false000101346200010134622024-05-222024-05-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2024

ANSYS, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

0-20853

|

04-3219960

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

2600 ANSYS Drive,

Canonsburg, PA 15317

(Address of principal executive offices)

(844)-462-6797

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value per share

|

|

ANSS

|

|

Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.07 |

Submission of Matters to a Vote of Security Holders.

|

On May 22, 2024, ANSYS, Inc., a Delaware corporation (the “Company” or “Ansys”), held a special meeting of stockholders (the “Special Meeting”) to consider certain proposals

related to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of January 15, 2024, by and among Ansys, Synopsys, Inc., a Delaware corporation (“Synopsys” or “Parent”), and ALTA Acquisition Corp., a Delaware corporation and wholly owned

subsidiary of Synopsys (“Merger Sub”), pursuant to which Merger Sub will merge with and into Ansys (the “Merger”), with Ansys surviving the Merger as a wholly owned subsidiary of Synopsys.

As of April 9, 2024, the record date for the Special Meeting, there were 87,299,981 shares of Ansys common stock, par value $0.01 per share (“Common Stock”), outstanding,

each of which was entitled to one (1) vote for each proposal at the Special Meeting. At the Special Meeting, a total of 74,068,377 shares of Common Stock, representing approximately 84.8% of the outstanding shares issued and outstanding and entitled

to vote, were present virtually or by proxy, constituting a quorum to conduct business.

At the Special Meeting the following proposals were considered:

| |

(1)

|

the proposal to adopt the Merger Agreement;

|

|

(2) |

the proposal to approve, on an advisory (non-binding) basis, the merger-related compensation that will or may be paid to the Company’s named executive officers in connection with the transactions

contemplated by the Merger Agreement; and

|

|

(3) |

the proposal to approve the adjournment of the special meeting to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the merger agreement

proposal or to ensure that any supplement or amendment to the accompanying proxy statement/prospectus is timely provided to Ansys stockholders.

|

The proposals were approved by the requisite vote of the Company’s stockholders. The final voting results for each proposal are described below. For more information on

each of these proposals, see the Company’s definitive proxy statement (“Proxy Statement”) filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 17, 2024.

1. The Company’s stockholders voted on a proposal to adopt the Merger Agreement:

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

|

|

913,892

|

|

|

2. The Company’s stockholders voted on a proposal to approve, on an advisory (non-binding) basis, the merger-related compensation that will or may be paid to the Company’s

named executive officers in connection with the transactions contemplated by the Merger Agreement:

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

70,231,822

|

|

3,747,166

|

|

89,389

|

3. The Company’s stockholders voted on a proposal to adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient

votes at the time of the special meeting to approve the merger agreement proposal or to ensure that any supplement or amendment to the accompanying proxy statement/prospectus is timely provided to Ansys stockholders:

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

68,674,342

|

|

5,347,197

|

|

46,838

|

Pursuant to the terms of the Merger Agreement, the completion of the Merger remains subject to various conditions, including (1) the absence of an order, injunction or law

prohibiting the Merger, (2) the expiration or early termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (3) the approval of the Merger under certain other applicable antitrust and

foreign investment regimes, (4) the shares of Synopsys common stock to be issued in the merger being approved for listing on the Nasdaq, (5) the accuracy of the other party’s

representations and warranties, subject to certain standards set forth in the Merger Agreement, (6) compliance in all material respects with the other party’s obligations under the Merger Agreement and (7) the absence of a Material Adverse Effect on

the Company or a Material Adverse Effect on Parent (as each are defined in the Merger Agreement) since the date of the Merger Agreement that is continuing. The Company continues to expect to complete the Merger in the first half of 2025, subject to

customary closing conditions.

The information set forth in Item 5.07 is incorporated by reference herein. On May 22, 2024, the Company issued a press release announcing the results of the Special Meeting

held today. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits.

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Cautionary Note Regarding Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the U.S. Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Ansys’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential

benefits thereof, its business and industry, management’s beliefs and certain assumptions made by Ansys and Synopsys, all of which are subject to change. In this context, forward-looking statements often address expected future business and financial

performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,” “will,” “may,” “would,” “might,” “potentially,” “estimate,” “continue,” “expect,” “target,” similar

expressions or the negatives of these words or other comparable terminology that convey uncertainty of future events or outcomes. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are

beyond our control, and are not guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate

the proposed transaction or to make or take any filing or other action required to consummate the transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause

actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore,

you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the completion of the

proposed transaction on anticipated terms and timing, including obtaining regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of Ansys’ and Synopsys’ businesses and other conditions to the completion of the transaction; (ii) failure to realize the

anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Ansys and Synopsys; (iii) Ansys’ ability to implement its business strategy; (iv) pricing trends, including

Ansys’ and Synopsys’ ability to achieve economies of scale; (v) potential litigation relating to the proposed transaction that could be instituted against Ansys, Synopsys or their respective directors; (vi) the risk that disruptions from the proposed

transaction will harm Ansys’ or Synopsys’ business, including current plans and operations; (vii) the ability of Ansys or Synopsys to retain and hire key personnel; (viii) potential adverse reactions or changes to business relationships resulting from

the announcement or completion of the proposed transaction; (ix) uncertainty as to the long-term value of Synopsys’ common stock; (x) legislative, regulatory and economic developments affecting Ansys’ and Synopsys’ businesses; (xi) general economic and

market developments and conditions; (xii) the evolving legal, regulatory and tax regimes under which Ansys and Synopsys operate; (xiii) potential business uncertainty, including changes to existing business relationships, during the pendency of the

transaction that could affect Ansys’ or Synopsys’ financial performance; (xiv) restrictions during the pendency of the proposed transaction that may impact Ansys’ or Synopsys’ ability to pursue certain business opportunities or strategic transactions;

and (xv) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Ansys’ and Synopsys’ response to any of the aforementioned factors. These risks, as well as

other risks associated with the proposed transaction, are more fully discussed in the proxy statement/prospectus filed with the U.S. Securities and Exchange Commission in connection with the proposed transaction. While the list of factors presented

here is, and the list of factors presented in the proxy statement/prospectus are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption,

operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Ansys’ or Synopsys’ consolidated financial condition, results of operations, or liquidity. Neither Ansys nor

Synopsys assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by

securities and other applicable laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

|

Date: May 22, 2024

|

|

| |

|

| |

ANSYS, Inc.

|

| |

|

| |

By:

|

|

| |

Name:

|

Ajei S. Gopal

|

| |

Title:

|

President and Chief Executive Officer

|

Exhibit 99.1

Ansys Stockholders Approve Transaction with Synopsys

Represents Key Milestone Toward Completion of Transaction with Synopsys

PITTSBURGH, PA – May 22, 2024 /PRNewswire/ -- ANSYS, Inc. (NASDAQ: ANSS) announced that at the special meeting of stockholders (the “Special Meeting”) held earlier today,

its stockholders voted to approve the proposed acquisition of Ansys by Synopsys, Inc. (NASDAQ: SNPS). Under the terms of the merger agreement, Ansys stockholders will receive $197.00 in cash and 0.3450 shares of Synopsys common stock for each Ansys

share they own, representing an enterprise value of approximately $35 billion based on the closing price of Synopsys common stock on December 21, 2023.

At the Special Meeting, approximately 98.7% of the shares voted were voted in favor of the transaction, which represented approximately 83.8% of the total outstanding

shares of Ansys common stock as of April 9, 2024, the record date for voting at the Special Meeting.

“Our stockholders overwhelming approved our merger with Synopsys because they recognize that this is a transformative combination that will create a leader in

silicon-to-systems design solutions,” said Ajei Gopal, Ansys president and CEO. “The combination of Ansys and Synopsys will help to reshape the products we use every day, and create new opportunities for Ansys customers, partners and employees. This

is an important milestone toward completing the transaction, and we remain focused on obtaining the required approvals to close.”

Ansys anticipates filing the final vote results for the Special Meeting, as certified by the independent Inspector of Election, on a Form 8-K with the U.S. Securities and

Exchange Commission within four business days of the Special Meeting. The transaction is anticipated to close in the first half of 2025, subject to satisfaction or waiver of all other closing conditions, including receipt of outstanding regulatory

approvals.

Cautionary Note Regarding Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the U.S. Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Ansys’ current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential

benefits thereof, its business and industry, management’s beliefs and certain assumptions made by Ansys and Synopsys, all of which are subject to change. In this context, forward-looking statements often address expected future business and financial

performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,” “will,” “may,” “would,” “might,” “potentially,” “estimate,” “continue,” “expect,” “target,” similar

expressions or the negatives of these words or other comparable terminology that convey uncertainty of future events or outcomes. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are

beyond our control, and are not guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate

the proposed transaction or to make or take any filing or other action required to consummate the transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause

actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and,

therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the completion

of the proposed transaction on anticipated terms and timing, including obtaining regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance,

indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of Ansys’ and Synopsys’ businesses and other conditions to the completion of the transaction; (ii) failure to

realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Ansys and Synopsys; (iii) Ansys’ ability to implement its business strategy; (iv) pricing

trends, including Ansys’ and Synopsys’ ability to achieve economies of scale; (v) potential litigation relating to the proposed transaction that could be instituted against Ansys, Synopsys or their respective directors; (vi) the risk that disruptions

from the proposed transaction will harm Ansys’ or Synopsys’ business, including current plans and operations; (vii) the ability of Ansys or Synopsys to retain and hire key personnel; (viii) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the proposed transaction; (ix) uncertainty as to the long-term value of Synopsys’ common stock; (x) legislative, regulatory and economic developments affecting Ansys’ and Synopsys’

businesses; (xi) general economic and market developments and conditions; (xii) the evolving legal, regulatory and tax regimes under which Ansys and Synopsys operate; (xiii) potential business uncertainty, including changes to existing business

relationships, during the pendency of the transaction that could affect Ansys’ or Synopsys’ financial performance; (xiv) restrictions during the pendency of the proposed transaction that may impact Ansys’ or Synopsys’ ability to pursue certain

business opportunities or strategic transactions; and (xv) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as Ansys’ and Synopsys’ response to any of

the aforementioned factors. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the proxy statement/prospectus filed with the U.S. Securities and Exchange Commission in connection with the

proposed transaction. While the list of factors presented here is, and the list of factors presented in the proxy statement/prospectus are considered representative, no such list should be considered to be a complete statement of all potential risks

and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements

could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Ansys’ or Synopsys’ consolidated financial

condition, results of operations, or liquidity. Neither Ansys nor Synopsys assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise,

should circumstances change, except as otherwise required by securities and other applicable laws.

Our Mission: Powering Innovation that Drives Human AdvancementTM

When visionary companies need to know how their world-changing ideas will perform, they close the gap between design and reality with Ansys simulation. For more than 50

years, Ansys software has enabled innovators across industries to push boundaries by using the predictive power of simulation. From sustainable transportation to advanced semiconductors, from satellite systems to life-saving medical devices, the next

great leaps in human advancement will be powered by Ansys.

Ansys and any and all ANSYS, Inc. brand, product, service and feature names, logos and slogans are registered trademarks or trademarks of ANSYS, Inc. or its subsidiaries in

the United States or other countries. All other brand, product, service and feature names or trademarks are the property of their respective owners.

|

Investors

|

Kelsey DeBriyn

|

| |

724.820.3927

|

| |

kelsey.debriyn@ansys.com

|

| |

|

|

Media

|

Mary Kate Joyce

|

| |

724.820.4368

|

| |

marykate.joyce@ansys.com

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

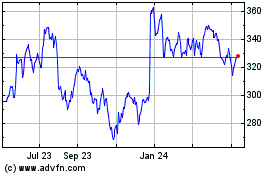

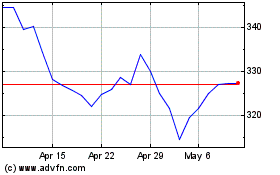

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From May 2024 to Jun 2024

ANSYS (NASDAQ:ANSS)

Historical Stock Chart

From Jun 2023 to Jun 2024