Banner Corporation (NASDAQ:BANR), the parent company of Banner

Bank and Islanders Bank, today reported net income of $5.1 million

in the fourth quarter of 2011, compared to net income of $6.0

million in the immediately preceding quarter and a net loss of

$12.7 million in the fourth quarter a year ago. For the full year

ended December 31, 2011, Banner reported net income of $5.5 million

compared to a net loss of $61.9 million in 2010.

“Banner’s 2011 performance provided consistent evidence that we

are successfully executing on our strategies and priorities to

strengthen our franchise and deliver sustainable profitability to

Banner,” said Mark J. Grescovich, President and Chief Executive

Officer. “Our return to profitability for the last three quarters,

and now for the year, reflects significant progress on the key

objectives of those strategies: reducing the adverse effect of

non-performing assets, increasing client relationships and reducing

our cost of funds. This progress and our 2011 operating results

clearly demonstrate that our strategic turnaround plan is effective

and is building shareholder value.

“Banner’s credit quality metrics further improved during the

fourth quarter, with non-performing loans, real estate owned and

total non-performing asset levels all decreasing at year end,

leading to reduced credit costs for the current quarter and for the

full year. Also notable during the quarter was an increase in net

loans and continued growth in non-interest-bearing deposits, as we

experienced further success in acquiring new client relationships

and account balances.”

In the fourth quarter of 2011, Banner paid a $1.6 million

dividend on the $124 million of senior preferred stock it issued to

the U.S. Treasury under the Capital Purchase Program. In addition,

Banner accrued $425,000 for related discount accretion. Including

the preferred stock dividend and related accretion, net income

available to common shareholders was $0.18 per share for the fourth

quarter of 2011, compared to net income available to common

shareholders of $0.24 per share in the third quarter of 2011 and a

net loss to common shareholders of $0.91 per share for the fourth

quarter a year ago. For the year ended December 31, 2011, the net

loss to common shareholders, including the preferred stock dividend

and related accretion, was $0.15 per share, compared to a net loss

of $7.21 per share for the year ended December 31, 2010.

Credit Quality

“Credit costs continue to decline and were significantly below

those of a year ago as our special asset teams continued to make

meaningful progress at reducing problem assets,” said Grescovich.

“Charge-offs and delinquencies as well as real estate owned

expenses and valuation adjustments continued to be concentrated in

loans for the construction of single-family homes and residential

land development projects. However, our exposure to one- to

four-family residential construction and land development loans has

continued to decline and at the end of December 31, 2011 had been

reduced to 7.3% of our loan portfolio. Importantly, strong sales

activity reduced our portfolio of real estate owned through

foreclosure by $23.5 million during the fourth quarter, resulting

in a net decrease of $57.9 million during 2011. We are encouraged

by the recent pace of problem asset resolution as well as the

significant reduction in non-performing assets over the last year

and remain diligent in our efforts to further improve our risk

profile.”

Banner recorded a $5.0 million provision for loan losses in the

fourth quarter of 2011, equal to the provision in the preceding

quarter and reduced substantially from $20.0 million in the fourth

quarter a year ago. The allowance for loan losses at December 31,

2011 totaled $82.9 million, representing 2.52% of total loans

outstanding and 110% of non-performing loans. Non-performing loans

decreased to $75.3 million at December 31, 2011, compared to $151.5

million at December 31, 2010 and $83.1 million at September 30,

2011.

Banner’s real estate owned and repossessed assets decreased to

$43.0 million at December 31, 2011, compared to $100.9 million a

year earlier and $66.5 million three months earlier. Net

charge-offs in the fourth quarter of 2011 totaled $8.2 million, or

0.25% of average loans outstanding, compared to $10.9 million, or

0.33% of average loans outstanding for the third quarter of 2011

and $19.0 million, or 0.55% of average loans outstanding, for the

fourth quarter a year ago. For all of 2011, net charge-offs were

$49.5 million, compared to $67.9 million in 2010.

Non-performing assets decreased to $118.9 million at December

31, 2011, compared to $151.6 million at September 30, 2011 and

$254.3 million at December 31, 2010. At December 31, 2011, Banner’s

non-performing assets were 2.79% of total assets, compared to 3.53%

at the end of the September 2011 and 5.77% a year ago.

One- to four-family residential construction, land and land

development loans were $241.7 million, or 7.3% of the total loan

portfolio at December 31, 2011, compared to $321.1 million, or 9.4%

of the total loan portfolio a year earlier. The geographic

distribution of these residential construction, land and land

development loans was approximately $80.0 million, or 33%, in the

greater Puget Sound market, $109.9 million, or 45%, in the greater

Portland, Oregon market and $4.9 million, or 2%, in the greater

Boise, Idaho market as of December 31, 2011. The remaining $46.9

million, or 20%, was distributed in the various eastern Washington,

eastern Oregon and northern Idaho markets served by Banner

Bank.

Income Statement Review

“The realignment of our delivery platforms and execution by our

sales teams, as well as further maturing of our expanded branch

system along with a targeted marketing campaign, have allowed

Banner Bank to add client relationships and increase core deposits.

That core deposit growth has enabled us to significantly reduce our

cost of funds during the year through changes in our deposit mix

and pricing strategies and has supported increased deposit fees

despite the adverse impact of regulatory changes on overdraft

revenues. The reduced cost of funds coupled with changes in our

asset mix made it possible for us to maintain a strong net interest

margin in recent quarters and to increase it by 26 basis points

compared to the fourth quarter a year ago, despite continued

downward pressure on asset yields,” said Grescovich. Banner’s net

interest margin was 4.07% in the fourth quarter of 2011, compared

to 4.10% in the preceding quarter and 3.81% in the fourth quarter a

year ago. For the year 2011, Banner’s net interest margin was

4.05%, a 38 basis point improvement compared to 3.67% for 2010.

Deposit costs decreased by 11 basis points compared to the

preceding quarter and 44 basis points compared to the fourth

quarter a year earlier. Funding costs for the fourth quarter of

2011 decreased 10 basis points compared to the previous quarter and

41 basis points from the fourth quarter a year ago. Asset yields

decreased 13 basis points compared to the prior quarter and

decreased 14 basis points from the fourth quarter a year ago. Loan

yields remained unchanged from the preceding quarter and decreased

14 basis points from the fourth quarter a year ago. Nonaccruing

loans reduced the margin by approximately 14 basis points in the

fourth quarter of 2011 compared to approximately 21 basis points in

the preceding quarter and approximately 33 basis points in the

fourth quarter of 2010.

“The continued growth in core deposits and reduced drag from

non-performing assets over the past year have led to a solid

increase in our revenues from core operations compared to a year

earlier,” said Grescovich. Net interest income, before the

provision for loan losses, was $41.6 million in the fourth quarter

of 2011, compared to $41.7 million in the preceding quarter and

$40.8 million in the fourth quarter a year ago. For the year 2011,

net interest income, before the provision for loan losses,

increased 4% to $164.6 million, compared to $157.8 million for

2010. Revenues from core operations* (net interest income before

the provision for loan losses plus total other operating income

excluding fair value and other-than-temporary impairment (OTTI)

adjustments) was $50.5 million in the fourth quarter of 2011,

compared to $50.1 million in the third quarter of 2011 and $49.0

million in the fourth quarter a year ago. For the year, revenues

from core operations increased 4% to $196.2 million, compared to

$189.4 million a year earlier.

Banner’s fourth quarter 2011 results included a net loss of $1.8

million for fair value adjustments as a result of changes in the

valuation of financial instruments carried at fair value. In the

immediately preceding quarter, Banner’s results included a net

recovery of $3.0 million of principal and $881,000 of interest as a

result of the full cash repayment of a security that had been

written off a year earlier as an OTTI charge. That recovery was

partially offset by a net loss of $1.0 million for fair value

adjustments in the third quarter. In the fourth quarter of 2010,

Banner recorded a net loss of $706,000 for fair value

adjustments.

Total other operating income, which includes the above-mentioned

changes in the valuation of financial instruments and OTTI

adjustments, was $7.2 million in the fourth quarter of 2011

compared to $10.3 million in the preceding quarter and $7.6 million

in the fourth quarter a year ago. For the year 2011, total other

operating income was $34.0 million, compared to $29.1 million for

2010. In addition to net fair value adjustments, the third quarter

of 2011 and the full year 2011 included a $3.0 million recovery of

a prior-period OTTI charge, while the third quarter of 2010 and the

full year 2010 included net OTTI charges of $3.0 million and $4.2

million, respectively. Other operating income from core operations*

(total other operating income, excluding fair value and OTTI

adjustments) for the current quarter was $8.9 million, compared to

$8.4 million for the preceding quarter and $8.3 million for the

fourth quarter a year ago. For the year 2011, other operating

income from core operations* was $31.6 million, the same as in

2010, as lower revenues from mortgage banking operations were

offset by increased deposit fees and other income items.

Deposit fees and other service charges were $5.9 million in the

fourth quarter of 2011 compared to $6.1 million in the preceding

quarter and $5.5 million in the fourth quarter a year ago. Income

from mortgage banking operations increased to $1.9 million in the

fourth quarter of 2011, compared to $1.4 million in the immediately

preceding quarter, but was lower than the $2.1 million recorded in

the fourth quarter of 2010. For the year 2011, deposit fees were

$23.0 million and mortgage banking revenues were $5.2 million

compared to $22.0 million and $6.4 million, respectively, for the

year 2010.

“Operating expenses declined for both the fourth quarter and the

full year compared to the respective periods a year ago, largely

due to lower costs associated with the real estate owned portfolio,

particularly valuation adjustments,” said Grescovich. “While we

expect collection expenses and costs associated with real estate

owned to remain elevated in the near term, these credit costs

should continue to decline as further problem asset resolution

occurs.”

Total other operating expenses, or non-interest expenses, were

$38.7 million in the fourth quarter of 2011, compared to $41.0

million in both the preceding quarter and in the fourth quarter of

2010. For the year 2011, total other operating expenses decreased

2% to $158.1 million compared to $160.8 million for 2010, largely

as a result of decreased costs related to real estate owned and

FDIC deposit insurance which were partially offset by increased

compensation-related expenses.

* Earnings information excluding fair value and OTTI adjustments

(alternately referred to as other operating income from core

operations or revenues from core operations) represent non-GAAP

(Generally Accepted Accounting Principles) financial measures.

Management has presented these non-GAAP financial measures in this

earnings release because it believes that they provide useful and

comparative information to assess trends in the Company’s core

operations reflected in the current quarter’s results. Where

applicable, the Company has also presented comparable earnings

information using GAAP financial measures.

Balance Sheet Review

“We increased net loan balances by $74.3 million during the

quarter, primarily in the commercial real estate and commercial

business portfolios, as our production levels for targeted loans

remained encouraging. Further, the calling efforts and

responsiveness of our local bankers are resulting in a consistent

pipeline of lending opportunities. While we expect a continued

challenging economic environment, we believe that these well

focused marketing efforts will allow us to capitalize on additional

lending opportunities going forward,” said Grescovich.

Net loans increased $74.3 million during the quarter to $3.21

billion at December 31, 2011, compared to $3.14 billion at

September 30, 2011. Net loans were $3.31 billion a year ago.

Commercial and agricultural business loans increased to $819.6

million at December 31, 2011 compared to $792.4 million at

September 30, 2011, and $790.4 million a year ago. Commercial and

multi-family real estate loans were $1.23 billion at December 31,

2011, reflecting a modest increase from $1.20 billion at both

September 30, 2011 and a year earlier.

The combined total of securities at fair value, available for

sale and held to maturity, increased to $622.0 million at December

31, 2011 compared to $548.4 million at September 30, 2011 and

$367.7 million at December 31, 2010. However, the aggregate total

of securities and interest-bearing deposits decreased to $691.7

million at December 31, 2011 compared to $783.2 million at

September 30, 2011 and was nearly unchanged compared to $689.6

million at December 31, 2010. The increase in the securities

holdings reflects a modest extension of the expected duration of

this aggregate total designed to increase the yield relative to

interest-bearing deposits. The securities purchased in recent

periods were primarily short- to intermediate-term U.S. Government

Agency notes and mortgage-backed securities.

Total assets were $4.26 billion at December 31, 2011, compared

to $4.29 billion at the end of the preceding quarter and $4.41

billion a year ago. Deposits totaled $3.48 billion at December 31,

2011, compared to $3.54 billion at September 30, 2011 and $3.59

billion a year ago. Non-interest-bearing accounts increased 29% to

$777.6 million at December 31, 2011, compared to $600.5 million a

year ago. At September 30, 2011, non-interest-bearing accounts

totaled $763.0 million. Interest-bearing transaction and savings

accounts were $1.45 billion at December 31, 2011, compared to $1.46

billion at September 30, 2011 and $1.43 billion at December 31,

2010.

“The improvement in our deposit mix helped lower our funding

costs by reducing our reliance on higher cost certificates of

deposit, increasing new client relationships and improving our core

funding position. To that point, our non-interest-bearing deposits

increased 29% from a year ago and 100% of this organic growth was

from our existing branch network,” said Grescovich

At December 31, 2011, total stockholders’ equity was $532.5

million, including $120.7 million attributable to preferred stock,

and common stockholders’ equity was $411.7 million, or $23.50 per

share. During 2010, Banner completed a common stock offering,

issuing a total of 85,639,000 shares in the offering, resulting in

net proceeds of approximately $161.6 million. In May 2011, Banner

announced a 1-for-7 reverse stock split, which took effect on June

1, 2011. Every seven shares of Banner’s pre-split common shares

were automatically consolidated into one post-split share. Taking

the reverse stock split into account, Banner had 17.6 million

shares outstanding at December 31, 2011, compared to 16.2 million

shares outstanding a year ago. Tangible common stockholders’

equity, which excludes preferred stock and other intangibles, was

$405.4 million at December 31, 2011, or 9.54% of tangible assets,

compared to $394.3 million, or 9.20% of tangible assets at

September 30, 2011 and $383.9 million, or 8.73% of tangible assets

a year ago. Tangible book value per common share was $23.14 at

December 31, 2011.

Augmented by the stock offering and continued sales of common

stock under its Dividend Reinvestment and Direct Stock Purchase and

Sale Plan (DRIP), Banner Corporation and its subsidiary banks

continue to maintain capital levels significantly in excess of the

requirements to be categorized as “well-capitalized” under

applicable regulatory standards. Banner Corporation used a

significant portion of the net proceeds from last year’s offering

to strengthen Banner Bank’s regulatory capital ratios while

retaining the balance for general working capital purposes,

including additional capital investments in its subsidiary banks if

appropriate. Through December 31, 2011, Banner Corporation had

invested $110.0 million of the net proceeds as additional paid-in

common equity in Banner Bank, although no additional equity

investment was made during the current year. Banner Corporation’s

Tier 1 leverage capital to average assets ratio was 13.44% and its

total capital to risk-weighted assets ratio was 18.07% at December

31, 2011. Banner Bank’s Tier 1 leverage ratio was 11.71 % at

December 31, 2011, which is in excess of the 10% minimum level

targeted in its Memorandum of Understanding with the Federal

Deposit Insurance Corporation (FDIC) and the Washington State

Department of Financial Institutions (Washington DFI).

Conference Call

Banner will host a conference call on Thursday, January 26,

2012, at 8:00 a.m. PST, to discuss its fourth quarter and year end

results. The conference call can be accessed live by telephone at

(480) 629-9770 to participate in the call. To listen to the call

online, go to the Company’s website at www.bannerbank.com. A replay

will be available for a week at (303) 590-3030, using access code

4503316.

About the Company

Banner Corporation is a $4.26 billion bank holding company

operating two commercial banks in Washington, Oregon and Idaho.

Banner serves the Pacific Northwest region with a full range of

deposit services and business, commercial real estate,

construction, residential, agricultural and consumer loans. Visit

Banner Bank on the Web at www.bannerbank.com.

This press release contains statements that the Company believes

are “forward-looking statements.” These statements relate to the

Company’s financial condition, results of operations, plans,

objectives, future performance or business. You should not place

undue reliance on these statements, as they are subject to risks

and uncertainties. When considering these forward-looking

statements, you should keep in mind these risks and uncertainties,

as well as any cautionary statements the Company may make.

Moreover, you should treat these statements as speaking only as of

the date they are made and based only on information then actually

known to the Company. There are a number of important factors that

could cause future results to differ materially from historical

performance and these forward-looking statements. Factors which

could cause actual results to differ materially include, but are

not limited to, the credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in our allowance for loan losses and provision for loan

losses that may be impacted by deterioration in the housing and

commercial real estate markets and may lead to increased losses and

non-performing assets and may result in our allowance for loan

losses not being adequate to cover actual losses; changes in

general economic conditions, either nationally or in our market

areas; changes in the levels of general interest rates and the

relative differences between short and long-term interest rates,

loan and deposit interest rates, our net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in our market areas; secondary market conditions for

loans and our ability to sell loans in the secondary market;

results of examinations of us by the Board of Governors of the

Federal Reserve System and of our bank subsidiaries by the FDIC,

the Washington DFI or other regulatory authorities, including the

possibility that any such regulatory authority may, among other

things, institute a formal or informal enforcement action against

us or any of the Banks which could require us to increase our

reserve for loan losses, write-down assets, change our regulatory

capital position or affect our ability to borrow funds or maintain

or increase deposits, which could adversely affect our liquidity

and earnings; our compliance with regulatory enforcement actions;

the requirements and restrictions that have been imposed upon

Banner Corporation and Banner Bank under the memoranda of

understanding with the Federal Reserve Bank of San Francisco (in

the case of Banner Corporation) and the FDIC and the Washington DFI

(in the case of Banner Bank) and the possibility that Banner

Corporation and Banner Bank will be unable to fully comply with the

memoranda of understanding, which could result in the imposition of

additional requirements or restrictions; legislative or regulatory

changes that adversely affect our business including changes in

regulatory policies and principles, or the interpretation of

regulatory capital or other rules; our ability to attract and

retain deposits; increases in premiums for deposit insurance; our

ability to control operating costs and expenses; the use of

estimates in determining fair value of certain of our assets and

liabilities, which estimates may prove to be incorrect and result

in significant changes in valuations; staffing fluctuations in

response to product demand or the implementation of corporate

strategies that affect our workforce and potential associated

charges; the failure or security breach of computer systems on

which we depend; our ability to retain key members of our senior

management team; costs and effects of litigation, including

settlements and judgments; our ability to implement our business

strategies; our ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel we may

acquire into our operations and our ability to realize related

revenue synergies and cost savings within expected time frames and

any goodwill charges related thereto; our ability to manage loan

delinquency rates; increased competitive pressures among financial

services companies; changes in consumer spending, borrowing and

savings habits; the availability of resources to address changes in

laws, rules, or regulations or to respond to regulatory actions;

our ability to pay dividends on our common and preferred stock and

interest or principal payments on our junior subordinated

debentures; adverse changes in the securities markets; inability of

key third-party providers to perform their obligations to us;

changes in accounting policies and practices, as may be adopted by

the financial institution regulatory agencies or the Financial

Accounting Standards Board including additional guidance and

interpretation on accounting issues and details of the

implementation of new accounting methods; the economic impact of

war or terrorist activities; other economic, competitive,

governmental, regulatory, and technological factors affecting our

operations, pricing, products and services; future legislative

changes in the United States Department of Treasury Troubled Asset

Relief Program Capital Purchase Program; and other risks detailed

in Banner Corporation’s reports filed with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for

the year ended December 31, 2010. We do not undertake and

specifically disclaim any obligation to revise any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements. These risks could cause our actual results for 2012 and

beyond to differ materially from those expressed in any

forward-looking statements by, or on behalf of, us, and could

negatively affect our operating and stock price performance.

RESULTS OF

OPERATIONS

Quarters Ended

Twelve Months Ended

(in thousands except shares and per share data)

Dec 31, 2011

Sep 30, 2011 Dec 31, 2010 Dec 31, 2011 Dec

31, 2010 INTEREST INCOME: Loans receivable

$ 45,115

$ 45,641

$ 49,390

$ 184,357

$ 205,784 Mortgage-backed securities 922 799 902 3,455 4,045

Securities and cash equivalents 2,414 3,121 1,936

9,751 8,253 48,451 49,561 52,228 197,563

218,082

INTEREST EXPENSE: Deposits 5,169 6,169 9,521

26,164 52,320 Federal Home Loan Bank advances 64 64 314 370 1,318

Other borrowings 559 559 584 2,265 2,448 Junior subordinated

debentures 1,073 1,041 1,052 4,193

4,226 6,865 7,833 11,471 32,992

60,312 Net interest income before provision for loan losses

41,586 41,728 40,757 164,571 157,770

PROVISION FOR LOAN

LOSSES 5,000 5,000 20,000 35,000

70,000 Net interest income 36,586 36,728 20,757 129,571

87,770

OTHER OPERATING INCOME: Deposit fees and other

service charges 5,894 6,096 5,515 22,962 22,009 Mortgage banking

operations 1,936 1,401 2,086 5,154 6,370 Loan servicing fees 136

289 177 1,078 951 Miscellaneous 972 586 514

2,420 2,302 8,938 8,372 8,292 31,614 31,632

Other-than-temporary impairment recovery (loss) - - 3,000 - - 3,000

(4,231 ) Net change in valuation of financial instruments carried

at fair value (1,787 ) (1,032 ) (706 ) (624 ) 1,747 Total

other operating income 7,151 10,340 7,586 33,990 29,148

OTHER OPERATING EXPENSE: Salary and employee benefits 18,730

18,226 17,045 72,499 67,490 Less capitalized loan origination costs

(2,404 ) (1,929 ) (2,123 ) (8,001 ) (7,199 ) Occupancy and

equipment 5,379 5,352 5,501 21,561 22,232 Information / computer

data services 1,388 1,547 1,531 6,023 6,132 Payment and card

processing services 2,156 2,132 1,942 7,874 7,067 Professional

services 1,210 1,950 1,740 6,017 6,401 Advertising and marketing

2,036 1,602 1,740 7,281 7,457 Deposit insurance 1,367 1,299 1,999

6,024 8,622 State/municipal business and use taxes 562 553 616

2,153 2,259 Real estate operations 4,365 6,698 7,044 22,262 26,025

Amortization of core deposit intangibles 555 554 600 2,276 2,459

Miscellaneous 3,323 3,054 3,399 12,135

11,856 Total other operating expense 38,667 41,038

41,034 158,104 160,801 Income (loss)

before provision for (benefit from) income taxes 5,070 6,030

(12,691 ) 5,457 (43,883 )

PROVISION FOR (BENEFIT FROM )

INCOME TAXES - - - - - - - - 18,013

NET INCOME (LOSS) 5,070 6,030

(12,691 ) 5,457 (61,896 )

PREFERRED STOCK DIVIDEND

AND DISCOUNT ACCRETION: Preferred stock dividend 1,550 1,550

1,550 6,200 6,200 Preferred stock discount accretion 425 425

398 1,701 1,593

NET INCOME

(LOSS) AVAILABLE TO COMMON SHAREHOLDERS $ 3,095

$ 4,055

$ (14,639 )

$ (2,444 )

$

(69,689 ) Earnings (loss) per share available to common

shareholder Basic

$ 0.18

$ 0.24

$ (0.91 )

$ (0.15 )

$ (7.21 ) Diluted

$ 0.18

$

0.24

$ (0.91 )

$ (0.15 )

$ (7.21 )

Cumulative dividends declared per common share

$ 0.01

$ 0.01

$ 0.07

$ 0.10

$ 0.28

Weighted average common shares outstanding Basic 17,269,269

16,808,589 16,008,467 16,724,113 9,664,906 Diluted 17,298,004

16,837,324 16,008,467 16,752,848 9,664,906 Common shares

issued in connection with exercise of stock options or DRIP 522,223

346,489 241,653 1,375,185 836,989

FINANCIAL

CONDITION

(in thousands except shares and per share data)

Dec 31, 2011

Sep 30, 2011 Dec 31, 2010

ASSETS

Cash and due from banks

$ 62,678

$ 53,503

$

39,756 Federal funds and interest-bearing deposits 69,758 234,824

321,896 Securities - at fair value 80,727 85,419 95,379 Securities

- available for sale 465,795 383,670 200,227 Securities - held to

maturity 75,438 79,289 72,087 Federal Home Loan Bank stock 37,371

37,371 37,371 Loans receivable: Held for sale 3,007 2,003 3,492

Held for portfolio 3,293,331 3,223,243 3,399,625 Allowance for loan

losses (82,912 ) (86,128 ) (97,401 ) 3,213,426 3,139,118 3,305,716

Accrued interest receivable 15,570 16,101 15,927 Real estate owned

held for sale, net 42,965 66,459 100,872 Property and equipment,

net 91,435 92,454 96,502 Other intangibles, net 6,331 6,887 8,609

Bank-owned life insurance 58,563 58,058 56,653 Other assets 37,255

38,611 55,087

$ 4,257,312

$ 4,291,764

$ 4,406,082

LIABILITIES

Deposits: Non-interest-bearing

$ 777,563

$ 763,008

$ 600,457 Interest-bearing transaction and savings accounts

1,447,594 1,461,383 1,433,248 Interest-bearing certificates

1,250,497 1,313,043 1,557,493 3,475,654

3,537,434 3,591,198 Advances from Federal Home Loan Bank at

fair value 10,533 10,572 43,523 Customer repurchase agreements and

other borrowings 152,128 139,704 175,813 Junior subordinated

debentures at fair value 49,988 48,770 48,425 Accrued

expenses and other liabilities

23,253

19,593 21,048 Deferred compensation

13,306

14,200 14,603 3,724,862 3,770,273 3,894,610

STOCKHOLDERS'

EQUITY

Preferred stock - Series A 120,702 120,276 119,000 Common stock

531,149 523,284 509,457 Retained earnings (accumulated deficit)

(119,465 ) (122,384 ) (115,348 ) Other components of stockholders'

equity 64 315 (1,637 ) 532,450 521,491

511,472

$ 4,257,312

$ 4,291,764

$ 4,406,082

Common Shares Issued: Shares

outstanding at end of period 17,553,472 17,031,249 16,164,781 Less

unearned ESOP shares at end of period 34,340 34,340

34,340 Shares outstanding at end of period excluding

unearned ESOP shares 17,519,132 16,996,909 16,130,441

Common stockholders' equity per share

(1) $

23.50

$ 23.61

$ 24.33 Common stockholders' tangible

equity per share

(1) (2) $ 23.14

$ 23.20

$ 23.80 Common stockholders' tangible equity to

tangible assets

(2) 9.54 % 9.20 % 8.73 % Consolidated Tier 1

leverage capital ratio 13.44 % 13.19 % 12.24 %

(1) - Calculation is based on

number of common shares outstanding at the end of the period rather

than weighted average shares outstanding and excludes unallocated

shares in the ESOP.

(2) - Common stockholders' tangible

equity excludes preferred stock, core deposit and other

intangibles. Tangible assets excludes other intangible assets.

These ratios represent non-GAAP financial measures.

ADDITIONAL FINANCIAL

INFORMATION (dollars in thousands)

Dec 31,

2011 Sep 30, 2011 Dec 31, 2010

LOANS (including

loans held for sale):

Commercial real estate Owner occupied

$ 469,806

$

474,863

$ 515,093

Investment properties 621,622 586,652 550,610 Multifamily real

estate 139,710 134,146 134,634 Commercial construction 42,391

38,124 62,707 Multifamily construction 19,436 16,335 27,394 One- to

four-family construction 144,177 145,776 153,383 Land and land

development Residential 97,491 96,875 167,764 Commercial 15,197

19,173 32,386 Commercial business 601,440 580,876 585,457

Agricultural business including secured by farmland 218,171 211,571

204,968 One- to four-family real estate 642,501 639,909 682,924

Consumer 103,347 98,794 99,761 Consumer secured by one- to

four-family real estate 181,049 182,152 186,036

Total loans outstanding

$ 3,296,338

$ 3,225,246

$ 3,403,117

Restructured loans performing under their restructured terms

$ 54,533

$ 51,990

$ 60,115

Loans 30 - 89 days past due and on accrual

$ 9,962

$ 7,895

$ 28,847

Total delinquent loans (including loans on non-accrual)

$ 85,274

$ 91,044

$ 180,336

Total delinquent loans / Total loans outstanding 2.59 % 2.82

% 5.30 %

GEOGRAPHIC CONCENTRATION OF LOANS

AT

December 31, 2011

Washington Oregon Idaho Other

Total Commercial real estate Owner occupied

$

352,965

$ 62,354

$ 51,321

$ 3,166

$

469,806 Investment properties 478,798 94,855 42,736 5,233 621,622

Multifamily real estate 121,699 9,344 8,260 407 139,710 Commercial

construction 24,386 2,255 15,750 - - 42,391 Multifamily

construction 19,436 - - - - - - 19,436 One- to four-family

construction 79,294 63,058 1,825 - - 144,177 Land and land

development Residential 49,611 43,382 4,498 - - 97,491 Commercial

12,874 890 1,433 - - 15,197 Commercial business 392,390 81,984

66,156 60,910 601,440 Agricultural business including secured by

farmland 106,212 49,721 62,210 28 218,171 One- to four-family real

estate 399,566 213,782 26,901 2,252 642,501 Consumer 72,349 25,871

5,127 - - 103,347 Consumer secured by one- to four-family real

estate 126,507 42,412 11,631 499

181,049 Total loans outstanding

$ 2,236,087

$ 689,908

$ 297,848

$

72,495

$ 3,296,338 Percent of total

loans 67.8 % 20.9 % 9.0 % 2.3 % 100.0 %

DETAIL OF

LAND AND LAND DEVELOPMENT LOANS AT December 31,

2011 Washington Oregon Idaho Other

Total Residential Acquisition & development

$ 13,200

$ 17,343

$ 3,607

$ - -

$ 34,150 Improved lots 22,651 23,055 408 - - 46,114

Unimproved land 13,760 2,984 483 - -

17,227 Total residential land and development

$ 49,611

$ 43,382

$ 4,498

$ - -

$ 97,491 Commercial &

industrial Acquisition & development

$ 2,557

$ -

-

$ 481

$ - -

$ 3,038 Improved land 5,892 - -

191 - - 6,083 Unimproved land 4,425 890 761 -

- 6,076 Total commercial land and development

$ 12,874

$ 890

$ 1,433

$ - -

$ 15,197

ADDITIONAL FINANCIAL

INFORMATION (dollars in thousands)

Quarters

Ended

Twelve Months Ended

CHANGE IN THE Dec 31, 2011 Sep 30, 2011 Dec

31, 2010 Dec 31, 2011 Dec 31, 2010

ALLOWANCE FOR

LOAN LOSSES

Balance, beginning of period

$ 86,128

$ 92,000

$ 96,435

$ 97,401

$ 95,269 Provision

5,000 5,000 20,000 35,000 70,000 Recoveries of loans

previously charged off: Commercial real estate 37 1 - - 53 - -

Multifamily real estate - - - - - - - - - - Construction and land

762 89 112 1,602 897 One- to four-family real estate 241 34 11 356

136 Commercial business 511 414 776 1,082 2,865 Agricultural

business, including secured by farmland 5 10 36 20 45 Consumer 73

69 79 304 284 1,629 617 1,014

3,417 4,227 Loans charged off: Commercial real estate (1,575 )

(1,644 ) (1,575 ) (6,079 ) (1,668 ) Multifamily real estate (11 ) -

- - - (682 ) - - Construction and land (3,269 ) (6,445 ) (11,811 )

(26,328 ) (43,592 ) One- to four-family real estate (3,324 ) (2,483

) (2,483 ) (9,910 ) (7,860 ) Commercial business (1,172 ) (863 )

(3,211 ) (8,396 ) (15,244 ) Agricultural business, including

secured by farmland (188 ) - - (460 ) (477 ) (1,940 ) Consumer (306

) (54 ) (508 ) (1,034 ) (1,791 ) (9,845 ) (11,489 ) (20,048 )

(52,906 ) (72,095 ) Net charge-offs (8,216 ) (10,872 ) (19,034 )

(49,489 ) (67,868 ) Balance, end of period

$ 82,912

$ 86,128

$ 97,401

$

82,912

$ 97,401 Net charge-offs /

Average loans outstanding 0.25 % 0.33 % 0.55 % 1.50 % 1.88 %

ALLOCATION OF

ALLOWANCE FOR

LOAN LOSSES

Dec 31, 2011 Sep 30, 2011 Dec 31, 2010

Specific or allocated loss allowance Commercial real estate

$ 16,457

$ 14,217

$ 11,779

Multifamily real estate 3,952 2,958 3,963 Construction and land

18,184 22,683 33,121 Commercial business 15,159 16,894 24,545

Agricultural business, including secured by farmland 1,548 1,257

1,846 One- to four-family real estate 12,299 11,249 5,829 Consumer

1,253 1,277 1,794 Total allocated

68,852 70,535 82,877 Estimated allowance for undisbursed

commitments 678 508 1,426 Unallocated 13,382 15,085

13,098 Total allowance for loan losses

$

82,912

$ 86,128

$ 97,401

Allowance for loan losses / Total loans outstanding 2.52 %

2.67 % 2.86 % Allowance for loan losses / Non-performing

loans 110 % 104 % 64 %

ADDITIONAL FINANCIAL

INFORMATION (dollars in thousands)

Dec

31, 2011 Sep 30, 2011 Dec 31, 2010

NON-PERFORMING

ASSETS

Loans on non-accrual status Secured by real estate:

Commercial

$ 9,226

$ 8,908

$ 24,727

Multifamily 362 - - 1,889 Construction and land 27,731 35,841

75,734 One- to four-family 17,408 15,274 16,869 Commercial business

13,460 15,754 21,100 Agricultural business, including secured by

farmland 1,896 1,301 5,853 Consumer 2,905 4,232 2,332

72,988 81,310 148,504 Loans more than 90 days

delinquent, still on accrual Secured by real estate: Commercial - -

- - - - Multifamily - - - - - - Construction and land - - - - - -

One- to four-family 2,147 1,111 2,955 Commercial business 4 687 - -

Agricultural business, including secured by farmland - - - - - -

Consumer 173 41 30 2,324 1,839 2,985

Total non-performing loans 75,312 83,149 151,489

Securities on non-accrual 500 1,942 1,896 Real estate owned (REO)

and repossessed assets 43,039 66,538 100,945

Total non-performing assets

$ 118,851

$

151,629

$ 254,330

Total non-performing assets / Total assets 2.79 % 3.53 %

5.77 %

DETAIL & GEOGRAPHIC CONCENTRATION OF

NON-PERFORMING ASSETS AT December 31,

2011 Washington Oregon Idaho

Other Total Secured by real estate: Commercial

$ 8,723

$ 368

$ 135

$ - -

$

9,226 Multifamily 362 - - - - - - 362 Construction and land One- to

four-family construction 4,039 2,278 306 - - 6,623 Commercial

construction 949 - - - - - - 949 Multifamily construction - - - - -

- - - - - Residential land acquisition & development 6,668

3,709 1,592 - - 11,969 Residential land improved lots 1,563 3,352

73 - - 4,988 Residential land unimproved 702 916 485 - - 2,103

Commercial land acquisition & development 308 - - - - - - 308

Commercial land improved 454 - - - - - - 454 Commercial land

unimproved 337 - - - - - - 337 Total

construction and land 15,020 10,255 2,456 - - 27,731 One- to

four-family 14,830 3,376 1,349 - - 19,555 Commercial business

12,627 113 724 - - 13,464 Agricultural business, including secured

by farmland 1,486 - - 410 - - 1,896 Consumer 2,441 131 506 - -

3,078 Total non-performing loans

55,489 14,243 5,580 - - 75,312 Securities on non-accrual - - - -

500 - - 500 Real estate owned (REO) and repossessed assets 18,380

17,967 6,692 - - 43,039 Total

non-performing assets at end of the period

$ 73,869

$ 32,210

$ 12,772

$ - -

$

118,851

ADDITIONAL FINANCIAL

INFORMATION (dollars in thousands)

Quarters Ended

Twelve Months Ended

REAL ESTATE

OWNED

Dec 31, 2011 Dec 31, 2010 Dec 31, 2011 Dec

31, 2010 Balance, beginning of period

$ 66,459

$ 107,159

$ 100,872

$ 77,743 Additions from

loan foreclosures 7,482 16,855 53,197 87,761 Additions from

capitalized costs 150 1,650 4,404 4,006 Dispositions of REO (28,299

) (19,095 ) (99,070 ) (51,651 ) Gain (loss) on sale of REO (170 )

(524 ) (1,374 ) (1,891 ) Valuation adjustments in the period (2,657

) (5,173 ) (15,064 ) (15,096 ) Balance, end of period

$ 42,965

$ 100,872

$ 42,965

$ 100,872

Quarters Ended

REAL ESTATE OWNED

- FIVE COMPARATIVE QUARTERS

Dec 31, 2011 Sep 30, 2011 Jun 30, 2011 Mar

31, 2011 Dec 31, 2010 Balance, beginning of

period

$ 66,459

$ 71,205

$ 94,945

$

100,872

$ 107,159 Additions from loan foreclosures 7,482

18,881 11,918 14,916 16,855 Additions from capitalized costs 150

1,107 1,532 1,615 1,650 Dispositions of REO (28,299 ) (19,440 )

(32,437 ) (18,894 ) (19,095 ) Gain (loss) on sale of REO (170 )

(725 ) 58 (537 ) (524 ) Valuation adjustments in the period (2,657

) (4,569 ) (4,811 ) (3,027 ) (5,173 ) Balance, end of period

$ 42,965

$ 66,459

$ 71,205

$ 94,945

$ 100,872

REAL ESTATE OWNED

- BY TYPE AND STATE

Washington Oregon Idaho Total

Commercial real estate

$ 1,852

$ - -

$ 1,620

$ 3,472 One- to four-family construction 405 2,323 - - 2,728

Land development- commercial 3,876 112 200 4,188 Land development-

residential 5,333 11,881 3,316 20,530 One- to four-family real

estate 6,896 3,651 1,500 12,047

Total

$ 18,362

$ 17,967

$ 6,636

$ 42,965

ADDITIONAL FINANCIAL INFORMATION

(dollars in thousands)

DEPOSITS &

OTHER BORROWINGS

Dec 31, 2011 Sep 30, 2011 Dec 31, 2010

DEPOSIT COMPOSITION Non-interest-bearing

$ 777,563

$ 763,008

$ 600,457

Interest-bearing checking 362,542 362,090 357,702 Regular

savings accounts 669,596 670,210 616,512 Money market accounts

415,456 429,083 459,034 Interest-bearing transaction

& savings accounts 1,447,594 1,461,383 1,433,248

Interest-bearing certificates 1,250,497 1,313,043 1,557,493

Total deposits

$ 3,475,654

$ 3,537,434

$ 3,591,198

INCLUDED IN TOTAL DEPOSITS Public

transaction accounts

$ 72,064

$ 67,753

$

64,482

Public interest-bearing certificates 67,112 69,321 81,809

Total public deposits

$ 139,176

$ 137,074

$ 146,291

Total brokered deposits

$ 49,194

$

59,576

$ 102,984

INCLUDED IN OTHER BORROWINGS Customer

repurchase agreements / "Sweep accounts"

$ 102,131

$

89,633

$ 125,140

GEOGRAPHIC CONCENTRATION OF DEPOSITS AT

December 31, 2011 Washington

Oregon Idaho Total $ 2,657,016

$ 595,801

$ 222,837

$ 3,475,654

Minimum for Capital Adequacy

REGULATORY

CAPITAL RATIOS AT

Actual or "Well Capitalized"

December 31, 2011 Amount Ratio

Amount Ratio Banner Corporation-consolidated

Total capital to risk-weighted assets

$ 615,091 18.07 %

$ 272,242 8.00 % Tier 1 capital to risk-weighted assets

572,036 16.80 % 136,121 4.00 % Tier 1 leverage capital to average

assets 572,036 13.44 % 169,639 4.00 % Banner Bank Total

capital to risk-weighted assets 511,614 15.81 % 323,499 10.00 %

Tier 1 capital to risk-weighted assets 470,668 14.54 % 194,100 6.00

% Tier 1 leverage capital to average assets 470,668 11.71 % 200,955

5.00 % Islanders Bank Total capital to risk-weighted assets

30,627 16.06 % 19,068 10.00 % Tier 1 capital to risk-weighted

assets 28,237 14.81 % 11,441 6.00 % Tier 1 leverage capital to

average assets 28,237 12.08 % 11,689 5.00 %

ADDITIONAL FINANCIAL

INFORMATION (dollars in thousands) (rates / ratios annualized)

Quarters Ended

Twelve Months Ended

OPERATING

PERFORMANCE

Dec 31, 2011 Sep 30, 2011 Dec 31, 2010 Dec

31, 2011 Dec 31, 2010 Average loans

$ 3,237,305

$ 3,271,728

$ 3,458,400

$

3,297,650

$ 3,607,151 Average securities 670,807 544,468

418,647 548,446 398,297 Average interest earning cash 148,070

224,993 368,194 219,025 291,968 Average non-interest-earning assets

207,609 206,420 254,242 215,646 262,888

Total average assets

$ 4,263,791

$ 4,247,609

$ 4,499,483

$

4,280,767

$ 4,560,304 Average deposits

$ 3,477,587

$ 3,498,594

$ 3,669,442

$

3,510,274

$ 3,768,748 Average borrowings 294,675 270,648

344,906 292,555 350,636 Average non-interest-bearing liabilities

(38,703 ) (41,337 ) (38,355 ) (40,266 ) (37,378 ) Total

average liabilities 3,733,559 3,727,905 3,975,993 3,762,563

4,082,006 Total average stockholders' equity 530,232

519,704 523,490 518,204 478,298 ` Total

average liabilities and equity

$ 4,263,791

$

4,247,609

$ 4,499,483

$ 4,280,767

$ 4,560,304 Interest rate yield on

loans 5.53 % 5.53 % 5.67 % 5.59 % 5.70 % Interest rate yield on

securities 1.92 % 2.75 % 2.46 % 2.32 % 2.91 % Interest rate yield

on cash 0.23 % 0.26 % 0.26 % 0.23 % 0.24 %

Interest rate yield on interest-earning

assets

4.74 % 4.87 % 4.88 % 4.86 % 5.07 % Interest rate expense on

deposits 0.59 % 0.70 % 1.03 % 0.75 % 1.39 % Interest rate expense

on borrowings 2.28 % 2.44 % 2.24 % 2.33 % 2.28 % Interest

rate expense on interest-bearing liabilities 0.72 % 0.82 % 1.13 %

0.87 % 1.46 % Interest rate spread 4.02 % 4.05 % 3.75 % 3.99

% 3.61 % Net interest margin 4.07 % 4.10 % 3.81 % 4.05 %

3.67 % Other operating income / Average assets 0.67 % 0.97 %

0.67 % 0.79 % 0.64 %

Other operating income EXCLUDING fair

value and OTTI adjustments / Average assets (1)

0.83 % 0.78 % 0.73 % 0.74 % 0.69 % Other operating expense /

Average assets 3.60 % 3.83 % 3.62 % 3.69 % 3.53 % Efficiency

ratio (other operating expense / revenue) 79.34 % 78.82 % 84.88 %

79.62 % 86.03 % Return (Loss) on average assets 0.47 % 0.56

% (1.12 %) 0.13 % (1.36 %) Return (Loss) on average equity

3.79 % 4.60 % (9.62 %) 1.05 % (12.94 %) Return (Loss) on

average tangible equity

(2) 3.84 % 4.67 % (9.78 %) 1.07 %

(13.21 %) Average equity / Average assets 12.44 % 12.24 %

11.63 % 12.11 % 10.49 %

(1) - Earnings information

excluding fair value and OTTI adjustments (alternately referred to

as other operating income from core operations or revenues from

core operations) represent non-GAAP financial measures.

(2) - Average tangible equity

excludes core deposit and other intangibles and represents a

non-GAAP financial measure.

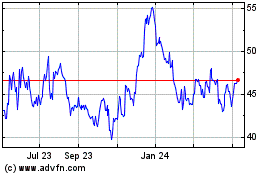

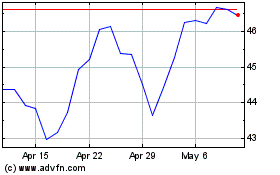

Banner (NASDAQ:BANR)

Historical Stock Chart

From May 2024 to Jun 2024

Banner (NASDAQ:BANR)

Historical Stock Chart

From Jun 2023 to Jun 2024