Astronics Corporation (NASDAQ: ATRO), a leading manufacturer of

advanced, high-performance lighting, electronics and electrical

power systems for the global aerospace industry, reported net

income of $1.9 million for the third quarter of 2006, an increase

of $1.1 million over net income of $0.8 million in the third

quarter of 2005. Earnings per diluted share were $0.23 for the

third quarter of 2006 compared with $0.10 in the same period the

prior year. For the nine months ended September 30, 2006, net

income was $5.1 million, or $0.63 per diluted share, compared with

$1.6 million, or $0.20 per diluted share, for the same period last

year. Sales for the third quarter were $28.5 million, a 40%

increase from $20.4 million in the third quarter of 2005. Over 95%

of the increase, or $7.9 million, can be attributed to higher sales

of the Company�s cabin electronics products, which provide power

for in-flight entertainment and in-seat power systems for the

global commercial airline market. Sales to the business jet market

also increased $2.5 million reflecting increased aircraft

production rates. Military sales were down 26% from the third

quarter last year. The decrease was primarily caused by a $2.2

million decrease in deliveries for F-16 night vision kits for the

Republic of Korea Air Force as the Korean program was concluded in

2005. Sequentially, sales in the third quarter were down 1.7% from

sales in the second quarter reflecting slower demand and production

over the summer. Peter J. Gundermann, President and CEO of

Astronics Corp., commented, �Our strategy to be in the three major

aircraft markets: military, business jet and commercial transport,

has worked very well in this environment of strong commercial

airlines growth, expansion of the business jet market and stable

sales to the military. Commercial and business jet aircraft

manufacturers are seeing continued expansion of their backlogs. As

a result, we believe that 2007 should be another year of solid

growth for Astronics.� Gross margin for the quarter was 22.8%, up

slightly from 21.9% in the third quarter of 2005, as a result of

leverage provided by higher sales. Selling, general and

administrative (SG&A) expenses were $3.5 million up from $2.9

million in the same period the prior year. As a percentage of

sales, SG&A was 12% in this year�s third quarter compared with

14% last year as sales grew at a faster pace than SG&A

spending. Operating profit almost doubled quarter-over-quarter,

from $1.6 million in the third quarter of 2005 to $3.1 million this

year. Nine-Month Period Review For the first nine months of 2006,

sales were $82.5 million, a 50% increase from $54.9 million in the

same period last year. Sales to the commercial transport sector

doubled over the prior year sales to $45.1 million and currently

represent about 55% of total sales. Business jet sales have

improved 40%, when comparing the nine month periods, from $11.9

million to $16.7 million while military sales have remained

relatively flat at $19.7 million for the first nine months of 2006.

Gross margin for the nine month period improved to 22.6% from 20.5%

in the first nine months of 2005 on higher volume. SG&A

increased on an absolute basis to $9.9 million from $7.7 million

during the first nine months last year, but as a percentage of

sales declined to 12% this year compared with 14% for the 2005

nine-month period. Liquidity Cash and cash equivalents at September

30, 2006, was $645 thousand, a decrease from $4.5 million at

December 31, 2005, but an increase from $425 thousand at July 1,

2006. Increased investment in working capital components, primarily

inventory and receivables associated with increasing sales growth

have used cash reserves. Capital expenditures for the third quarter

of 2006 were $693 thousand up from $432 thousand in the same period

last year. For the nine month period, capital expenditures

increased to $2.3 million from $1.8 million in the first nine

months last year. Outlook Bookings for the third quarter of 2006

were $26.0 million, a 29% increase from bookings of $20.2 million

in the third quarter last year. Backlog at the end of the third

quarter was $86.4 million compared with $77.6 million at the end of

the same quarter last year. Mr. Gundermann added, �As we move

through the fourth quarter, we anticipate that we could be at the

high end or somewhat above our estimated sales range of $105

million to $110 million for 2006. We are encouraged by the demand

for aircraft and the success our customers are having with orders

which should contribute to next year�s growth and beyond. Across

the aerospace industry conditions remain strong.� Third Quarter

Webcast and Conference Call The release of the financial results on

November 9, 2006, will be followed by a company-hosted

teleconference at 11:00 a.m. ET. During the teleconference, Peter

J. Gundermann, President and CEO, and David C. Burney, Vice

President and CFO, will review the financial and operating results

for the period and discuss Astronics� corporate strategy and

outlook. A question-and-answer session will follow. The Astronics

conference call can be accessed the following ways: The live

webcast can be found at http://www.astronics.com. Participants

should go to the website 10 - 15 minutes prior to the scheduled

conference in order to register and download any necessary audio

software. The teleconference can be accessed by dialing (913)

312-1267 approximately 5 - 10 minutes prior to the call. To listen

to the archived call: The archived webcast will be at

http://www.astronics.com. A transcript will also be posted once

available. A replay can also be heard by calling (719) 457-0820,

and entering passcode 2437531. The telephonic replay will be

available through Thursday, November 16, 2006 at 11:59 p.m. ET.

ABOUT ASTRONICS CORPORATION Astronics Corporation is a leading

manufacturer of advanced, high-performance lighting and electrical

power distribution systems for the global aerospace industry. Its

strategy is to expand the value and content it provides to various

aircraft platforms through product development and acquisition.

Astronics Corporation, and its wholly-owned subsidiaries Astronics

Advanced Electronic Systems Corp. and Luminescent Systems Inc.,

have a reputation for high quality designs, exceptional

responsiveness, strong brand recognition and best-in-class

manufacturing practices. For more information on Astronics and its

products, visit its website at www.Astronics.com. Safe Harbor

Statement This press release contains forward-looking statements as

defined by the Securities Exchange Act of 1934. One can identify

these forward-looking statements by the use of the words �expect,�

�anticipate,� �plan,� �may,� �will,� �estimate� or other similar

expression. Because such statements apply to future events, they

are subject to risks and uncertainties that could cause the actual

results to differ materially from those contemplated by the

statements. Important factors that could cause actual results to

differ materially include the state of the aerospace industry, the

market acceptance of newly developed products, the ability to cross

sell products and expand markets, internal production capabilities,

the timing of orders received, the status of customer certification

processes, the demand for and market acceptance of new or existing

aircraft which contain the Company�s products, such as the Airbus

A380; the Eclipse 500; the Air Canada�s CRJ705, A320, and several

configurations of B767; Cessna single engine aircraft; Cessna

Mustang; Hawker Horizon; the V22 Osprey; Lockheed Martin F-35 JSF;

China Eastern Airlines Corp. Limited�s upgrade of 15 Airbus

A330-300�s and five Airbus A330-200�s; Air China Limited�s upgrades

of 20 Airbus A330-200�s; and F-22 Raptor; customer preferences, and

other factors which are described in filings by Astronics with the

Securities and Exchange Commission. The Company assumes no

obligation to update forward-looking information in this press

release whether to reflect changed assumptions, the occurrence of

unanticipated events or changes in future operating results,

financial conditions or prospects, or otherwise. ASTRONICS

CORPORATION CONSOLIDATED INCOME STATEMENT DATA (unaudited) � (in

thousands except per share data) � Three months ended Nine months

ended � 9/30/2006� � � 10/1/2005� � � � 9/30/2006� � � 10/1/2005�

Sales $ 28,540� $ 20,421� $ 82,505� $ 54,916� Cost of products sold

22,019� 15,947� 63,891� 43,654� Gross margin 22.8% 21.9% 22.6%

20.5% Selling general and administrative � 3,469� � � 2,890� � � �

9,931� � � 7,679� Income from operations 3,052� 1,584� 8,683�

3,583� Operating margin 10.7% 7.8% 10.5% 6.5% Interest expense, net

232� 202� 650� 519� Other (income) expense � (5) � � -� � � � (39)

� � -� Income (loss) before tax 2,825� 1,382� 8,072� 3,064� Income

taxes � 912� � � 592� � � � 2,934� � � 1,468� Net Income $ 1,913� �

$ 790� � � $ 5,138� � $ 1,596� � Basic earnings per share: $ 0.24�

$ 0.10� $ 0.65� $ 0.20� Diluted earnings per share: $ 0.23� $ 0.10�

$ 0.63� $ 0.20� � Weighted average diluted shares outstanding

8,264� 8,094� 8,210� 8,006� � � � � � � � � � Capital Expenditures

$ 693� $ 432� $ 2,300� $ 1,765� Depreciation and Amortization $

701� � $ 720� � � $ 1,960� � $ 2,042� ASTRONICS CORPORATION

CONSOLIDATED BALANCE SHEET DATA (unaudited) (in thousands) �

9/30/2006� � � 12/31/2005� ASSETS: Cash and cash equivalents $ 645�

$ 4,473� Accounts receivable 18,065� 12,635� Inventories 26,584�

19,013� Other current assets 1,966� 1,401� Property, plant and

equipment, net 21,221� 20,461� Other assets � 7,691� � � 7,874�

Total Assets $ 76,172� � $ 65,857� � LIABILITIES AND SHAREHOLDERS'

EQUITY: Current maturities of long term debt $ 921� $ 914� Note

payable 7,900� 7,000� Accounts payable and accrued expenses 18,843�

15,843� Long-term debt 9,837� 10,304� Other liabilities 6,179�

5,962� Shareholders' equity � 32,492� � � 25,834� Total liabilities

and shareholders' equity $ 76,172� � $ 65,857� ASTRONICS

CORPORATION NET SALES BY MARKET ($, in thousands) � Three Months

Ended Nine Months Ended � 9/30/2006� � � 10/1/2005� � % change� �

9/30/2006� � � 10/1/2005� � % change� 2006 YTD % � Military $

6,136� $ 8,330� -26.3% $ 19,724� $ 19,500� 1.15% 23.9% Commercial

Transport 15,781� 7,943� 98.7% 45,106� 22,534� 100.17% 54.7%

Business Jet 6,340� 3,812� 66.3% 16,668� 11,914� 39.90% 20.2% Other

283� 336� -15.8% 1,007� 968� 4.03% 1.2% � � � � � � � � � � � Total

$ 28,540� � $ 20,421� � 39.8% $ 82,505� � $ 54,916� � 50.24% 100.0%

ASTRONICS CORPORATION NET SALES BY PRODUCT ($, in thousands) �

Three Months Ended Nine Months Ended � 9/30/2006� � � 10/1/2005� �

% change� � 9/30/2006� � � 10/1/2005� � % change� 2006 YTD % �

Cockpit Lighting $ 8,300� $ 8,184� 1.42% $ 23,582� $ 21,597� 9.2%

28.6% Cabin Electronics 12,358� 4,472� 176.34% 33,316� 12,556�

165.3% 40.4% Airframe Power 3,759� 3,959� -5.05% 12,320� 8,189�

50.4% 14.9% External Lighting 1,872� 1,933� -3.16% 5,851� 6,632�

-11.8% 7.1% Cabin Lighting 1,968� 1,537� 28.04% 6,429� 4,974� 29.3%

7.8% Other 283� 336� -15.77% 1,007� 968� 4.0% 1.2% � � � � � � � �

� � � Total $ 28,540� � $ 20,421� � 39.76% $ 82,505� � $ 54,916� �

50.2% 100.0% ASTRONICS CORPORATION ORDER AND BACKLOG TREND � 2005�

2006� ($, in thousands) Q1 2005 Q2 2005 Q3 2005 Q4 2005 Twelve

Months Q1 2006 Q2 2006 Q3 2006 Nine Months 4/2/05� � 7/2/05� �

10/1/05� � 12/31/05� � 12/31/05� 4/1/06� � 7/1/06� � 9/30/06� �

9/30/06� Bookings $ 14,868� � $ 23,564� � $ 20,176� � $ 37,946� � $

96,554� $ 23,850� � $ 23,929� � $ 25,985� � $ 73,764� Backlog $

72,292� � $ 77,856� � $ 77,611� � $ 95,121� � $95,121� $ 94,045� �

$ 88,935� � $ 86,380� � $ 86,380� Book:Bill 0.95� 1.25� 0.99� 1.86�

1.28� 0.96� 0.82� 0.91� 0.89� Astronics Corporation (NASDAQ: ATRO),

a leading manufacturer of advanced, high-performance lighting,

electronics and electrical power systems for the global aerospace

industry, reported net income of $1.9 million for the third quarter

of 2006, an increase of $1.1 million over net income of $0.8

million in the third quarter of 2005. Earnings per diluted share

were $0.23 for the third quarter of 2006 compared with $0.10 in the

same period the prior year. For the nine months ended September 30,

2006, net income was $5.1 million, or $0.63 per diluted share,

compared with $1.6 million, or $0.20 per diluted share, for the

same period last year. Sales for the third quarter were $28.5

million, a 40% increase from $20.4 million in the third quarter of

2005. Over 95% of the increase, or $7.9 million, can be attributed

to higher sales of the Company's cabin electronics products, which

provide power for in-flight entertainment and in-seat power systems

for the global commercial airline market. Sales to the business jet

market also increased $2.5 million reflecting increased aircraft

production rates. Military sales were down 26% from the third

quarter last year. The decrease was primarily caused by a $2.2

million decrease in deliveries for F-16 night vision kits for the

Republic of Korea Air Force as the Korean program was concluded in

2005. Sequentially, sales in the third quarter were down 1.7% from

sales in the second quarter reflecting slower demand and production

over the summer. Peter J. Gundermann, President and CEO of

Astronics Corp., commented, "Our strategy to be in the three major

aircraft markets: military, business jet and commercial transport,

has worked very well in this environment of strong commercial

airlines growth, expansion of the business jet market and stable

sales to the military. Commercial and business jet aircraft

manufacturers are seeing continued expansion of their backlogs. As

a result, we believe that 2007 should be another year of solid

growth for Astronics." Gross margin for the quarter was 22.8%, up

slightly from 21.9% in the third quarter of 2005, as a result of

leverage provided by higher sales. Selling, general and

administrative (SG&A) expenses were $3.5 million up from $2.9

million in the same period the prior year. As a percentage of

sales, SG&A was 12% in this year's third quarter compared with

14% last year as sales grew at a faster pace than SG&A

spending. Operating profit almost doubled quarter-over-quarter,

from $1.6 million in the third quarter of 2005 to $3.1 million this

year. Nine-Month Period Review For the first nine months of 2006,

sales were $82.5 million, a 50% increase from $54.9 million in the

same period last year. Sales to the commercial transport sector

doubled over the prior year sales to $45.1 million and currently

represent about 55% of total sales. Business jet sales have

improved 40%, when comparing the nine month periods, from $11.9

million to $16.7 million while military sales have remained

relatively flat at $19.7 million for the first nine months of 2006.

Gross margin for the nine month period improved to 22.6% from 20.5%

in the first nine months of 2005 on higher volume. SG&A

increased on an absolute basis to $9.9 million from $7.7 million

during the first nine months last year, but as a percentage of

sales declined to 12% this year compared with 14% for the 2005

nine-month period. Liquidity Cash and cash equivalents at September

30, 2006, was $645 thousand, a decrease from $4.5 million at

December 31, 2005, but an increase from $425 thousand at July 1,

2006. Increased investment in working capital components, primarily

inventory and receivables associated with increasing sales growth

have used cash reserves. Capital expenditures for the third quarter

of 2006 were $693 thousand up from $432 thousand in the same period

last year. For the nine month period, capital expenditures

increased to $2.3 million from $1.8 million in the first nine

months last year. Outlook Bookings for the third quarter of 2006

were $26.0 million, a 29% increase from bookings of $20.2 million

in the third quarter last year. Backlog at the end of the third

quarter was $86.4 million compared with $77.6 million at the end of

the same quarter last year. Mr. Gundermann added, "As we move

through the fourth quarter, we anticipate that we could be at the

high end or somewhat above our estimated sales range of $105

million to $110 million for 2006. We are encouraged by the demand

for aircraft and the success our customers are having with orders

which should contribute to next year's growth and beyond. Across

the aerospace industry conditions remain strong." Third Quarter

Webcast and Conference Call The release of the financial results on

November 9, 2006, will be followed by a company-hosted

teleconference at 11:00 a.m. ET. During the teleconference, Peter

J. Gundermann, President and CEO, and David C. Burney, Vice

President and CFO, will review the financial and operating results

for the period and discuss Astronics' corporate strategy and

outlook. A question-and-answer session will follow. The Astronics

conference call can be accessed the following ways: -- The live

webcast can be found at http://www.astronics.com. Participants

should go to the website 10 - 15 minutes prior to the scheduled

conference in order to register and download any necessary audio

software. -- The teleconference can be accessed by dialing (913)

312-1267 approximately 5 - 10 minutes prior to the call. To listen

to the archived call: -- The archived webcast will be at

http://www.astronics.com. A transcript will also be posted once

available. -- A replay can also be heard by calling (719) 457-0820,

and entering passcode 2437531. The telephonic replay will be

available through Thursday, November 16, 2006 at 11:59 p.m. ET.

ABOUT ASTRONICS CORPORATION Astronics Corporation is a leading

manufacturer of advanced, high-performance lighting and electrical

power distribution systems for the global aerospace industry. Its

strategy is to expand the value and content it provides to various

aircraft platforms through product development and acquisition.

Astronics Corporation, and its wholly-owned subsidiaries Astronics

Advanced Electronic Systems Corp. and Luminescent Systems Inc.,

have a reputation for high quality designs, exceptional

responsiveness, strong brand recognition and best-in-class

manufacturing practices. For more information on Astronics and its

products, visit its website at www.Astronics.com. Safe Harbor

Statement This press release contains forward-looking statements as

defined by the Securities Exchange Act of 1934. One can identify

these forward-looking statements by the use of the words "expect,"

"anticipate," "plan," "may," "will," "estimate" or other similar

expression. Because such statements apply to future events, they

are subject to risks and uncertainties that could cause the actual

results to differ materially from those contemplated by the

statements. Important factors that could cause actual results to

differ materially include the state of the aerospace industry, the

market acceptance of newly developed products, the ability to cross

sell products and expand markets, internal production capabilities,

the timing of orders received, the status of customer certification

processes, the demand for and market acceptance of new or existing

aircraft which contain the Company's products, such as the Airbus

A380; the Eclipse 500; the Air Canada's CRJ705, A320, and several

configurations of B767; Cessna single engine aircraft; Cessna

Mustang; Hawker Horizon; the V22 Osprey; Lockheed Martin F-35 JSF;

China Eastern Airlines Corp. Limited's upgrade of 15 Airbus

A330-300's and five Airbus A330-200's; Air China Limited's upgrades

of 20 Airbus A330-200's; and F-22 Raptor; customer preferences, and

other factors which are described in filings by Astronics with the

Securities and Exchange Commission. The Company assumes no

obligation to update forward-looking information in this press

release whether to reflect changed assumptions, the occurrence of

unanticipated events or changes in future operating results,

financial conditions or prospects, or otherwise. -0- *T ASTRONICS

CORPORATION CONSOLIDATED INCOME STATEMENT DATA

----------------------------------------------------------------------

(unaudited) (in thousands except per share data) Three months ended

Nine months ended 9/30/2006 10/1/2005 9/30/2006 10/1/2005

------------------------------------------------ Sales $ 28,540 $

20,421 $ 82,505 $ 54,916 Cost of products sold 22,019 15,947 63,891

43,654 Gross margin 22.8% 21.9% 22.6% 20.5% Selling general and

administrative 3,469 2,890 9,931 7,679

------------------------------------------------ Income from

operations 3,052 1,584 8,683 3,583 Operating margin 10.7% 7.8%

10.5% 6.5% Interest expense, net 232 202 650 519 Other (income)

expense (5) - (39) -

------------------------------------------------ Income (loss)

before tax 2,825 1,382 8,072 3,064 Income taxes 912 592 2,934 1,468

------------------------------------------------ Net Income $ 1,913

$ 790 $ 5,138 $ 1,596

================================================ Basic earnings per

share: $ 0.24 $ 0.10 $ 0.65 $ 0.20 Diluted earnings per share: $

0.23 $ 0.10 $ 0.63 $ 0.20 Weighted average diluted shares

outstanding 8,264 8,094 8,210 8,006

----------------------------------------------------------------------

Capital Expenditures $ 693 $ 432 $ 2,300 $ 1,765 Depreciation and

Amortization $ 701 $ 720 $ 1,960 $ 2,042

----------------------------------------------------------------------

*T -0- *T ASTRONICS CORPORATION CONSOLIDATED BALANCE SHEET DATA

----------------------------------------------------------------------

(unaudited) (in thousands) 9/30/2006 12/31/2005

------------------------ ASSETS:

---------------------------------------------- Cash and cash

equivalents $ 645 $ 4,473 Accounts receivable 18,065 12,635

Inventories 26,584 19,013 Other current assets 1,966 1,401

Property, plant and equipment, net 21,221 20,461 Other assets 7,691

7,874 ------------------------ Total Assets $ 76,172 $ 65,857

======================== LIABILITIES AND SHAREHOLDERS' EQUITY:

---------------------------------------------- Current maturities

of long term debt $ 921 $ 914 Note payable 7,900 7,000 Accounts

payable and accrued expenses 18,843 15,843 Long-term debt 9,837

10,304 Other liabilities 6,179 5,962 Shareholders' equity 32,492

25,834 ------------------------ Total liabilities and shareholders'

equity $ 76,172 $ 65,857 ======================== *T -0- *T

ASTRONICS CORPORATION NET SALES BY MARKET ($, in thousands) Three

Months Ended 9/30/2006 10/1/2005 % change

------------------------------------ Military $ 6,136 $ 8,330

-26.3% Commercial Transport 15,781 7,943 98.7% Business Jet 6,340

3,812 66.3% Other 283 336 -15.8%

------------------------------------ Total $ 28,540 $ 20,421 39.8%

------------------------------------ Nine Months Ended 2006

9/30/2006 10/1/2005 % change YTD %

--------------------------------- ------ Military $ 19,724 $ 19,500

1.15% 23.9% Commercial Transport 45,106 22,534 100.17% 54.7%

Business Jet 16,668 11,914 39.90% 20.2% Other 1,007 968 4.03% 1.2%

--------------------------------- ------ Total $ 82,505 $ 54,916

50.24% 100.0% --------------------------------- ------ *T -0- *T

ASTRONICS CORPORATION NET SALES BY PRODUCT ($, in thousands) Three

Months Ended 9/30/2006 10/1/2005 % change

------------------------------------ Cockpit Lighting $ 8,300 $

8,184 1.42% Cabin Electronics 12,358 4,472 176.34% Airframe Power

3,759 3,959 -5.05% External Lighting 1,872 1,933 -3.16% Cabin

Lighting 1,968 1,537 28.04% Other 283 336 -15.77%

------------------------------------ Total $ 28,540 $ 20,421 39.76%

------------------------------------ Nine Months Ended 2006

9/30/2006 10/1/2005 % change YTD %

--------------------------------- ------ Cockpit Lighting $ 23,582

$ 21,597 9.2% 28.6% Cabin Electronics 33,316 12,556 165.3% 40.4%

Airframe Power 12,320 8,189 50.4% 14.9% External Lighting 5,851

6,632 -11.8% 7.1% Cabin Lighting 6,429 4,974 29.3% 7.8% Other 1,007

968 4.0% 1.2% --------------------------------- ------ Total $

82,505 $ 54,916 50.2% 100.0% ---------------------------------

------ *T -0- *T ASTRONICS CORPORATION ORDER AND BACKLOG TREND 2005

($, in thousands) Q1 2005 Q2 2005 Q3 2005 Q4 2005 Twelve Months

4/2/05 7/2/05 10/1/05 12/31/05 12/31/05

---------------------------------------------- Bookings $14,868

$23,564 $20,176 $37,946 $96,554

----------------------------------------------------------------------

Backlog $72,292 $77,856 $77,611 $95,121 $95,121

----------------------------------------------------------------------

Book:Bill 0.95 1.25 0.99 1.86 1.28 2006 ($, in thousands) Q1 2006

Q2 2006 Q3 2006 Nine Months 4/1/06 7/1/06 9/30/06 9/30/06

------------------------------------- Bookings $23,850 $23,929

$25,985 $73,764

----------------------------------------------------------------------

Backlog $94,045 $88,935 $86,380 $86,380

----------------------------------------------------------------------

Book:Bill 0.96 0.82 0.91 0.89 *T

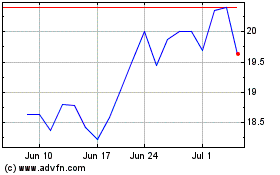

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Apr 2024 to May 2024

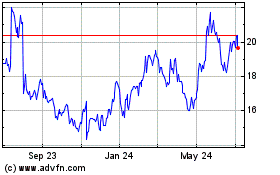

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2023 to May 2024