JOHNSTOWN, Pa., Jan. 22 /PRNewswire-FirstCall/ -- AmeriServ

Financial, Inc. (NASDAQ:ASRV) reported fourth quarter 2007 net

income of $924,000 or $0.04 per diluted share. This represents an

increase of $343,000 or 59.0% over the fourth quarter 2006 net

income of $581,000 or $0.03 per diluted share. For the year ended

December 31, 2007, the Company reported net income of $3.0 million

or $0.14 per diluted share. This represents an increase of $702,000

or 30.1% when compared to net income of $2.3 million or $0.11 per

diluted share for the full year 2006. The following table

highlights the Company's financial performance for both the

quarters and years ended December 31, 2007 and 2006: Year Ended

Year Ended Fourth Fourth December 31, December 31, Quarter 2007

Quarter 2006 2007 2006 Net income $924,000 $581,000 $3,034,000

$2,332,000 Diluted earnings per share $0.04 $0.03 $0.14 $0.11

Additionally, the Company also announced that its Board of

Directors approved a stock repurchase program which calls for

AmeriServ Financial, Inc. to buyback up to 5% or approximately 1.1

million of its outstanding common shares. The shares may be

purchased in open market, negotiated, or block transactions. This

stock repurchase program does not obligate the Company to acquire

any specific number of shares and may be suspended or discontinued

at any time. As of December 31, 2007, the Company had approximately

22.2 million shares of its common stock outstanding. ASRV had total

assets of $905 million and shareholders' equity of $90.3 million or

a book value of $4.07 per share at December 31, 2007. The Company's

asset leverage ratio remained strong at 10.47%. Allan R. Dennison,

President and Chief Executive Officer, commented on the 2007

results and stock repurchase program, "Our focus on executing our

strategic plan has caused AmeriServ Financial to report improved

financial performance in 2007. We enter 2008 with positive earnings

momentum, a high quality balance sheet, and a strong capital

position. The announcement of this stock repurchase program

reflects our belief that the ASRV stock price has been unfairly

impacted by the recent credit concerns in the banking sector and

the return of capital to our shareholders through a stock buyback

program is an appropriate capital management strategy at this

time." The Company's net interest income in the fourth quarter of

2007 increased by $337,000 from the prior year's fourth quarter and

the net interest margin is up by 15 basis points over the same

comparative period. The increased net interest income and margin in

the fourth quarter of 2007 reflects the benefits of solid loan

growth experienced throughout 2007. Since year-end 2006, total

loans have grown by $46.7 million or 7.9% to $636.2 million at

December 31, 2007. The loan growth was most evident in the

commercial loan portfolio with particularly strong performance

during the second half of 2007. The Federal Reserve reductions in

short-term interest rates that began late in the third quarter of

2007 also contributed to the increased net interest income in the

fourth quarter of 2007. On a quarterly basis the Company's net

interest margin has shown improvement throughout 2007 increasing

from 2.97% in the first quarter to 3.08% in the fourth quarter.

This helped to reverse a trend of four consecutive quarters of net

interest income and margin contraction experienced in 2006 where

the margin declined from 3.20% to a low of 2.93% in the fourth

quarter. When the full year 2007 is compared to the full year 2006,

the Company's net interest income decreased by $255,000 or 1.0%

while the net interest margin declined by six basis points. The

full year decline in both net interest income and net interest

margin resulted from the Company's cost of funds increasing at a

faster pace than the earning asset yield particularly during the

first six months of 2007. This resulted from deposit customer

preference for higher yielding certificates of deposit and money

market accounts due to the inverted/flat yield curve with

short-term interest rates exceeding intermediate to longer term

rates during that period. As mentioned earlier, that trend changed

during the second half of 2007 and the Company believes it is well

positioned for net interest income and margin expansion in 2008.

The Company recorded a $150,000 provision for loan losses in the

fourth quarter of 2007 compared to a negative loan loss provision

of $75,000 realized in the fourth quarter of 2006. For the full

year 2007, the provision for loan losses amounted to $300,000

compared to a negative loan loss provision of $125,000 for the full

year 2006. The Company did experience higher net charge-offs in

2007. For the full year 2007, net charge-offs have amounted to $1.1

million or 0.19% of total loans compared to net charge-offs of

$926,000 or 0.16% of total loans for the full year 2006. Note that

the Company's 2007 net charge-offs were materially impacted by a

third quarter $875,000 complete charge-off of a commercial loan

that resulted from fraud committed by the borrower. Net charge-offs

decreased to only $16,000 or 0.01% of total loans in the fourth

quarter of 2007; the Company's best quarterly performance of 2007.

Non-performing assets totaled $5.3 million or 0.83% of total loans

at December 31, 2007 which represented an increase from the

approximate $2.4 million non-performing asset total at both

September 30, 2007 and December 31, 2006. The increase during the

fourth quarter of 2007 resulted primarily from the transfer of a

$2.4 million commercial real-estate loan into non-accrual status.

The Company is pleased to report that this non-performing loan was

subsequently paid-off in January 2008 with no loss to the bank. The

allowance for loan losses provided 137% coverage of non-performing

assets and was 1.14% of total loans at December 31, 2007. Note also

that the Company has no exposure to sub-prime mortgage loans in

either the loan or investment portfolios. The Company's

non-interest income in the fourth quarter of 2007 increased by

$776,000 from the prior year's fourth quarter and for the full year

2007 increased by $1.9 million or 14.5% when compared to 2006. The

increase for both periods was due in part to the West Chester

Capital Advisors acquisition, which closed in early March of 2007.

This accretive acquisition provided $268,000 of investment advisory

fees in the fourth quarter of 2007 and $974,000 of fees for the

full year 2007. Trust fees also increased by $79,000 for the fourth

quarter 2007 and by $234,000 or 3.6% for the full year 2007 due to

continued successful new business development efforts and an

increased value for trust assets. The fair market value of trust

assets totaled $1.9 billion at December 31, 2007. The Company also

realized an increase on gains realized on residential mortgage loan

sales into the secondary market that amounted to $51,000 for the

fourth quarter of 2007 and $202,000 for the full year 2007. These

increases reflect improved residential mortgage production from the

Company's primary market as this has been an area of emphasis in

the strategic plan. Finally, other income increased by $326,000 in

the fourth quarter and $377,000 for the full year 2007 due in part

to a $200,000 gain realized on the sale of a bank owned operations

facility that was no longer being fully utilized. The Company also

benefited from a $69,000 gain realized on the sale of a closed

branch facility in the third quarter of 2007. Total non-interest

expense in the fourth quarter of 2007 increased by $211,000 from

the prior year's fourth quarter but for the full year 2007 declined

by $20,000 when compared to the full year 2006. The largest factor

responsible for the quarterly increase was the inclusion of

$253,000 of non- interest expenses from West Chester Capital

Advisors; the largest component of which was reflected in salaries

and employee benefits. West Chester Capital Advisors has

contributed $820,000 in non-interest expenses for full year 2007.

The overall reduction in expenses for the full year 2007 reflects

the Company's continuing focus on containing and reducing

non-interest expenses. The largest expense reductions were

experienced in equipment expense $304,000, other expenses $355,000

and FDIC deposit insurance expense $104,000. The Company recorded

an income tax expense of $315,000 in the fourth quarter of 2007

compared to an income tax benefit of $19,000 in the fourth quarter

of 2006. The tax benefit in the fourth quarter of 2006 resulted

from the elimination of a $100,000 income tax valuation allowance

related to the deductibility of charitable contributions that

management determined was no longer needed given the level of

taxable income generated by the Company in 2006. For the full year

2007, the Company recorded an income tax expense of $924,000, which

reflects an estimated effective tax rate of 23.3%. This compares to

$420,000 of income tax expense or an effective tax rate of

approximately 15.3% in 2006. The higher effective tax rate in 2007

resulted from the Company's improved profitability. This news

release may contain forward-looking statements that involve risks

and uncertainties, as defined in the Private Securities Litigation

Reform Act of 1995, including the risks detailed in the Company's

Annual Report and Form 10-K to the Securities and Exchange

Commission. Actual results may differ materially. NASDAQ: ASRV

SUPPLEMENTAL FINANCIAL PERFORMANCE DATA January 22, 2008 (In

thousands, except per share and ratio data) (All quarterly and 2007

data unaudited) 2007 1QTR 2QTR 3QTR 4QTR YEAR TO DATE PERFORMANCE

DATA FOR THE PERIOD: Net income $428 $808 $874 $924 $3,034

PERFORMANCE PERCENTAGES (annualized): Return on average assets

0.20% 0.37% 0.39% 0.41% 0.34% Return on average equity 2.05 3.79

4.00 4.12 3.51 Net interest margin 2.97 3.01 3.00 3.08 3.06 Net

charge-offs as a percentage of average loans 0.06 0.07 0.61 0.01

0.19 Loan loss provision as a percentage of average loans - - 0.10

0.09 0.05 Efficiency ratio 94.16 88.52 87.15 86.04 88.85 PER COMMON

SHARE: Net income: Basic $0.02 $0.04 $0.04 $0.04 $0.14 Average

number of common shares outstanding 22,159 22,164 22,175 22,184

22,171 Diluted 0.02 0.04 0.04 0.04 0.14 Average number of common

shares outstanding 22,166 22,171 22,177 22,186 22,173 2006 1QTR

2QTR 3QTR 4QTR YEAR TO DATE PERFORMANCE DATA FOR THE PERIOD: Net

income $540 $568 $643 $581 $2,332 PERFORMANCE PERCENTAGES

(annualized): Return on average assets 0.25% 0.26% 0.29% 0.26%

0.27% Return on average equity 2.59 2.71 3.00 2.66 2.74 Net

interest margin 3.20 3.16 3.06 2.93 3.12 Net charge-offs as a

percentage of average loans 0.09 0.07 0.39 0.09 0.16 Loan loss

provision as a percentage of average loans - (0.04) - (0.05) (0.02)

Efficiency ratio 92.68 92.08 91.38 94.34 92.60 PER COMMON SHARE:

Net income: Basic $0.02 $0.03 $0.03 $0.03 $0.11 Average number of

common shares outstanding 22,119 22,143 22,148 22,154 22,141

Diluted 0.02 0.03 0.03 0.03 0.11 Average number of common shares

outstanding 22,127 22,153 22,156 22,161 22,149 AMERISERV FINANCIAL,

INC. (In thousands, except per share, statistical, and ratio data)

(All quarterly and 2007 data unaudited) 2007 1QTR 2QTR 3QTR 4QTR

PERFORMANCE DATA AT PERIOD END: Assets $891,559 $876,160 $897,940

$904,878 Investment securities 185,338 174,508 170,765 163,474

Loans 603,834 604,639 629,564 636,155 Allowance for loan losses

8,010 7,911 7,119 7,252 Goodwill and core deposit intangibles

15,119 14,903 14,687 14,470 Deposits 768,947 762,902 763,771

710,439 FHLB borrowings 15,170 4,258 23,482 82,115 Stockholders'

equity 85,693 86,226 88,517 90,294 Trust assets - fair market value

(B) 1,828,475 1,872,366 1,846,240 1,883,307 Non-performing assets

2,706 2,825 2,463 5,280 Asset leverage ratio 10.23% 10.36% 10.44%

10.47% PER COMMON SHARE: Book value (A) $3.87 $3.89 $3.99 $4.07

Market value 4.79 4.40 3.33 2.77 Market price to book value 123.88%

113.12% 83.44% 68.07% STATISTICAL DATA AT PERIOD END: Full-time

equivalent employees 375 376 358 351 Branch locations 21 21 20 20

Common shares outstanding 22,161,445 22,167,235 22,180,650

22,188,997 2006 1QTR 2QTR 3QTR 4QTR PERFORMANCE DATA AT PERIOD END:

Assets $876,393 $887,608 $882,837 $895,992 Investment securities

223,658 210,230 209,046 196,200 Loans 548,466 573,884 580,560

589,435 Allowance for loan losses 9,026 8,874 8,302 8,092 Goodwill

and core deposit intangibles 12,031 11,815 11,599 11,382 Deposits

727,987 740,979 743,687 741,755 FHLB borrowings 45,223 43,031

31,949 50,037 Stockholders' equity 84,336 84,231 86,788 84,684

Trust assets - fair market value (B) 1,669,525 1,679,634 1,702,210

1,778,652 Non-performing assets 4,193 4,625 2,978 2,292 Asset

leverage ratio 10.36% 10.54% 10.52% 10.54% PER COMMON SHARE: Book

value $3.81 $3.80 $3.92 $3.82 Market value 5.00 4.91 4.43 4.93

Market price to book value 131.26% 129.09% 113.07% 128.98%

STATISTICAL DATA AT PERIOD END: Full-time equivalent employees 375

367 364 369 Branch locations 22 22 21 21 Common shares outstanding

22,140,172 22,145,639 22,150,767 22,156,094 Note: (A) Other

comprehensive income had a negative impact of $0.18 on book value

per share at December 31, 2007. (B) Not recognized on the balance

sheet AMERISERV FINANCIAL, INC. CONSOLIDATED STATEMENT OF INCOME

(In thousands) (All quarterly and 2007 data unaudited) 2007 1QTR

2QTR 3QTR 4QTR YEAR TO DATE INTEREST INCOME Interest and fees on

loans $10,061 $10,303 $10,591 $10,608 $41,563 Total investment

portfolio 2,114 2,005 1,863 1,834 7,816 Total Interest Income

12,175 12,308 12,454 12,442 49,379 INTEREST EXPENSE Deposits 5,699

5,931 5,994 5,187 22,811 All borrowings 521 364 438 1,022 2,345

Total Interest Expense 6,220 6,295 6,432 6,209 25,156 NET INTEREST

INCOME 5,955 6,013 6,022 6,233 24,223 Provision for loan losses - -

150 150 300 NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES

5,955 6,013 5,872 6,083 23,923 NON-INTEREST INCOME Trust fees 1,704

1,689 1,677 1,683 6,753 Net realized gains on loans held for sale

25 79 116 87 307 Service charges on deposit accounts 585 636 671

687 2,579 Investment advisory fees 102 329 275 268 974 Bank owned

life insurance 258 265 479 266 1,268 Other income 559 594 804 869

2,826 Total Non-Interest Income 3,233 3,592 4,022 3,860 14,707

NON-INTEREST EXPENSE Salaries and employee benefits 4,885 4,930

4,813 4,711 19,339 Net occupancy expense 664 615 618 597 2,494

Equipment expense 546 564 466 469 2,045 Professional fees 695 818

814 870 3,197 FDIC deposit insurance expense 22 22 22 22 88

Amortization of core deposit intangibles 216 216 216 217 865 Other

expenses 1,645 1,357 1,824 1,818 6,644 Total Non-Interest Expense

8,673 8,522 8,773 8,704 34,672 PRETAX INCOME 515 1,083 1,121 1,239

3,958 Income tax expense 87 275 247 315 924 NET INCOME $428 $808

$874 $924 $3,034 AMERISERV FINANCIAL, INC. CONSOLIDATED STATEMENT

OF INCOME (In thousands) (All quarterly and 2007 data unaudited)

2006 1QTR 2QTR 3QTR 4QTR YEAR TO DATE INTEREST INCOME Interest and

fees on loans $8,900 $9,155 $9,677 $9,865 $37,597 Total investment

portfolio 2,279 2,259 2,218 2,212 8,968 Total Interest Income

11,179 11,414 11,895 12,077 46,565 INTEREST EXPENSE Deposits 4,026

4,563 5,143 5,500 19,232 All borrowings 861 660 653 681 2,855 Total

Interest Expense 4,887 5,223 5,796 6,181 22,087 NET INTEREST INCOME

6,292 6,191 6,099 5,896 24,478 Provision for loan losses - (50) -

(75) (125) NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES

6,292 6,241 6,099 5,971 24,603 NON-INTEREST INCOME Trust fees 1,641

1,671 1,603 1,604 6,519 Net realized gains on loans held for sale

23 20 26 36 105 Service charges on deposit accounts 627 651 645 638

2,561 Bank owned life insurance 256 260 428 263 1,207 Other income

695 666 545 543 2,449 Total Non-Interest Income 3,242 3,268 3,247

3,084 12,841 NON-INTEREST EXPENSE Salaries and employee benefits

4,815 4,612 4,600 4,642 18,669 Net occupancy expense 655 591 573

591 2,410 Equipment expense 639 631 529 550 2,349 Professional fees

795 859 791 763 3,208 FDIC deposit insurance expense 73 74 22 23

192 Amortization of core deposit intangibles 216 216 216 217 865

Other expenses 1,665 1,794 1,833 1,707 6,999 Total Non-Interest

Expense 8,858 8,777 8,564 8,493 34,692 PRETAX INCOME 676 732 782

562 2,752 Income tax expense (benefit) 136 164 139 (19) 420 NET

INCOME $540 $568 $643 $581 $2,332 AMERISERV FINANCIAL, INC. AVERAGE

BALANCE SHEET DATA (In thousands) (All quarterly and 2007 data

unaudited) Note: 2006 data appears before 2007. 2006 2007 TWELVE

TWELVE 4QTR MONTHS 4QTR MONTHS Interest earning assets: Loans and

loans held for sale, net of unearned income $582,165 $564,173

$625,255 $607,507 Deposits with banks 688 706 603 500 Federal funds

248 62 85 2,278 Total investment securities 211,747 221,704 174,094

184,117 Total interest earning assets 794,848 786,645 800,037

794,402 Non-interest earning assets: Cash and due from banks 18,439

18,841 17,797 17,750 Premises and equipment 8,285 8,324 8,328 8,623

Other assets 68,003 68,920 72,823 70,369 Allowance for loan losses

(8,237) (8,750) (7,181) (7,755) Total assets 881,338 873,980

891,804 883,389 Interest bearing liabilities: Interest bearing

deposits: Interest bearing demand 59,280 57,817 55,853 56,383

Savings 75,150 81,964 68,354 71,922 Money market 173,538 172,029

132,141 169,696 Other time 336,089 319,220 352,074 346,134 Total

interest bearing deposits 644,057 631,030 608,422 644,135

Borrowings: Federal funds purchased, securities sold under

agreements to repurchase, and other short-term borrowings 27,910

32,821 54,051 19,844 Advanced from Federal Home Loan Bank 951 967

8,585 4,852 Guaranteed junior subordinated deferrable interest

debentures 13,085 13,085 13,085 13,085 Total interest bearing

liabilities 686,003 677,903 684,143 681,916 Non-interest bearing

liabilities: Demand deposits 101,188 104,266 108,214 105,306 Other

liabilities 7,310 6,765 10,385 9,703 Stockholders' equity 86,837

85,046 89,062 86,464 Total liabilities and stockholders' equity

$881,338 $873,980 $891,804 $883,389 DATASOURCE: AmeriServ

Financial, Inc. CONTACT: Jeffrey A. Stopko, Senior Vice President

& Chief Financial Officer of AmeriServ Financial, Inc.,

+1-814-533-5310 Web site: http://www.ameriservfinancial.com/

Copyright

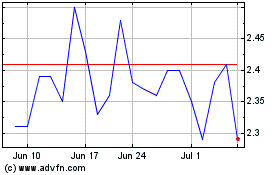

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

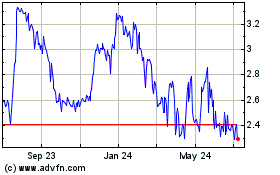

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Jul 2023 to Jul 2024