Amerisafe, Inc. (AMSF) - Bear of the Day

September 28 2011 - 8:00PM

Zacks

Amerisafe, Inc.'s (AMSF) second-quarter earnings lagged the

Zacks Consensus Estimate substantially, due to high underwriting

loss and reduced investment income coupled with higher expenses,

which significantly deteriorated the combined ratio, operating cash

flow and ROE.

The top-line growth was only cushioned by higher premiums

written and earned as other revenue sources failed to showcase

growth. Though the pricing environment has witnessed some

improvement, the company is expected to face uncertainty for the

next few quarters as the market weakness continues to hurt

payrolls.

Our six-month target price of $18.00 per share equates to about

14.6x our earnings estimate for 2011. With no dividend supplement,

this target price implies a total expected negative return of 7.8%

over that period, which is consistent with our Underperform

recommendation.

AMERISAFE INC (AMSF): Free Stock Analysis Report

Zacks Investment Research

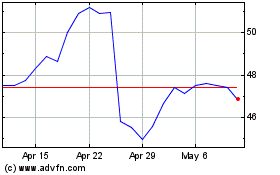

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From May 2024 to Jun 2024

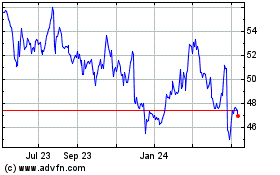

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Jun 2023 to Jun 2024