- Sales increase 59% over first quarter last year EAST AURORA,

N.Y., May 11 /PRNewswire-FirstCall/ -- Astronics Corporation

(NASDAQ:ATRO), a leading manufacturer of advanced, high-performance

lighting, electronics and electrical power systems for the global

aerospace industry, reported sales of $24.9 million for the first

quarter of 2006 compared with $15.7 million in the first quarter of

2005, up $9.2 million, or 59.2%. Last year's first quarter included

only eight weeks of Astronics Advanced Electronic Systems sales, as

it was acquired in February 2005. Net income for the first quarter

2006 doubled to $1.2 million compared with net income of $0.6

million in the prior year first quarter. On a diluted earnings per

share basis, earnings were $0.15 this year's first quarter compared

with $0.08 in the first quarter 2005. Higher sales of cabin

electronics due to stronger demand from the commercial transport

market and sales to Air Canada on the contract win announced

December 21, 2005, were the primary drivers of the growth. Airframe

power sales were higher as a result of sales to the military for

the Tactical Tomahawk and Taurus missile programs, which entered

full production in the second half of 2005. Increased aircraft

production rates also contributed to revenue growth. When compared

with the fourth quarter of 2005, sales increased $4.5 million, or

22%. When the sequential quarters are compared, a $6.0 million

increase in sales of cockpit lighting, cabin electronics, and

airframe power products more than offset a $1.5 million decline in

external and cabin lighting products. Product sales are highly

dependent on customer production rates and the timing of various

programs. Peter J. Gundermann, President and CEO noted, "Our strong

first quarter performance was a result of our strong product

offering, the overall health of the aerospace industry, the

acceleration of the Air Canada program and certain customer

projects that are progressing well. The industry continues to

demonstrate solid growth without any indications of weakening in

the near term. In particular, the commercial transport market was a

large contributor to our growth this quarter. Going forward, we

believe that our market mix and product demand will vary based on

when certain customer programs enter production." Gross margin for

the quarter was 21.1%, essentially flat compared with last year's

first quarter gross margin of 21.0%. Higher engineering labor,

testing and consulting fees offset gains from higher volume.

Selling, general and administrative (SG&A) expenses declined to

12.1% of sales compared with 14% in the same period last year. On

an absolute basis, SG&A increased to $3.0 million in this

year's first quarter from $2.2 million during the first quarter

last year. A full quarter of expenses related to Astronics AES, as

well as $140 thousand in stock based compensation expenses incurred

as a result of the adoption of SFAS 123(R) in the first quarter,

contributed to higher absolute expenses. During the first quarter

of this year, there were no costs associated with the

implementation of Section 404 in the first quarter, but it is

expected that $300 to $500 thousand may be incurred in the

remaining nine months of fiscal 2006 for these purposes. Cash and

cash equivalents declined from $4.5 million to $6.0 thousand to

support working capital needs and to reduce notes payable. The

Company has a $15 million demand line of credit facility available

and believes this, along with cash from operations, is adequate to

meet its on going needs. Capital expenditures were $645 thousand

for the first quarter, while depreciation and amortization was $623

thousand. Outlook Bookings for the first quarter 2006 were $23.9

million compared with $14.9 million and $37.9 million in the first

and fourth quarters of last year, respectively. Backlog was $94.0

million at the end of the first quarter this year up from last

year's first quarter backlog of $72.3 million and down slightly

from 2005 year end backlog of $95.1 million. Mr. Gundermann added,

"We are encouraged by the robustness of the aerospace market, in

which production rates for new aircraft are exceeding forecasts

from last year. However, we remain focused on the range of new

aircraft in which we are involved. We have been designed into many

of the premier new aircraft that will dominate the skies over the

next twenty years. These include the Eclipse 500 jet, the V-22

Osprey, the Airbus A380, the Citation Mustang, the Hawker Horizon

and the Joint Strike Fighter. We have been involved with these

programs for a long time and look forward to their successful

airworthiness certification and entry into production." He went on

to say, "We expect that our second quarter will be as strong as our

first quarter, if not better, in part due to strong production

rates at OEMs and the continued acceleration of the Air Canada

program. Right now, we are benefiting tremendously from the growth

of the global commercial air transport industry. As we look into

the second half of the year, our visibility becomes reduced as the

timing of customer projects and the rate and consistency of their

orders can vary measurably. However, we expect that with a strong

first half, we will have revenue for the year in the $90 to $100

million range." First Quarter Webcast and Conference Call The

release of the financial results on May 11, 2006, will be followed

by a company-hosted teleconference at 11:00 a.m. ET. During the

teleconference, Peter J. Gundermann, President and CEO, and David

C. Burney, Vice President and CFO, will review the financial and

operating results for the period and discuss Astronics' corporate

strategy and outlook. A question-and-answer session will follow.

The Astronics conference call can be accessed the following ways:

-- The live webcast can be found at http://www.astronics.com/.

Participants should go to the website 10 - 15 minutes prior to the

scheduled conference in order to register and download any

necessary audio software. -- The teleconference can be accessed by

dialing (913) 312-1267 approximately 5 - 10 minutes prior to the

call. To listen to the archived call: -- The archived webcast will

be at http://www.astronics.com/. A transcript will also be posted

once available. -- A replay can also be heard by calling (719)

457-0820, and entering passcode 9440576. The telephonic replay will

be available through Thursday, May 18, 2006 at 11:59 p.m. ET.

Annual Meeting of Shareholders Additionally, the Company will

webcast its 2006 annual shareholders' meeting on Friday, May 12,

2006 at approximately 10:00 am. During the management presentation,

Peter Gundermann, President and Chief Executive Officer will

discuss Astronics' financial and business performance and strategy.

The webcast will be accessible on Astronics' website at

http://www.astronics.com/. An archive of the webcast will be

available at http://www.astronics.com/ for approximately 60 days.

Participants will need Windows Media Player to view the webcast,

which can be downloaded from the Astronics website. ABOUT ASTRONICS

CORPORATION Astronics Corporation is a leading manufacturer of

advanced, high- performance lighting and electrical power

distribution systems for the global aerospace industry. Its

strategy is to expand the value and content it provides to various

aircraft platforms through product development and acquisition.

Astronics Corporation, and its wholly-owned subsidiaries Astronics

Advanced Electronic Systems Corp. and Luminescent Systems Inc.,

have a reputation for high quality designs, exceptional

responsiveness, strong brand recognition and best-in-class

manufacturing practices. For more information on Astronics and its

products, visit its website at http://www.astronics.com/. Safe

Harbor Statement This press release contains forward-looking

statements as defined by the Securities Exchange Act of 1934. One

can identify these forward-looking statements by the use of the

words "expect," "anticipate," "plan," "may," "will," "estimate" or

other similar expression. Because such statements apply to future

events, they are subject to risks and uncertainties that could

cause the actual results to differ materially from those

contemplated by the statements. Important factors that could cause

actual results to differ materially include the state of the

aerospace industry, the market acceptance of newly developed

products, the ability to cross sell products and expand markets,

internal production capabilities, the timing of orders received,

the status of customer certification processes, the demand for and

market acceptance of new or existing aircraft which contain the

Company's products, such as the Airbus A380; the Eclipse 500; the

Air Canada's CRJ705, A320, and several configurations of B767;

Cessna single engine aircraft; Cessna Mustang; Hawker Horizon; the

V22 Osprey; Lockheed Martin F-35 JSF; China Eastern Airlines Corp.

Limited's upgrade of 15 Airbus A330-300's and five Airbus A330-

200's; Air China Limited's upgrades of 20 Airbus A330-200's; and

F-22 Raptor; customer preferences, and other factors which are

described in filings by Astronics with the Securities and Exchange

Commission. The Company assumes no obligation to update

forward-looking information in this press release whether to

reflect changed assumptions, the occurrence of unanticipated events

or changes in future operating results, financial conditions or

prospects, or otherwise. ASTRONICS CORPORATION CONSOLIDATED INCOME

STATEMENT DATA (unaudited) (in thousands except per share data)

Three months ended 4/1/2006 4/2/2005 Sales $24,926 $15,656 Cost of

products sold 19,677 12,363 Gross profit 5,249 3,293 Gross margin

21.1% 21.0% Selling general and administrative 3,019 2,207 Income

from operations 2,230 1,086 Operating margin 8.9% 6.9% Interest

expense, net 199 126 Other (income) expense (12) - Income before

tax 2,043 960 Income taxes 833 351 Net Income $1,210 $609 Basic

earnings per share: $0.15 $0.08 Diluted earnings per share: $0.15

$0.08 Weighted average diluted shares outstanding 8,143 7,900

Capital Expenditures 645 551 Depreciation and Amortization 623 616

ASTRONICS CORPORATION CONSOLIDATED BALANCE SHEET DATA (unaudited)

(in thousands) 4/1/2006 12/31/2005 ASSETS: Cash and cash

equivalents $6 $4,473 Accounts receivable 15,949 12,635 Inventories

21,369 19,013 Other current assets 1,778 1,401 Property, plant and

equipment, net 20,604 20,461 Other assets 7,737 7,874 Total Assets

$67,443 $65,857 LIABILITIES AND SHAREHOLDERS' EQUITY: Current

maturities of long term debt $913 $914 Note payable 6,000 7,000

Accounts payable and accrued expenses 17,008 15,843 Long-term debt

10,239 10,304 Other liabilities 6,039 5,962 Shareholders' equity

27,244 25,834 Total liabilities and shareholders' equity $67,443

$65,857 ASTRONICS CORPORATION NET SALES BY MARKET ($, in thousands)

Three Months Ended 4/1/2006 4/2/2005 %change 2006 YTD % Military

$7,141 $5,095 40.16% 28.65% Commercial Transport 12,444 6,162

101.95% 49.92% Business Jet 4,881 4,004 21.90% 19.58% Other 460 395

16.46% 1.85% Total $24,926 $15,656 59.21% 100.00% ASTRONICS

CORPORATION NET SALES BY PRODUCT ($, in thousands) Three Months

Ended 4/1/2006 4/2/2005 % change 2006 YTD % Cockpit Lighting $8,073

$6,720 20.13% 32.39% Cabin Electronics 8,292 2,992 177.14% 33.27%

Airframe Power 4,166 1,840 126.41% 16.71% External Lighting 1,750

1,972 -11.26% 7.02% Cabin Lighting 2,185 1,737 25.79% 8.77% Other

460 395 16.46% 1.85% Total $24,926 $15,656 59.21% 100.00% ORDER AND

BACKLOG TREND ($, in thousands) Twelve Q1 2005 Q2 2005 Q3 2005 Q4

2005 Months Q1 2006 4/2/05 7/2/05 10/1/05 12/31/05 12/31/05 4/1/06

Bookings $14,868 $23,564 $20,176 $37,946 $96,554 $23,850 Backlog

$72,292 $77,856 $77,611 $95,121 $95,121 $94,045 Book: Bill 0.95

1.25 0.99 1.86 1.28 0.96 DATASOURCE: Astronics Corporation CONTACT:

David C. Burney, Chief Financial Officer for Astronics Corporation,

+1-716-805-1599, ext. 159, Fax: +1-716-805-1286, Web site:

http://www.astronics.com/

Copyright

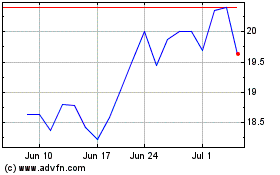

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Apr 2024 to May 2024

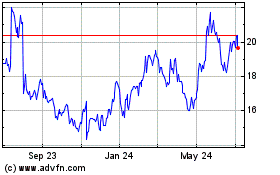

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2023 to May 2024