitchen. Revision trends in the last 30 days

drifted toward the positive side. For fiscal 2011, 7 out of

the 11 analysts covering the stock raised their estimates while for

fiscal 2012, 6 out of the 10 analysts increased their

estimates. Only two analysts slashed their estimates for both 2011

and 2012. The revision trend remains identical for the last 7 days

also.

Positive revisions by the analysts

are based on continous efforts made the company to plug its falling

comps by implementing several sales-building programs.

Additionally, to drive traffic, California Pizza Kitchen intends to

roll out new menu offerings in June with a new look and nine new

items.

The highlight of the menu will be

natural chicken and turkey, gluten-free pizza crust, etc. Moreover,

to drive traffic, aggressive marketing is planned particularly for

the third quarter of 2011 to support the new menu launch as well as

mitigate the drag of the thank-you card program last year, which

has historically been a significant comp driver.

The company witnessed a drop of

3.1% in comps for the month of April, mostly due to the unfavorable

impact of the Easter shift. However, California Pizza Kitchen

expects comps to be up 3% for the remaining two months of the

second quarter of 2011 aided by earlier promotion of the thank-you

card program. Management projects comparable store sales between 0%

and positive 1.0% for second quarter 2011.

The company also continues to

expand its restaurant margin by using its integrated information

system, including point-of-sale system, an inventory usage analysis

system, labor-scheduling system and theoretical food cost system.

To further enhance margin and reduce cost, the company also rolled

out a menu optimization program, which targets to eliminate 14

lower-selling and labor-intensive items from the menu, and create a

more efficient and cost-effective back-of-the-house operation.

Through this program, the company

expects to save approximately $6 million annually. Management also

plans to utilize 0.7% of pricing in the new menu to mitigate the

commodity cost inflation. To further enhance profit, California

Pizza Kitchen is currently pruning its several underperforming

units from its existing base of restaurants. Additionally,

California Pizza Kitchen’s transition to Nestle is complete with

royalties from the licensing agreement increasing 0.8% in the first

quarter.

The company also remains focused on

accelerating its growth in 2011 and 2012, through franchising in

the international market. The company’s international franchisees

expect to open a minimum of 10 restaurants in 2011.

However, for the second quarter of

2011, the analysts remain slightly negative with 5 out of the 11

analysts reducing their estimates while 4 moved in the opposite

direction.

The analysts remain cautious due to

cost inflation, which will lower the magnitude of the margin

rebound. The company expects commodities cost inflation in the

range of 3% to 3.5% for 2011, up from the previous expectation of

2.5%.

Magnitude of Estimate

Revisions

Following the release of the first

quarter results, estimates for both fiscal 2011 and 2012 have

jumped by 2 cents to 73 cents and 86 cents, respectively, over the

last 30 days. However, for the second quarter, estimates remain

unchanged at 21 cents in the last 30 days.

Our

Recommendation

California Pizza Kitchen has

implemented several sales-building programs to revive its top-line

growth and falling comparable store sales. The company also intends

to focus on operational efficiencies in order to drive restaurant

margins. The financial condition of the company is also sound with

a debt free balance sheet.

We remain cautious on the stock as

comparable store sales and traffic have slumped, given that

budget-constrained consumers are trading down to lower-priced

dining options. Moreover, the company is experiencing stiff

competition from other casual dining restaurants and cost

escalation is expected to keep margins under pressure in the

upcoming quarters.

Accordingly, we keep our

conservative view on California Pizza Kitchen shares and have a

Zacks #3 Rank (short-term Hold recommendation). Our long-term

recommendation for the stock remains at Neutral.

Apart from California Pizza

Kitchen, another stock that promises long-term growth opportunities

is BJ’s Restaurants, Inc. (BJRI), which has a

Zacks #1 Rank (short-term Buy recommendation), as the company

reported first quarter 2011 adjusted earnings of 25 cents per

share, exceeding the Zacks Consensus Estimate of 19 cents driven by

strong comparable restaurant sales growth.

About Earnings Estimate

Scorecard

Len Zacks, PhD in mathematics

from MIT, proved over 30 years ago that earnings estimate revisions

are the most powerful force impacting stock prices. He turned this

ground breaking discovery into two of the most celebrating stock

rating systems in use today. The Zacks Rank for stock trading in a

1 to 3 month time horizon and the Zacks Recommendation for

long-term investing (6+ months). These “Earnings Estimate

Scorecard” articles help analyze the important aspects of estimate

revisions for each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at http://www.zacks.com/education/.

BJ'S RESTAURANT (BJRI): Free Stock Analysis Report

CALIF PIZZA KIT (CPKI): Free Stock Analysis Report

Zacks Investment Research

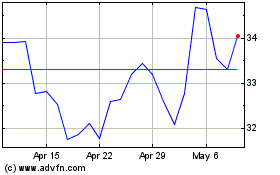

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From May 2024 to Jun 2024

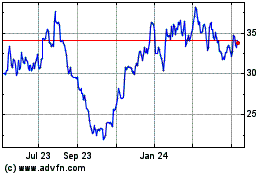

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From Jun 2023 to Jun 2024