Insurance Industry Stock Update - Feb. 2012 - Industry Outlook

February 10 2012 - 10:25AM

Zacks

The impact of a series of natural disasters in 2011 and the

ongoing economic uncertainty is still quite palpable in the

performance of U.S. insurers. These impediments aside, there are

fundamental challenges that are expected to come in the way

insurers’ efforts to meet growing investor expectations in the

upcoming quarters. Among the possible way outs of such

difficulties, rising rates and pricing flexibility are primary.

The overall health of the U.S. insurance industry has improved to

some extent in the recent quarters, after enduring pricing

pressures and reduced insured exposure for quite some time. The

market turmoil resulting from the Great Recession forced many

companies to take immense write-downs, but those memories are fast

becoming a thing of the past.

That said, continued soft market conditions, shrinking businesses,

a still-high unemployment rate, uncertain fiscal policy and

legislative challenges are threatening insurers’ ability to rebound

to the historical growth rate. The industry continues to be

challenged by subdued premium volume growth in a perked up economy

as well as a massive healthcare restructuring.

Though there are signs of economic recovery, its sluggish pace is

expected to continue at least through the first half of 2012. Also,

structural economies of scale have pushed the industry toward

consolidation. As a result, inter-segment competition within the

industry has alleviated. Moving forward, maintaining profitability

after complying with regulatory requirements could be a painful

task.

We expect static growth from persistent soft market conditions to

result in further consolidation in the industry. Though there are

near-term opportunities for insurers, braced by some rapidly

growing sectors such as health care and technology, overall

industry conditions are expected to improve beyond the first half

of 2012, should the economy turn to growth post-recovery. Probably,

the industry would take a couple of years to overcome most industry

challenges with the help of an improved market mechanism.

Life Insurers

Losses in the investment portfolio and lower income from the

variable annuity business will continue to hurt earnings of life

insurers. Most life insurers have substantial exposure to

commercial real estate-backed loans and securities, which will

result in further losses in the coming quarters.

As the industry’s statutory capital level fell sharply during the

recession, life insurance companies will need to optimize their

capital levels to address the ensuing challenges. In the short

term, traditional sources of capital are expected to fulfill most

of what life insurers need in order to stay in good shape. However,

non-traditional sources of capital will take years to strengthen

financials of the insurers.

Moreover, regulatory changes under the Dodd-Frank Wall Street

Reform are still troubling life insurers as they pose strategic and

competitive challenges. In order to address such concerns, life

insurers may have to burn some of their financial energy.

The underlying trends amid sluggish economic recovery indicate

stability of U.S. life insurers over the medium term with respect

to credit profile and financial prospects. However,

higher-than-average asset losses of life insurers, primarily

resulting from their real estate exposure, will remain a major

concern in 2012.

Most importantly, the tardy economic recovery is making it

difficult for life insurers to enhance their customer base. In

fact, the insurers are struggling to even retain their existing

clientele. Narrowed disposable income owing to high unemployment

and huge credit card debt has made it difficult for Americans to

invest in retirement products such as life insurance.

Moreover, the low interest rate environment is one of the major

risks for life insurers at this point. Investment income remains

weak as life insurers are experiencing low returns on fixed-income

instruments.

On the other hand, interest in cheaper products to cover only basic

risks has increased. So, returning to providing basic services and

reducing operating costs should be the primary course of action for

life insurers to realize some profit in the near term.

Some life insurers have already gone back to the basics in order to

meet demand and escape financial and regulatory difficulties, but

taking shelter from the icy winds will not be adequate for

thriving. Life insurance companies have to be more proactive to

weather the situation.

Health Insurers

The U.S. health care system is significantly dependent on private

health insurance, the primary source of coverage for most

Americans. More than half of the U.S. citizens are covered under

private health insurance.

Unfortunately, these insurance companies utilize a pre-existing

exemption clause to control costs and maximize profit. The historic

health care legislation, which was passed by Congress in 2010, aims

to prevent private insurance companies from using the pre-existing

clause, but at the same time claims to bring in 32 million more

people under coverage by 2019.

While the legislative overhaul brings more regulatory scrutiny for

private insurance companies, the net negative effect is far softer

than was initially feared. Also, the removal of this uncertainty is

a net positive in its own right.

Though the reform will provide more cross-selling opportunities for

health insurers, their overall profitability will be marred in the

long run as the negative impact of Medicare Advantage payment cuts,

industry taxes and restrictions on underwriting practices will more

than offset the benefits of adding the extra 32 million.

The recent growth in nonfarm payroll employment is expected to

enhance health insurers’ customer base to some extent as these

people are getting insured through their jobs. According to the

U.S. Bureau of Labor Statistics, in January, total nonfarm payroll

employment rose by 243,000 and the rate of unemployment decreased

to 8.3%.

However, reduced government employment will partially offset this

benefit. Moreover, growth in industry revenue is expected to

decline till 2015 as insurers will be forced to adjust the benefits

to comply with the health care legislation. Among others, providing

coverage to everyone regardless of whether they had an expensive

pre-existing condition would put their top line at stake.

Property & Casualty Insurers

Steep losses in the investment portfolios since the beginning of

2008 have significantly reduced the capital adequacy of most

Property & Casualty insurers. The seizure of credit markets and

rising concerns over defaults have pushed down bond prices sharply

since then, causing significant realized and unrealized capital

losses on these insurers’ portfolios. As Property & Casualty

insurers hold about two-thirds of the invested assets in the form

of bonds, their capacity is highly sensitive to changes in credit

market conditions.

While the ongoing recovery in the credit and equity markets is

leading to a reduction in unrealized investment losses, the premium

rates continue to decline, though at a slower pace.

Reduced financial flexibility and weak underwriting and reserves

have added to insurer woes. The only positive trend visible as of

now is a slight improvement in some insurance pricing after

persistent deterioration for two years since 2008.

Though premium rates are showing signs of stabilization in the

recent quarters, loss trends are rising at a faster pace. This will

ultimately lead to underwriting margins compression.

On the other hand, catastrophe losses, competition, lower

reinvestment yields and economic uncertainty will remain the

headwinds for Property & Casualty insurers’ operating

performance in the near-to-mid term.

However, the Property & Casualty industry endured the latest

financial crisis better than the other financial service sectors.

Once the economic recovery gains momentum, insurance volume will

grow rapidly.

The recent quarters have been witnessing an increasing rebound in

claims-paying capacity (as measured by policyholders’ surplus),

which reflects the industry’s resilience over the prior years.

Strong capital adequacy and conservative investment strategies will

keep these insurers on solid financial footing in the upcoming

quarters.

Reinsurers

Losses from the investment portfolios of reinsurance companies have

gotten worse during the last few quarters. The deterioration

resulted from the supply-demand imbalance in reinsurance coverage

due to intense competition that kept pricing soft over the last few

years.

Also, catastrophic events like Hurricanes Ike and Gustav were the

major culprits that pressure on underwriting profits. However, in

the recent months, reinsurance prices have increased substantially.

In fact, rising rates are expected to be more than sufficient to

offset 2011 catastrophe losses.

With signs of recovery in the capital market (though still weak by

any means), concerns related to reinsurers' ability to access

capital markets on reasonable terms have sufficiently eased.

However, lesser new business and rising expense ratios are major

concerns for reinsurers at this point. An increased level of price

competition also may hurt top lines in the upcoming quarters.

Moreover, reinsurance market capital levels are expected to be down

for reinsurers with huge exposure to the European sovereign debt

crisis.

OPPORTUNITIES

We remain positive on Phoenix Companies, Inc.

(PNX) and ProAssurance Corporation (PRA) with a

Zacks #1 Rank (short-term Strong Buy).

Other insurers that we like with a Zacks #2 Rank (short-term Buy)

include AMERISAFE, Inc. (AMSF), Manulife

Financial Corporation (MFC), Ace Limited

(ACE), Markel Corporation (MKL), OneBeacon

Insurance Group, Ltd. (OB), Progressive

Corporation (PGR), RenaissanceRe Holdings

Ltd. (RNR), Prudential Financial, Inc.

(PRU), Horace Mann Educators Corporation (HMN) and

MetLife, Inc. (MET).

American International Group Inc. (AIG) currently

retains a Zacks #3 Rank which translates into a short-term Hold

rating.

WEAKNESSES

We expect continued pressure on investment portfolios and lower

income from the variable annuity business to restrict the earnings

growth rate of life insurers. Also, reduced financial flexibility

and weak underwriting will hurt the earnings of Property &

Casualty Insurers.

Among the Zacks covered U.S. insurers, we prefer to stay away from

the Zacks #5 Rank (short-term Strong Sell) companies ––

Axis Capital Holdings Limited (AXS),

Cincinnati Financial Corporation (CINF),

Loews Corporation (L), Endurance Specialty

Holdings (ENH), Kemper Corporation

(KMPR), Meadowbrook Insurance Group (MIG) and

MGIC Investment Corporation (MTG).

ACE LIMITED (ACE): Free Stock Analysis Report

AMER INTL GRP (AIG): Free Stock Analysis Report

AMERISAFE INC (AMSF): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

HORACE MANN EDS (HMN): Free Stock Analysis Report

LOEWS CORP (L): Free Stock Analysis Report

METLIFE INC (MET): Free Stock Analysis Report

MANULIFE FINL (MFC): Free Stock Analysis Report

MARKEL CORP (MKL): Free Stock Analysis Report

ONEBEACON INSUR (OB): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

PHOENIX CMPNIES (PNX): Free Stock Analysis Report

PROASSURANCE CP (PRA): Free Stock Analysis Report

PRUDENTIAL FINL (PRU): Free Stock Analysis Report

RENAISSANCERE (RNR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

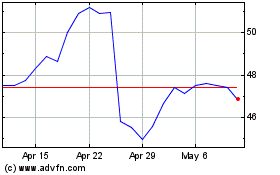

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Apr 2024 to May 2024

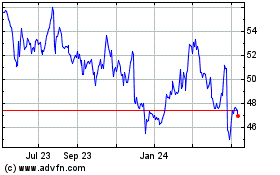

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From May 2023 to May 2024