Amerisafe Lags on Higher Expenses - Analyst Blog

March 02 2012 - 6:45AM

Zacks

Amerisafe Inc.’s (AMSF) fourth-quarter 2011

operating earnings per share of 32 cents missed the Zacks Consensus

Estimate by a couple of pennies but modestly lagged the prior-year

quarter earnings of 44 cents.

Consequently, operating net income plunged 29.1% year over year

to $5.9 million. Including net realized gains of $0.95 million

against $0.11 million in the year-ago period and valuation

allowance of $1.2 million versus $0.08 million in the year-ago

quarter, reported net income came in at $8.06 million or 44 cents

per share, compared with $8.55 million or 45 cents in the

prior-year quarter.

Reported results reflect higher premiums written and earned that

shored up the top line and investment portfolio. These factors also

drove the capital position and book value of the shares. However,

the positives were mitigated by higher-than-expected underwriting

and operating expenses along with a deteriorating combined ratio,

all of which dampened the underwriting results, bottom line and

ROE.

The accident year 2007 primarily contributed to favourable

development, reducing loss and loss adjustment expenses (LAE) by

$2.2 million. This also helped the current accident year loss ratio

to be flat at 78.2% from the prior quarter.

Amerisafe’s total revenue for the reported quarter was $74.9

million, up 18.6% from $63.1 million in the prior-year quarter,

also exceeding the Zacks Consensus Estimate of $70.0 million. Gross

premiums written for the quarter were $62.1 million, reflecting a

19.1% year-over-year surge. The uptick was driven by payroll audits

and related premium adjustments for policies written in previous

periods. These adjustments increased premiums by $3.8 million in

the reported quarter, while they reduced premiums by $2.5 million

in the year-ago quarter.

Furthermore, voluntary premiums written climbed 5.9% year over

year in the reported quarter. Besides, net premiums earned jumped

17.3% from the year-ago quarter to $66.2 million. Net investment

income, which represented about 9% of total revenue, was $6.7

million for the reported quarter, thereby improving 3.8% from the

prior-year quarter. However, underwriting profit substantially

reduced to $1.1 million against $6.1 million in the year-ago

quarter.

On the flip side, insurance loss and loss adjusted expenses

(LAE) increased 26.0% year over year to $49.6 million (or about 74%

of net premiums earned). As a result, total expenses jumped 29.0%

year over year to $65.4 million, while net underwriting expense

ratio increased to 22.7% from 19.2% in the year-ago quarter due to

higher underwriting and operating costs. Even net combined ratio

for the reported quarter deteriorated to 98.4% from 89.2% in the

prior-year quarter.

Full-Year 2011 Highlights

For full-year 2011, Amerisafe reported operating net income of

$21.2 million or $1.14 per share compared with $32.1 million or

$1.68 per share in 2010. Earnings per share also lagged the Zacks

Consensus Estimate of $1.27.

Including net capital gains and valuation allowance, reported

net income came in at $24.1 million or $1.29 per share versus $34.6

million or $1.81 per share in 2010.

However, Amerisafe’s total revenue increased 13.1% year over

year to $280.7 million in 2011, and exceeded the Zacks Consensus

Estimate of $275.0 million. Meanwhile, total expenses surged 24.3%

year over year to $253.4 million. Net combined ratio deteriorated

to 100.5% in 2011 from 92.4% in 2010. The effective tax rate

reduced to 11.5% in 2011 from 22.0% in 2010.

Amerisafe exited 2011 with ROE of 7.1% that dipped from 10.9% in

2010. Operating ROE also plummeted to 6.3% from 10.2% in 2010.

However, book value per share came in at $19.33 as on December 31,

2011, up 7.5% from $17.99 at 2010-end.

As on December 31, 2011, Amerisafe’s fair value of the

portfolio, including cash and investments, stood at $890.7 million

compared with $826.5 million at the end of 2010. The investment

portfolio also improved to $806.0 million at 2011-end versus $765.5

million at 2010-end. Total shareholders’ equity stood at $350.9

million in 2011, up from $330.2 million at the end of 2010.

Share Repurchase Update

In November 2011, the board of Amerisafe had announced the

renewal of the previously authorized share repurchase program

through December 31, 2012. Additionally, the current program has

been extended up to $25 million, effective October 1, 2011.

During the reported quarter, Amerisafe repurchased 32,610 shares

at an average price of $18.78, for a total cost of $0.6 million

including commissions. Since the initiation of its share repurchase

program, the company has bought back shares worth $22.4 million, at

an average price of $17.78 including commissions.

Our Take

Amerisafe is expected to face an uncertain environment for the

next few quarters as the economic fragility continues to hurt

payrolls and underwriting results. However, though the pricing

environment is somewhat improving now, it fails to drive adequate

growth owing to challenging industry trends and robust price

competition fuelled by excess capacity and muted demand.

Nevertheless, improved book value, prudent capital management,

expanded share repurchase plan and a strong financial strength

rating augur a decent mid- to long-term growth. Amerisafe competes

with SeaBright Insurance Holdings (SBX) and

Employers Holders Inc. (EIG) in its industry

space.

Currently, Amerisafe carries a Zacks Rank #2, implying a

short-term Buy rating and a long-term Neutral stance.

AMERISAFE INC (AMSF): Free Stock Analysis Report

EMPLOYERS HLDGS (EIG): Free Stock Analysis Report

SEABRIGHT INSUR (SBX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

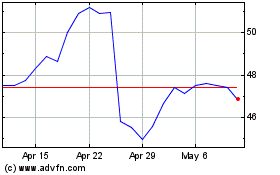

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From May 2024 to Jun 2024

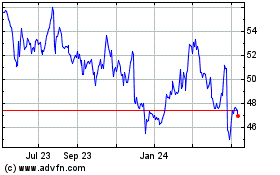

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Jun 2023 to Jun 2024