UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| x |

Soliciting

Material under §240.14a-12 |

AMERISERV FINANCIAL, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary

materials |

| ☐ |

Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On April 18, 2023, AmeriServ Financial, Inc. (the

“Company”) began mailing a letter to shareholders of the Company, a copy of which is filed as Exhibit 1.

Important Additional Information

The Company intends to file a proxy statement

and GOLD proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its upcoming annual

meeting of shareholders (the “Annual Meeting”) and, in connection therewith, the Company, its directors and certain of its

executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such

meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING GOLD PROXY CARD AND ALL OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE ANNUAL MEETING. The Company’s definitive proxy statement for the 2022 annual meeting of shareholders contains information

regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers

in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be

found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.ameriserv.com/sec-filings/insider-filings

or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, filed on March 27, 2023. Updated information regarding the identity of potential participants, and

their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other

materials to be filed with the SEC in connection with the Annual Meeting. Shareholders will be able to obtain the definitive proxy statement,

any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s

website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.ameriserv.com/sec-filings/documents.

EXHIBIT 1

April

18, 2023

Dear Shareholder,

On behalf of the Board of Directors (the “Board”)

of AmeriServ Financial, Inc. (NASDAQ: ASRV) (the “Company” or “AmeriServ”), thank you for your investment. We

are writing to you in advance of our upcoming 2023 Annual Meeting of Shareholders (the “Annual Meeting”), where you will

have the opportunity to vote on our recommended slate of highly qualified director candidates: Richard W. Bloomingdale, David J. Hickton

and Daniel A. Onorato. You will also be asked to vote on eliminating cumulative voting in the election of directors, which we believe

is an important step towards further enhancing AmeriServ’s corporate governance and establishing a more level playing field for

shareholder votes.

In the coming weeks, you will be receiving definitive

proxy materials and a GOLD proxy card that will contain instructions on how to cast your vote. We want to remind you that your vote is

important – no matter how many shares you own. In fact, this year your vote will be especially critical for ensuring the long-term

success of the Company and our ability to deliver value for you, our shareholders.

For now, we ask you to consider the following:

The Board – Including the Refreshed Slate of Nominees to

be Voted on at the Annual Meeting – Possesses the Right Mix of Skills and Experience to Support Priority Growth Areas and Appropriate

Capital Allocation Decisions Critical to Delivering Long-Term Value

AmeriServ benefits from an experienced and high-integrity

Board that provides diligent oversight of management and guidance on the execution of the Company’s strategy. The Board continuously

evaluates its composition to ensure it maintains the optimal mix of perspectives, qualifications and experience needed to properly carry

out its duties and manage risk while creating long-term value for shareholders and all our stakeholders. To accomplish this goal, we

have listened to shareholder feedback and have made Board refreshment a priority over the years, including appointing two new independent

directors since 2020. This commitment to refreshment continues in 2023 with the new addition of two new Board members and the retirements

of two directors.

In addition to recently added current director

Mr. Onorato, AmeriServ’s slate for election at the Annual Meeting includes Mr. Bloomingdale and Mr. Hickton. Each member of the

Company’s slate brings additive experience and relevant qualifications:

Richard “Rick” W. Bloomingdale

| |

|

| ü |

Recently retired

President of the Pennsylvania American Federation of Labor and Congress of Industrial Organizations (“Pennsylvania AFL-CIO”),

a labor federation |

| |

|

| ü |

Previously served as Secretary-Treasurer

of the Pennsylvania AFL-CIO |

| |

|

| ü |

Has a more than four-decade

career in labor relations |

The Board believes Mr. Bloomingdale’s

finance and labor experience will strengthen AmeriServ’s human capital management efforts and position the Company to further expand

its union business throughout Pennsylvania.

David J. Hickton

| ü | Since

2017, has been the Founding Director of the Institute for Cyber Law, Policy and Security

at the University of Pittsburgh, a research institute |

| ü | Was

the U.S. Attorney for the Western District of Pennsylvania from August 2010 until November

2016 |

| ü | Served

as staff director and senior counsel to the U.S. House of Representatives Select Subcommittee

on the Coronavirus Crisis from May 2020 until June 2021 |

The Board believes

Mr. Hickton’s experience in cybersecurity, data security and privacy approaches, legal affairs and regulatory matters will directly

benefit the Company as it meets customers’ expectations for online and mobile services.

Daniel A. Onorato

| ü | Has

been an integral member of the Board since 2020, serving on the investment/asset liability

committee and the audit committee, on which he is the Board’s designated audit committee

financial expert under applicable U.S. Securities and Exchange Commission (the “SEC”)

rules |

| ü | Since

2012, has been Executive Vice President, Chief Corporate Affairs Officer for Highmark Health,

a large regional healthcare company headquartered in Pittsburgh, Pennsylvania |

| ü | Prior

to joining Highmark Health, served two terms as chief executive of Allegheny County and prior

to that, served as Allegheny County’s controller and two terms on the Pittsburgh City

Council |

The Board believes that Mr. Onorato’s

professional experience in healthcare, government, accounting and law make him a valuable addition to our Board given the areas that

banking touches.

Aligning our Bylaws with Corporate Governance Best Practices

After careful consideration, the Board

unanimously determined that it is in the best interests of the Company and its shareholders to amend the Articles of Incorporation to

eliminate cumulative voting in the election of directors at the Annual Meeting. Put simply, cumulative voting allows a given shareholder

or shareholders to have outsized influence over the election of a director or multiple directors on the Board. This can increase the

chances that a certain director or directors may be focused on advancing the special interests or self-serving goals of the specific

minority shareholder(s) who exploited the mechanics of cumulative voting to elect them.

The Board

believes that eliminating cumulative voting will create a more level playing field for all shareholders by aligning voting power proportionally

with share ownership and recommends that you vote in favor of this change. This approach is consistent with the Company’s desire

to proactively enhance its corporate governance practices and serve the best interests of our shareholders. It will also align the Company

with standard corporate practices, given that only a tiny percentage of U.S. companies have cumulative voting1.

14.6% of S&P 500 companies

and 3.72% of Russell 3000 companies have cumulative voting. Source: Diligent.

The Future is Bright – Protect Your Investment

Your Board is working diligently to create lasting,

long-term shareholder value as the Company continues to navigate once-in-a-generation banking sector challenges. The improved earnings

performance that the Company saw in fiscal 2022 reflects the full benefit of several important strategic actions that we executed in

2021, including but not limited to the successful management of our asset quality throughout the pandemic and effective balance sheet

management.

Unfortunately, an activist shareholder group

consisting of J. Abbott R. Cooper, Julius D. Rudolph and Brandon L. Simmons, and Driver Management Company LLC and its affiliates (collectively,

the “Driver Group”) submitted documents to the Company purporting to nominate three director candidates for election to the

Board at the Annual Meeting. Driver is a serial bank activist, having targeted 6 institutions such as ours over the past four years.

The Company has informed the Driver Group that its purported nomination notice is invalid due to its failure to comply with the Company’s

Amended and Restated Bylaws (the “Bylaws”). The Board also believes you should be aware of the following:

| û | The

Driver Group’s notice includes certain material omissions and deficiencies that include

omitting that one nominee’s family members have sizable financial relationships with

the Company and that the purported nomination of Mr. Cooper does not comply with the Company’s

interlocks bylaw that prohibits Board members and nominees from, among other things, maintaining

concurrent directorships at other depository institutions – because Mr. Cooper is apparently

becoming a director of New York-based First of Long Island Corporation, the parent company

of The First National Bank of Long Island2. |

| û | To

protect the interests of all our shareholders and stakeholders, AmeriServ filed a complaint

with the Court of Common Pleas for Cambria County, Pennsylvania to obtain a declaratory judgment

that the Company properly rejected the notice in accordance with its Bylaws and, therefore,

the Driver Group has no right to nominate any director candidates for election at the Annual

Meeting. |

| û | In

an apparent attempt to advance its own interests and goals, the Driver Group filed a motion

for a preliminary injunction in the United States District Court for the Western District

of Pennsylvania against the Company and the Board seeking, among other things, to enjoin

the Annual Meeting until the court determines whether the Driver Group’s purported

nomination notice was properly rejected. |

| û | Unless

the result of the litigation is that the Driver Group’s purported nomination notice

is deemed valid, any director nominations made by the Driver Group will be disregarded, and

no proxies voted in favor of the Driver Group’s nominees will be recognized or tabulated

at the Annual Meeting. |

2Source: Press Release, “The

First of Long Island Corporation Announces Additional Board Refreshment as Part of Ongoing Commitment to Strong Corporate Governance,”

January 9, 2023.

The Board also believes it is important for you

to be aware of our attempts to engage in good faith with the Driver Group prior to its purported nomination and in spite of its seemingly

counter-productive actions:

| û | AmeriServ

immediately commenced a dialogue with Mr. Cooper after his firm disclosed an investment in

the Company via a 13D filing late last year. |

| û | We

hoped Mr. Cooper would appreciate that our Board could not blindly agree to an 8.1% shareholder's

demands to designate 33% of the Company's directors and take leadership roles on multiple

committees. |

| û | We

explained that our Board owes it to all of AmeriServ's shareholders, including the roughly

92% of shareholders unaffiliated with the Driver Group, to carry out normal-course vetting

and consider their long-term interests. |

| û | We

also explained our Board has no intention of agreeing to the type of seemingly self-enriching

cash payments and share repurchases that Mr. Cooper has extracted from other community banks

– at the expense of fellow shareholders – in order to end litigious contests3. |

On behalf of the entire Board, we look forward

to continuing to engage with shareholders and supporting our refreshed slate of director candidates for this year’s Annual Meeting,

including Messrs. Bloomingdale, Hickton and Onorato.

| Thank you for your support. |

|

|

| |

|

|

| Sincerely, |

|

|

| Allan R. Dennison |

Kim W. Kunkle |

Mark

E. Pasquerilla |

| |

|

|

| J. Michael Adams,

Jr. |

Margaret A. O’Malley |

Sara

A. Sargent |

| |

|

|

| Amy Bradley |

Daniel A. Onorato |

Jeffrey

A. Stopko |

3Source: American Banker, “First United in

Maryland buys out activist investor,” April 19, 2021.

About AmeriServ Financial, Inc.

AmeriServ Financial, Inc. is the parent of AmeriServ

Financial Bank and AmeriServ Trust and Financial Services Company in Johnstown, Pennsylvania. The Company’s subsidiaries provide

full-service banking and wealth management services through 17 community offices in southwestern Pennsylvania and Hagerstown, Maryland.

The Company also operates loan production offices in Altoona and Monroeville, Pennsylvania. On December 31, 2022, AmeriServ had total

assets of $1.4 billion and a book value of $6.20 per common share. For more information, visit www.ameriserv.com.

Forward Looking Statements

This press release contains forward-looking

statements as defined in the Securities Exchange Act of 1934, as amended, and is subject to the safe harbors created therein. Such statements

are not historical facts and include expressions about management’s confidence and strategies and management’s current views

and expectations about new and existing programs and products, relationships, opportunities, technology, market conditions, dividend

program, and future payment obligations. These statements may be identified by such forward-looking terminology as “continuing,”

“expect,” “look,” “believe,” “anticipate,” “may,” “will,” “should,”

“projects,” “strategy,” or similar statements. Actual results may differ materially from such forward-looking

statements, and no reliance should be placed on any forward-looking statement. Factors that may cause results to differ materially from

such forward-looking statements include, but are not limited to, unanticipated changes in the financial markets, the level of inflation,

and the direction of interest rates; volatility in earnings due to certain financial assets and liabilities held at fair value; competition

levels; loan and investment prepayments differing from our assumptions; insufficient allowance for credit losses; a higher level of loan

charge-offs and delinquencies than anticipated; material adverse changes in our operations or earnings; a decline in the economy in our

market areas; changes in relationships with major customers; changes in effective income tax rates; higher or lower cash flow levels

than anticipated; inability to hire or retain qualified employees; a decline in the levels of deposits or loss of alternate funding sources;

a decrease in loan origination volume or an inability to close loans currently in the pipeline; changes in laws and regulations; adoption,

interpretation and implementation of accounting pronouncements; operational risks, including the risk of fraud by employees, customers

or outsiders; unanticipated effects of our banking platform; risks and uncertainties relating to the duration of the COVID-19 pandemic,

and actions that may be taken by governmental authorities to contain the pandemic or to treat its impact; and the inability to successfully

implement or expand new lines of business or new products and services. These forward-looking statements involve risks and uncertainties

that could cause AmeriServ’s results to differ materially from management’s current expectations. Such risks and uncertainties

are detailed in AmeriServ’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2022,

filed on March 27, 2023.

Forward-looking statements are based on the beliefs

and assumptions of AmeriServ’s management and on currently available information. The statements in this press release are made

as of the date of this press release, even if subsequently made available by AmeriServ on its website or otherwise. AmeriServ undertakes

no responsibility to publicly update or revise any forward-looking statement.

Important Additional Information

The Company intends to file a proxy

statement and GOLD proxy card with the SEC in connection with the Annual Meeting and, in connection therewith, the Company,

its directors and certain of its executive officers will be participants in the solicitation of proxies from the Company’s

shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT,

ACCOMPANYING GOLD PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The Company’s definitive proxy statement for the 2022

annual meeting of shareholders contains information regarding the direct and indirect interests, by security holdings or otherwise,

of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes

to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the

Company’s website at http://investors.ameriserv.com/sec-filings/insider-filings or through the SEC’s website at www.sec.gov.

Information can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed on March

27, 2023. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security

holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in

connection with the Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or

supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov.

Copies will also be available at no charge at the Company’s website at http://investors.ameriserv.com/sec-filings/documents.

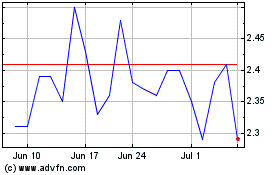

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

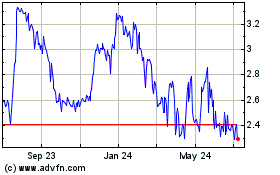

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Jul 2023 to Jul 2024