Asure Software (NASDAQ: ASUR), a leading provider of workforce

management software, today announced financial results for the

Fiscal 2010 first quarter, ended October 31, 2009.

Q1 Highlights:

-- As expected, revenue declined 4% vs. the previous quarter to $2.3M.

iEmployee's revenue grew 3% compared to Q4 '09, driven largely by growth in

clock sales, which grew 41% over Q4 '09. Additionally, iEmployee posted

record new bookings in Q1 '10, a 69% improvement over Q4 '09.

NetSimplicity's revenue declined 12% vs. the previous quarter. This drop

was anticipated as we transition the business from a perpetual license

model to a SaaS model. Importantly, NetSim's SaaS revenue component grew

10% over Q4 '09.

-- Operating expenses decreased in Q1 2010 versus Q4 2009 by ($4.0M),

(55%), due to both a significant decline in one-time costs, ($3.3M) and

operational efficiency, ($0.7M). Q1 '10 one-time costs were driven by final

proxy contest charges and severance expenses. Operational efficiencies were

realized in many areas, with the most significant being in Compensation.

The full effect of recent reductions in force drove $0.5M in reduced

operating expenses in Q1 '10. Q1 '10 was EBITDA neutral, excluding one-time

costs of $1.1M and excess net lease expense of $0.1M.

Pat Goepel, Asure's Chief Executive Officer, remarked, "We will

see a new Asure rise in 2010; we have drastically reduced operating

costs and will put negative one-time events behind us as we move

forward. The upcoming short period for November and December, 2009

will yield similar levels of adjusted EBITDA and going forward the

only anticipated one-time costs will be in the form of investments

to further enhance our products and services and improve

operational efficiency. By calendar Q1, 2010, we expect to begin

seeing the benefits of our growth plan and along with our

normalized lower cost structure, expect to be EBITDA positive."

"Furthermore,..." continued Goepel, "...Asure is committed to

reducing exposure to our Austin Headquarters lease arrangement

which can only accelerate our plan to become profitable for the

calendar year 2010. We continue to believe that our business and

assets are undervalued and we wish to inform shareholders that we

presently have 1.2M shares available under our current stock

buyback plan and we intend to be active in the near future."

Chairman of the Board, David Sandberg, added, "Lastly, in one

week's time we have an important Annual Meeting where we are asking

shareholders to approve several proposals. Among these are

non-routine votes seeking ratification of a 10-for-1 reverse split

in order to retain our Nasdaq listing, a rights plan to protect our

$150+ million in tax loss carryforwards, and an equity plan to

facilitate the granting of options as part of a new compensation

plan to our employees given we have ended the furlough period but

are retaining salaries at furlough levels. I represent the largest

shareholder of the Company and I believe these proposals are the

right moves for the Company and are in the shareholders' best

interests as we strive for value creation. For these reasons, I ask

each shareholder to consider and vote in support of each of our

proposals if you agree, and to do so in time for next week's

meeting. If you have not yet done so, please contact our proxy

solicitor, InvestorCom, Inc., at (203) 972-9300."

Conference Call Details

Asure Software has scheduled a conference call for Thursday,

December 10, 2009 at 11:00 a.m. ET (10:00 a.m. CT) to discuss its

most recent financial results and outlook. Participating in the

call will be Pat Goepel, Chief Executive Officer and David

Sandberg, Chairman of the Board.

To take part, please dial 800-901-5217 ten minutes before the

conference call begins, ask for the Asure Software event and use

passcode 23171971. International callers should dial 617-786-2964

and reference the same passcode, 23171971.

Investors, analysts, media and the general public will also have

the opportunity to listen to the conference call in listen-only

mode via the Internet by visiting the investor relations page of

Asure's web site at www.asuresoftware.com. To monitor the live

call, please visit the web site at least 15 minutes early to

register, download and install any necessary audio software. For

those who cannot listen to the live broadcast, an archived replay

will be available shortly after the call on the investor relations

page of the Company's web site at www.asuresoftware.com.

About Asure Software

Headquartered in Austin, Texas, Asure Software (ASUR), (a d/b/a

of Forgent Networks, Inc.), empowers small to mid-size

organizations and divisions of large enterprises to operate more

efficiently, increase worker productivity and reduce costs through

a comprehensive suite of on-demand workforce management software

and services. Asure's market-leading suite includes products that

optimize workforce time and attendance tracking, benefits

enrollment and tracking, pay stubs and W2 documentation, and

meeting and event management. With additional offices in Warwick,

Rhode Island, Vancouver, British Columbia, and Mumbai, India, Asure

serves 3,500 customers around the world. For more information,

please visit www.asuresoftware.com.

"Safe Harbor" Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release regarding

Asure's business which are not historical facts are

"forward-looking statements" that involve risks and uncertainties.

Such risks and uncertainties, which include those associated with

continued listing of the Company's securities on the NASDAQ Capital

Market, could cause actual results to differ from those contained

in the forward-looking statements.

FORGENT NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share data)

OCTOBER 31, JULY 31,

2009 2009

(UNAUDITED)

ASSETS

Current Assets:

Cash and equivalents $ 1,651 $ 4,375

Short-term investments 1,303 5,339

Accounts receivable, net of allowance for

doubtful accounts of $17 and $20 at

October 31, 2009 and July 31, 2009,

respectively 1,576 1,207

Inventory 31 3

Prepaid expenses and other current assets 274 143

------------- -------------

Total Current Assets 4,835 11,067

Property and equipment, net 625 672

Intangible assets, net 3,753 3,949

------------- -------------

Total Assets $ 9,213 $ 15,688

============= =============

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 1,601 $ 6,294

Accrued compensation and benefits 188 278

Lease impairment and advance 709 899

Other accrued liabilities 439 541

Deferred revenue 1,826 1,897

------------- -------------

Total Current Liabilities 4,763 9,909

Long-Term Liabilities:

Deferred revenue 120 119

Lease impairment and advance 210 250

Other long-term obligations 219 206

------------- -------------

Total Long-Term Liabilities 549 575

Stockholders' Equity:

Preferred stock, $.01 par value; 10,000

shares authorized; none issued or

outstanding -- --

Common stock, $.01 par value; 40,000 shares

authorized; 33,406 and 32,906 shares

issued; 31,616 and 31,116 shares

outstanding at October 31, 2009 and July

31, 2009, respectively 334 329

Treasury stock at cost, 1,790 shares at

October 31, 2009 and July 31, 2009 (4,815) (4,815)

Additional paid-in capital 270,915 270,738

Accumulated deficit (262,453) (260,947)

Accumulated other comprehensive income (80) (101)

------------- -------------

Total Stockholders' Equity 3,896 5,204

------------- -------------

Total Liabilities and Stockholders'

Equity $ 9,213 $ 15,688

============= =============

FORGENT NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

FOR THE THREE

MONTHS ENDED

OCTOBER 31,

------------------

2009 2008

-------- --------

(UNAUDITED)

Revenues $ 2,321 $ 2,792

Cost of Sales (479) (564)

Gross Margin 1,842 2,228

OPERATING EXPENSES:

Selling, general and administrative 2,741 3,197

Research and development 411 561

Amortization of intangible assets 149 149

Total Operating Expenses 3,301 3,907

LOSS FROM OPERATIONS (1,459) (1,679)

OTHER INCOME AND (EXPENSES):

Interest income 7 55

Foreign currency translation (31) 120

Interest expense and other (11) (10)

Total Other Income (36) 165

LOSS FROM OPERATIONS, BEFORE INCOME TAXES (1,494) (1,514)

Provision for income taxes (12) (25)

NET LOSS $ (1,506) $ (1,539)

BASIC AND DILUTED LOSS PER SHARE:

Net loss per share - basic and diluted $ (0.05) $ (0.05)

WEIGHTED AVERAGE SHARES OUTSTANDING:

Basic 31,317 31,104

Diluted 31,317 31,104

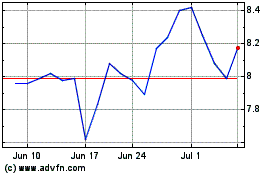

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From May 2024 to Jun 2024

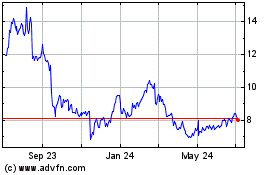

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Jun 2023 to Jun 2024