Astronics Corporation (NASDAQ: ATRO), a leader in

advanced, high performance lighting, electrical power and automated

test systems for the global aerospace and defense industries, today

reported financial results for the first quarter of 2010.

First Quarter Operating

Results

(in millions)

Three Months Ended

Increase/(Decrease)

April 3,2010

April 4,2009

$ % Sales $

46.9 $ 50.0 $ (3.1 ) (6.2

)%

Gross profit $ 11.5 $ 8.5

$ 3.0 35.4 % Gross margin 24.6 % 17.1 %

SG&A $ 5.5 $ 6.1 $

(0.6 ) (9.9 )% SG&A percent to sales 11.6 % 12.1

%

Income from Operations $ 6.1 $

2.5 $ 3.6 146.7 % Operating margin 13.0 % 4.9

%

Net Income $ 3.4 $ 1.4

$ 2.0 142.7 %

Sales in the first quarter of 2010 were $46.9 million, down $3.1

million, or 6.2%, from the prior year period. The 2010 first

quarter included sales for Astronics’ DME subsidiary for the entire

period while the 2009 first quarter included DME sales for a nine

week period. Astronics acquired DME on January 30, 2009. The

Company reported net income in the first quarter of 2010 of $3.4

million, or $0.31 per diluted share, compared with net income of

$1.4 million, or $0.13 per diluted share, in the same period of

last year. Consolidated bookings in the first quarter totaled $54.3

million, an increase of 76% over the first quarter of 2009.

The improved margins were a result of higher margins in our

Aerospace segment as leverage was achieved from increased sales

volumes and reductions to our cost structure, as well as a

favorable sales mix compared with the first quarter of last year.

Also contributing to the margin expansion was reduced amortization

expense on purchased intangibles of $0.5 million and the reduction

of our estimated warranty liability of $0.7 million, both in our

Test Systems segment.

Engineering and development (E&D) costs were relatively flat

at $7.1 million and $7.4 million in the first quarter of 2010 and

2009, respectively.

The $0.6 million decrease in selling, general and administrative

(SG&A) expense in the first quarter of 2010 compared with last

year’s first quarter was primarily due to approximately $0.5

million in higher amortization of purchased intangible assets for

the acquired DME business in 2009.

Peter J. Gundermann, President and Chief Executive Officer of

Astronics, commented “First quarter results provided a strong start

for 2010. Demand was higher than expected, especially for our

in-seat power products, and our aggressive cost cutting over the

last year drove solid margins. We are also encouraged with the

bookings level which gives us increased confidence for the rest of

the year.”

First quarter

Review: Aerospace

Segment (refer to sales by market and segment data in

accompanying tables)

Sales for the Aerospace segment were $43.2 million in the first

quarter of 2010, up $1.4 million, or 3%, compared with the 2009

first quarter. The 19% sales increase to the commercial transport

market was a result of increased volume due in part to the timing

of shipments and in part to a general improvement of the commercial

transport market, as airlines increased their procurement and

installation of in-flight entertainment and in-seat power systems.

Sales to the business jet market were 20% below last year’s first

quarter due to reduced volumes, as the business jet manufacturers’

build rates were lower than last year and demand for our products

decreased. Military sales fell 14% primarily as a result of the

conclusion of shipments of our power conditioning unit for the

Tactical Tomahawk missile in the third quarter of 2009 and lower

shipment rates for lighting products.

Aerospace operating profit for the first quarter of 2010 was

$6.7 million, or 15.6% of sales, compared with $3.4 million, or

8.1% of sales, in the same period last year. Margin improvement was

due to the leverage provided on the increased sales volume, the

effect of cost reductions and favorable product mix.

Bookings for the Aerospace segment were $50.7 million, up

significantly from $28.0 million in the first quarter of 2009.

First quarter

Review: Test Systems

Segment (refer to sales by market and segment data in

accompanying tables)

Sales for the Test Systems segment were $3.7 million in the

first quarter of 2010 compared with $8.2 million in the first

quarter of 2009. The decrease in the Test Systems segment sales

reflected the low rate of new orders received during the past year

and the resulting low backlog level.

Operating profit was $0.2 million, or 5.0% of sales, in the

first quarter of 2010, compared with $0.2 million, or 2.4% of

sales, in the first quarter of 2009. Amortization costs decreased

by $0.5 million compared with the same quarter last year and

savings have been realized through cost reductions. Additionally,

the first quarter 2010 operating profit reflected a reduction in

estimated warranty liability of $0.7 million.

Test Systems bookings in the first quarter were $3.6 million

compared with $2.8 million in the first quarter of 2009.

Balance Sheet

At April 3, 2010, the cash balance was $12.7 million compared

with $14.9 million at December 31, 2009. The Company has

availability of approximately $32 million at April 3, 2010 from its

revolving credit facility.

Cash generated from operations during the first quarter of 2010

was $1.6 million compared with cash generated from operations of

$2.9 million in the 2009 first quarter. Higher net income was

offset by increased investment in net working capital components.

Capital expenditures in the quarter were $0.9 million and payments

made to reduce long-term debt during the quarter were $3.1 million.

The Company expects capital spending in 2010 to be approximately

$2.5 million to $3.5 million.

Outlook

Backlog at April 3, 2010 was $92.8 million, above backlog at the

end of the fourth quarter of 2009 of $85.4 million and down from

backlog at the end of the first quarter of 2009 of $111.7 million.

Approximately $71 million of total backlog is expected to ship by

the end of 2010 and approximately $79 million of total backlog is

expected to ship in the next 12 months.

Mr. Gundermann stated, “We are off to a better start to the year

than we anticipated, but are not ready to increase our revenue

guidance for 2010. Aerospace has had a better start than expected,

while Test Systems is off to a somewhat slower start. We continue

to expect that sales for the year will be in the range of $170 to

$190 million.”

Astronics anticipates that approximately $145 million to $155

million of projected 2010 revenue will be from the Aerospace

segment, while approximately $25 million to $35 million will be

from the Test Systems segment.

First quarter 2010 Webcast and

Conference Call

The Company will host a teleconference at 1:00 p.m. ET today.

During the teleconference, Peter J. Gundermann, President and CEO,

and David C. Burney, Vice President and CFO, will review the

financial and operating results for the period and discuss

Astronics’ corporate strategy and outlook. A question-and-answer

session will follow.

The Astronics conference call can be accessed by dialing (201)

689-8562 and entering conference ID number 348533. The listen-only

audio webcast can be monitored at www.astronics.com. To listen to

the archived call, dial (201) 612-7415 and enter conference ID

number 348533 and account number 3055. The telephonic replay will

be available from 4:00 p.m. on the day of the call until 11:59 p.m.

ET, Wednesday, May 12, 2010. A transcript will also be posted to

the Company’s Web site, once available.

ABOUT ASTRONICS CORPORATION

Astronics Corporation is a leader in advanced, high performance

lighting, electrical power and automated test systems for the

global aerospace and defense industries. Astronics’ strategy is to

develop and maintain positions of technical leadership in its

chosen aerospace and defense markets, to leverage those positions

to grow the amount of content and volume of product it sells to

those markets and to selectively acquire businesses with similar

technical capabilities that could benefit from our leadership

position and strategic direction. Astronics Corporation, and its

wholly-owned subsidiaries, DME Corporation, Astronics Advanced

Electronic Systems Corp. and Luminescent Systems Inc., have a

reputation for high quality designs, exceptional responsiveness,

strong brand recognition and best-in-class manufacturing practices.

The Company routinely posts news and other important information on

its Web site at www.Astronics.com.

For more information on Astronics and its products, visit its

Web site at www.Astronics.com.

Safe Harbor Statement

This press release contains forward-looking statements as

defined by the Securities Exchange Act of 1934. One can identify

these forward-looking statements by the use of the words “expect,”

“anticipate,” “plan,” “may,” “will,” “estimate” or other similar

expression. Because such statements apply to future events, they

are subject to risks and uncertainties that could cause the actual

results to differ materially from those contemplated by the

statements. Important factors that could cause actual results to

differ materially include the state of the aerospace industry, the

market acceptance of newly developed products, internal production

capabilities, the timing of orders received, the status of customer

certification processes, the demand for and market acceptance of

new or existing aircraft which contain the Company’s products,

customer preferences, and other factors which are described in

filings by Astronics with the Securities and Exchange Commission.

The Company assumes no obligation to update forward-looking

information in this press release whether to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results, financial conditions or prospects, or

otherwise.

FINANCIAL TABLES FOLLOW.

ASTRONICS CORPORATION

CONSOLIDATED INCOME STATEMENT

DATA

(Unaudited, $ in thousands except per share data)

Three Months Ended 4/3/2010

4/4/2009 Sales $ 46,936

$ 50,015 Cost of products sold 35,390

41,485 Gross profit 11,546 8,530

Gross

margin 24.6 % 17.1 %

Selling, general and administrative 5,466

6,065 Income from operations 6,080 2,465

Operating

margin 13.0 % 4.9 % Interest

expense, net 599 424 Other income (38 ) (13 )

Income before tax 5,519 2,054 Income tax expense 2,119

653

Net Income $

3,400 $ 1,401

Basic earnings per share: $ 0.31 $ 0.13 Diluted earnings per share:

$ 0.31 $ 0.13 Weighted average diluted shares outstanding

10,966 10,768 Capital

Expenditures $ 875 $ 968 Depreciation and Amortization $

1,239 $ 1,740

ASTRONICS CORPORATION

CONSOLIDATED BALANCE SHEET

DATA

(Unaudited, $ in thousands)

4/3/2010

12/31/2009

ASSETS:

Cash and cash equivalents $ 12,678 $ 14,949 Accounts

receivable 30,831 30,560 Inventories 31,716 31,909 Other current

assets 4,966 5,075 Property, plant and equipment, net 31,174 31,243

Other long-term assets 3,697 3,763 Deferred taxes long-term 7,916

8,131 Intangible assets 5,453 5,591 Goodwill 7,610

7,493

Total Assets $

136,041 $ 138,714

LIABILITIES AND SHAREHOLDERS'

EQUITY:

Current maturities of long term debt $ 5,245 $ 6,238 Accounts

payable and accrued expenses 20,960 23,398 Long-term debt 36,523

38,538 Other liabilities 9,285 10,427 Shareholders' equity

64,028 60,113

Total Liabilities and

Shareholders' Equity $ 136,041

$ 138,714

ASTRONICS

CORPORATIONSEGMENT

DATA(Unaudited, $ in thousands)

Three Months Ended 4/3/2010

4/4/2009 Sales Aerospace $

43,190 $ 41,818 Test Systems 3,746

8,197

Total Sales $ 46,936 $ 50,015

Operating Profit and Margins Aerospace $ 6,742 $

3,395 15.6 % 8.1 % Test Systems 187 198 5.0 %

2.4 %

Total Operating Profit 6,929 3,593 14.8 % 7.2 %

Corporate Expenses and Other (849 ) (1,128 )

Income from Operations $ 6,080 $ 2,465 13.0 %

4.9 %

ASTRONICS CORPORATION

SALES BY MARKET

(Unaudited, $ in thousands)

Three Months Ended 2010 4/3/2010

4/4/2009

%change

YTD % Aerospace Segment Commercial Transport $ 27,445

$ 23,006 19 % 58 % Military 8,398 10,486 -20 % 18 % Business Jet

5,592 6,522 -14 % 12 % FAA/Airport 1,755 1,804

-3 % 4 % Aerospace Total

$ 43,190 $

41,818 3 % 92 % Test

Systems Segment

Military

$ 3,746 $ 8,197

-54 % 8 % Total $

46,936 $ 50,015 -6

% 100 % ASTRONICS CORPORATION

SALES BY PRODUCT

(Unaudited, $ in thousands)

Three Months Ended

2010 4/3/2010 4/4/2009

%change

YTD % Aerospace Segment Cabin

Electronics

$

21,496

$ 16,502 30 % 46 % Aircraft Lighting

15,733

18,051 -13 % 33 % Airframe Power

4,206

5,461 -23 % 9 % Airfield Lighting

1,755

1,804 -3 % 4 % Aerospace Total

$

43,190

$ 41,818 3 % 92 %

Test Systems Segment

$

3,746

$ 8,197 -54 % 8

% Total

$

46,936

$ 50,015 -6 % 100

% ASTRONICS CORPORATION

ORDER AND BACKLOG TREND

(Unaudited, $ in thousands)

Q12009*

Q22009

Q32009

Q42009

Q12010

4/4/2009

7/4/2009

10/3/2009

12/31/2009

4/3/2010

Sales Aerospace $ 41,818 $ 38,216 $ 38,958 $ 36,613 $ 43,190

Test Systems 8,197 8,808 9,628

8,963 3,746

Total Sales $

50,015 $

47,024 $

48,586

$

45,576 $

46,936 Bookings

Aerospace $ 28,016 $ 34,605 $ 40,135 $ 29,270 $ 50,668 Test Systems

2,798 6,168 3,932

743 3,634

Total Bookings $

30,814

$

40,773 $

44,067 $

30,013 $

54,302 Backlog

Aerospace $ 85,418 $ 81,807 $ 82,983 $ 75,639 $ 83,116 Test Systems

26,311 23,671 17,974

9,755 9,644

Total Backlog $

111,729 $

105,478 $

100,957

$

85,394 $

92,760

Book:Bill Aerospace 0.67 0.91 1.03 0.80 1.17 Test Systems

0.34 0.70 0.41

0.08 0.97

Total Book:Bill 0.62

0.87 0.91

0.66 1.16

* On January 30, 2009, Astronics acquired DME Corporation,

including backlog of $10,172 for Aerospace and $31,710 for Test

Systems.

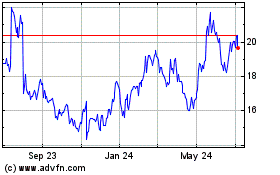

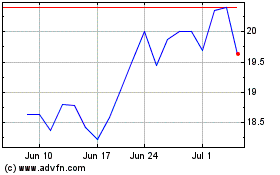

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Apr 2024 to May 2024

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2023 to May 2024