Balchem Corporation (Nasdaq:BCPC) reported as follows (unaudited)

for the period ended December 31, 2009.

|

($000 Omitted Except for Net Earnings per Share)

|

|

|

|

For the Three Months Ended December 31,

|

|

|

|

|

|

|

2009

|

2008

|

|

|

|

|

|

Net sales

|

$ 59,184

|

$ 54,053

|

|

Gross profit

|

16,957

|

13,432

|

|

Operating expenses

|

6,196

|

5,954

|

|

Earnings from operations

|

10,761

|

7,478

|

|

Other income (expense)

|

49

|

(175)

|

|

Earnings before income tax expense

|

10,810

|

7,303

|

|

Income tax expense

|

3,844

|

2,411

|

|

Net earnings

|

$ 6,966

|

$ 4,892

|

|

|

|

|

|

Basic net earnings per common share

|

$ 0.25

|

$ 0.18

|

|

Diluted net earnings per common share

|

$ 0.24

|

$ 0.17

|

|

|

|

|

|

Shares used in the calculation of diluted net

earnings per common share

|

29,224

|

28,642

|

|

|

|

For the Twelve Months Ended December

31,

|

|

|

|

|

|

|

2009

|

2008

|

|

|

|

|

|

Net sales

|

$ 219,438

|

$ 232,050

|

|

Gross profit

|

66,958

|

52,578

|

|

Operating expenses

|

26,299

|

23,230

|

|

Earnings from operations

|

40,659

|

29,348

|

|

Other expense

|

(57)

|

(917)

|

|

Earnings before income tax expense

|

40,602

|

28,431

|

|

Income tax expense

|

13,817

|

9,381

|

|

Net earnings

|

$ 26,785

|

$ 19,050

|

|

|

|

|

|

Basic net earnings per common share

|

$ 0.98

|

$ 0.71

|

|

Diluted net earnings per common share

|

$ 0.93

|

$ 0.67

|

|

|

|

|

|

Shares used in the calculation of diluted net

earnings per common share

|

28,874

|

28,521

|

Record Quarterly Earnings and Sales

For the quarter ended December 31, 2009, the company achieved

record net earnings of $7.0 million, an increase of $2.1 million,

or 42.4%. The $7.0 million generated diluted net earnings per

common share of $0.24, versus $0.17 for the prior year comparable

period, an increase of 41.2%. Record fourth quarter net sales of

$59.2 million were approximately 9.5% greater than the $54.1

million result of the prior year comparable quarter; and on a

sequential basis, were 9.0% greater than the third quarter 2009

result.

Detailing this fourth quarter of 2009, Animal Nutrition &

Health ("ANH"), including specialties, choline and industrial

derivative product sales, totaled $40.4 million, an increase of

8.7%, or $3.2 million from the prior year comparable quarter.

Within North American poultry production markets, levels appear to

have stabilized and are showing modest growth, resulting in

improved sales of choline and certain specialty ingredients. We

continue to focus efforts in the international poultry and swine

markets, where we realized 39% revenue improvement over the prior

year comparable quarter, from exports and European produced choline

in particular. The ANH specialty ingredients, largely targeted to

the ruminant and companion animal markets, realized 27% sales

growth from the prior year comparable quarter, as some regional

improvement in dairy economics created improved demand for these

products, particularly chelates and Aminoshure-L®, our

rumen protected lysine. Sales of industrial derivatives (both

choline and methylamines) were essentially flat with the prior year

quarter; however, there was approximately 11% improvement on a

sequential basis. Earnings from operations for the entire ANH

segment increased to $5.9 million as compared to $2.9 million in

the prior year comparable quarter. The above noted increase in

sales, product/geographic mix, reductions in key raw materials and

improved production/supply chain efficiencies in both the U.S. and

Europe led to these improved results.

Sales of the Food, Pharma & Nutrition segment were $9.4

million which is a 23.7% improvement over the prior year comparable

quarter. The domestic and international food sectors were up again

this quarter, as we continue to see solid double digit growth of

encapsulated ingredients for baking, preservation and confection

markets. In the quarter, we also realized double digit growth of

our human choline products, both domestic and international, as we

continue to target new food applications and experienced some

rebound in supplements. These results were partially offset

by continued slowness of calcium products sold into the

over-the-counter pharmaceutical markets and a decline in quarterly

sales of our VitaShure® products for nutritional

enhancement. Earnings from operations for this segment were $1.4

million, as compared to $0.7 million in the prior year comparable

quarter, with gross margin levels accounting for this gain, largely

due to an approximately 11% improvement in sales volume and the

product mix.

The ARC Specialty Products segment generated fourth quarter

sales of $9.4 million, an increase of 1.0% from the comparable

prior year quarter. This modest increase was principally a result

of an increase in volumes sold in the quarter. We did however see

some softness in certain ethylene oxide products, which reflects

industry inventory reduction control and order timing of the

medical device sterilization end use markets. Earnings from

operations for this segment, at $3.4 million, decreased 10.6% from

the prior year comparable quarter, principally a result of product

mix, increased raw material costs, and increased expenses related

to development work on our ERC technology for repackaging,

distribution and delivery of a product for the fruit ripening

industry.

Consolidated gross profit for the quarter ended December 31,

2009 was $17.0 million, as compared to $13.4 million for the prior

year comparable period. This increase, to 28.7% of sales from 24.8%

of sales, was a result of product mix, volume and price increases,

plant and logistics efficiencies, and net declines in certain key

raw material costs. We continue to focus on volume growth of our

human and animal health products into export markets, capitalizing

on our varied choline production capabilities, and new product

launches. Operating (Selling, R&D, and Administrative) expenses

at $6.2 million, increased $0.2 million over the prior year

comparable quarter, principally a result of some modest increase of

employee headcount, other payroll related expenses, and increased

investment in R&D.

For the year ended December 31, 2009, net sales decreased 5.4%

to $219.4 million from $232.1 million in the comparable prior year

period. This is a significant improvement from the 10.0% level of

decline we had reported for the nine months ended September 30,

2009. Net earnings, however, increased 40.6% to a record $26.8

million, generating a record $0.93 per diluted share, versus net

earnings of $19.1 million, or $0.67 per diluted share, in the prior

year comparable period.

The company continues to maintain a healthy balance sheet with

$59.2 million in net working capital. Cash closed at $46.4

million on December 31, 2009, up from $38.8 million at September

30, 2009 and total debt was reduced to $6.8 million. Diligent

working capital controls, particularly effective inventory and

accounts receivable management, combined with the noted improved

operating results, drove strong cash flow generation for the year

ended December 31, 2009.

Commenting on 2009, Dino A. Rossi, Chairman, President and CEO

of Balchem, said, "This record fourth quarter reflects strong

performances across all of Balchem's segments, and despite the well

publicized difficult economic conditions, we continue to

demonstrate the value of our diversified business. We leveraged

cross business integration opportunities and increased our global

presence, off-setting softness in certain U.S. markets. Raw

material costs have had negative impact on certain segments, but we

will continue to closely monitor all key economic drivers, stay

customer focused, and take appropriate actions to improve operating

margins and cash flow.

Considerable ongoing volatility in the global economy is

expected, but we believe 2010 will be a year of improvements in

sales and earnings, as we continue to implement lean programs,

de-bottleneck production capabilities, leverage our existing

business and research infrastructure, and launch new, innovative

products through each of our business segments. We expect improved

results in the Food, Pharma & Nutrition segment, particularly

in the choline, calcium, domestic and international food markets.

The Animal Nutrition & Health segment realized some margin

relief in late 2009, despite supply chain interruptions, which now

appear to be behind us. Nevertheless, many end specie producers

continue to have financial issues, so our focus on successful new

product launches and continued production efficiencies are

critical. The ARC Specialty Products segment should continue its

steady revenue growth and solid profit results, as well as

development of new market opportunities for specialized delivery of

certain gases. Our healthy financial situation has us positioned to

capitalize on strategic acquisition opportunities that will likely

arise from the current economic environment."

Quarterly Conference Call

A quarterly conference call will be held on Thursday, February

25, at 2:00 PM Eastern Time (ET) to review fourth quarter 2009

results. Dino A. Rossi, Chairman, President and CEO, and Frank

Fitzpatrick, Chief Financial Officer, will host the call. We

invite you to listen to the conference by calling toll-free

1-877-407-8289 (local dial-in 1-201-689-8341), five minutes prior

to the scheduled start time of the conference call. The conference

call will be available for digital replay through Tuesday, March 2,

2010. To access the replay of the conference call, dial

1-877-660-6853 (local dial-in 1-201-612-7415), and use account #298

and replay ID #345182. Both account and replay ID

numbers are required for replay access.

Segment Information

Balchem Corporation consists of three business segments: ARC

Specialty Products; Food, Pharma & Nutrition; and Animal

Nutrition and Health. Through ARC Specialty Products, Balchem

provides specialty-packaged chemicals for use in healthcare and

other industries. The Food, Pharma & Nutrition segment provides

proprietary microencapsulation, granulation and agglomeration

solutions to a variety of applications in the human food,

pharmaceutical and nutrition marketplaces. The Animal Nutrition

& Health segment manufactures and supplies products to numerous

animal health markets and certain derivative products into

industrial applications.

Forward-Looking Statements

This release contains forward-looking statements, which reflect

Balchem's expectation or belief concerning future events that

involve risks and uncertainties. Balchem can give no assurance that

the expectations reflected in forward-looking statements will prove

correct and various factors could cause results to differ

materially from Balchem's expectations, including risks and factors

identified in Balchem's annual report on Form 10-K for the year

ended December 31, 2008. Forward-looking statements are qualified

in their entirety by the above cautionary statement. Balchem

assumes no duty to update its outlook or other forward-looking

statements as of any future date.

|

Selected Financial Data

|

|

|

|

($ in 000's)

|

|

|

|

|

|

|

Three Months Ended

|

Twelve Months Ended

|

|

|

December 31,

|

December 31,

|

|

|

2009

|

2008

|

2009

|

2008

|

|

Specialty Products

|

$ 9,362

|

$ 9,271

|

$ 36,368

|

$ 35,835

|

|

Food, Pharma & Nutrition

|

9,373

|

7,580

|

35,407

|

35,702

|

|

Animal Nutrition & Health

|

40,449

|

37,202

|

147,663

|

160,513

|

|

Total

|

$ 59,184

|

$ 54,053

|

$ 219,438

|

$ 232,050

|

|

|

|

|

|

|

|

Business Segment Earnings Before Income Taxes:

|

|

|

|

|

|

|

|

|

Three Months Ended

|

Twelve Months Ended

|

|

|

December 31,

|

December 31,

|

|

|

2009

|

2008

|

2009

|

2008

|

|

Specialty Products

|

$ 3,428

|

$ 3,836

|

$ 14,250

|

$ 12,545

|

|

Food, Pharma & Nutrition

|

1,445

|

706

|

5,029

|

5,469

|

|

Animal Nutrition & Health

|

5,888

|

2,936

|

21,380

|

11,334

|

|

Interest and other income (expense)

|

49

|

(175)

|

(57)

|

(917)

|

|

Total

|

$ 10,810

|

$ 7,303

|

$ 40,602

|

$ 28,431

|

|

|

|

|

|

Selected Balance Sheet Items

|

|

|

|

|

December 31,

|

December 31,

|

|

|

2009

|

2008

|

|

Cash and Cash Equivalents

|

$ 46,432

|

$ 3,422

|

|

Accounts Receivable

|

29,149

|

30,250

|

|

Inventories

|

13,965

|

16,618

|

|

Other Current Assets

|

3,466

|

4,961

|

|

Total Current Assets

|

93,012

|

55,251

|

|

|

|

|

|

Property, Plant, & Equipment (net)

|

41,579

|

42,513

|

|

Other Assets

|

53,222

|

56,710

|

|

Total Assets

|

$ 187,813

|

$ 154,474

|

|

|

|

|

|

Current Liabilities

|

$ 33,815

|

$ 25,685

|

|

Long-Term Obligations

|

6,855

|

14,283

|

|

Total Liabilities

|

40,670

|

39,968

|

|

|

|

|

|

Stockholders' Equity

|

147,143

|

114,506

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

$ 187,813

|

$ 154,474

|

CONTACT: Balchem Corporation

Karin McCaffery

845-326-5635

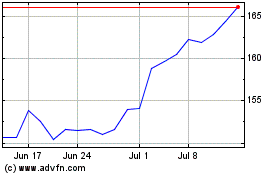

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Jul 2024 to Jul 2024

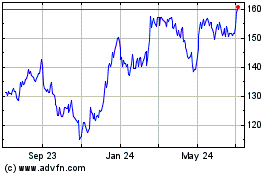

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Jul 2023 to Jul 2024